Within the midst of the latest market intricacies, the USD index showcased an intriguing trip throughout the previous few periods. It’s evident that the greenback’s trajectory is drawing consideration from buyers globally. The latest unveiling of the US actual GDP and Q2 ADP employment knowledge painted an image of blended fortunes, contributing to a nuanced perspective on the Federal Reserve’s potential actions and a revaluation of future fee hikes.

Within the midst of the latest market intricacies, the USD index showcased an intriguing trip throughout the previous few periods. It’s evident that the greenback’s trajectory is drawing consideration from buyers globally. The latest unveiling of the US actual GDP and Q2 ADP employment knowledge painted an image of blended fortunes, contributing to a nuanced perspective on the Federal Reserve’s potential actions and a revaluation of future fee hikes.

A cascade of occasions, together with vital drops in JOLTS job openings for July, the Convention Board Shopper Confidence Index for August, and the following unveiling of weaker ADP employment knowledge, have set the stage for meticulous commentary. Notably, the Q2 GDP’s departure from expectations prompts us to suppose whether or not the bigger cycle’s downward trajectory for the US index is already etched in stone. This transition may probably catalyse a reconfiguration of investor consideration in direction of non-US entities.

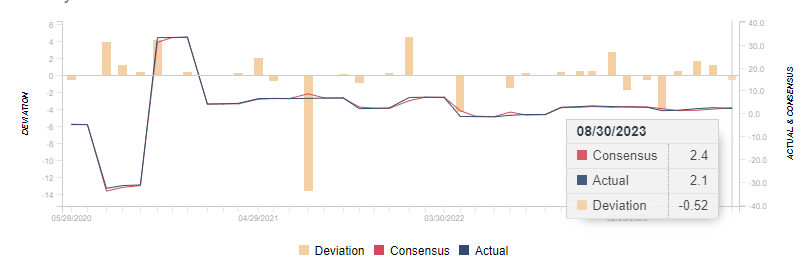

Peering into the info, the US ADP employment figures for August unveiled a modest tally of 177,000 – a notch under the anticipated 195,000 and strikingly distant from the revised worth of 371,000 from the previous interval. Such a divergence raises a crimson flag, evoking apprehensions in regards to the impending Non-Farm Payroll launch. Equally vital, the revised Q2 GDP, charting at 2.1%, fell in need of the envisaged 2.4%, including one other layer of complexity to the unfolding narrative.

A shift to the technical evaluation reveals an intricate sample throughout the day by day timeframe. The USD index has ventured under the ascending development line since July, penetrating the pivotal 103.40 Degree. This might signify a notable reversal. Presently, the index is within the throes of testing assist across the psychological 103 mark – a breach right here may pave the best way for deeper downward strides. In the meantime, the MACD indicator paints a vivid image of a loss of life cross at elevated ranges, ushering a discernible bearish sign. A noteworthy shift within the transferring averages (MAs) from ascension to adhesion additional underscores this evolving narrative. Ought to this state of affairs be augmented by a pronounced bearish development, the greenback index may very well be destined for extra formidable pressures.

Click on right here to entry our Financial Calendar

Francois du Plessis

Market Analyst

Disclaimer: This materials is offered as a normal advertising communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or must be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.