Nasdaq 100 – Talking Points

- Nasdaq 100 tests key resistance at 11700 before retreating

- US Treasury yields continue to climb ahead of NFP Friday

- Equities continue to test Fed on a potential policy pivot

Recommended by Brendan Fagan

Get Your Free Equities Forecast

The Nasdaq 100 Index continues to chop around late in the New York session as traders cast an eye to Friday’s key nonfarm payrolls (NFP) report. Markets are following data releases closely as the Fed continues to look for a softening in the labor market. The 2-year Treasury yield traded back through 4.20% early in today’s session, which initially pressured equities following the opening bell. With Fed officials indicating that they are fully committed to returning inflation to target, equity markets may need to digest that a pivot may not be coming anytime soon.

US Economic Calendar

Courtesy of the DailyFX Economic Calendar

Equities initially pushed higher following the opening bell, but rallies were rejected as US Treasury yields continued their recent advance. The 10-year benchmark yield traded through 3.80% while the 2-year yield stretched beyond 4.22%. Following the largest 2-day rally since 2020, stocks have looked sluggish into Friday’s NFP print. As equities continue to call the Fed’s bluff that they won’t pivot, rates and FX continue to flash warning signs. Recent routs in the FX and rates markets now have investors asking questions about financial stability, and whether the global economy can survive a higher rate regime given the amount of leverage. But with inflation showing little to no progress of returning to the Fed’s 2% target, equity markets may just have to stomach a period of higher rates, lower valuations, and weaker earnings.

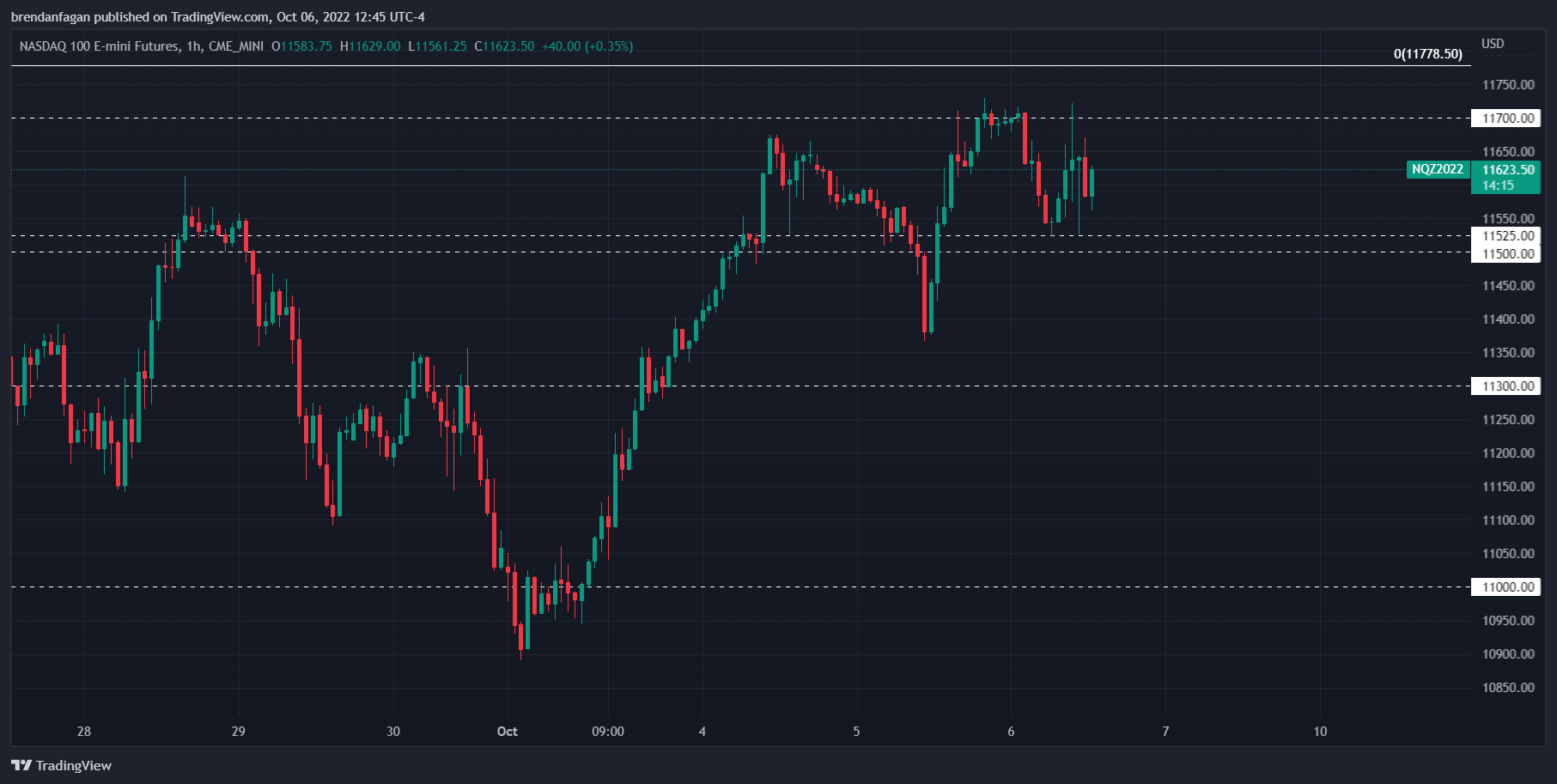

Nasdaq 100 Futures (NQ) 1 Hour Chart

Chart created with TradingView

Following the opening bell, Nasdaq 100 futures (NQ) bounced into key resistance at 11700. This rally was rejected back to the overnight low at 11525, which provided the platform for another rally beyond 11600. It appears that markets remain cautious ahead of tomorrow’s jobs print, as neither bears nor bulls have been able to take control of the session thus far. Any bullish breakout could call for a quick retest of the 12000 psychological level, which could come should tomorrow offer an NFP print below the 250k consensus. Given the state of macroeconomic affairs, the path of least resistance appears lower for risk but equity markets in particular. With the Fed showing no signs of deviating from their course, downside pressure may look to take price below the recent swing lows at 10890.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

RESOURCES FOR FOREX TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

— Written by Brendan Fagan

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter