NASDAQ 100, HANG SENG INDEX, ASX 200 INDEX OUTLOOK:

- Dow Jones, S&P 500 and Nasdaq 100 indexes closed +1.55%, +2.24% and +3.70% respectively

- The Fed raised rate of interest by a quarter-point and pointed to 6 extra hikes within the forthcoming conferences this 12 months

- Hold Seng Index appears to be like set to increase rally after leaping 9% on Wednesday as Chinese language policymakers pledged to help market. APAC shares to open increased.

Nasdaq 100, FOMC, Hold Seng Index, Asia-Pacific at Open:

The Nasdaq 100 index soared 3.7% on Wednesday as Jerome Powell painted a clearer image concerning the Fed’s tightening trajectory on the FOMC assembly. The central financial institution raised the rate of interest by 25bps and signaled six extra hikes within the forthcoming gatherings to tame inflation, in keeping with market expectations. It additionally anticipates to start lowering its holdings of Treasury securities and company debt and company mortgage-backed securities at a coming assembly, seemingly in Might. Powell additionally pointed to a “sturdy financial system” that is ready to stand up to the Fed’s tightening coverage.

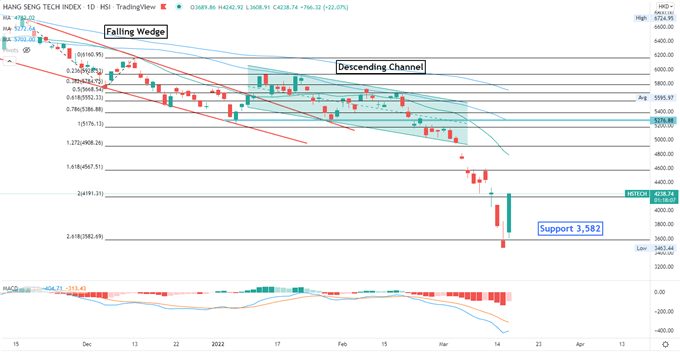

In the meantime, Chinese language policymakers made an uncommon announcement to help the inventory and property market on Wednesday, sparking an astonishing rally in each mainland and Hong Kong shares. The Hold Seng Index jumped essentially the most since 2008 after China’s state council pledged to help inventory markets. The Hold Seng Tech Index rallied 22%and marked its largest single day acquire. Chinese language tech ADRs listed on US exchanges prolonged the rally in a single day, led by Alibaba (+36.7%), JD.COM (+39.4%) and Tencent (+33.4%).

The Monetary Stability and Growth Committee of the State Council held a particular assembly to review the present financial scenario and capital market points on Wednesday. The authorities pledged to help abroad inventory listings and to maintain Chinese language capital markets steady. Additionally they promised to implement measures to assist deal with dangers for property builders. Relating to Chinese language corporations listed within the US, the Chinese language and US regulators have maintained good communications and have made optimistic progress.

Constructive indicators despatched by the state council marks a “coverage backside” for the Hong Kong inventory market after a year-long selloff. The know-how sector has misplaced 68% of its market worth over the past 12 months as a result of Beijing’s anti-monopoly crackdown, US delisting threats and a slowing financial system. Because the state council made a “U-turn” in its perspective in the direction of the platform corporations corresponding to Meituan and Alibaba, traders lastly see lights on the finish of the tunnel.

Hold Seng Tech Index – Every day

Chart created with TradingView

Asia-Pacific inventory markets look set to open increased on Thursday. Futures in Japan, mainland China, Australia, Hong Kong, Taiwan, South Korea, Taiwan, Singapore, Malaysia, India, Thailand and Indonesia are all within the inexperienced.

Wanting forward, the Australian jobs report dominates the financial docket alongside the BoE rate of interest choice. Discover out extra from the DailyFX calendar.

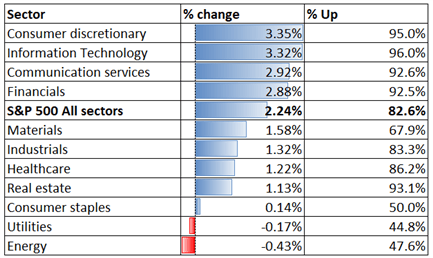

Wanting again to Wednesday’s shut, 9 out of 11 S&P 500 sectors ended increased, with 82.6% of the index’s constituents closing within the inexperienced. Client discretionary (+3.35%), data know-how (+3.32%) and communication providers (+2.92%) had been among the many greatest performers, whereas vitality (-0.43%) and utilities (-0.17%) trailed behind.

S&P 500 Sector Efficiency 16-03-2022

Supply: Bloomberg, DailyFX

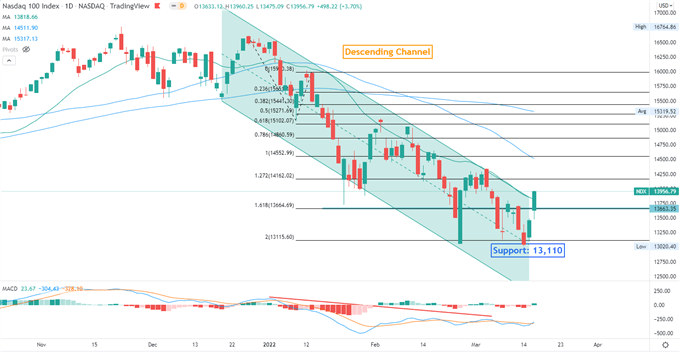

Nasdaq 100 Technical Evaluation

The Nasdaq 100 index is making an attempt to breach the ceiling of a “Descending Channel” as highlighted on the chart under. A profitable try could sign a bullish pattern reversal. A direct help stage may be discovered at 13,110 – the 200% Fibonacci extension. The MACD indicator has shaped a bullish crossover, suggesting that purchasing strain could also be constructing.

Nasdaq 100Index – Every day Chart

Chart created with TradingView

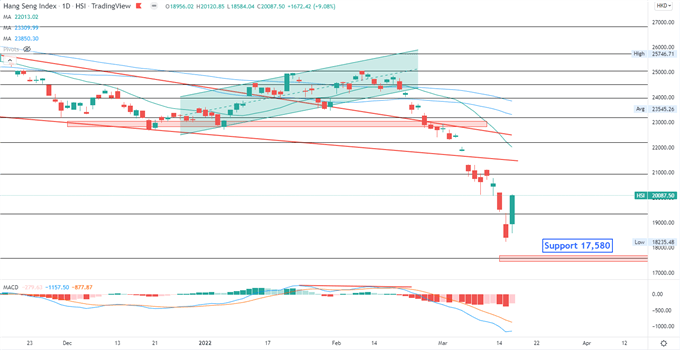

Hold Seng Index Technical Evaluation:

The Hold Seng Index rebounded sharply, forming a “bullish engulfing” candlestick sample. It indicators a powerful bullish pattern reversal and will pave the way in which for extra upside potential. A direct help stage may be discovered at 17,580, whereas a direct resistance stage may be discovered at 20,950. The MACD indicator is about to kind a bullish crossover beneath the impartial midpoint, suggesting that purchasing strain could also be constructing.

Chart created with TradingView

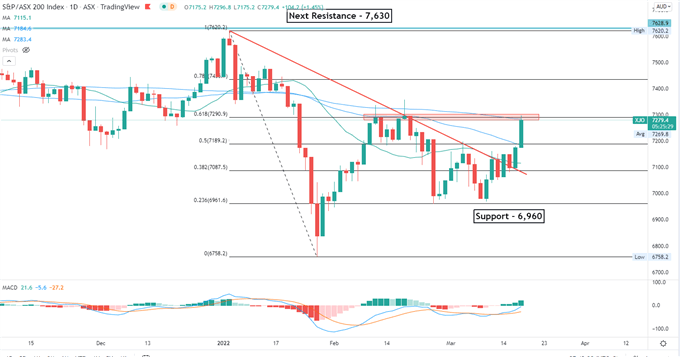

ASX 200 Index Technical Evaluation:

The ASX 200 index breached above a trendline help as proven on the chart under. Costs are hitting a direct resistance stage at 7,290, breaching which can open the door for additional upside potential with a watch on 7,435. The MACD indicator is trending increased, underscoring upward momentum.

ASX 200 Index – Every day Chart

Chart created with TradingView

— Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Feedback part under or @margaretyjy on Twitter