stockdevil/iStock by way of Getty Photos

By Andrew Prochnow

Again within the Nineteen Eighties, E.F. Hutton—a widely known brokerage agency on Wall Road—featured a intelligent tagline of their promoting marketing campaign.

The slogan was “When E.F. Hutton talks, folks pay attention.” The commercials featured busy scenes through which everybody would freeze in place and hearken to the sage recommendation of an E.F. Hutton consultant, implying that the corporate’s market perception was past comparability.

At the moment, one may say the identical about Nvidia (NVDA)—“When Nvidia talks, folks pay attention.”

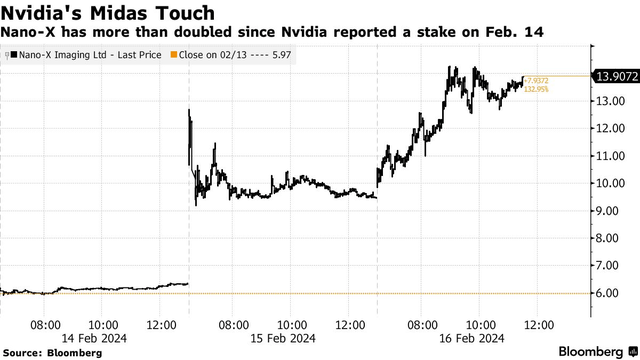

That was actually the case on Feb. 14 when Nvidia disclosed passive investments in a number of publicly-traded firms. In mid-February, Nvidia disclosed that it maintains investments in 5 publicly-traded firms: Arm Holdings (ARM), Nano-X Imaging (NNOX), Recursion Prescription drugs (RXRX), SoundHound AI (SOUN) and TuSimple Holdings (TSPH).

Not surprisingly, every of the aforementioned shares moved larger within the wake of that information. And contemplating Nvidia’s distinctive perspective on the rising AI area of interest, there’s probably purpose for that. A minimum of that’s in all probability the case for 4 of the aforementioned firms. Within the case of Nano-X Imaging, one may argue that individual funding isn’t just like the others.

Additional investigation has revealed that Nvidia did not truly purchase a stake in NNOX. As a substitute, Nvidia principally inherited the NNOX place after NNOX acquired Zebra Medical again in 2021. Nvidia owned a stake in Zebra Medical, and that holding is now represented by means of its present NNOX holding.

Past being a considerably unintentional funding, Nvidia’s place in NNOX is miniscule. Nvidia owns about 60,000 shares of NNOX, which was price about $400,000 on the time of the disclosure. For a corporation like Nvidia, that is an insignificant quantity.

In fact, after the rally in NNOX shares, that place was price a bit extra. NNOX shares spiked to round $14/share within the wake of the Nvidia disclosure, pushing Nvidia’s place in NNOX as much as about $850,000. That is nonetheless pocket change for a tech titan like Nvidia. And within the interim, shares of NNOX have tailed again right down to about $8.50/share, shedding a big portion of their earlier beneficial properties.

Bloomberg

Previous to the Nvidia disclosure, NNOX shares have been buying and selling round $6/share, and the first pattern during the last yr was downward. NNOX inventory hit its 52-week excessive of round $23/share final June, after which proceeded to pattern decrease for more often than not in between. Previous to the Nvidia announcement, NNOX shares have been down about 75% from their 52-week excessive.

Trying extra intently at Nano-X’s current fundamentals, there seems to be purpose for current pessimism in NNOX shares.

Transient Background on the Nano-X Imaging Enterprise Mannequin

By way of its basic enterprise, Nano-X Imaging is considerably of a hybrid medical units and software program firm that focuses on x-ray imaging. X-ray imaging, generally utilized in radiology, works by passing X-ray beams by means of the physique to create pictures of inner constructions comparable to bones, organs, and tissues.

X-ray imaging is often used for diagnosing situations comparable to fractures, infections, tumors, and lung illnesses. It’s a invaluable instrument within the broad area of medical imaging as a result of its skill to supply detailed pictures shortly and non-invasively, aiding within the prognosis and administration of varied medical situations.

Within the case of Nano-X, the corporate shouldn’t be solely pursuing a brand new technique of x-ray imaging, however additionally it is hoping to pair the evaluation of these pictures with an AI-assisted digital prognosis platform.

A vital piece of this course of entails the Nano-X “Robodiologist,” which scans the x-ray picture, and highlights any abnormalities. If abnormalities are found, the picture is then despatched to a specialist, to allow them to be reviewed in larger element.

By way of its new method to imaging, Nano-X has developed some progressive applied sciences that it refers to as Nanox.ARC and Nanox.Supply.

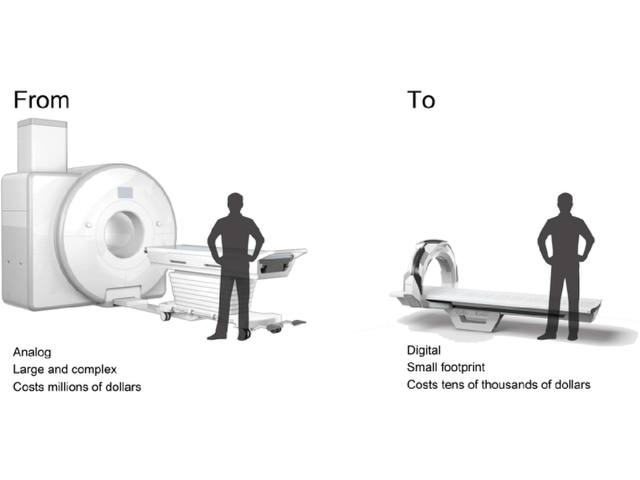

The Nanox.ARC expertise makes use of a digital X-ray that’s primarily based on a proprietary semiconductor chip. The Nano-X proprietary chip is designed to supply digital x-rays by means of a course of referred to as chilly cathode emission, which eliminates the necessity for the standard high-voltage vacuum tubes which can be present in typical x-ray machines. Nano-X’s purpose is to supply smaller, lighter, and doubtlessly cheaper units as in comparison with conventional x-ray techniques, as illustrated beneath.

BioWorld

On the plus facet, Nano-X imaging has already reaped some rewards from its improvement efforts. Nano-X has secured numerous related patents, and a few key clearances by the Meals and Drug Administration [FDA].

That features a key 510(ok) clearance from the FDA which permits Nano-X to formally market its Nanox ARC X-ray system. As a part of that 510(ok), the FDA cleared the system to be used in healthcare amenities and radiological departments of hospitals, imaging facilities, and clinics.

That FDA clearance is a key purpose that shares of NNOX rallied sharply final summer season. Nonetheless, the shares weren’t in a position to maintain the momentum.

Since June of final yr, shares of NNOX have been trending steadily decrease, dropping from $23/share all the best way again right down to about $5.50/share. A minimum of that was the case till Feb. 14, when Nvidia unexpectedly revealed its small, passive funding within the firm.

Fundamentals Do not Justify Present Inventory Worth

Whereas the Nvidia disclosure actually represents a constructive improvement, traders and merchants contemplating a brand new place within the inventory have to have a look at the general worth proposition supplied by NNOX shares, not simply the truth that Nvidia is a minor investor within the firm. And from this angle, the argument for proudly owning NNOX inventory will get just a little weaker.

One of many important causes for this outlook is that the corporate hasn’t but confirmed it will probably efficiently commercialize its progressive applied sciences. And with a small cap firm, some of the compelling causes to personal the shares is the potential for sturdy development.

Sadly, Nano-X has but to display it’s able to reaching such development. Or that it has the capital, company, and assets to take action.

In Q3 of final yr, the corporate generated solely $2.5 million in income, which was nearly similar to the quantity it produced in the identical quarter a yr prior.

And for the full-year 2023, Nano-X is estimated to have generated about $9.5 million in income, which is just marginally larger than the $8.5 million it produced in 2022.

Nano-X is scheduled to launch its This autumn 2023 earnings report in early March 2024, and at this level there isn’t any purpose to consider that the corporate’s revenues shall be considerably totally different from Q3.

General, the corporate reported a web lack of round $21.5 million final quarter, indicating that it’s nonetheless far faraway from its final purpose of turning an annual revenue.

As of Sept. 30, the corporate nonetheless had complete money, money equivalents, restricted money and marketable securities of round $95 million.

Nonetheless, that determine will in all probability have shrunk during the last a number of months. And if the corporate continues posting quarterly losses—because it has for a few years—issues over Nano-X’s persevering with money burn and solvency may intensify.

Moreover, it must be famous that again in 2020, each Citron Analysis and Muddy Waters Analysis—two well-known funding companies that concentrate on brief facet alternatives—revealed damaging reviews on Nano-X. On the time, these reviews steered that Nano-X hadn’t achieved any materials degree of success, and that the corporate’s market capitalization was bloated as in comparison with its valuation.

The current approval by the FDA might have helped to allay a few of these issues, as evidenced by the sturdy rebound within the firm’s shares final summer season. However the truth that the corporate hasn’t been in a position to considerably develop its revenues within the wake of that approval, supplies a sound purpose for persevering with skepticism.

Alongside these strains, Nano-X might finally have to boost further capital to fund its future development. And a secondary providing like that might dilute the prevailing shares, and doubtlessly push them decrease in worth.

For all of those causes, traders and merchants ought to tread cautiously in terms of new or current positions in Nano-X Imaging. The Nvidia disclosure was actually constructive information for current shareholders.

However contemplating that Nvidia inherited the place, and hasn’t constructed on it, the profit from that disclosure seems restricted. As a substitute, traders and merchants ought to in all probability concentrate on why the inventory was transferring decrease forward of that Nvidia disclosure.

On the finish of the day, Nano-X is an organization that is posted appreciable and constant quarterly losses. Till that modifications—or there’s some purpose to consider that it’s going to change within the close to future—there would not seem like a compelling purpose to personal this inventory.

Particularly with a possible secondary providing on the horizon. Then again, if Nvidia have been so as to add to its current holdings in NNOX, that will change the narrative dramatically, and sure sign a bullish shift within the firm’s future prospects.

Andrew Prochnow has greater than 15 years of expertise buying and selling the worldwide monetary markets, together with 10 years as an expert choices dealer. Andrew is a frequent contributor Luckbox journal.