tadamichi

Currently, plenty of you have got requested me to share my portfolio allocation for 2024, and I’m pleased to do this. However earlier than I get into it, please understand that what is sensible for me could not make sense for you.

All of us have distinctive circumstances, views of the market, tolerance for danger, return targets, liquidity necessities, and so forth.

I’m nonetheless a comparatively younger millennial, I’ve a excessive tolerance for danger and a very long time horizon, I come from an actual property background, and have expertise working in personal fairness.

For these causes, I make investments very closely in actual property (through REITs), personal fairness asset managers, different investments, and glued earnings is just a minor a part of my portfolio.

Beneath, I focus on every of those classes intimately and share a few of my favourite investments for every of them:

Actual Property Funding Trusts: ~50%

Most of my actual property investments are at the moment in REITs (VNQ), but it surely wasn’t at all times that manner. I used to work for an actual property funding agency that owned $100s of thousands and thousands value of belongings, and so I might additionally purchase properties myself.

However at the moment, most of my capital goes in direction of REITs as a result of they’re providing a historic alternative.

Over the previous two years, their share costs have crashed at the same time as their money flows saved on rising, and in consequence, they’re at the moment priced at their lowest valuations in a decade.

It isn’t unusual to seek out REITs that commerce at simply 50 cents on the greenback, that means that you simply get to purchase actual property at a 50% low cost.

Such giant reductions are extremely uncommon. REITs usually commerce at a small premium to their web asset values and that is the way it ought to be on condition that they supply liquidity, diversification, {and professional} administration.

So I do not assume that this window of alternative will final for lengthy.

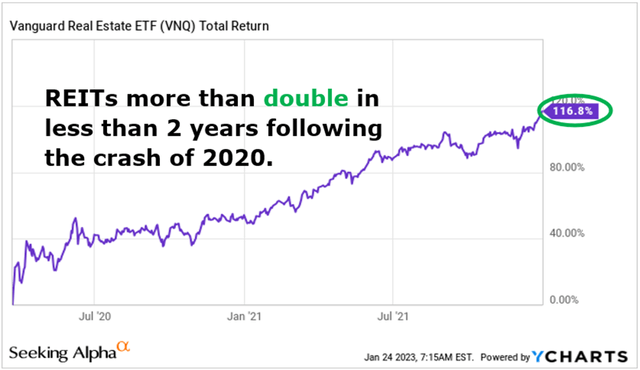

The final time REITs have been this low-cost, it was early into the pandemic, they usually then doubled in worth within the following 12 months as they recovered:

YCHARTS

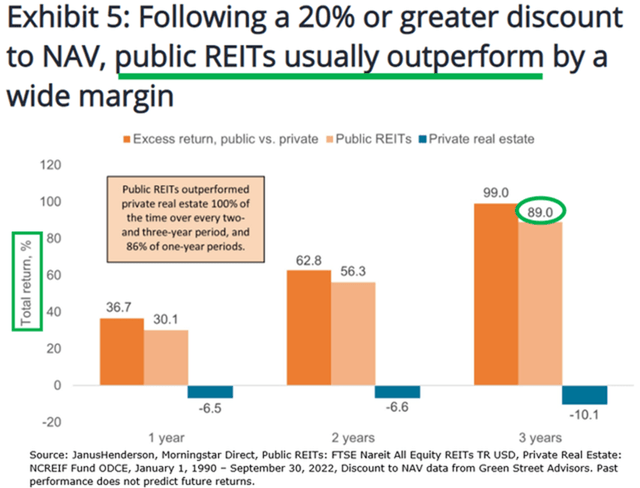

Traditionally, at any time when REITs have been priced at reductions that exceeded 20%, they have been extremely rewarding within the following years:

Janus Henderson

The latest crash occurred as a result of the market overreacted to the surge in rates of interest, but it surely failed to acknowledge that:

- The surge in rates of interest will seemingly be short-lived. Most main banks are predicting vital price cuts in 2024.

- Furthermore, REIT steadiness sheets are robust with low debt and lengthy maturities, lowering the affect even when rates of interest stay excessive for years.

- And eventually, rents preserve rising at a speedy tempo and REITs are additionally buying new properties with retained earnings to develop their money stream.

Put merely, if a REIT has a 40% LTV and just one/10 of that matures every year, this could imply that the rising rates of interest solely have a direct affect on 4% of the steadiness sheet every year. However on the identical time, the hire hikes affect 100% of the steadiness sheet, and so even when the hire escalations are restricted, they might greater than make-up for the surge in rates of interest typically.

I feel that as rates of interest return to decrease ranges in 2024, REITs will surge to new all-time highs, and so I’m investing closely in them as a result of I need to take advantage of out of this chance.

To offer you an instance of a REIT that I like: BSR REIT (OTCPK:BSRTF / HOM.U) owns inexpensive house communities in quickly rising Texan markets, and it’s at the moment priced at an estimated 40% low cost to its web asset worth. Merely closing the hole to its NAV would unlock as much as 70% upside potential, and when you wait, you earn a 5% dividend yield that is paid month-to-month. The money stream yield is far greater at round 8%, however the REIT retains practically half of that to purchase again shares, creating worth for affected person shareholders.

BSR REIT

Shares: ~20%

My shares are primarily companies that I feel I perceive higher than the market resulting from my distinctive background working in personal fairness.

Because of this, I make investments closely in personal fairness asset administration companies. These are corporations like KKR & Co. Inc. (KKR) that earn charges for managing investments for others.

It may be a really worthwhile enterprise if you happen to can persuade others to allow you to handle investments for them, because it basically lets you take part of their returns with out having to take a position any of the capital your self.

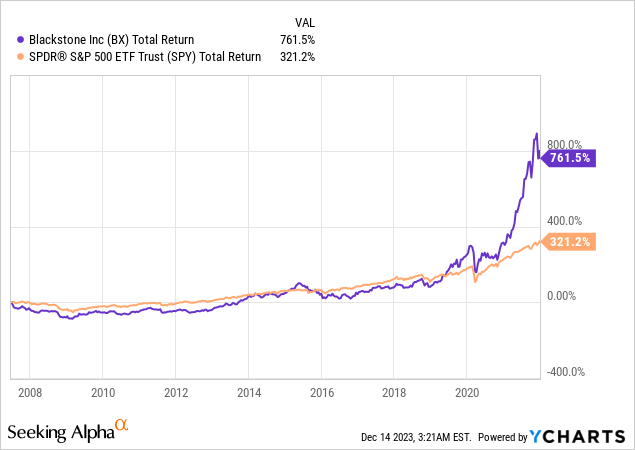

It’s a high-margin enterprise that is extremely scalable, and it leads to constant payment earnings. Blackstone (BX) is the largest firm on this area, and its shareholders have accomplished very effectively over the long term:

However at the moment, Blackstone is getting very massive with $1 trillion of capital beneath administration, so its future returns seemingly will not be practically as excessive.

The hot button is to seek out “the following Blackstone” earlier than it will get so massive as a result of that is how one can earn such distinctive returns.

And having labored on this discipline, I feel that I’m effectively positioned to determine what makes a robust firm with speedy progress prospects.

I personal a number of of them, however instance is Patria Investments (PAX), which I’ve beforehand referred to as the “Blackstone of Latin America.”

Immediately, it’s the chief within the area with simply $30 billion of belongings beneath administration, and I predict that in a decade from now, it’s going to handle nearer to 10x as a lot. Regardless of providing very robust progress prospects, it’s at the moment priced at a low valuation and affords an ~8% ahead dividend yield.

Options: ~20%

Options are personal investments that could possibly be very rewarding, however additionally they include greater danger.

My different investments are largely concentrated in two issues:

Firstly, I’ve invested in an actual property improvement venture in Tallinn, Estonia. I’ve lived in Estonia for a number of years and know the market very effectively. I feel that it’s set to turn out to be the “Luxembourg of Northern Europe,” the place rich individuals and overseas entrepreneurs transfer to save lots of on taxes and luxuriate in Europe’s finest enterprise atmosphere. It’s at the moment already the nation with essentially the most unicorns (Skype, Bolt, Smart, Pipedrive, and so forth.) per capita on the planet, and it’s nonetheless simply getting began. Estonia began from scratch within the 90s when it regained its independence from the Soviet occupation, and in simply 30 years of improvement, it has already turn out to be richer on a per capita foundation than nations like Portugal or Greece. I feel that the long run is brilliant, and the fitting properties will achieve vital worth over the approaching decade.

Secondly, I personal a stake in a personal firm referred to as FarmTogether. It’s the main crowdfunding platform for farmland investments. I feel that each investor ought to personal some farmland of their portfolio for the sake of diversification and inflation safety, however it’s at the moment very troublesome for many buyers to entry this asset class. FarmTogether solves this concern. I’ve identified its founder, Artem, for years, and I do not know any higher answer to put money into farmland. They’re nonetheless early of their progress part, and I bought to put money into the corporate when it was nonetheless lots smaller.

Farmland Companions

Fastened Earnings: ~10%

My fixed-income investments are supposed to function a pool of liquidity to purchase extra shares, REITs, and different investments in case of a market crash.

Immediately, I personal two forms of fixed-income investments:

I personal publicly listed child bonds and most popular shares, usually backed by actual asset-heavy corporations. I’m generally in a position to earn a 7-8% yield from good corporations with restricted draw back danger. A very good instance are the Sequence O most popular shares (GOODO) of Gladstone Industrial (GOOD), which at the moment provide an 8.3% dividend yield that is very effectively coated.

I additionally personal some personal short-term bridge loans which are backed by properties. They’re riskier than your common bond funding and, naturally, additionally they include a lot greater rates of interest, typically reaching 12%. However regardless of occasional defaults, my common annual return has been round 11%, they usually present a gradual stream of earnings to purchase extra shares when the market is risky.

Closing Be aware

We’re all totally different.

Investing 50% into REITs might be an excessive amount of for you, but it surely is sensible for me given my background, excessive tolerance for danger, and lengthy funding horizon.

Equally, simply holding 10% in mounted earnings is probably not sufficient for a few of you who want protected earnings.

So take all of this with a grain of salt. That is meant to provide you some concepts, however do not simply copy my complete portfolio allocation.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.