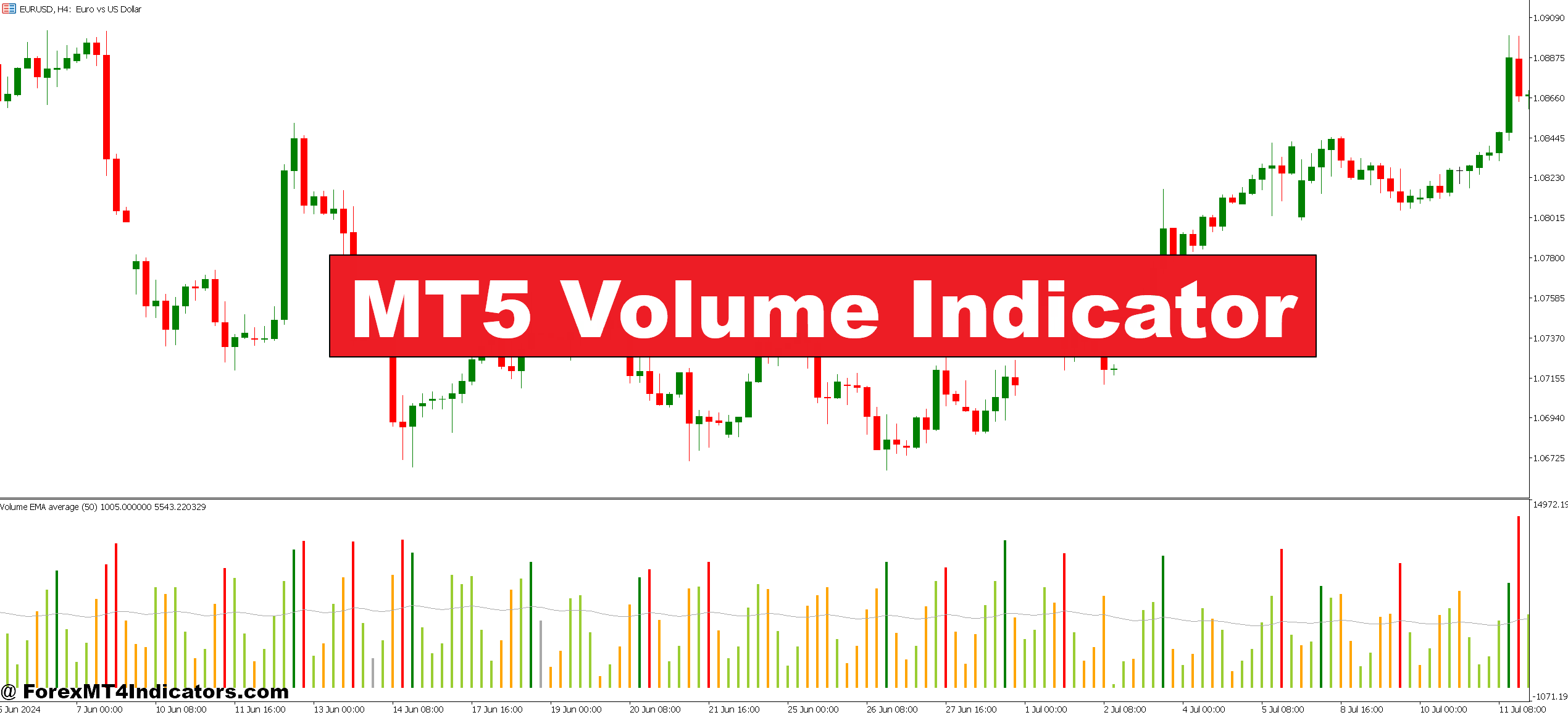

The MT5 Quantity Indicator shows tick quantity—the variety of worth modifications throughout every interval. Whereas foreign exchange doesn’t have centralized quantity like shares, tick quantity serves as a dependable proxy for precise buying and selling exercise. Extra ticks usually imply extra trades taking place.

The indicator seems as a histogram beneath your worth chart. Inexperienced bars present intervals the place quantity elevated from the earlier bar. Crimson bars point out lowering quantity. The peak of every bar represents the depth of buying and selling exercise throughout that particular candle.

This isn’t simply ornament to your chart. Quantity patterns reveal market psychology. Excessive quantity throughout uptrends suggests real shopping for curiosity. Low quantity throughout rallies? That’s usually a warning signal of weak strikes that received’t final.

How Quantity Patterns Information Buying and selling Choices

Quantity works greatest when paired with worth motion. A breakout above resistance means little if solely 50 tick quantity accompanies it. But when that very same breakout exhibits 500 tick quantity—3 times the latest common—you’re seemingly seeing actual institutional participation.

Right here’s a selected instance. On EUR/USD’s 15-minute chart in the course of the London open, worth broke above 1.0850 resistance. The breakout candle confirmed 320 tick quantity whereas latest candles averaged 180. That quantity surge confirmed robust shopping for strain, and the pair continued 40 pips greater over the subsequent two hours.

Conversely, look ahead to quantity divergences. When worth makes new highs however quantity retains declining, patrons are dropping curiosity. Sensible merchants use this as an early exit sign. The 4-hour GBP/JPY chart confirmed this completely final month—worth climbed to 183.50 with steadily dropping quantity, then reversed 150 pips over three days.

Quantity additionally helps throughout ranging markets. Low, constant quantity throughout sideways worth motion confirms you’re in consolidation. Don’t power trades there. Look ahead to quantity to increase, signaling the market’s able to pattern once more.

Customizing Your Quantity Show

MT5 enables you to regulate the indicator’s look and habits. Proper-click the quantity histogram, choose “Properties,” and also you’ll discover a number of helpful choices.

The “Volumes” dropdown affords two modes. “Tick Quantity” (default) works effective for many foreign currency trading. “Actual Quantity” solely features on exchanges that present precise quantity knowledge, which excludes most foreign exchange brokers.

Coloration settings matter greater than merchants notice. Commonplace inexperienced/crimson works, however some choose customized colours that match their chart theme. Higher visibility means you’ll truly use the indicator as a substitute of ignoring it.

Apply totally different quantity indicators throughout timeframes for affirmation. A quantity spike on the 1-hour chart carries extra weight when the 4-hour chart exhibits rising quantity too. Cross-timeframe evaluation filters out noise.

That stated, don’t overcomplicate issues. The default settings work properly for many buying and selling kinds. Resist the urge to tweak each parameter—quantity is easy by design.

Actual Benefits Over Flying Blind

The most important edge quantity gives is affirmation. Value patterns look similar whether or not they’ll succeed or fail—till you test quantity. Ascending triangles, flags, head and shoulders patterns all change into extra dependable when quantity confirms the anticipated transfer.

Quantity catches divergences that worth evaluation misses. Merchants watching solely candlesticks usually maintain dropping positions too lengthy. Quantity warns you earlier by displaying participation is drying up earlier than worth visibly weakens.

It’s additionally tougher to faux. Whereas giant gamers can push worth round briefly, they will’t maintain strikes with out precise quantity. These fast stop-hunts and false breakouts usually present minimal tick quantity. Study to identify them, and also you’ll keep away from half the traps that catch retail merchants.

The Limitations Price Understanding

Buying and selling foreign exchange carries substantial threat. No indicator ensures earnings, and quantity is not any exception.

Tick quantity isn’t true quantity. Throughout main information occasions, you would possibly see huge tick quantity from fast worth fluctuations with comparatively few precise trades. NFP releases and central financial institution bulletins create this distortion commonly.

Quantity doesn’t predict path. Excessive quantity simply means robust participation—it confirms strikes after they begin however received’t inform you which method worth will break beforehand. You continue to want strong worth motion evaluation and correct threat administration.

Low liquidity pairs present much less dependable quantity patterns. EUR/USD and GBP/USD work nice as a result of they’re closely traded. Unique pairs like USD/TRY present erratic quantity that’s tougher to interpret meaningfully.

The indicator additionally lags. By the point quantity confirms a breakout, you’ve already missed the best possible entry. That’s acceptable—getting affirmation beats playing on each potential breakout. However don’t count on quantity to get you in at precise tops and bottoms.

Commerce with MT5 Quantity Indicator

Purchase Entry

- Quantity surge on breakout above resistance – Enter lengthy when worth breaks a key stage (like 1.0850 on EUR/USD) with quantity 2x the 20-period common on the 1-hour chart or greater timeframes.

- Bullish candle with increasing quantity – Take purchase positions when a powerful bullish engulfing or pin bar kinds with no less than 50% extra quantity than the earlier 5 candles.

- Quantity affirmation at help bounce – Purchase when worth touches main help and the bounce candle exhibits quantity exceeding the latest common by 30% or extra.

- Declining quantity throughout pullbacks – Enter on pullbacks that present lowering quantity (indicating weak promoting strain) when the primary uptrend has robust quantity, particularly on GBP/USD 4-hour charts.

- Quantity divergence restoration – Purchase when worth makes the next low with rising quantity after a interval of bearish divergence (falling quantity throughout uptrend), signaling renewed purchaser curiosity.

- Threat 1-2% most per commerce – By no means enter a purchase sign, no matter quantity affirmation, in case you can’t place a cease loss that dangers solely 1-2% of your account stability.

- Keep away from low-volume breakouts throughout Asia session – Skip purchase indicators on EUR/USD or GBP/USD between 10 PM-3 AM EST when quantity usually drops beneath 60% of London session averages.

- Look ahead to quantity follow-through – Don’t purchase instantly on quantity spikes throughout information occasions; wait 15-Half-hour for follow-through quantity to verify the transfer isn’t simply preliminary volatility.

Promote Entry

- Quantity spike on resistance rejection – Enter brief when worth fails at resistance with quantity 2x greater than the 20-candle common, indicating robust promoting strain on 1-hour or 4-hour timeframes.

- Bearish sample with excessive quantity affirmation – Promote when bearish engulfing, night star, or taking pictures star patterns type with quantity no less than 40% above latest averages.

- Breakdown by help with enlargement – Take brief positions when worth breaks help ranges with quantity exceeding the 50-period shifting common by 60% or extra.

- Declining quantity throughout rally makes an attempt – Quick when worth tries to rally inside a downtrend however quantity retains dropping 20-30% with every bounce, displaying weak shopping for conviction.

- Quantity divergence at new highs – Promote when worth makes greater highs however quantity decreases for 3+ consecutive peaks, particularly on GBP/JPY or EUR/USD every day charts.

- Place stops 20-30 pips above construction – Set cease losses above the newest swing excessive plus unfold; skip the commerce if this exceeds your 2% threat restrict per place.

- Skip sells throughout Friday afternoon – Keep away from brief entries after 12 PM EST on Fridays when quantity drops considerably and weekend gaps can set off stops unexpectedly.

- Ignore quantity spikes in skinny markets – Don’t brief unique pairs or throughout main holidays when quantity readings change into unreliable on account of low liquidity and erratic tick patterns.

How This Suits Your Buying and selling Technique

Quantity works as a filter, not a standalone system. Use it to verify what your main evaluation already suggests. Spot a bullish engulfing sample? Test if quantity elevated. See a trendline break? Search for increasing quantity. Discover a double prime formation? Declining quantity provides conviction.

Mix quantity with help and resistance ranges for high-probability setups. When worth approaches a significant stage with rising quantity, count on a major response—both a powerful bounce or a clear break.

The 200-period shifting common on the quantity indicator itself gives context. Quantity above its personal common suggests heightened exercise value taking note of. Quantity beneath common throughout breakouts screams “fake-out.”

Begin easy. Look ahead to quantity enlargement throughout your regular commerce entries. In case your methodology works higher with quantity affirmation, maintain utilizing it. For those who discover little distinction after testing 30-50 trades, you may not want it. The objective is discovering what improves your particular method, not copying another person’s setup.

Quantity received’t rework a struggling dealer in a single day. But it surely provides yet another layer of affirmation that retains you out of marginal trades. Over time, avoiding these additional losses compounds into actual cash saved—and that’s usually the distinction between worthwhile months and breakeven ones.

Really helpful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 90% VIP Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90