An MT5 value motion indicator is a technical instrument designed particularly for the MetaTrader 5 platform that identifies and visualizes value motion patterns with out heavy mathematical transformations. In contrast to lagging indicators that easy or common previous knowledge, these instruments mark key value buildings in real-time: swing highs and lows, help and resistance zones, candlestick patterns, or momentum shifts primarily based on precise candle habits.

The time period covers varied instruments, however they share one philosophy: value tells the story if you know the way to learn it. Some indicators robotically detect patterns like pin bars or engulfing candles. Others mark fractal factors or establish pattern construction breaks. One of the best ones don’t predict they merely manage what value is already displaying.

What makes these indicators useful for MT5 customers? They combine seamlessly with the platform’s superior backtesting capabilities and multi-timeframe evaluation instruments, letting merchants validate value motion ideas with exhausting knowledge reasonably than intestine emotions.

How Value Motion Indicators Truly Work

Right here’s the place it will get sensible. Most MT5 value motion indicators use one in every of three core approaches.

- Sample Recognition Fashions scan every accomplished candle in opposition to predefined standards. A pin bar indicator, for example, checks whether or not the candle’s wick exceeds the physique by a sure ratio (sometimes 2:1 or 3:1) and whether or not it seems close to key ranges. When circumstances match, it fires an alert or plots a marker.

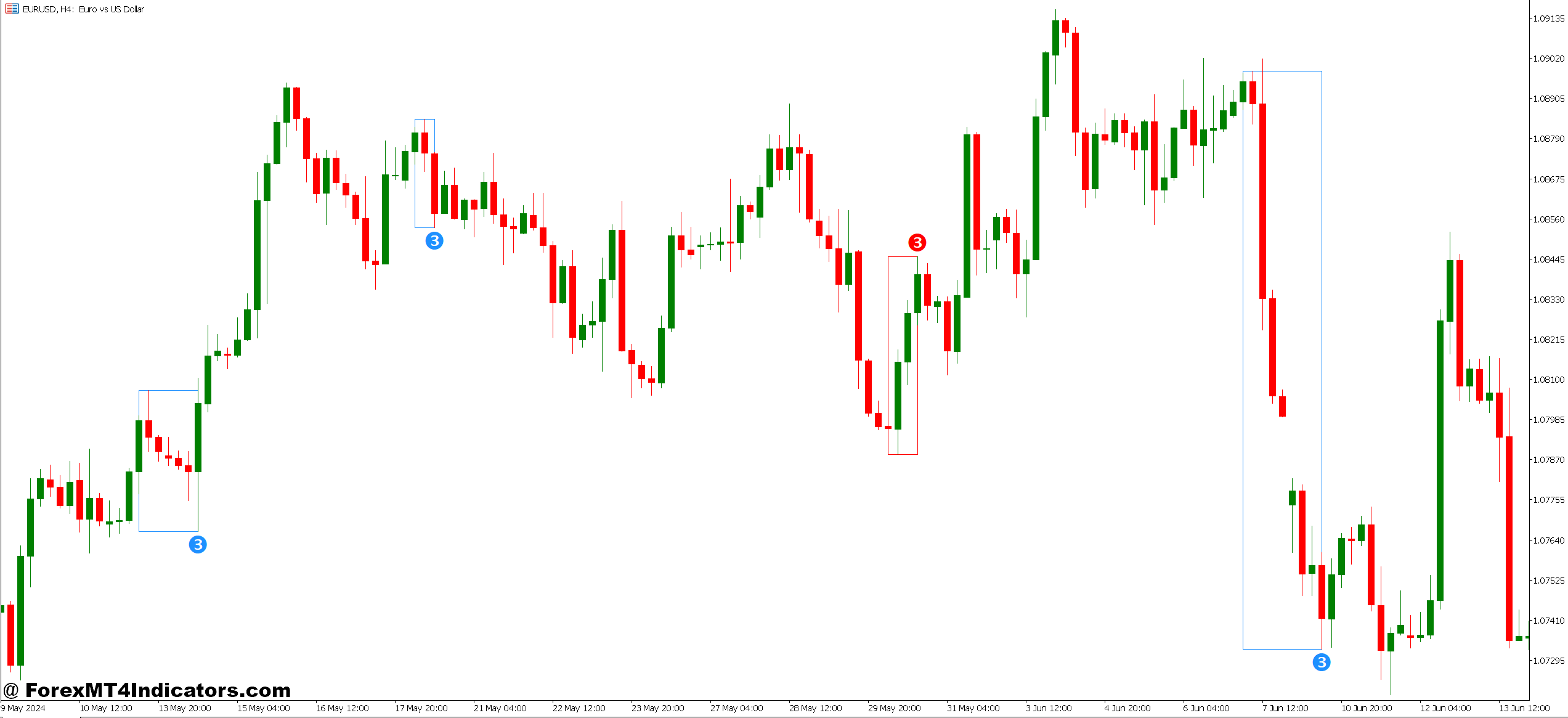

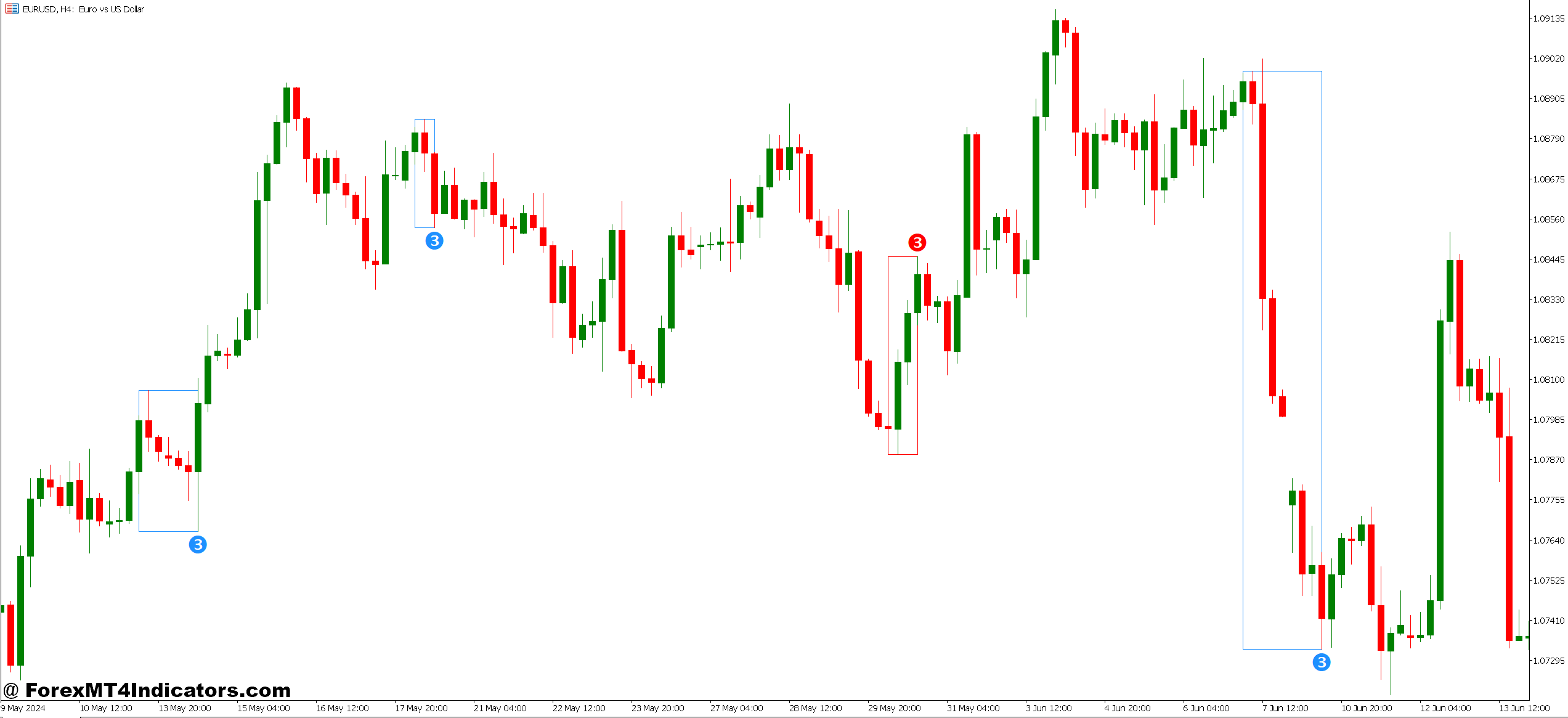

- Construction-Based mostly Instruments establish swing factors utilizing lookback intervals. They could mark a swing excessive when value makes a peak that’s increased than the earlier X candles and the next Y candles. This creates visible anchor factors displaying the place value momentum shifted. Some merchants use a 5-3-3 construction (5 candles left, peak, 3 candles proper) on increased timeframes for vital reversals.

- Momentum Shift Indicators measure the character of value motion reasonably than route. They could calculate the ratio of candle our bodies to complete ranges throughout a rolling window, flagging when the market transitions from uneven sideways motion to trending momentum. While you see tight-bodied candles all of the sudden give option to large-bodied bars, that shift usually precedes sustained strikes.

The maths isn’t rocket science that’s the purpose. A resistance zone indicator would possibly merely observe the place value rejected twice inside 20 pips over the past 100 bars. It’s marking apparent ranges, however doing it systematically so that you don’t miss them whereas managing three forex pairs concurrently.

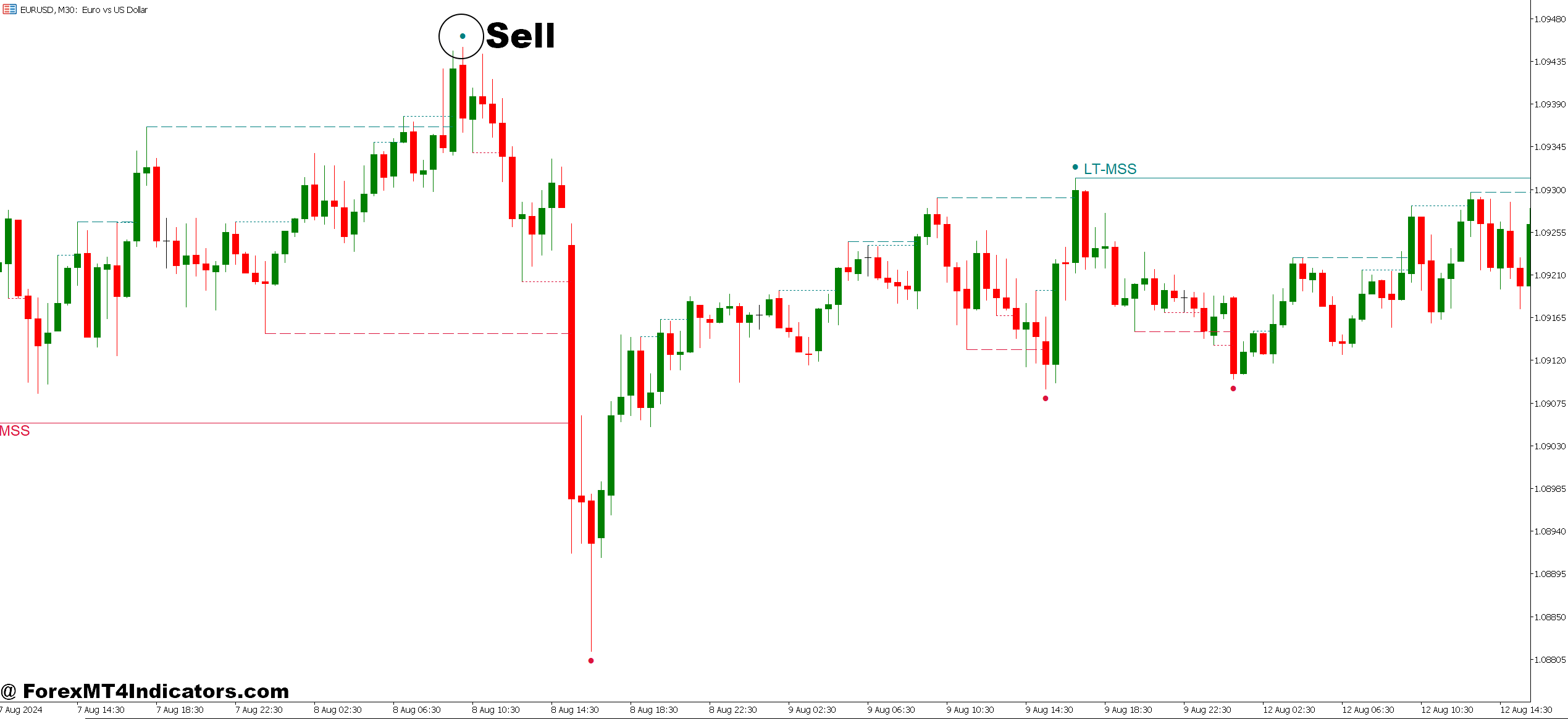

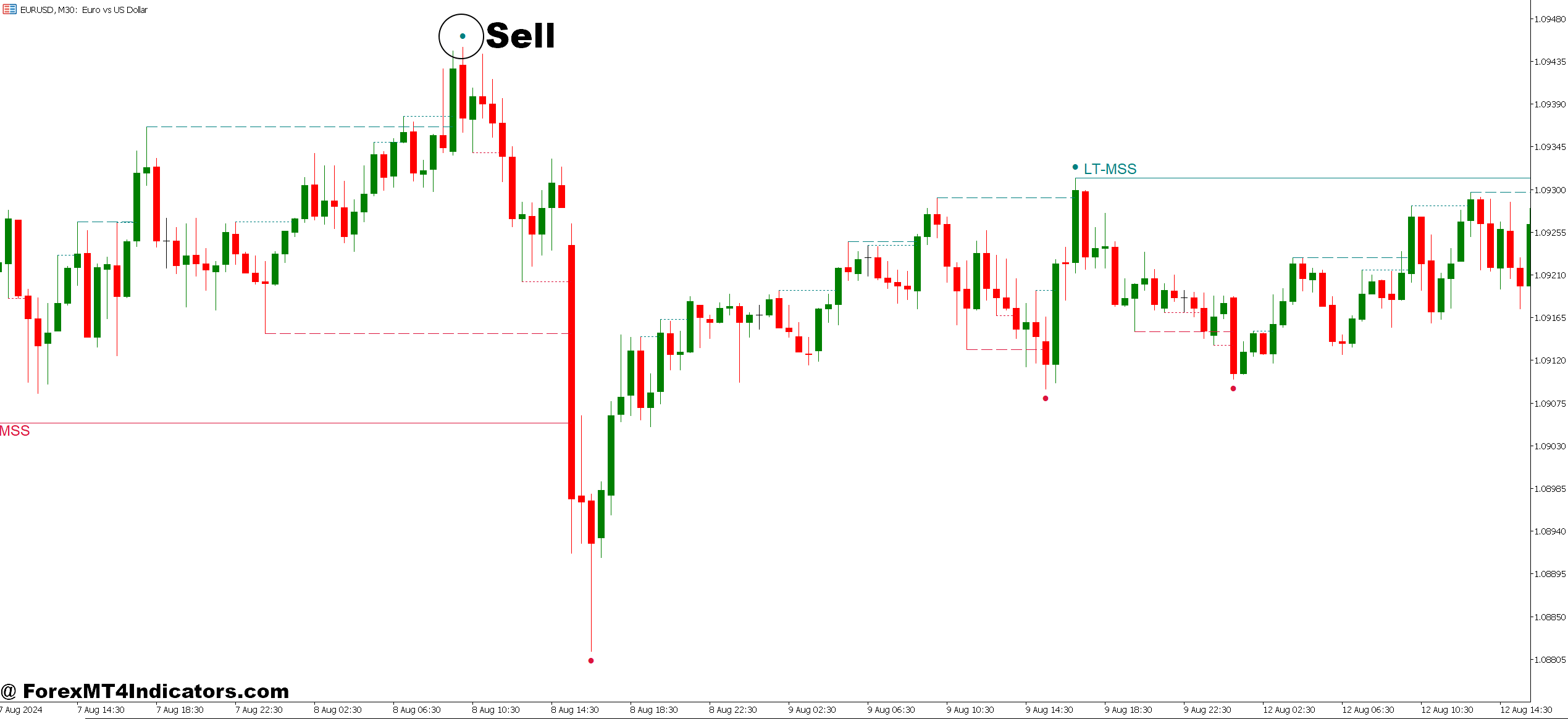

Actual-World Utility: Buying and selling the Sample

Let’s speak specifics. On GBP/JPY’s 1-hour chart throughout the November 2024 volatility, a swing level indicator marked a decrease excessive at 191.85 after value failed to interrupt 192.20. Three candles later, value knifed via the earlier swing low at 190.40. That construction break clearly marked by the indicator signaled the shift from ranging to bearish trending.

A dealer watching this might’ve entered quick at 190.35 with a cease above 191.90 (simply above the decrease excessive), focusing on the following help zone at 188.80. Danger-to-reward: roughly 1:2.5. The indicator didn’t predict something it simply organized the data so the setup was apparent.

However right here’s the factor: you continue to want context. That very same indicator will mark swing breaks in uneven circumstances too, and people usually lead nowhere. Throughout Asian session ranges, value motion indicators hearth alerts that get you chopped up. The instrument reveals you value construction; you present the market context about whether or not that construction issues.

One sensible tip: mix timeframes. In case your major timeframe is the 15-minute chart, verify what the value motion indicator reveals on the 1-hour or 4-hour. When swing breaks align throughout timeframes say, a 15-minute construction break taking place as value approaches a 4-hour resistance zone that’s the place edge lives.

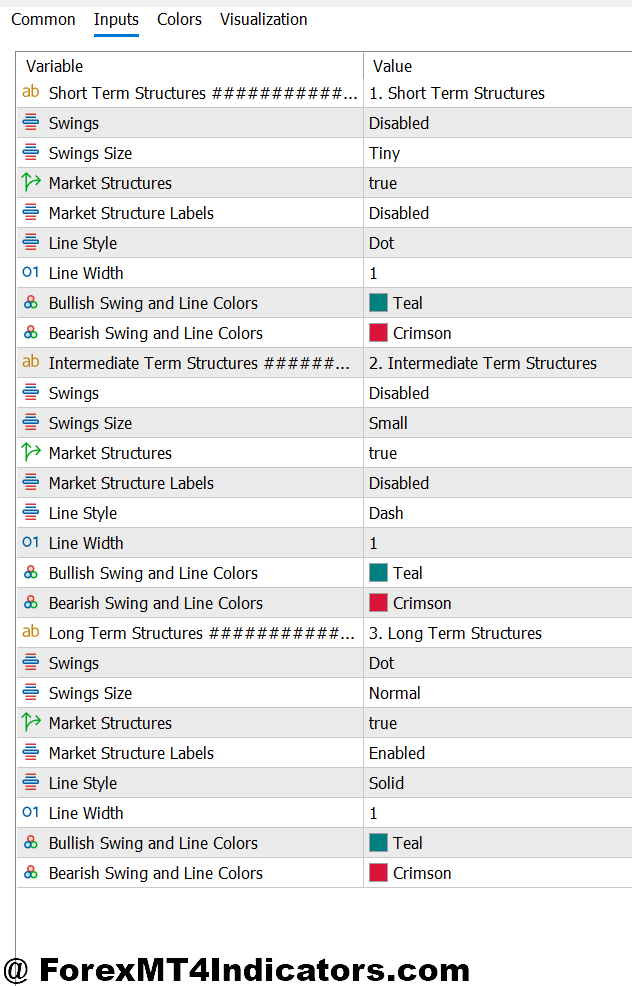

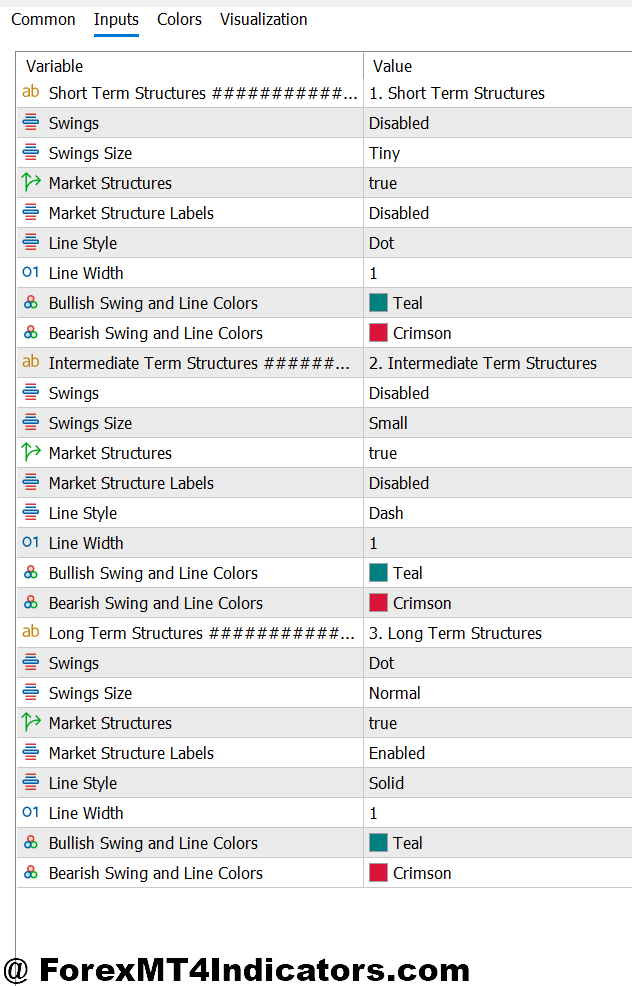

Customization: Making It Work for Your Type

Most MT5 value motion indicators include adjustable parameters that considerably have an effect on their habits. Understanding these settings separates merchants who use instruments successfully from those that complain that “nothing works.”

- Sensitivity Settings management what number of patterns or swing factors get marked. A pin bar indicator may need a wick-to-body ratio parameter. Set it to 2:1, and also you’ll catch extra patterns (together with weaker ones). Crank it to 4:1, and also you’ll solely see essentially the most dramatic rejections. Scalpers would possibly need extra alerts; swing merchants need fewer, higher-quality setups.

- Lookback Intervals decide what number of candles the indicator considers. A swing excessive indicator with a 5-bar lookback reacts rapidly however marks extra minor swings. A 20-bar lookback is slower however identifies extra vital pivots. For day buying and selling, shorter lookbacks (5-10 bars) make sense. For place buying and selling, you’d prolong it to 15-25 bars or extra.

- Zone Thickness issues for help/resistance indicators. Some merchants favor precise strains; others need 10-pip zones acknowledging that ranges aren’t exact. GBP pairs with their wider spreads want thicker zones than EUR/USD’s tight spreads.

One often-overlooked setting: alert customization. Set alerts for sample formation reasonably than watching charts continually. When a pin bar types at a key zone on AUD/USD’s 4-hour chart, you wish to know even should you’re away out of your desk.

Benefits and Actual Limitations

The benefits are simple. Value motion indicators scale back choice paralysis by highlighting what issues. They’re not repainting the previous (no less than, the correctly coded ones aren’t). They work throughout all timeframes and forex pairs as a result of value habits is common. They usually encourage merchants to consider market construction reasonably than chasing magic settings on lagging oscillators.

There’s additionally the simplicity issue. A clear chart with swing factors marked beats a rainbow of EMAs and stochastic oscillators each time. Much less distraction means clearer pondering, particularly throughout unstable periods when you might want to act quick.

However let’s be sincere about limitations. Buying and selling foreign exchange carries substantial danger, and no indicator ensures earnings together with these. Value motion indicators mark patterns, however patterns fail. An ideal pin bar at help can get steamrolled if elementary information hits. Throughout main financial releases like NFP or central financial institution choices, technical patterns take a backseat to uncooked order stream.

These indicators additionally require interpretation. They’re not mechanical methods spitting out “purchase right here” alerts. A swing break is perhaps the beginning of a pattern or only a cease hunt earlier than value reverses. It is advisable filter alerts via extra evaluation: Is there clear directional momentum? What’s the broader market context? The place are the main ranges?

And right here’s one thing merchants don’t talk about sufficient: even good indicators can develop into crutches. Counting on automated sample detection can forestall you from creating the ability to learn uncooked value motion your self. Use these instruments as coaching wheels, not everlasting options.

How They Examine to Conventional Technical Indicators

Stack an MT5 value motion indicator in opposition to one thing like MACD or RSI, and the variations develop into clear. Conventional oscillators derive from value however function steps faraway from precise market habits. MACD measures the connection between two transferring averages helpful, however you’re analyzing an evaluation of an evaluation.

Value motion instruments keep nearer to the supply. When a swing low indicator marks a degree, it’s pointing to the place patrons really stepped in with sufficient pressure to reverse downward momentum. That’s tangible market habits, not a mathematical abstraction.

That mentioned, they’re not mutually unique. Some merchants use value motion indicators for entries and construction, whereas utilizing RSI or MACD for confluence. If value breaks a swing low and RSI drops beneath 30 into oversold territory, that’s two completely different analytical strategies agreeing which provides confidence.

The sting value motion indicators maintain over indicator soup? They age higher. A help zone that mattered in 2020 would possibly nonetheless matter now. However that good MACD crossover setting somebody discovered? Market circumstances shift, and people parameters cease working. Value motion ideas help, resistance, momentum shifts stay fixed as a result of they mirror human habits, which doesn’t essentially change.

The best way to Commerce with MT5 Value Motion Indicator

Purchase Entry

- Bullish swing low break rejection – When value breaks beneath a marked swing low by 5-10 pips on EUR/USD 1-hour chart then instantly reverses with a robust bullish candle, enter lengthy with cease 15 pips beneath the swing low.

- Pin bar at help zone – Search for pin bars with 3:1 wick-to-body ratio forming at recognized help on GBP/USD 4-hour chart; enter on subsequent candle open with cease beneath pin bar low, focusing on 2:1 reward-to-risk.

- Greater excessive affirmation – After indicator marks the next excessive above earlier swing peak, enter lengthy on pullback to 50% retracement degree; works greatest on day by day charts throughout clear uptrends with 40-50 pip stops.

- Failed breakdown sample – When value breaks help by 15-20 pips however closes again above inside 2-3 candles, enter lengthy as bulls defend the extent; keep away from throughout main information occasions when breakouts are likely to comply with via.

- A number of timeframe alignment – Solely take purchase alerts when 15-minute swing break coincides with 1-hour bullish construction and 4-hour uptrend; single timeframe alerts in ranging markets produce 60%+ false entries.

- Momentum candle after consolidation – When value coils in 20-30 pip vary for 8+ candles then breaks increased with physique 2x common dimension, enter on retest of breakout degree with 25-pip cease.

- Don’t purchase at resistance – Ignore bullish patterns forming inside 10 pips of marked resistance zones on any timeframe; anticipate break and retest affirmation or danger getting trapped in rejection zones.

- Quantity surge affirmation – Enter lengthy solely when bullish swing breaks happen with 150%+ common quantity; low-volume breakouts on Asian session EUR/USD steadily reverse inside 5-10 candles.

Promote Entry

- Bearish swing excessive break – When value breaks above marked swing excessive then fails with rejection candle, enter quick on break beneath that candle’s low; use 20-pip cease above swing excessive on GBP/USD pairs.

- Capturing star at resistance – Establish taking pictures stars with higher wick 3x physique dimension at resistance zones on 4-hour charts; enter quick subsequent candle with cease 10 pips above excessive, minimal 1.5:1 risk-reward ratio.

- Decrease low affirmation – After indicator marks new decrease low, enter quick on rally to 38.2% Fibonacci retracement of the down-leg; works greatest on day by day timeframe with 60-80 pip stops for swing trades.

- Failed breakout above resistance – When value spikes 15-25 pips above resistance however closes again beneath inside 1-2 candles, enter quick instantly; this “bull entice” sample works exceptionally effectively on EUR/USD London open.

- Triple timeframe bearish construction – Solely promote when 15-minute reveals swing break, 1-hour confirms decrease excessive, and 4-hour shows downtrend; single timeframe alerts throughout uneven circumstances lose 70% of the time.

- Distribution sample completion – When value makes 3+ related highs inside 30-pip vary then breaks decrease with momentum candle, enter quick on retest with cease above vary excessive plus 15 pips.

- Keep away from promoting at main help – By no means take quick alerts inside 15 pips of day by day/weekly help zones even when sample appears good; these ranges entice large shopping for curiosity that invalidates technical setups.

- Information occasion filter – Skip all promote alerts half-hour earlier than and a pair of hours after high-impact information (NFP, charge choices, GDP); value motion patterns fail when elementary order stream dominates the market construction.

Making It Work for You

The MT5 value motion indicator isn’t a holy grail these don’t exist in buying and selling. What it affords is construction and readability in studying market actions which might be already taking place. It marks swing factors you would possibly miss throughout quick markets, highlights patterns forming throughout a number of pairs, and retains your evaluation grounded in precise value habits reasonably than spinoff arithmetic.

Begin easy. Decide one kind of value motion indicator swing factors, sample recognition, or construction breaks and study it completely on a demo account. Check it throughout completely different pairs and timeframes. Discover when alerts work and after they fail. Construct that sample recognition earlier than including complexity.

And bear in mind: the indicator reveals you value construction, however you deliver the context. Market circumstances, timeframe alignment, danger administration these parts decide whether or not a marked sample turns into a worthwhile commerce or a lesson in what to not do. Use these instruments to arrange data, not as an alternative choice to buying and selling ability.

The query isn’t whether or not value motion indicators work. It’s whether or not you’ll put within the display screen time to grasp what value is telling you.

Advisable MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 90% VIP Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90