S&P 500 (ES1!) Analysis

- Large moves to the upside during a market downturn aren’t exactly out of the ordinary

- S&P 500 consolidates at first real test of resistance. Morning star on the 4-hour chart hints at bearish continuation

- Major Risk events: US NFP then US PPI and CPI next week along with FOMC minutes

Recommended by Richard Snow

Get Your Free Equities Forecast

Outsized Moves to the Upside Aren’t Unusual During Downturns

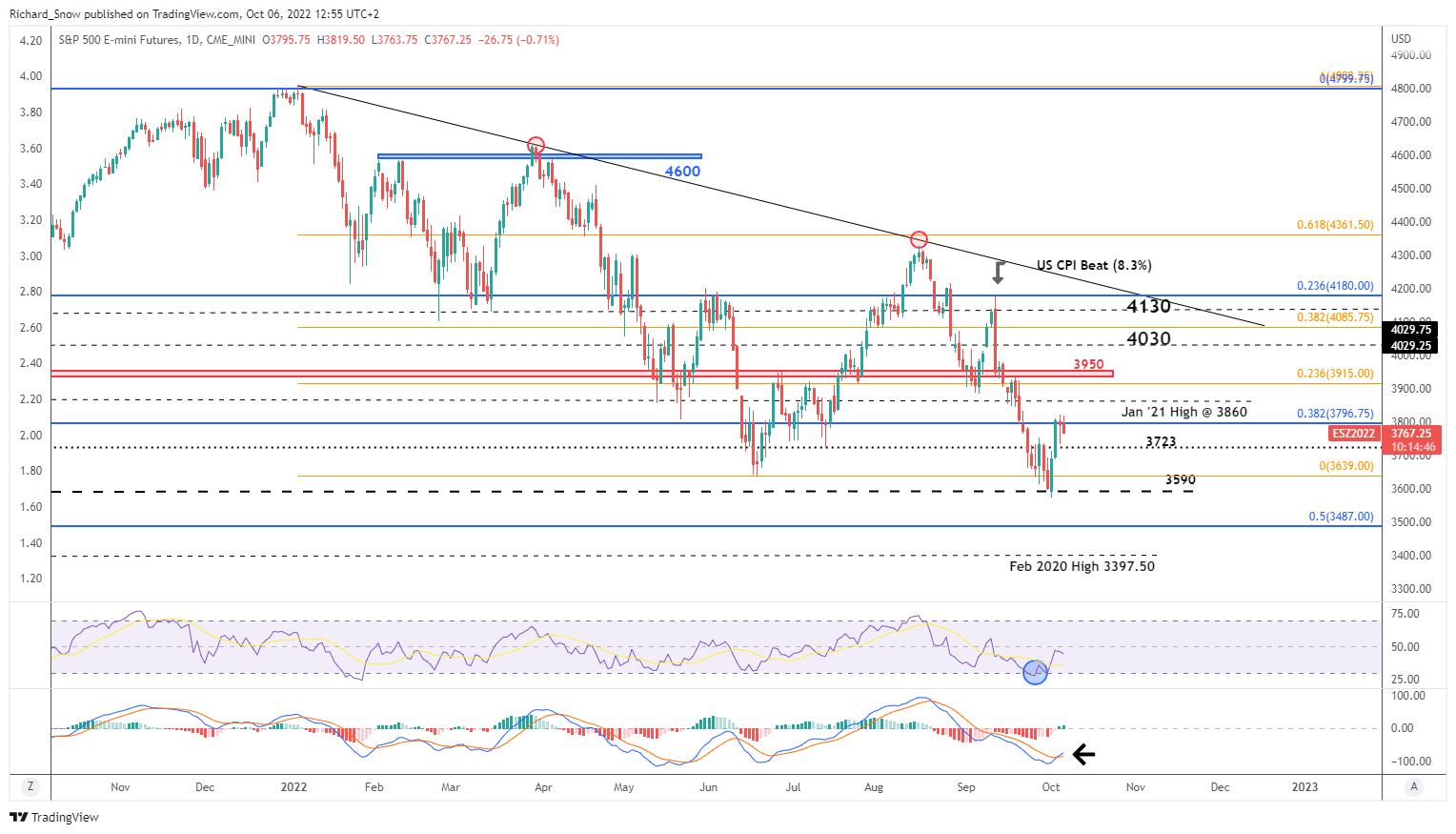

The S&P 500 tests resistance after an amazing 2-day performance where the index rose around 6% over the two days. It may seem illogical, but it is not unusual for equity markets to make sizeable one or two day advances while experiencing a downturn. Using a rate of change indicator, it is clear to see large spikes to the upside during the global lockdowns in 2020. A similar phenomenon is clear during the 2008/09 global financial crisis.

S&P 500 Daily Chart Showing Large Upside Moves During a Downturn

Source: TradingView

The recent advance appears to have stalled at the prior high around 3822 (upper wicks) before easing off towards the 38.2% Fibonacci level (3796) of the 2020 to 2021 major move. Equity markets have at times traded with a short-term memory, anticipating cooler inflation prints accompanied by a ‘Fed pivot’, which had brought about a general rise in equity levels. Last month provided the perfect example around the US CPI print for August which proved to confirm stubbornly high inflation, resulting in a sudden move lower. In this environment of aggressive rate hikes, equity valuations get revised lower and disposable incomes shrink. Less disposable income means less spending which negatively impacts company sales in aggregate.

Support comes in at 3727 followed by 3639 and 3590. There is a rather high bar for continued upside from here. A bullish continuation remains constructive above 3950 for the time being.

ES1! Daily Chart

Source: TradingView, prepared by Richard Snow

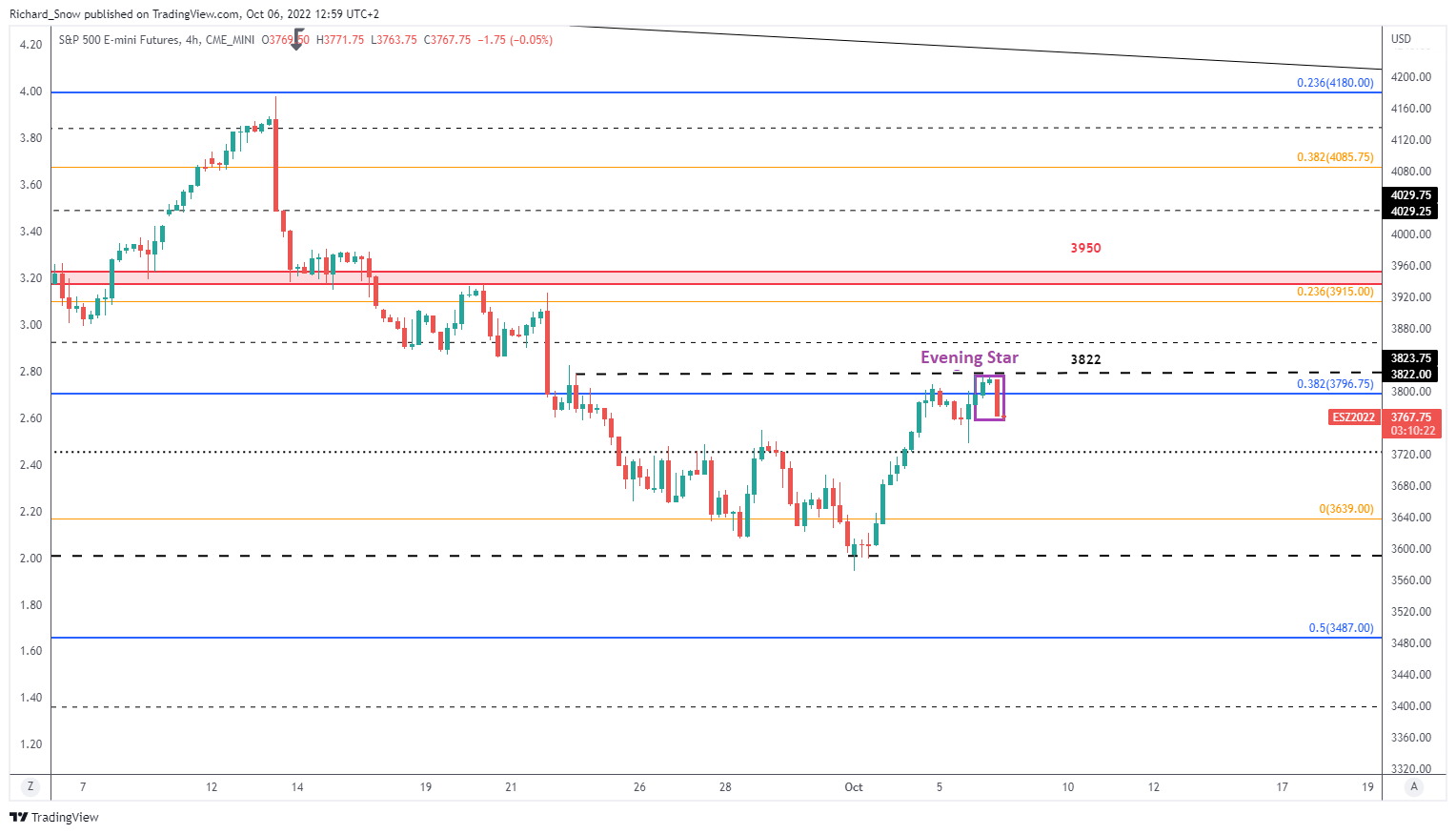

The 4-hour chart reveals the formation of an evening star at the aforementioned level of 3822 where price action has traded lower since.

ES1! 4-Hour Chart

Source: TradingView, prepared by Richard Snow

IG Client Sentiment: S&P 500

- US 500:Retail trader data shows 57.39% of traders are net-long with the ratio of traders long to short at 1.35 to 1.

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests US 500 prices may continue to fall.

- The number of traders net-long is 1.05% higher than yesterday and 1.32% higher from last week, while the number of traders net-short is 2.23% lower than yesterday and 5.36% higher from last week.

- Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed US 500 trading outlook.

| Change in | Longs | Shorts | OI |

| Daily | 0% | -2% | -1% |

| Weekly | -7% | 18% | 3% |

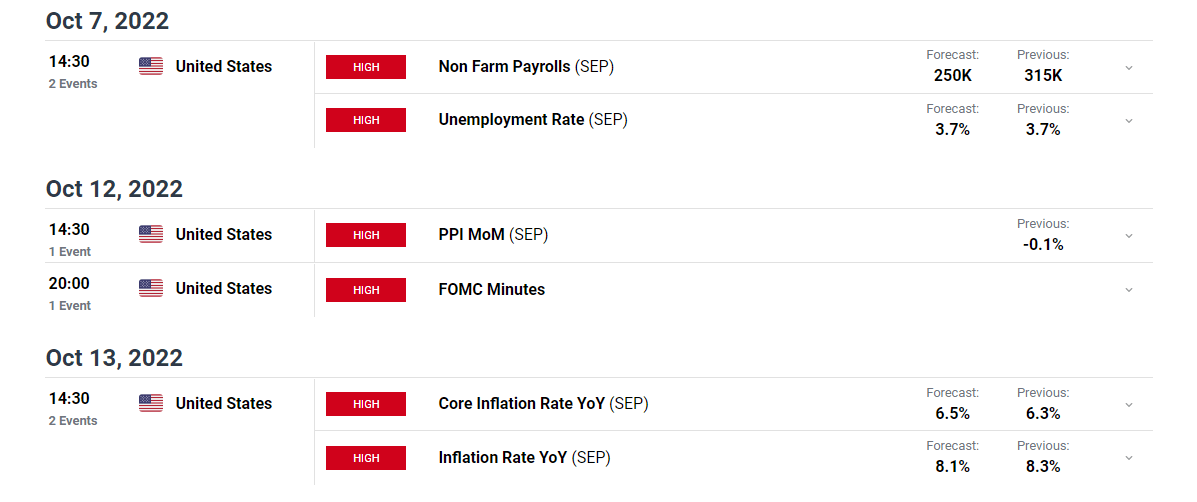

Major Risk Events Ahead

Non-farm payrolls brings this week to a close, where the focus will return to the resilient labor market. The massive drop in job openings earlier this week via the JOLTS report could compound the effect of any material drop in employment for September. In this event equities could receive another lift while the dollar may weaken as a result.

Next week, PPI data and the FOMC meeting minutes are due to be released along with the highly anticipated CPI data for September. The last time inflation was forecast to come in at 8.1% we saw an instant repricing in US equities as inflation proved stubbornly high at 8.3%.

Customize and filter live economic data via our DaliyFX economic calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX