Up to date on October seventeenth, 2024 by Felix Martinez

The Keg Royalties Earnings Fund (KRIUF) has two interesting funding traits:

#1: It’s a high-yield inventory primarily based on its 7.5% dividend yield.

Associated: Listing of 5%+ yielding shares.

#2: It pays dividends month-to-month as an alternative of quarterly.

Associated: Listing of month-to-month dividend shares

You possibly can obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter, like dividend yield and payout ratio) by clicking on the hyperlink beneath:

The mixture of a excessive dividend yield and a month-to-month dividend render The Keg Royalties Earnings Fund interesting to income-oriented buyers.

However there’s extra to the corporate than simply these components. Hold studying this text to study extra about The Keg Royalties Earnings Fund.

Enterprise Overview

The Keg Royalties Earnings Fund is a limited-purpose fund that owns the Keg logos and associated property bought from Keg Eating places Ltd (KRL). Keg Eating places has constructed a premier steakhouse model in Canada and a longtime presence in the US.

The fund owns the rights to the model and has granted KRL an unique license to make use of the Keg Rights in trade for a month-to-month royalty fee equal to 4% of the product sales of Keg eating places.

In return for including eating places to the fund’s royalty pool, KRL receives the appropriate to accumulate items within the fund. KRL’s efficient possession of the fund has grown from 10.00% on the time of the IPO in 2002 to over 33.%% as of the tip of 2023. Therefore, the pursuits of the 2 entities are well-aligned.

The Keg Royalties Earnings Fund stands out as a “top-line” fund, with its income stemming predominantly from KRL’s restaurant gross sales and solely minor working and financing bills curbing its web revenue. Moreover, the fund advantages from a secondary supply of revenue – a $57.0 million Keg Mortgage, which generates curiosity revenue at a price of seven.5% every year, paid month-to-month.

This distinctive construction shields the fund from the fluctuating earnings and bills related to really working the eating places. Because of this, the fund enjoys safety from inflation and a comparatively predictable stream of royalties and curiosity, amongst different advantages.

Progress Prospects

Just like different royalty funds of its sort that we have now analyzed, just like the Boston Pizza Royalty Earnings Fund and the A&W Income Royalties Earnings Fund, the fund’s development prospects and general efficiency hinge on simply two key components. The primary is the variety of franchised eating places in its royalty pool, whereas the second is the speed of development in same-restaurant gross sales.

For context, at first 0f 2004, the fund had 86 Keg eating places in its royalty pool. By the tip of 2007 and 2013, this quantity had grown to 95 and 102, respectively. Since then, exercise within the royalty pool has been reasonably stagnant. On the finish of 2020 and 2021, the fund had 106 eating places in its pool, whereas by the tip of 2023, it had added another to its rely of 105.

We anticipate only a few annual additions to the fund’s royalty pool, because it seems the model has reached peak scaling potential. Compared to the Boston Pizza and A&W Royalty Funds, which primarily give attention to fast-food manufacturers and supply extra vital development potential, Keg’s high-end eating expertise is extra tailor-made to a smaller and extra specialised demographic, leading to a extra contained enlargement functionality.

That mentioned, rising same-restaurant gross sales nonetheless poses a development catalyst for the fund. In 2019, earlier than the COVID-19 pandemic, there have been 105 Keg eating places within the fund’s royalty pool, producing about C$623.7 million in product sales, or C$5.94 million per restaurant.

Because of this, the final six months, the fund recorded about C$14.257 million (pink field) in royalty, which is strictly 4% of the underlying gross restaurant gross sales within the royalty pool. It additionally recorded a further $2.177 million in curiosity revenue from its 7.5%-yielding mortgage, as talked about earlier. You may as well see the distributions paid to KRL equivalent to its possession within the fund and different developments paid for upcoming restaurant openings.

Supply: Annual Report

Future value will increase in keeping with inflation ought to slowly however step by step add to the fund’s royalty-eligible product sales generated by KRL. In fact, foot visitors within the firm’s eating places and/or restaurant openings and closings may sway outcomes, both.

The corporate reported its monetary outcomes for the second quarter and the primary half of 2024, displaying combined efficiency. Royalty Pool Gross sales elevated by 2.3% within the second quarter to $175.2 million, however decreased by 1.8% year-to-date, totaling $356.4 million. Equally, Keg Eating places Ltd.’s (KRL) common gross sales per working week noticed a 2.3% rise within the quarter, however dropped by 1.2% for the yr. Regardless of a decline in visitor visits, same-store gross sales had been up 1.7% within the quarter however down 1.9% year-to-date.

Royalty revenue for the quarter elevated by 2.3% to $7.0 million, although it fell 1.8% year-to-date. Distributable money, a key indicator of economic well being, decreased by 4.3% to $0.282 per Fund unit for the quarter however rose by 8.9% year-to-date. The Fund paid out a particular money distribution of $0.08 per unit in January 2024, contributing to a payout ratio of 100.8% for the quarter and 82.1% year-to-date.

Regardless of these fluctuations, the Fund stays financially secure, with $2 million in money and a optimistic working capital steadiness of $3.7 million. Administration stays optimistic, attributing the optimistic quarter outcomes to operational efficiencies and a powerful visitor expertise. KRL plans to give attention to advertising and marketing efforts and enhancing visitor demand via the rest of 2024.

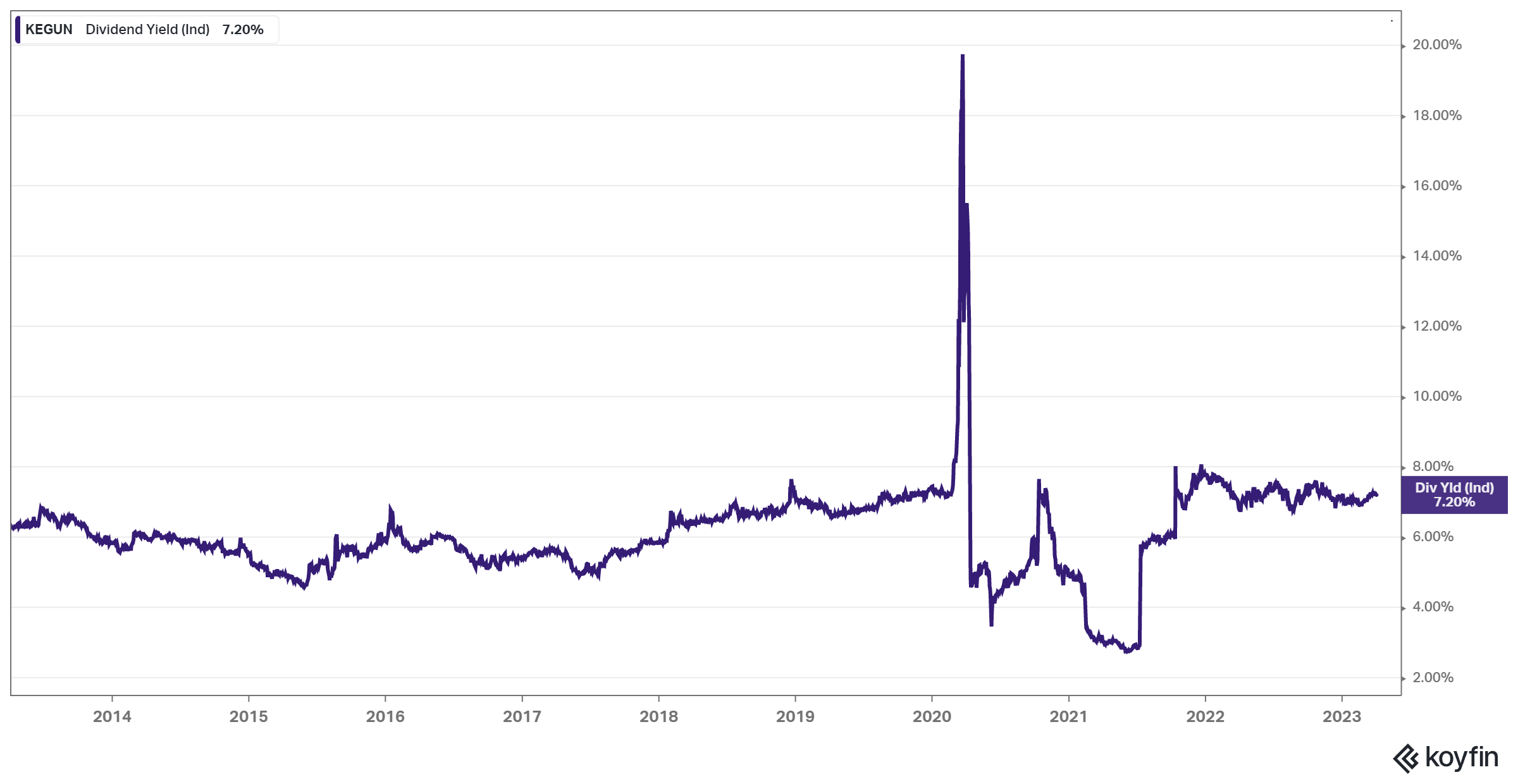

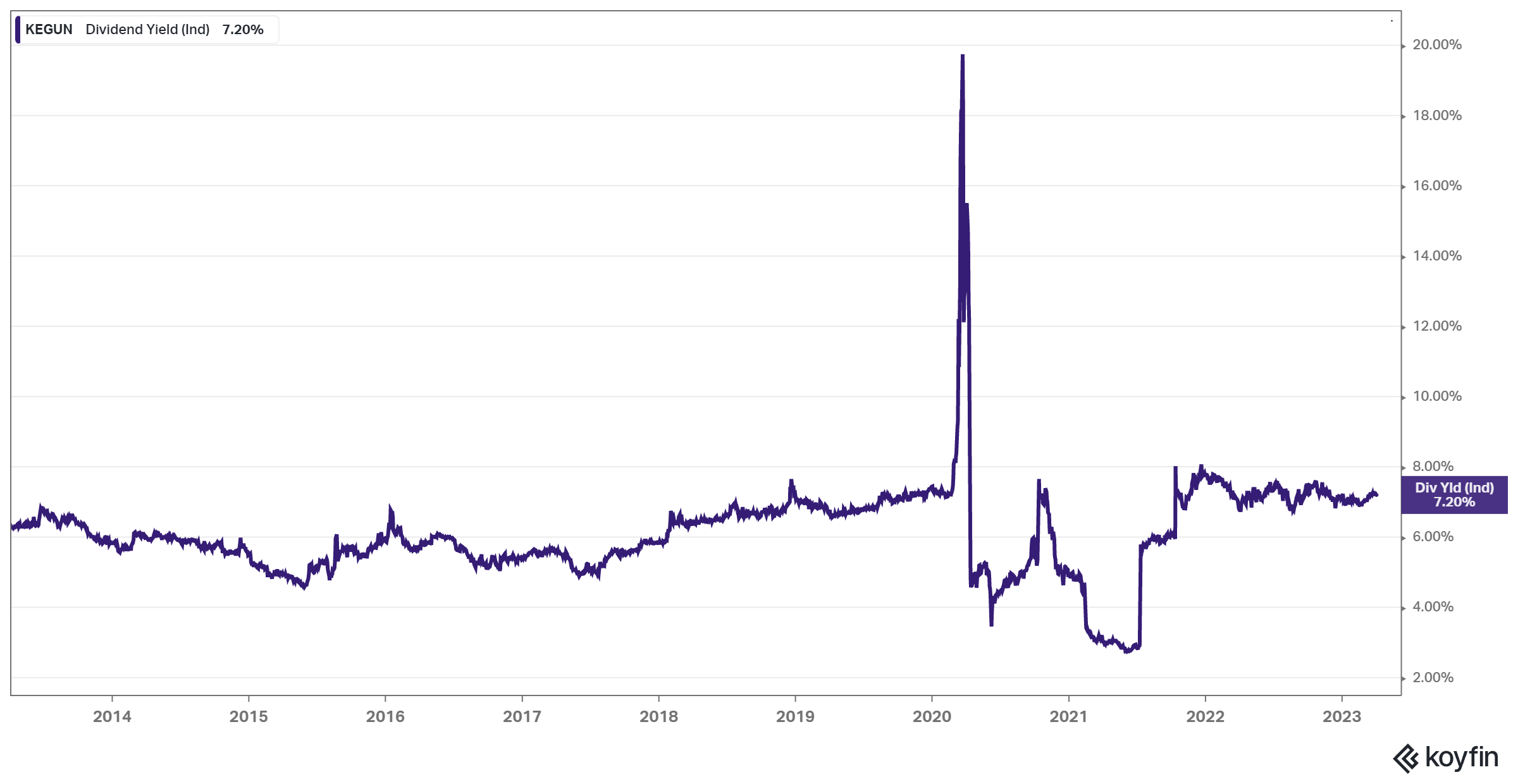

Dividend Evaluation

Aligned with the fund’s intention to distribute all its earnings to unitholders, the payout ratio has constantly hovered across the 100% mark. In 2023, it stood at 87%, whereas in 2021, it was 121.5%, owing to the fund’s resolution to disburse additional money that had been held again in 2020 as a result of pandemic, which had resulted in a payout ratio of simply 85.9% on the time. Nonetheless, since its inception, administration estimates that 99.78% of distributable money has been distributed.

Buyers shouldn’t anticipate distribution will increase or distribution “cuts”, however as an alternative anticipate that every yr’s whole distributions per unit will differ primarily based on the underlying product sales of Keg-licensed eating places.

We see restricted distribution development prospects shifting ahead, in keeping with our rationale relating to the fund’s general development. Aside from larger pricing through the years, we will see the fund producing roughly stagnant earnings and thus paying out reasonably stagnant distributions.

The present month-to-month distribution of C$0.09 interprets to an annualized price of C$1.08 (or US$0.78), implying a yield of seven.5%. This yield is reasonably substantial, but it surely additionally displays buyers’ expectations for restricted dividend development prospects.

Supply: Koyfin

It’s price highlighting that the administration’s strategy seems to contain dividing the quarterly or yearly distributions into equal sums by forecasting the forthcoming money flows, thereby making a uniform distribution price and making certain consistency in payouts month after month.

Closing Ideas

The Keg Royalties Earnings Fund gives a hefty dividend yield, which, together with the extremely enticing frequency of its month-to-month payouts, makes it a compelling choose for income-oriented buyers.

Its frictionless income mannequin, which is instantly tied to the restaurant’s product sales in its royalty pool, gives safety from inflation and a reliable stream of earnings, no matter every particular person restaurant’s profitability.

Offered that the Keg model doesn’t considerably change, we anticipate the corporate will proceed to generate a secure stream of month-to-month distributions via dependable royalty and curiosity revenue.

Nevertheless, in comparison with different trusts of this sort we have now analyzed, we anticipate that the scope for distribution development is comparatively restricted as a result of paucity of recent restaurant openings and the doable saturation of the model.

Consequently, buyers ought to put together for the majority of their returns to come back from the dividend. Taking this under consideration, we imagine the fund is not going to obtain annualized returns exceeding the mid-to-high single digits, which is in keeping with its present dividend yield.

Don’t miss the assets beneath for extra month-to-month dividend inventory investing analysis.

And see the assets beneath for extra compelling funding concepts for dividend development shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].