Revealed on October eighth, 2024 by Aristofanis Papadatos

Paramount Sources (PRMRF) has two interesting funding traits:

#1: It’s providing an above common dividend yield of 6.4%, which is greater than 5 occasions the dividend yield of the S&P 500.

#2: It pays dividends month-to-month as an alternative of quarterly.

You may obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yield and payout ratio) by clicking on the hyperlink under:

The mix of an above common dividend yield and a month-to-month dividend render Paramount Sources interesting to particular person buyers.

However there’s extra to the corporate than simply these components. Preserve studying this text to be taught extra about Paramount Sources.

Enterprise Overview

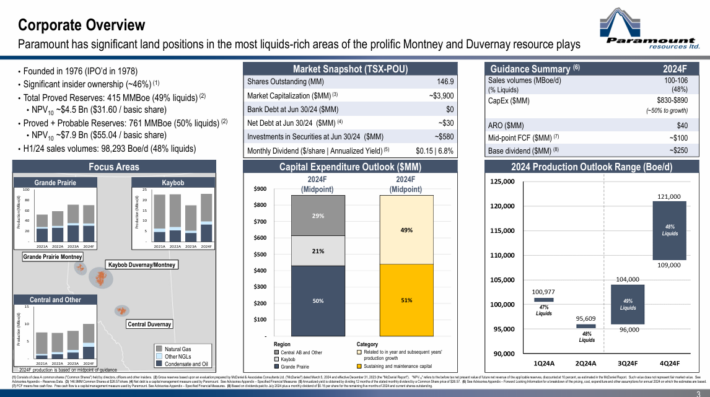

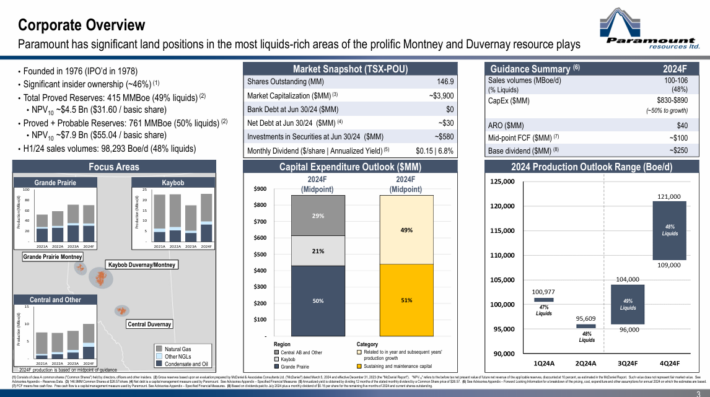

Paramount Sources explores for and produces oil and pure gasoline from typical and unconventional fields within the Western Canadian Sedimentary Basin.

The corporate holds pursuits within the Karr and Wapiti Montney properties, which cowl an space of 185,000 internet acres positioned south of town of Grande Prairie, Alberta. The corporate was based in 1976 and is predicated in Calgary, Canada.

Paramount Sources has a median manufacturing charge of about 100,000 barrels per day and whole proved reserves of 415 million barrels of oil equal, with oil and gasoline at a 49/51 ratio.

Supply: Investor Presentation

Additionally it is necessary to notice that the corporate has 46% possession by insiders. This can be a remarkably excessive p.c of possession, which ends up in the alignment of pursuits between insiders and the opposite particular person shareholders.

As an oil and gasoline producer, Paramount Sources is extremely cyclical because of the dramatic swings of the costs of oil and gasoline. The corporate has reported losses in 5 of the final 10 years and resumed its dividend funds solely in the summertime of 2021, after 22 years and not using a dividend fee.

Alternatively, Paramount Sources has some benefits when in comparison with the well-known oil and gasoline producers. Most oil and gasoline producers have been struggling to replenish their reserves because of the pure decline of their producing wells.

Quite the opposite, Paramount Sources posted an exceptionally excessive reserve substitute ratio of 140% in 2023. Consequently, the corporate expects its manufacturing in 2028 to be practically 50% greater than its manufacturing in 2023.

The reserve substitute ratio is paramount within the oil and gasoline trade. With no stable reserve substitute ratio, a producer can not develop its earnings in a sustainable method in the long term.

The worth of pure gasoline has plunged as a consequence of abnormally heat winter climate for 2 years in a row. The worth of oil has slumped practically 50% off its peak in early 2022 nevertheless it has remained above common due to the sustained manufacturing cuts executed by OPEC and Russia.

Consequently, Paramount Sources has posted earnings per share of $1.72 within the final 12 months. These earnings per share are 50% decrease than the 7-year excessive earnings per share of the corporate in 2022 however they’re above common.

Progress Prospects

Paramount Sources posted among the many highest reserve substitute ratios within the oil and gasoline trade in 2022 and 2023.

Even higher, the corporate has ample room for manufacturing progress due to the acceleration of its growth efforts in its producing areas.

Supply: Investor Presentation

Paramount Sources has a confirmed report of figuring out key useful resource areas, with a low decline charge and greater than 15 years of manufacturing.

Alternatively, as an oil and gasoline producer, Paramount Sources is extremely delicate to the cycles of the costs of oil and gasoline. That is clearly mirrored within the efficiency report of the corporate, which has posted materials losses in 5 of the final 10 years.

The worth of oil has slumped practically 50% off its peak in 2022. Consequently, the corporate is prone to put up a lot decrease earnings per share this 12 months.

Given the promising manufacturing progress prospects of Paramount Sources but additionally the extremely cyclical nature of the oil and gasoline trade, we count on the earnings per share of Paramount Sources to develop by about 2.0% per 12 months on common over the subsequent 5 years, from an estimate of $1.50 this 12 months to $1.66 in 2029.

Dividend & Valuation Evaluation

Paramount Sources is presently providing an above common dividend yield of 6.4%, which is greater than 5 occasions as a lot because the 1.2% yield of the S&P 500. The inventory is thus an attention-grabbing candidate for income-oriented buyers however the latter ought to be conscious that the dividend is much from protected because of the dramatic cycles of the costs of oil and gasoline.

Paramount Sources has a good payout ratio of 46%. As well as, the corporate has a robust steadiness sheet, with internet debt of solely $525 million.

As this quantity is barely 17% of the market capitalization of the inventory, it’s actually manageable and can assist the corporate endure the subsequent downturn of the vitality sector with none liquidity points. Additionally it is outstanding that Paramount Sources pays negligible curiosity expense yearly.

Nonetheless, it’s essential to notice that Paramount Sources reinstated its dividend solely in mid-2021, after 22 years and not using a dividend fee.

The corporate failed to supply a dividend within the previous years, because it incurred materials losses in a lot of these years. Subsequently, it’s evident that the dividend of the corporate is much from protected.

In reference to the valuation, Paramount Sources is presently buying and selling for 13.9 occasions its anticipated earnings per share of $1.50 this 12 months.

Given the excessive cyclicality of the corporate, we assume a good price-to-earnings ratio of 12.5, which is a typical mid-cycle valuation stage for oil and gasoline producers.

Subsequently, the present earnings a number of is greater than our assumed truthful price-to-earnings ratio. If the inventory trades at its truthful valuation stage in 5 years, it is going to incur a -2.1% annualized drag in its returns. This drag will offset our anticipated 2.0% common annual progress of earnings per share over the subsequent 5 years.

Considering the two.0% annual progress of earnings per share, the 6.4% present dividend yield and a -2.1% annualized contraction of valuation stage, Paramount Sources might provide a 5.8% common annual whole return over the subsequent 5 years.

The modest anticipated return alerts that the inventory is unattractive from a long-term perspective, as we’ve got handed the height of the cycle of the oil and gasoline trade. Subsequently, buyers ought to look ahead to a decrease entry level.

Ultimate Ideas

Paramount Sources has been thriving since early 2022 due to the above common costs of oil and gasoline. The inventory is providing an above common dividend yield of 6.4%, with a payout ratio of 46%. Consequently, it’s prone to entice some income-oriented buyers.

Nonetheless, the corporate has proved extremely weak to the cycles of the costs of oil and gasoline. As the value of oil has peaked and should have materials draw back, the inventory is dangerous proper now. Subsequently, buyers ought to look ahead to a extra engaging entry level.

Furthermore, Paramount Sources is characterised by under common buying and selling quantity. Because of this it could be exhausting to ascertain or promote a big place on this inventory.

Further Studying

Don’t miss the sources under for extra month-to-month dividend inventory investing analysis.

And see the sources under for extra compelling funding concepts for dividend progress shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].