Up to date on September twelfth, 2024 by Felix Martinez

The demographics of the USA are present process a seismic shift as Child Boomers age. The Child Boomers are a really giant generational group, which means the growing old U.S. inhabitants is predicted to end in increased demand for healthcare.

Many buyers have expressed concern about how it will have an effect on the economic system. Whereas some areas of the economic system might really feel stress from this development, one sector is sort of sure to develop consequently: healthcare spending and healthcare Actual Property Funding Trusts (REITs for brief).

LTC Properties (LTC) is poised to reap the benefits of this development. As a premier owner-operator of healthcare properties, LTC is seeing the demand for its properties improve.

We consider LTC is a beautiful funding for revenue buyers. The inventory has a excessive dividend yield of 6.2% and pays these dividends month-to-month. There are at present ~78 month-to-month dividend shares.

You may obtain our full record of all month-to-month dividend shares (plus vital monetary metrics corresponding to price-to-earnings ratios and dividend yields) by clicking on the hyperlink beneath:

Whereas LTC Properties is poised to profit from the growing old inhabitants, that doesn’t assure that the inventory shall be a robust performer transferring ahead; basic evaluation continues to be required.

This text will analyze the funding prospects of LTC Properties intimately.

Enterprise Overview

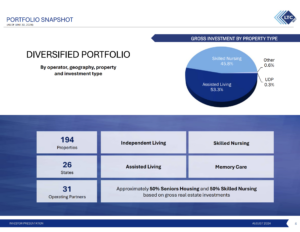

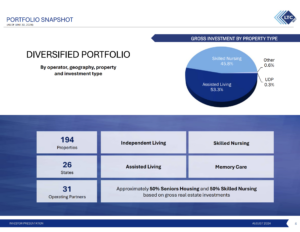

LTC Properties is a healthcare Actual Property Funding Belief that owns and operates expert nursing services, assisted dwelling services, and different healthcare properties. Its portfolio consists of roughly 53.3% assisted dwelling and 45.8% expert nursing properties. The REIT owns 194 investments in 26 states with 31 working companions.

Supply: Investor Presentation

Similar to different healthcare REITs, LTC advantages from a robust secular development, specifically the excessive progress of the inhabitants that is above 80 years previous. This progress outcomes from the growing old of the infant boomers’ technology and the regular rise of life expectancy because of sustained progress in medical sciences.

In late July (7/29/24), LTC reported its monetary outcomes for the second quarter of fiscal 2024. Funds from operations (FFO) per share fell by 1.5% in comparison with final yr’s quarter, dropping from $0.66 to $0.65, lacking analysts’ expectations by $0.01. The decline in FFO per share was primarily attributable to an elevated share depend. LTC improved its leverage ratio (Internet Debt to EBITDA) from 5.5x to five.3x, but it surely stays above the popular stage of 5.0x.

The corporate can be going through challenges with deferred funds from some tenants. Regardless of the pandemic easing, LTC’s enterprise momentum stays weak, main it to keep up its modest FFO per share steerage of $2.63-$2.65 for the yr. We nonetheless anticipate FFO per share to be $2.64.

Progress Prospects

As talked about, LTC Properties will profit from the secular tailwind of the growing old inhabitants in the USA. Because the Child Boomers age, the demand for expert nursing and assisted dwelling properties will improve materially. This advantages LTC Properties in two predominant methods.

First, extra demand for its properties signifies that LTC can buy extra properties and develop its asset base. If this may be achieved conservatively – with out diluting the REIT’s unitholders – it will increase the belief’s per-share funds from operations.

Second, LTC Properties can have a tangential profit since its tenants (healthcare operators) shall be experiencing a better demand for his or her companies. Since their companies are in excessive demand, this reduces the likelihood of default on their leases and likewise reduces the tenant emptiness of LTC Properties.

This REIT has been investing closely to reap the benefits of this development. Since 2010, LTC has put ~$1.5 billion to work in new actual property investments.

Due to the aforementioned favorable underlying fundamentals of the healthcare sector, LTC has grown its funds from operations at a mid-single digit CAGR within the final decade. Furthermore, the REIT has most of its belongings within the states with the best projected will increase within the 80+ inhabitants cohort over the following decade. Then again, progress has stalled within the final 4 years, partly as a result of chapter of Senior Care.

As well as, the REIT has been affected by the pandemic. We proceed to anticipate a 3.0% progress in funds from operations over the following 5 years.

Supply: Investor Presentation

Dividend Evaluation

The corporate pays a really enticing dividend yield of 6.2%. The dividend is paid month-to-month at a price of $0.19 per share. This dividend price has not been modified since October 2016. Thus, we don’t see the corporate growing its dividend within the close to future. This inventory is for buyers who’re searching for revenue proper now.

We anticipate the corporate to earn an FFO of $2.64 per share for 2024. This can symbolize an FFO dividend payout ratio of ~86%. This might be excessive if the corporate was a traditional company. Nevertheless, because the firm is a REIT, it’s required by legislation to pay out a big proportion of its earnings. It’s subsequently commonplace for REITs to have elevated FFO payout ratios.

For the reason that firm is predicted to extend FFO by about 3% on an annualized foundation for the following 5 years, we expect a dividend increase can come if this FFO progress performs out. Earlier than 2017, the corporate was growing its dividend at an annual compound price of 15.8% over 14 years. Since 2017, nonetheless, FFO has been flat and lowering, however we do anticipate that to vary.

Supply: Investor Presentation

Ultimate Ideas

LTC has most of the traits of a strong dividend funding. The corporate has a robust 6.2% dividend yield (greater than thrice the typical dividend yield of the S&P 500) and may be very shareholder-friendly, paying these dividends month-to-month.

The belief can even profit immensely from the secular development of growing old home populations. Whereas FFO progress has been arduous to come back by in recent times, the inventory seems undervalued, with a excessive dividend yield to additional increase shareholder returns.

With all this in thoughts, LTC Properties seems to be enticing for revenue buyers searching for publicity to the healthcare REIT area.

Don’t miss the assets beneath for extra month-to-month dividend inventory investing analysis.

And see the assets beneath for extra compelling funding concepts for dividend progress shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.