Printed on August twenty first, 2025 by Bob Ciura

Month-to-month dividend shares have immediate attraction for a lot of earnings buyers. Shares that pay their dividends every month provide extra frequent payouts than conventional quarterly or semi-annual dividend payers.

Because of this, we created a full record of over 80 month-to-month dividend shares.

You’ll be able to obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yields and payout ratios) by clicking on the hyperlink beneath:

Healthpeak Properties (DOC) switched to a month-to-month dividend payout schedule in April 2025. This probably makes the inventory extra engaging for earnings buyers searching for extra frequent dividend payouts.

This text will analyze Healthpeak Properties in larger element.

Enterprise Overview

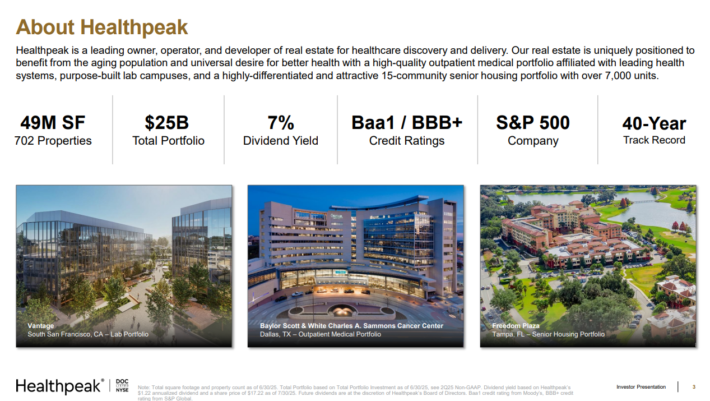

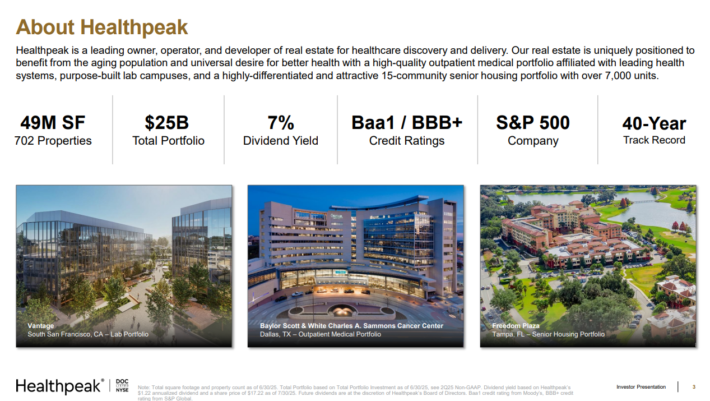

Healthpeak Properties is the biggest healthcare REIT within the U.S., with 774 properties. It was the primary healthcare REIT that was included within the S&P 500. The 37-year previous REIT invests in life science services, senior homes, and medical places of work, with 97% of its portfolio based mostly on private-pay sources. It has a market capitalization of $12 billion.

Healthpeak Properties posted declining FFO for six consecutive years, till 2022. Nevertheless, Healthpeak Properties has bought a number of belongings and has used the proceeds to cut back its debt. In consequence, the REIT has acquired credit standing upgrades from S&P and Fitch (to BBB+) in addition to Moody’s (to Baa1).

Supply: Investor Presentation

On July twenty fourth 2025, the REIT reported second-quarter monetary outcomes. Quarterly income of $694.35 million was in-line with analyst estimates, and represented a year-over-year decline of 0.2%. Adjusted funds-from-operation (FFO) was $0.46 per share, up 2.2% from the identical quarter final 12 months. Adjusted FFO-per-share was additionally in-line with estimates. Similar-store money web working earnings progress was 3.5% for the second quarter.

Funding exercise for the quarter included two new growth agreements with a mixed projected value of $148 million to help Northside Hospital’s continued outpatient enlargement within the Atlanta market. Healthpeak Properties additionally bought one outpatient medical land parcel in June 2025 and two outpatient medical buildings in July 2025 for mixed proceeds of roughly $35 million.

For 2025, Healthpeak Properties confirmed its forecast for adjusted diluted FFO-per-share to be in a spread of $1.81 to $1.87. As well as, same-store money (Adjusted) NOI progress is predicted to be 3.0% to 4.0% for the complete 12 months.

Development Prospects

Healthpeak Properties advantages from favorable secular developments. Because the child boomer era ages and the typical life expectancy is on the rise, the senior inhabitants of the U.S. is predicted to develop considerably within the upcoming years. The 80+ age group is predicted to develop by about 5% per 12 months on common till 2030.

As well as, this age group has immense spending energy. Thanks to those developments, healthcare spending within the U.S. is predicted to develop by about 5% per 12 months on common till 2030.

Though Healthpeak Properties posted declining FFO for six consecutive years, till 2022, and the restructuring course of will preserve burdening the REIT within the close to future, a lot of the injury has already been completed. We additionally anticipate the belief to enter a sustainable progress trajectory.

However, because of the hefty issuance of recent shares for the above merger and excessive curiosity expense amid excessive rates of interest, we anticipate 3% annual progress of FFO per share over the following 5 years.

Dividend & Valuation Evaluation

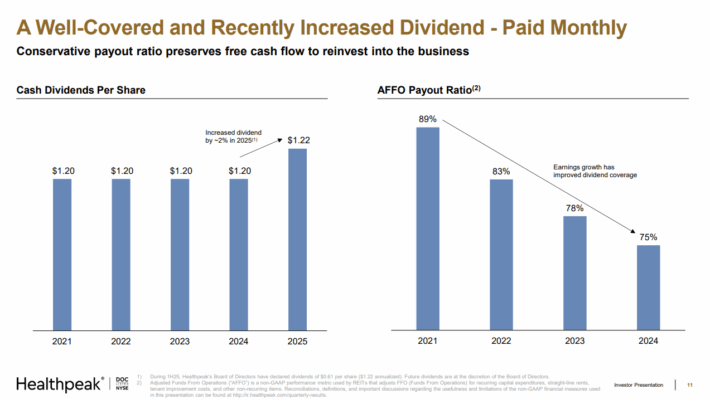

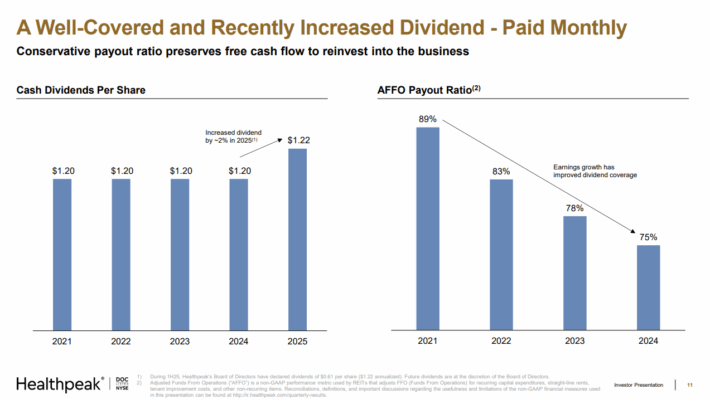

The efficiency of Healthpeak Properties has been poor within the final 9 years and the REIT reduce its dividend by -19% in 2021, because of the impacts of the coronavirus pandemic. As this was the second dividend reduce within the final decade, it’s evident that the REIT is weak to downturns.

As well as, curiosity expense has elevated 85% since 2021 as a consequence of excessive rates of interest and the merger.

Alternatively, we be aware that the payout ratio is standing at an almost 10-year low whereas the REIT doesn’t have any debt maturities this 12 months.

Supply: Investor Presentation

DOC has a 2025 anticipated dividend payout ratio of 66%, based mostly on the midpoint of the REIT’s adjusted FFO-per-share steering for 2025. This means a sustainable dividend payout backed by adequate FFO.

We additionally view the REIT as undervalued. Primarily based on anticipated adjusted FFO-per-share of $1.84 for 2025, shares of DOC at the moment commerce for a price-to-FFO ratio of 9.3. That is considerably beneath the 10-year common P/FFO ratio of 15.1, which we view as honest worth.

If the valuation a number of had been to increase to fifteen.1, it might enhance annual shareholder returns by 10.2% per 12 months over the following 5 years. This means the inventory is considerably undervalued.

Including in 3% anticipated FFO-per-share progress per 12 months, in addition to the 7.1% present dividend yield, whole returns may exceed 20% per 12 months for DOC.

Ultimate Ideas

Healthpeak Properties is a comparatively new month-to-month dividend inventory, having began paying its dividend on a month-to-month foundation in April 2025.

The REIT has recovered from the varied challenges confronted in the course of the pandemic, and will provide excessive common annual returns over the following 5 years, because of progress of FFO per share, its 7.1% dividend yield, and a major enlargement of the valuation a number of. Usually, we might price such a excessive stage of anticipated returns as a purchase.

However, because of the risky efficiency file and the excessive debt load of the REIT, we price it as a maintain for affected person, risk-tolerant buyers who can endure prolonged intervals of inventory value strain.

Further Studying

Don’t miss the assets beneath for extra month-to-month dividend inventory investing analysis.

And see the assets beneath for extra compelling funding concepts for dividend progress shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].