Up to date on September twenty second, 2024 by Felix Martinez

Actual property funding trusts typically have excessive dividend yields in extra of 10%. Ellington Residential Actual Mortgage REIT is one such instance. The REIT has a large dividend yield of 13.7% immediately.

Actual property shares are a well-liked selection for creating passive retirement revenue, however high-yielding shares can typically be a warning signal that important challenges are impeding the enterprise. For Ellington Residential, because the share value drops resulting from its circumstances, the dividend yield will increase.

Ellington Residential Mortgage (EARN) is probably not a widely known REIT. In October 2021, the company selected to switch its dividend cost schedule from quarterly to month-to-month.

Meaning EARN joins the listing of month-to-month dividend shares. We’ve compiled an inventory of 84 month-to-month dividend shares, together with necessary monetary metrics like dividend yields and payout ratios, which you’ll be able to view by clicking on the hyperlink under:

This text will analyze the funding prospects of Ellington Residential Mortgage REIT intimately.

Enterprise Overview

Ellington Residential Mortgage REIT acquires, invests in, and manages residential mortgage and actual estate-related property. Ellington focuses totally on residential mortgage-backed securities, particularly these backed by a U.S. Authorities company or U.S. government-sponsored enterprise.

Ellington Residential is headquartered in Outdated Greenwich, Connecticut. It’s a small-cap firm with a market capitalization of solely $1077 million. Ellington Residential Mortgage Administration LLC externally manages Ellington Residential Mortgage REIT.

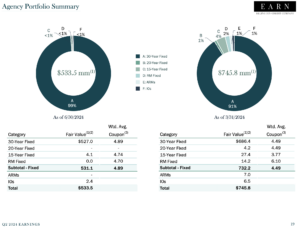

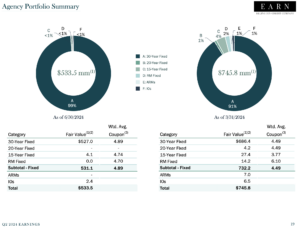

The mortgage REIT has an company residential mortgage-backed securities (RMBS) portfolio of $873 million and a non-agency RMBS portfolio of $20.7 million. Company MBS are created and backed by authorities businesses or enterprises, whereas the federal government doesn’t assure non-agency MBS.

Supply: Investor Presentation

In April 2024, Ellington Residential Mortgage REIT rebranded as Ellington Credit score Firm and introduced plans to shift its focus to collateralized mortgage obligations (CLOs). The transformation is predicted to be accomplished by the top of the 12 months, with the corporate transferring away from mortgage-backed securities (MBS). Ellington has additionally ended its REIT standing and plans to grow to be a closed-end fund, handled as a regulated funding firm. Regardless of the adjustments, the corporate is sustaining its $0.08 month-to-month dividend.

On August 12, 2024, Ellington reported a web lack of $0.8 million, or $0.04 per share, for the second quarter ending June 30, 2024. Nonetheless, the corporate generated $7.3 million in adjusted distributable earnings, translating to $0.36 per share, sufficient to cowl the dividend. Its web curiosity margin was 4.24%. On the finish of the quarter, Ellington held $118.8 million in money and money equivalents, together with $44 million in different unencumbered property. The debt-to-equity ratio stood at 4.0x, and ebook worth per share decreased 4.2% from the earlier quarter to $6.91.

Progress Prospects

Ellington has seen its core earnings per share shrink reasonably than develop for many of its historical past.

In its first few years, the corporate held its share rely constant, however following 2016, the variety of shares excellent has grown, which will be one other barrier to rising earnings on a per share foundation.

The company has a couple of avenues of progress, which all revolve round optimizing its MBS portfolio. Capitalizing on alternatives pushed by market volatility, significantly round Fed tapering, might yield outcomes. The growing rates of interest will even profit the corporate in the long run.

Supply: Investor Presentation

Moreover, Ellington will shield their ebook worth by means of rate of interest hedges and liquidity administration. Regardless of this, the corporate has a poor monitor document of earnings, main us to anticipate little or no progress of three.5%. This anemic progress will unlikely result in additional dividend will increase within the medium time period.

Aggressive Benefit & Recession Efficiency

Ellington claims that its portfolio managers are among the many most skilled within the MBS sector, and its analytics have been developed all through the corporate’s 29-year historical past. Elligton Administration Group is massive, with $9 billion in property underneath administration.

The corporate possesses superior proprietary fashions for prepayments and credit score evaluation. Additionally, roughly 25% of the corporate’s workers give attention to analysis and data know-how.

Whereas the corporate’s particulars weren’t public within the 2008 actual property crash, a recession of that magnitude would virtually positively have an effect on EARN. Its give attention to government-sponsored MBS gives some security, however a chronic recession sooner or later would seemingly have an effect on EARN’s backside line and lead to additional dividend reductions.

Dividend Evaluation

The dividend has been minimize each single 12 months (outcomes from 2013 solely account for half the 12 months) in its historical past aside from a rise in 2021. Adopted by the dividend schedule being modified to month-to-month over quarterly, which sure shareholders could favor.

Ellington’s newest dividend payout degree is $0.08 monthly. This equals an annual dividend of $0.96.

On an annualized foundation, the $0.96 per share dividend is effectively under all earlier payout ranges.

Nonetheless, at a degree of $0.96 per share, EARN inventory yields 13.7%. Subsequently, EARN inventory continues to be enticing for revenue traders as a excessive dividend inventory.

EARN’s dividend is way from reliable, given the company has had a path of cuts up to now. In at the very least three years of the final eight full calendar years in operation, the corporate’s payout ratio was close to or above 100%. The dividend payout ratio is 81%, which can be lined for the 12 months.

Ultimate Ideas

Ellington Residential Mortgage REIT has a large dividend yield of 13.7%, and the corporate solely just lately began paying out month-to-month dividends.

Nonetheless, Ellington Residential has a protracted historical past of reducing its dividend. That, and the truth that the corporate has had a dividend pay out almost 100% of core earnings up to now, places the dividend in danger for one more minimize.

Ellington Residential could also be a becoming selection for high-yield traders with an urge for food for threat, however its dividend historical past is way lower than stellar. And the dividend immediately is on shaky grounds.

Don’t miss the sources under for extra month-to-month dividend inventory investing analysis.

And see the sources under for extra compelling funding concepts for dividend progress shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.