Up to date on August twenty second, 2024 by Bob Ciura

Actual Property Funding Trusts, or REITs for brief, are a core holding for a lot of revenue traders as a result of their excessive dividend yields.

On the identical time, month-to-month dividend shares are additionally interesting for revenue traders, as a result of their extra frequent payout schedules.

Agree Realty (ADC) is a rarity amongst REITs, in that it pays a month-to-month dividend. Month-to-month dividend shares pay shareholders 12 dividends per yr as a substitute of the extra typical quarterly funds.

We created an inventory of 79 month-to-month dividend shares (together with vital monetary metrics reminiscent of dividend yields and payout ratios). You possibly can obtain the month-to-month dividend shares spreadsheet by clicking on the hyperlink beneath:

Agree Realty has a 4.1% dividend yield, which is greater than 3 times the typical dividend yield of the S&P 500 Index.

And, Agree Realty has a excessive stage of dividend security, together with the potential for dividend development within the coming years. This text discusses ADC in better element.

Enterprise Overview

Agree Realty is a retail Actual Property Funding Belief. Agree has developed over 40 neighborhood buying facilities all through the Midwestern and Southeastern United States.

As of June 30, 2024, the property portfolio consisted of two,202 properties situated in 49 states, and contained roughly 45.8 million sq. ft of gross leasable space.

On the finish of the 2024 second quarter, Agree’s portfolio was 99.8% leased, and a weighted-average remaining lease time period of roughly 8.1 years.

Simply over two-thirds of annualized base lease comes from investment-grade retail tenants.

It has a diversified property portfolio, spanning numerous totally different business teams, together with grocery shops, dwelling enchancment retailers, auto service, and comfort shops.

Supply: Investor Presentation

On the identical time, Agree Realty has high-graded its portfolio by lowering its publicity to tenant teams most in danger from the present challenges, particularly the coronavirus pandemic.

For instance, Agree Realty derives simply 2% of its annual base lease from well being golf equipment and health facilities and simply 1% of ABR from film theaters. In all, Agree Realty generates two-thirds of its ABR from investment-grade tenants.

This portfolio high quality is mirrored within the firm’s robust fundamentals. Agree Realty continues to publish spectacular leads to a particularly difficult interval for a lot of REITs, notably these working within the retail business.

In the latest quarter, internet revenue per share for the quarter rose by 25.6% year-over-year to $0.52, and adjusted funds from operations (AFFO) per share elevated by 6.4% to $1.04.

The corporate additionally declared a month-to-month dividend of $0.250 per frequent share, marking a 2.9% year-over-year enhance. Moreover, a $450 million bond providing was accomplished, contributing to a sturdy liquidity place of $1.7 billion.

For the primary half of 2024, Agree Realty demonstrated constant development, with internet revenue per share growing by 11.3% to $0.95. AFFO per share rose by 5.5% year-over-year, to $2.07.

Development Prospects

Agree Realty has grown AFFO by a compound price of 6.8% over the previous ten years. AFFO has elevated by 5.8% per yr over the previous 5 years.

We anticipate that Agree Realty will proceed to develop however at a barely slower tempo of 4.0% yearly for the following 5 years. Present development prospects stem from the current acquisitions introduced for the yr.

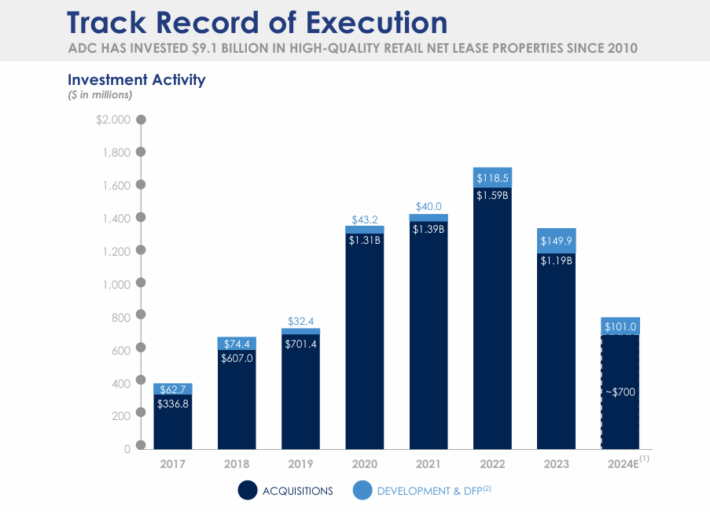

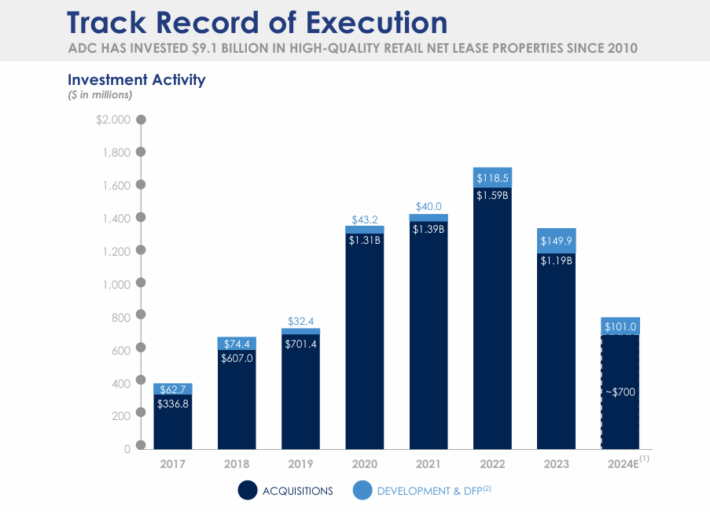

We see Agree Realty with the ability to develop AFFO by way of its three-pronged development technique revolving round acquisitions, growth, and companion capital options.

Throughout the first half of 2024, Agree Realty invested $343 million in 102 retail internet lease properties, and dedicated over $101 million to 25 growth initiatives.

Wanting again additional, it has invested over $9 billion in properties since 2010.

Supply: Investor Presentation

Wanting forward, Agree Realty raised its 2024 AFFO per share steerage to a variety of $4.11 to $4.14 and elevated its

acquisition steerage to roughly $700 million.

We anticipate ADC to generate 4.0% compound annual development of FFO-per-share over the following 5 years.

Dividend Evaluation

Previous to 2021, Agree Realty had paid a quarterly dividend just like the overwhelming majority of dividend shares. However in 2021, the corporate switched to a month-to-month dividend schedule.

Agree Realty presently pays a month-to-month dividend of $0.25 per share. On an annual foundation, the $3.00 dividend payout represents a 4.1% present yield.

Contemplating the S&P 500 Index presently yields simply 1.3%, Agree Realty inventory is a pretty possibility for revenue traders.

And, the corporate grows its dividend recurrently. Agree Realty elevated its dividend by roughly 5.9% per yr previously 10 years.

The dividend can also be extremely safe. Based mostly on the anticipated AFFO of $4.09 for 2024, Agree Realty has a projected dividend payout ratio of 73% for your complete yr.

Agree Realty’s payout ratio has remained extremely constant within the final decade, across the mid–70s. It is a wholesome payout ratio for a REIT, which should pay out nearly all of its earnings to shareholders.

The corporate operates a wholesome stability sheet with a internet debt-to-equity ratio of 0.5x, nicely beneath many different REITs. Preserving a manageable stage of debt is essential for REITs to maintain the price of capital down.

The corporate maintains investment-grade credit score scores of BBB+.

Last Ideas

Actual Property Funding Trusts are common for his or her excessive dividend yields, however excessive high-yielders ought to be prevented. Traders shouldn’t ignore REITs with considerably decrease yields, as these REITs typically have superior fundamentals.

Agree Realty is an instance of this; though it has a 4.1% yield that trails many different REITs, it makes up for this with a excessive dividend security and development price.

Because of this, we view it as a stable decide for revenue traders, notably these occupied with dividend development.

Don’t miss the sources beneath for extra month-to-month dividend inventory investing analysis.

And see the sources beneath for extra compelling funding concepts for dividend development shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].