Steve King

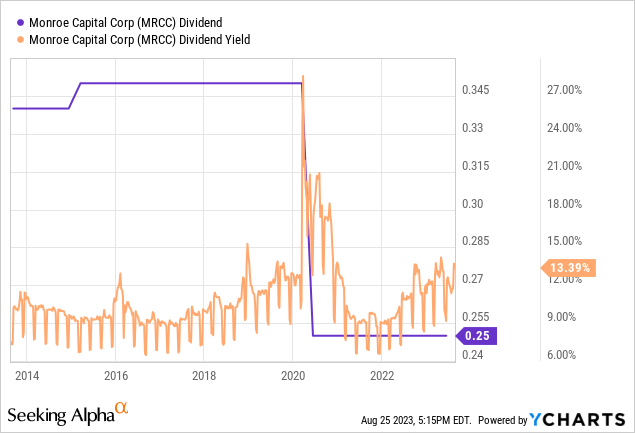

Monroe Capital (NASDAQ:MRCC) final declared a quarterly money dividend of $0.25 per share, according to its prior fee and for a 13.5% annualized ahead yield. Earnings is the prize and Monroe’s double-digit yield has moved to pandemic-era highs on the again of what is been a 17% dip in its frequent shares over the past 1-year in response to a rising Fed funds price that now sits at a 22-year excessive of 5.25% to five.50%. The externally managed enterprise improvement firm did lower its quarterly distributions by 28.5% through the outbreak of the pandemic with the payouts but to get well to this degree regardless of their stability over the past 3 years. The BDC is at present swapping arms for $7.42 per share, a roughly 25% low cost to its web asset worth per share of $9.84 on the finish of its fiscal 2023 second quarter.

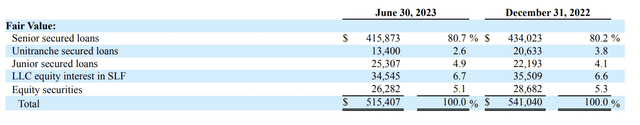

Therefore, the upside right here is constructed across the closing of this low cost to NAV in mixture with the double-digit yield. Monroe focuses on first-lien loans, which shaped 83.3% of the portfolio, and held debt and fairness investments in 99 portfolio corporations with a complete honest worth of $515.4 million as of the top of the second quarter. This was a $16.7 million dip sequentially from a portfolio honest worth of $532.1 million within the first quarter. Critically, the BDC’s weighted common contractual and efficient yield on its debt investments was 12.2% as of the top of the second quarter, a 70 foundation factors growth from 11.5% within the first quarter on the again of the continued hawkish rate of interest path from the Fed.

Observe The NAV

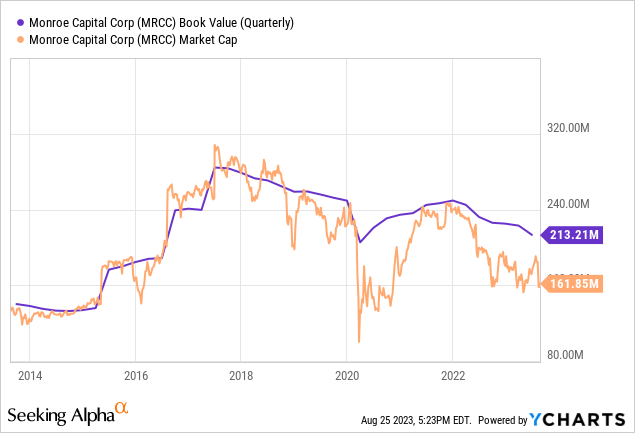

The path of Monroe’s NAV, as outlined by e book worth, has not been nice. The trendline has pointed down since 2017 with the commons of the BDC shifting in tow. Critically, NAV dictates worth returns and Monroe’s NAV has shaped an intense headwind for whole returns which have lagged behind. Certainly, a NAV of $213.2 million as of the second quarter fell 8.15% from $232.1 million within the year-ago comp. It was additionally down from $244.8 million within the second quarter of fiscal 2021. This fixed strain on NAV ought to have been considerably alleviated by a macroeconomic surroundings that has seen the typical yield of BDC credit score investments transfer up.

Monroe Capital Fiscal 2023 Second Quarter Kind 10-Q

Debt to fairness of 1.54x as of the top of the second quarter was broadly according to its friends however elevated from 1.49x within the first quarter and was set in opposition to second-quarter whole funding earnings of $16.35 million. This was up from whole funding earnings of $13 million within the year-ago interval. Web funding earnings for the latest second quarter got here in at $5.9 million, $0.27 per share, and up from web funding earnings of $5 million, or $0.23 per share within the year-ago interval. The quarter-over-quarter NAV decline stood at $0.45, round 4.4%, and was primarily pushed by what administration flagged had been unfavorable market circumstances stemming from adverse realizations on its fairness investments in two brick-and-mortar retailers Forman Mills and California Pizza Kitchen. The BDC realized a $10.3 million loss on investments through the second quarter, a marked deterioration from a $3.3 million realized loss within the prior first quarter, and held a 5.1% allocation to fairness securities.

Loans On Non-accrual Spike However Dividend Lined As Financial system Set To Stay Robust

1.3% of Monroe’s whole investments at honest worth had been on non-accrual standing as of the top of the second quarter, up sequentially from 0.4% within the first quarter. This bump in loans on non-accruals standing additionally shaped a part of the headwinds confronted by NAV through the second quarter. NII per share of $0.27 meant the BDC’s payout ratio stood at 92.6% for the second quarter. This payout ratio has improved considerably from a 12 months in the past when Monroe was paying out 108.7% of its NII as a dividend.

Critically, larger protection ought to assist rebuild NAV and type a hedge for Monroe within the occasion of a tough touchdown that sees loans on non-accrual standing expertise upward strain. Nonetheless, recession forecasts have been dialed again with no US recession anticipated in 2023 and Goldman Sachs writing down its chance of a recession subsequent 12 months to twenty% from 25%. The upper for longer mantra can also be set to proceed to offer a lift for Monroe’s first lien credit score heavy portfolio even with the market anticipating the Fed to maintain charges unchanged at its subsequent FOMC assembly on the twentieth of September. Therefore, while Monroe shouldn’t be a purchase resulting from its NAV challenges, increased NII is driving higher protection and a safer distribution that renders it a maintain.