Sean Anthony Eddy

Funding Abstract

A considerate evaluation of the longer term includes pondering in first ideas.

Regardless of Wall Road’s robust conviction on the corporate’s inventory value, the outlook is much less optimistic for ModivCare Inc. (NASDAQ:MODV) in my knowledgeable opinion. Nothing has modified from my final publication on MODV in November final 12 months. Much less so in first ideas.

MODV has underperformed the market over the long-term and will proceed to take action going ahead with out main modifications.

Mainly, it hasn’t recycled capital nicely. A greenback is extra beneficial within the traders hand versus within the firm’s hand. Due to its progress investments, MODV hasn’t crushed the hurdle price. You want a measure (earnings progress) to point out the place a agency is rising in worth, and the market is a reasonably good decide of truthful worth over time. Agency’s rising financial earnings will develop at greater multiples, making good use of investor capital by rising forward of the market.

In that vein, it’s essential to know what traders have priced into MODV’s inventory, and is that this right. Understanding the vary of chances then permits an investor to look at any deviances from the consensus of expectations. With respect to MODV, I consider the market has acquired it priced appropriately and observe there’s a good bit of pessimism within the identify, which could possibly be enticing from a contrarian’s view, nonetheless there aren’t the present fundamentals to shut this hole. Internet-net, reiterate MODV is a maintain.

What are the expectations in MODV’s inventory value?

The quote of an organization’s inventory value is kind of a set of expectations aggregated to type a value vary. That, mixed with demand/provide and alternative value elements, in the end resolve value ranges. Clever traders are inclined to consider the market does a very good job at deciding truthful worth over time. So that they secret is to know what’s within the value, and if there’s any cause to consider the expectations are flawed.

The market has been beneficiant to traders of MODV pricing it at 8.8x ahead EBITDA and 9x ahead P/E. On this foundation, it’s low cost and will supply some upside with a reversion to the long-term imply (5-year avg. P/E 24x, EV/EBITDA 12.7x). For this, consensus believes the corporate will to $2.6–$2.8Bn in revenues and ~$7.50 in earnings. Just a few key factors for consideration, nonetheless. If you happen to have a look at the market-implied ahead progress charges, it requires 14% YoY progress in working earnings, but in addition a lower in FCF per share and ROE of 10% and 5%, respectively.

Fig. 1

Knowledge: Looking for Alpha

The query is, has the market figured the MODV story out fully or not. Trying on the This autumn earnings name, administration mentioned “[t]e firm’s aim to create shareholders is to “construct for scale and develop our enterprise”. It sounds pretty easy as nicely – scale up through the use of know-how and develop by promoting level options “extra successfully”. Besides it’ll take much more, particularly to information top-line revenues to $2.6Bn this 12 months. Think about a couple of factors:

- FY’22 P&L was robust – $2.5Bn on the high, 25% YoY progress with upsides in all working segments.

- It pulled this right down to $103mm adj. earnings, of $7.32/share, adj. EBITDA margin of 8.9%.

- After investing closely in FY’20 and FY’21 ($1.8Bn over two years cumulatively), MODV pared this again to $153mm final 12 months. On this, incremental returns on new capital have been 14%, in FY’20, destructive 4.6% in FY’21, destructive 2.7% in FY’22. Trying forward, the return on new capital may common 0% to six% for my part.

- This, because the 2-year returns on current capital have ranged down from 12% in 2020 to 4.8% final 12 months.

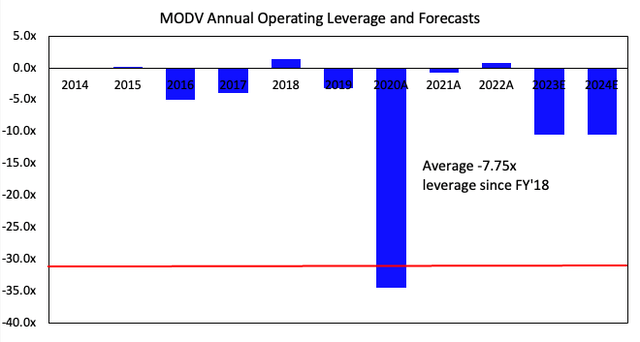

If the market expects ~11% YoY in top-line progress and 14% EBIT upside the agency must hit $2.6–2.8Bn, however I consider 5% is a extra cautious determine and venture $2.6Bn in income. That may name for $100mm in working earnings and could possibly be a stretch. Particularly the working leverage – income progress of 11% for 14% on the working line, that is nicely above the historic vary for MODV. Loved some Sleight of hand final 12 months, [Figure 2] however my numbers counsel working leverage could possibly be mild going ahead. That is essential to deal with, as a result of the market is seeking to see the capital their firm retains (in retained earnings) is being put to make use of and being invested at a price above the market’s return to create worth. If it doesn’t see capital finest positioned for progress in MODV, then its share value gained’t catch a bid.

Fig. 2

Knowledge: Writer, MODV 10-Ks

Lastly, the flexibility to create worth wanting forward. Clever cash is interested in corporations that generate returns on the enterprise’ capital greater than the market’s anticipated return. If an organization generates excessive return on its progress investments, above the market’s return, this progress is shortly translated into greater valuations within the market. The corporate’s progress/ROIC is a measure of the funding’s return. So if the return on fairness (“ROE”) and ROIC numbers are robust, chances are high the market will reward this with greater multiples. Which means, traders pays a better value for $1 of MODV’s earnings. A number of observations right here:

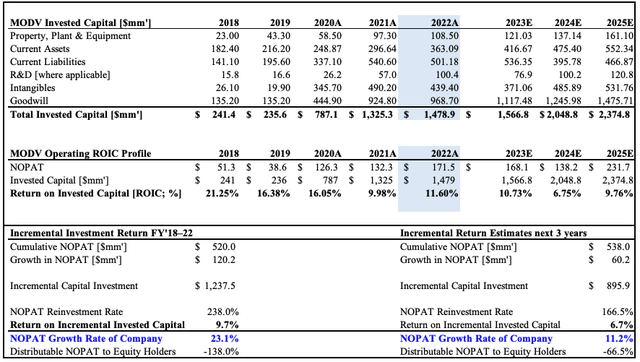

- Spanning again to FY’18, return on incremental capital was 9.7% for the 5-years. MODV invested $1.23Bn and generated extra $120mm extra post-tax earnings.

- MODV nonetheless reinvested very closely on the incremental return (238% of NOPAT) and compounded its valuation by 23% over that point. Though that is spectacular, it got here at a heavy web value to shareholders (238% of earnings at 9.7% price of return).

- Additional, the $1 take a look at there was no worth created ($120/0.1=$1,200, $37mm beneath the funding).

- This could possibly be why MODV trades at 9.4x ahead P/E, 60% off the 5-year common of 24x.

- Trying ahead, in a single state of affairs MODV may make investments $895mm incremental capital and get $60mm extra post-tax earnings for this. If the chance value is 10% (risk-free price + ahead earnings yield S&P 500), this doesn’t cross the $1 take a look at ($60/0.1=$600 ; lower than $895, want >$900).

- It could have to generate at the least $90mm on a $895mm funding to develop its valuation at a significant price ($90/0.1=$900).

- If MODV can’t/doesn’t generate a return on its progress investments that’s above the market’s return, it gained’t create extra market worth, and gained’t catch a bid from patrons. So these numbers would severely want bettering.

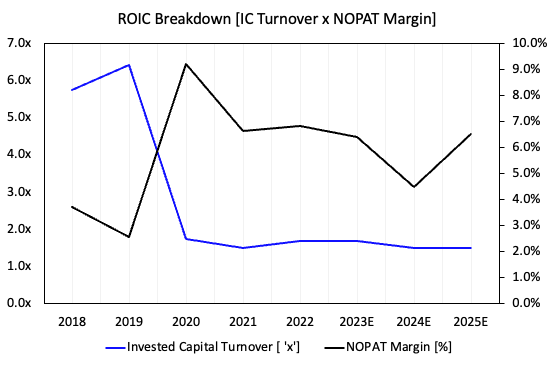

For this to occur, capital depth would wish to stay flat at 1x turnover and post-tax earnings must rise to 7-8% margin, however my estimates have the agency to incur some strain on the margin [Figure 4].

So the earnings energy of MODV will rely largely on its means to extend gross-to–working margin and pull this right down to earnings progress for shareholders. If the capital it decides to spend money on is unproductive, we could possibly be taking a look at sub-par returns. Therefore, a ROIC of 10% or higher could be preferrred, and right here, I’ve acquired 6-7% which is a threat issue. You possibly can see the potential of outcomes in Determine 3 and Determine 4. Notice the potential ROIC charges, along with the incremental charges of return. MODV would wish to see some upside on these, for my part.

Fig. 3

Knowledge: Writer, MODV 10-Ks

Fig. 4

Knowledge: Writer, MODV 10-Ks

In that vein, I consider the market has recognized the key dangers and priced MODV accordingly. The inventory value peaked in FY’21 and has pushed south ever since, now down 7% within the final 5-years. As seen above, $1.2Bn extra funding into progress capital corresponded with a $231mm change in market worth.

That equates to $0.19 in market worth created for every $1 in funding the corporate made. Conversely, the S&P 500 whole return index has returned $0.40 for each $1 funding in that point. Fairly a large unfold – MODV is 52% beneath that benchmark.

So you could possibly have purchased MODV who generated 5.4% CAGR in market worth on an 18.9% compound reinvestment price, or the index for 11.9% CAGR. Nevertheless, if ahead progress is 5% YoY progress, the numbers counsel a $1.05Bn market worth, $75/share. Contrasted to an 11% progress in market worth, this may add $360-$370mm in market cap for MODV to $1.36Bn, or $97 per share. That’s not horrible, and provides doubtlessly 38-40% upside on the present market value.

However these mechanics definitely do clarify why the underperformance within the first place. Take the previous 3-5 years. Each returns on capital and progress charges have been beneath the place they wanted to be. If traders are to allocate capital within the first place, why ought to they to wherever else if they’ll get the UST 10-year yield and the U.S. fairness benchmark. And, if the attraction is in comparison with these devices, 9.7% incremental return over 5-years isn’t going to shift the dial. Trying ahead, I’ve projected 6.7% return on incremental capital, which I doubt will surpass the required price of return. Therefore, this helps a impartial view.

Valuation and conclusion

I’ve mentioned why I consider the market has appropriately priced MODV inventory at a reduction. As to what’s already within the value, I’d say many of the draw back has been acknowledged, but it surely’s tough to say it it’s all been priced in. Additional, unhealthy information occurs in down tendencies – get used to it. Any destructive updates from MODV are due to this fact an outsized threat.

You may pay 9.4x ahead P/E ($9.40 for each $1 of earnings) for MODV and doubtlessly obtain 11% in ahead earnings yield. That’s truly enticing worth. However you’ve acquired to ask what’s in retailer going ahead. If you happen to’re going to allocate fairness capital, you’d need the enterprise you spend money on to do the laborious be just right for you, by investing money and producing a return on this above the hurdle price. In any other case, there’s no incentive to tackle that form of threat, with benchmark yields summing to ~10%. My estimates have MODV to do 6-7% return on incremental capital subsequent few years, and I consider there are different companies on the market that may do a greater job than this.

At 9.4x my FY’23 earnings estimates of $79.1mm, this derives a value goal of $52, draw back threat to the present market value. I consider MODV is value 12x earnings proper now, value goal $70. Therefore, that is supportive of a impartial viewpoint.

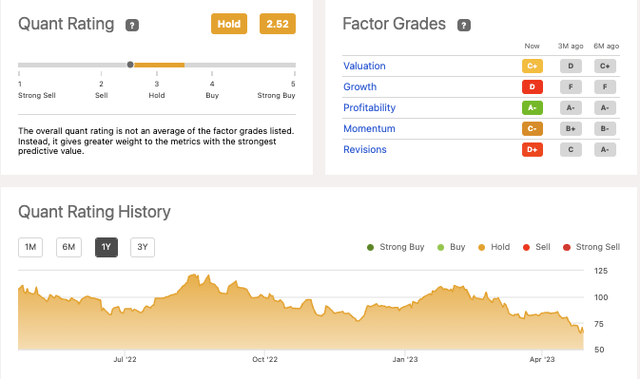

Furthermore, there’s quantitative proof that MODV is a maintain. Trying on the graphic beneath, utilizing evaluation throughout a composite of graded measures signifies there are dangers to progress and valuation, in-line with findings above. This warrants a maintain ranking. The quant grading system is a terrific measure to objectively view the entire options within the funding debate.

Fig. 5

Knowledge: Looking for Alpha

What I’d wish to see wanting forward from MODV is effort to construct extra arteries of earnings to its enterprise pump to ensure that 1) develop earnings, 2) develop margins, 3) with out one jeopardising the opposite. Ahead returns on capital would be the keystone of all of it for my part. Now tight cash and violently reactive markets, these companies rising post-tax earnings from recycled capital and retained earnings will stay within the entrance seat for my part. MODV has some work to do right here, relative to different top-notch companies. Reiterate maintain.