The $175B U.S. life insurance coverage market stands at a essential inflection level: whereas 90% of insurance policies are offered by way of monetary advisors, these professionals navigate a fragmented ecosystem of over 10 disconnected legacy instruments, every dealing with separate features of quoting, underwriting, and case administration. This operational complexity interprets right into a six-month common coverage cycle time for everlasting life insurance coverage, creating friction at each stage of the shopper journey and limiting advisors’ capability to serve their purchasers successfully. Trendy Life addresses this systemic inefficiency by consolidating the whole life insurance coverage workflow right into a single AI-powered platform that permits advisors to immediately quote throughout 30+ carriers, obtain underwriting choices in minutes relatively than weeks by way of its Specific Resolution functionality, and handle the whole shopper lifecycle from a unified dashboard. The platform’s proprietary AI analyzes medical and monetary information to determine probably the most aggressive carriers for every shopper’s distinctive wants whereas serving to advisors navigate the intricate intersections of tax planning, monetary optimization, and medical underwriting—capabilities that may in any other case require a crew of specialised consultants. With entry to each main product kind from everlasting and time period life to annuities and long-term care, Trendy Life delivers as much as 20% value financial savings for purchasers by way of smarter product choice and professional underwriting advocacy, all whereas sustaining SOC 2 certification and enterprise-grade information safety.

AlleyWatch sat down with Trendy Life Founder and CEO Michael Konialian to be taught extra in regards to the enterprise, the long run plans, current funding spherical, and far, way more…

Who had been your buyers and the way a lot did you elevate?

We raised a $20M Collection A led by Thrive Capital, with participation from New York Life Ventures, Northwestern Mutual Future Ventures, and Allegis. That brings our complete funding to $35M, following our earlier $15M seed spherical, which was additionally led by Thrive.

Inform us in regards to the services or products that Trendy Life gives.

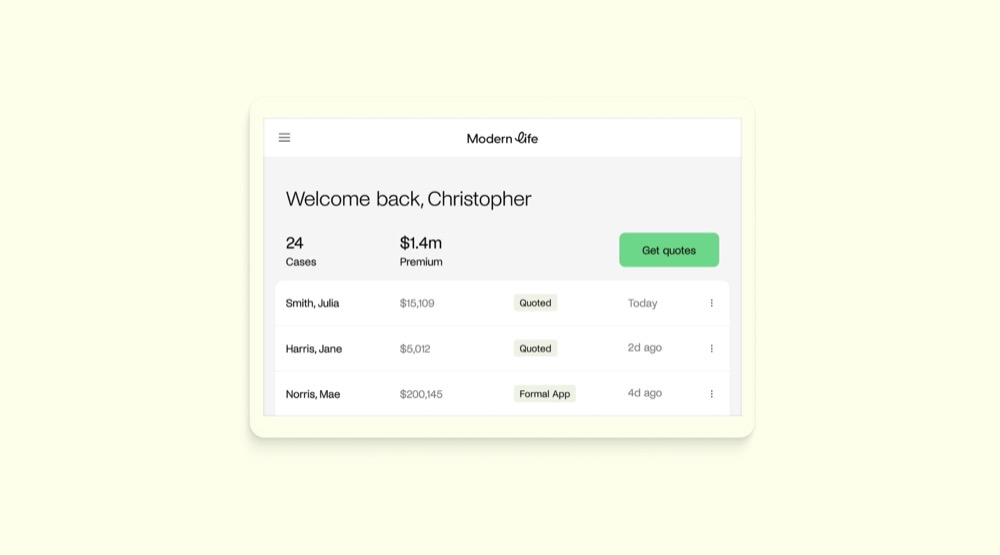

At Trendy Life, we’ve constructed an AI-powered, tech-enabled life insurance coverage brokerage platform designed particularly for monetary professionals. Advisors use our platform to acquire and examine prompt quotes from greater than 30 main carriers, leverage AI-driven underwriting, obtain as quickly as prompt choices, and handle the whole case lifecycle, from quotes to purposes to insurance policies, inside a single, unified dashboard.

What impressed the beginning of Trendy Life?

The inspiration for Trendy Life got here immediately from my very own expertise making an attempt to purchase life insurance coverage. At the same time as a comparatively younger and wholesome particular person, I discovered the method complicated, invasive, and extremely outdated. There have been advanced merchandise I barely understood, lengthy and repetitive varieties, infinite cellphone interviews, and medical exams that felt like they belonged to a different period. Given my background in constructing digital platforms for advisors, it was clear to me that know-how and AI may dramatically enhance the life insurance coverage buying expertise for each advisors and their purchasers, which in the end led to the beginning of Trendy Life.

How is Trendy Life completely different?

Trendy Life is completely different due to our singular concentrate on empowering advisors. We allow the five hundred,000 professionals who distribute life insurance coverage and are accountable for 90% of the entire market however who’ve an extremely difficult job. We deliver collectively what would in any other case require a number of fragmented legacy instruments right into a single platform that handles quoting, underwriting, workflow, and shopper lifecycle administration. We additionally supply prompt or near-instant underwriting choices in lots of circumstances, typically with out medical exams, which dramatically quickens the method. As a result of we’ve constructed our know-how in-house, we will embed AI throughout the whole journey in a means that legacy brokerages merely can’t match.

What market does Trendy Life goal and the way massive is it?

We concentrate on the U.S. life insurance coverage market, which is roughly a $175B market, 90% of which is offered by way of advisors. We additionally distribute long-term care, annuities, and incapacity insurance coverage which collectively are significant markets as properly. Our purchasers are monetary corporations and professionals primarily serving prosperous purchasers and who want higher instruments, workflows, and experiences for his or her shopper service.

What’s your enterprise mannequin?

Our enterprise mannequin is B2B by way of advisors. Advisors and corporations use our platform for gratis to them and obtain commissions from Trendy Life if licensed. We generate income from carriers on insurance policies positioned by way of Trendy Life.

What was the funding course of like?

Thrive Capital has been a constant and extremely supportive companion, main each our seed and Collection A rounds. We additionally introduced in strategic buyers from New York Life Ventures and Northwestern Mutual Future Ventures who perceive the significance of advisor-driven distribution and see the necessity for modernization in life insurance coverage.

What are the largest challenges that you just confronted whereas elevating capital?

Earlier than Trendy Life, just about all VC funding in life insurance coverage — about $1B — centered solely on transactional time period insurance coverage offered both D2C or by way of extra D2C-like restricted agent experiences. Our strategy is completely different as a result of it focuses on the advisor because the buyer, not a particular insurance coverage product. This presents a 10x bigger addressable market, albeit a a lot tougher one to serve. An enormous a part of our story is how we differentiate from each the primary wave of D2C startups and legacy gamers who concentrate on advisors.

What elements about your enterprise led your buyers to put in writing the examine?

We’ve established ourselves because the class chief centered on innovating for advisors and in everlasting life insurance coverage, which is the appreciable majority of the market by worth. The sheer dimension and under-digitized nature of the life insurance coverage market make it one of many largest untapped alternatives in monetary providers. Additionally, our skill to deliver significant AI-driven innovation to an business that has lagged on know-how is compounding our differentiation to D2C startups and legacy gamers.

What are the milestones you propose to attain within the subsequent six months?

Over the approaching months, we’re centered on scaling our shopper base of corporations and advisors, deepening our strategic partnerships throughout the business, and constructing out our AI-powered platform. Particularly, we’re centered on underwriting, workflow automation, and shopper lifecycle administration.

What recommendation are you able to supply firms in New York that should not have a contemporary injection of capital within the financial institution?

There has by no means been a greater time to be a builder right this moment. The AI growth has fueled progressive conventional enterprise fashions and delivered distinctive buyer experiences with out requiring tons of capital. At each scale, groups can get vital leverage while not having an abundance of assets.

The place do you see the corporate going now over the close to time period?

Within the close to time period, I see Trendy Life persevering with to scale and serve the nation’s high corporations and advisors, strengthening and increasing strategic partnerships with carriers and huge monetary corporations, and cementing our place as a class chief in AI-powered life insurance coverage distribution. We’re going to maintain investing within the know-how and AI capabilities that make advisors simpler and provides their purchasers a greater, sooner, and extra clear expertise.

What’s your favourite fall vacation spot in and across the metropolis?

Storm King within the fall is a particular place — an incredible place to wander round and get misplaced in.