MakerDAO (MKR) has navigated a tumultuous path within the Decentralized Finance (DeFi) market since June, marked by regulatory pressures and varied challenges quite a few initiatives face. Nonetheless, a shift in focus has occurred as altcoins, spearheaded by MKR, seem to overshadow this turbulence.

Presently, the worth of MKR on CoinGecko stands at $1,346, displaying a noteworthy 9.1% surge inside the previous 24 hours, accompanied by a powerful week-long ascent of 18.0%.

From mid-June, MKR has achieved a rise exceeding 115%. This progress has successfully diminished the proportion of buyers encountering losses by a big margin of 26%.

MKR Worth Report Reveals Sustained Accumulation, Whale Exercise

MKR has emerged as a notable hotbed of investor curiosity, with a current value report shedding mild on intriguing market dynamics. The journey of MKR’s value has been marked by a definite pattern of accumulation (see chart beneath) that has been underway since March, underscoring the rising curiosity and confidence amongst buyers.

Supply: Santiment

Because the calendar flipped to June, the buildup of MKR gained appreciable traction. Notably, this month noticed a strategic transfer by outstanding buyers, usually referred to as “whales,” who opted to divest a portion of their holdings.

This strategic determination, seemingly geared toward capitalizing on earnings, had the unintended consequence of quickly affecting the availability.

Nevertheless, the cryptocurrency market is thought for its intricate interplays, and MKR’s case was no exception. Whereas whales lowered their holdings, extra outsized pockets holders acknowledged an opportune second and swiftly absorbed the newly obtainable provide. This orchestrated shift in possession demonstrated the agility and resilience of the MKR ecosystem.

Resurging Curiosity In DeFi Tokens

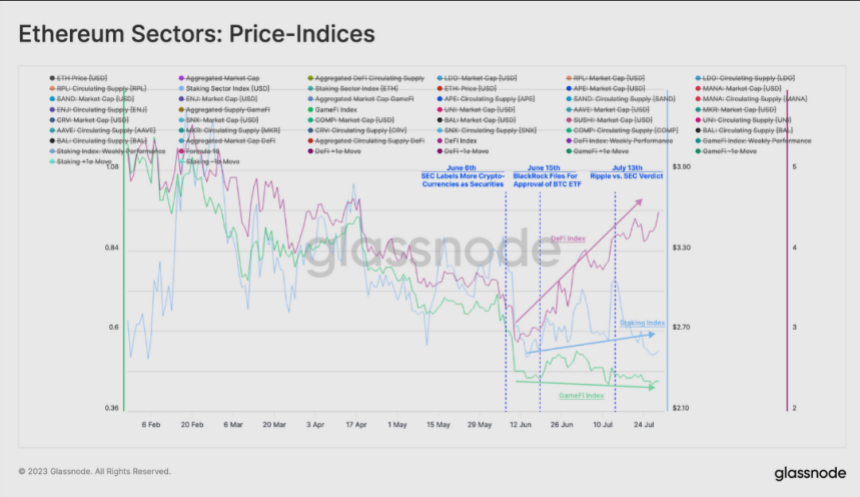

DeFi has just lately witnessed a captivating shift in dynamics, drawing consideration from analysts and buyers. Glassnode’s insightful observations spotlight a definite surge of curiosity in DeFi tokens sparked by lackluster performances inside the ecosystem.

The backdrop in opposition to which this resurgence unfolds is essential to understanding its significance. The earlier dip in DeFi token costs was undeniably attributed to a big occasion – the discharge of a memo by the US Securities and Trade Fee (SEC).

Maker (MKR) is at the moment in a optimistic pattern, buying and selling at $1,328 on TradingView.com

This regulatory communication deemed roughly 68 tokens unregistered securities, casting a shadow of uncertainty over the DeFi panorama.

Amidst the tumultuous panorama, the resurgence of curiosity is certainly noteworthy. Glassnode’s analytical lens zooms in on this intriguing growth, providing priceless insights into the altering sentiment. The info evaluation agency aptly captures the essence of this rebound:

“That is the primary outperformance since September 2022, with very related efficiency up to now.”

This evaluation not solely underscores the importance of the present uptick but in addition attracts parallels to a previous interval, hinting on the potential of a sustained trajectory.

(This web site’s content material shouldn’t be construed as funding recommendation. Investing entails threat. Once you make investments, your capital is topic to threat).

Featured picture from The Coin Republic