Really useful by IG

Traits of Profitable Merchants

The US markets shall be again on-line in the present day to set a clearer backdrop for the chance atmosphere, with US fairness futures barely within the purple on the time of writing as a mirrored image of some lingering warning. In a single day, European indices largely revealed a lacklustre exhibiting (DAX -0.96%, FTSE -0.71%, CAC -1.01%), whereas European bond yields noticed a broad transfer greater. Forward of the Financial institution of England (BoE) rate of interest resolution, positioning for a hawkish takeaway could immediate a transfer in UK 10-year authorities bond yields to its eight-month excessive, rising by 8 basis-point (bp) in a single day.

The meet-up between US Secretary of State Antony Blinken and Chinese language President Xi Jinping could mark a child step in the fitting route in the direction of a hotter US-China relationship, though the absence of any concrete developments and still-firm tone from China means that better readability could also be warranted, other than simply phrase exchanges. The pocket of optimism is that at the very least the assembly opens the gateway to extra bilateral conferences and even hopes of a Biden-Xi summit later this 12 months.

Aside from that, it has been a comparatively quiet begin to the week. The US greenback is trying to stabilise after its post-Fed sell-off, however it should now have to maneuver again above the 103.12 support-turned-resistance degree to offer some conviction for the bulls. Declining shifting common convergence divergence (MACD) and Relative Power Index (RSI) beneath 50 nonetheless reveal bearish momentum, with any draw back to go away its 2023 backside on watch on the 100.50 degree.

Supply: IG charts

Asia Open

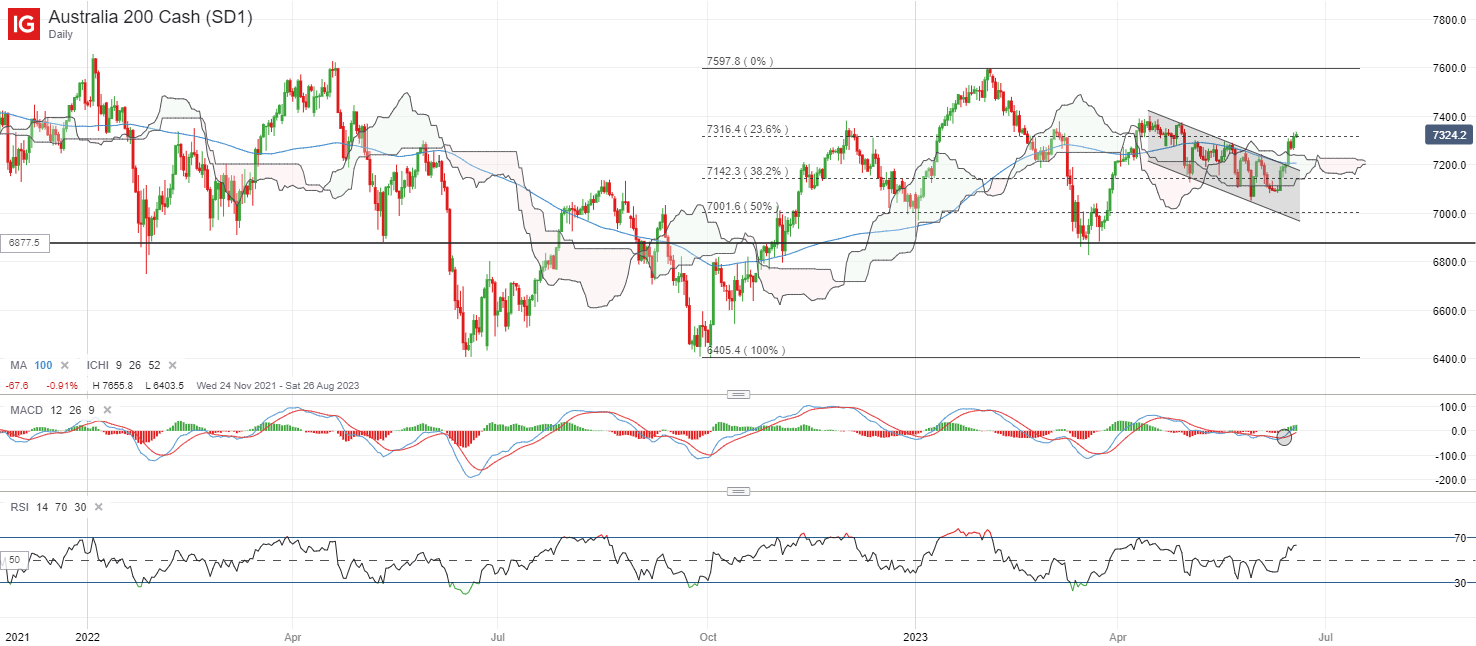

Asian shares look set for a blended open, with Nikkei -0.07%, ASX +0.23% and KOSPI -0.38% on the time of writing. The relentless rise within the ASX 200 over the previous week has marked a break above a near-term descending channel sample and its 100-day shifting common (MA), leaving it lower than 1% away from its April 2023 excessive. A reclaim above 50 for the RSI and a bullish crossover on MACD factors to constructing upward momentum, though it should face a check of resistance forward on the 7,380 degree. Overcoming this degree could also be key in paving the way in which to retest its 2023 excessive on the 7,600 degree.

Supply: IG charts

Give attention to the financial calendar in the present day shall be on the Reserve Financial institution of Australia (RBA) assembly minutes and China’s mortgage prime price (LPR) resolution.

With Australia’s money price futures leaning in the direction of a terminal price at 4.6%, which suggests an extra 50 bp price of hikes over the approaching months, additional validation shall be sought from policymakers’ views on the upcoming minutes. Currently, policymakers have been involved concerning the sluggish progress in its inflation struggle, as its month-to-month Shopper Value Index (CPI) noticed a renewed rise in pricing pressures to six.8% in April versus 6.3% the earlier month. Any higher-for-longer stance or pushback in opposition to any upcoming price pause from the central financial institution could also be deemed as hawkish, which can proceed to assist the AUD.

Taking over a special route in financial insurance policies would be the Individuals’s Financial institution of China (PBoC), with expectations for a ten bp reduce to each its one-year and five-year LPR in the present day, monitoring an identical transfer to its 7-day Reverse Repo price and one-year MLF price final week. Latest easing strikes recommend that reopening efforts are shedding their shine, setting the groundwork for extra coverage intervention to observe within the months forward.

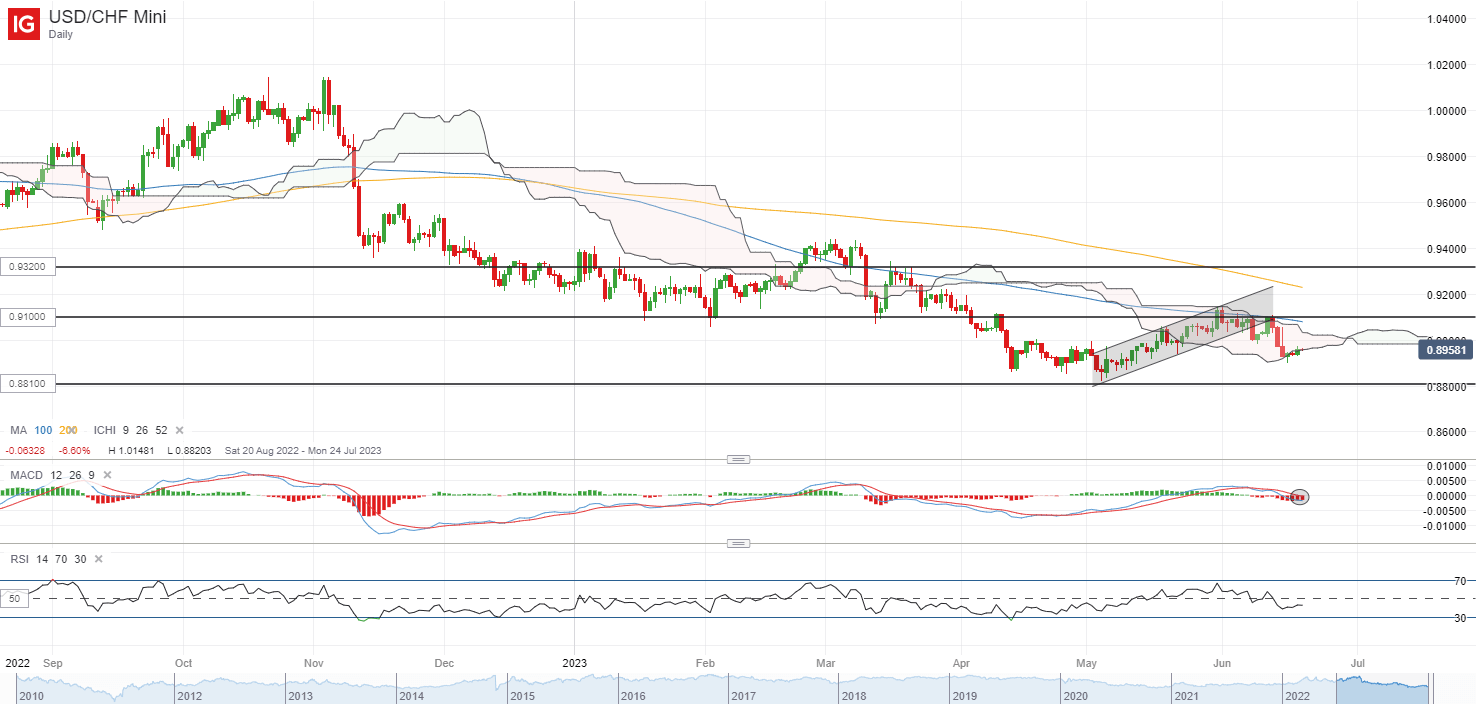

On the watchlist: USD/CHF on watch forward of Swiss Nationwide Financial institution’s (SNB) assembly

The SNB’s coverage assembly shall be held this Thursday and up to date hawkish feedback on persistent inflation from its Chairman Thomas Jordan have left expectations well-anchored for additional tightening to happen. He talked about that “the struggle in opposition to inflation shouldn’t be over” and he “can’t exclude an extra tightening of financial coverage”.

That mentioned, will probably be an in depth name on how a lot tightening is required, with rate of interest futures comparatively break up between a 25 bp (42% chance) and a 50 bp transfer (58% chance). The tone and steerage on its price trajectory shall be in focus as effectively, with any higher-for-longer stance more likely to reinforce the coverage divergence with the Fed, at a time the place broad expectations are for the Fed to finish its tightening course of subsequent month.

The USD/CHF has struggled to cross above a key resistance confluence zone (horizontal support-turned-resistance, 100-day MA, Ichimoku cloud) on the 0.910 degree recently, because the formation of lengthy bearish candles appear to replicate sturdy promoting strain. Its RSI is beneath the 50 mark whereas MACD can also be crossing beneath zero, as indicators of bearish momentum. Additional draw back could go away its Might 2023 backside on the 0.881 degree on watch. However, better conviction for the bulls could have to return from a transfer above the 0.910 degree.

Supply: IG charts

Monday: US markets closed for Juneteenth vacation, DAX -0.96%, FTSE -0.71%