- Microsoft briefly toppled Apple to develop into the world’s most useful firm, highlighting a possible shift within the tech trade.

- Apple is going through challenges in China, in the meantime, robust fundamentals and macro tailwinds are favoring Microsoft.

- The latter’s resilience and technique in rising markets might assist it regain the crown in the long run and retain it for some time.

- Seeking to beat the market in 2024? Let our AI-powered ProPicks do the leg be just right for you, and by no means miss one other bull market once more. Be taught Extra »

In a seismic shift within the tech trade, Microsoft (NASDAQ:) briefly dethroned Apple (NASDAQ:) because the world’s most useful firm yesterday, boasting a market cap of $2.888 trillion in opposition to $2.887 trillion for the Cupertino, California-based behemoth.

Whereas the shift in management was solely momentary, with Apple reclaiming its place earlier than market shut, this transformation of forces might counsel a possible reshaping of the large tech panorama in the long term.

Actually, because the starting of the 12 months, it has been evident that Microsoft’s ascent to turning into the world’s largest firm was not a query of “if” however quite of “when.”

Now, probably the most fascinating query lies in whether or not Microsoft’s management is sustainable – and for the way lengthy.

Let’s take a deep dive into the 2 giants’ newest information and financials with our InvestingPro software to raised perceive the place we stand proper now.

Macroeconomic Situations Favor Microsoft

The first issue influencing the shift in management is the broader international macroeconomic backdrop shaping the tech panorama in 2024.

Whereas Apple has held the coveted title of probably the most extremely valued firm on the inventory market since 2011 – being solely briefly topped by Saudi Arabia’s Aramco (TADAWUL:) amid the rise in costs in 2022 – current developments point out a tougher panorama for the iPhone maker than for its peer.

For years, tech firms have been valued with an expectation of fast development fueled by an acceleration of the Chinese language economic system in each shopper and manufacturing sectors.

Nonetheless, the panorama has shifted, marked by China’s anticipated deceleration and a metamorphosis within the financial matrix.

This simultaneous enhance in manufacturing prices and dampening of anticipated gross sales have altered the dynamics on each ends of Apple’s margins due its disproportional publicity to the nation – its main market when it comes to quantity for iPhone gross sales.

Actually, despite a strong 48% enhance in inventory worth in 2023, the corporate has been feeling the implications of China’s deceleration, significantly pronounced by the disappointing iPhone 15 and iPhone 15 Professional gross sales within the nation.

The rising geopolitical tensions between america and China pose yet one more threat for Apple, as traders should worth within the risk (not but concrete) of the Chinese language authorities limiting iPhone purchases within the nation or additional dampening the digital system provide chain.

Monetary establishments, together with Barclays, Piper Sandler, and extra just lately, Redburn-Atlantic, have downgraded Apple’s shares, citing a slowdown within the firm’s development tempo, issues concerning the Chinese language market, and the danger of dropping a profitable contract with Google (NASDAQ:) price US$18 billion on account of an ongoing antitrust lawsuit in opposition to the search engine big.

In stark distinction, Microsoft appears extra resilient to those challenges, with much less publicity to the Asian big and a broader suite of income streams.

Microsoft’s steady revenue supply from software program licensing, involving recurring fee providers to loyal clients, has favored the corporate. This enterprise mannequin and a relentless give attention to AI permit Microsoft to include AI developments into established merchandise effectively.

As analysts anticipate international development to be led by different strong shopper markets, together with India, Mexico, and sure components of Africa, that are experiencing fast development and promising sustained gross sales in the long run, the Redmond, Washington-based big seems higher positioned.

Conversely, this shift poses a problem for Apple, because it favors firms pursuing development with extra accessible merchandise and better AI integration – areas by which Microsoft excels.

Microsoft Excels at Monetizing AI, Whereas Apple’s Providing Stays Subpar

Microsoft’s stellar efficiency all through 2023, marked by a 57% surge in inventory worth, might be attributed, partly, to a strategic alliance with OpenAI, the mastermind behind ChatGPT.

This collaboration empowered Microsoft to seamlessly combine cutting-edge synthetic intelligence (AI) options throughout its software program spectrum, encompassing textual content era, picture processing, and programming code creation.

The corporate additional solidified its dominance within the fiercely aggressive cloud providers enviornment by means of its Azure platform, difficult trade giants like Amazon (NASDAQ:) and Alphabet (NASDAQ:).

Satya Nadella, the CEO of the Home windows developer, almost employed Altman throughout this era, showcasing the depth of Microsoft’s impression on OpenAI.

Apple’s AI integration, alternatively, stays sub-par, to say the least.

The corporate’s strategic transfer for 2024 was the announcement of the Imaginative and prescient Professional augmented actuality headset, set to hit the market on February 2nd with a considerable price ticket of US$3,500.

Nonetheless, even contemplating the anticipated CAGR for the VR trade, together with Apple’s rising market share within the section, calculations are that the numbers will hardly make up for the opening left by the softening Chinese language economic system within the iPhone market.

Taking a look at market expectations for the years forward, it’s clear that the iPhone maker should run quick in an effort to breach the hole of its AI providing earlier than falling considerably behind the competitors.

InvestingPro Monetary Fashions Additionally Favor Microsoft

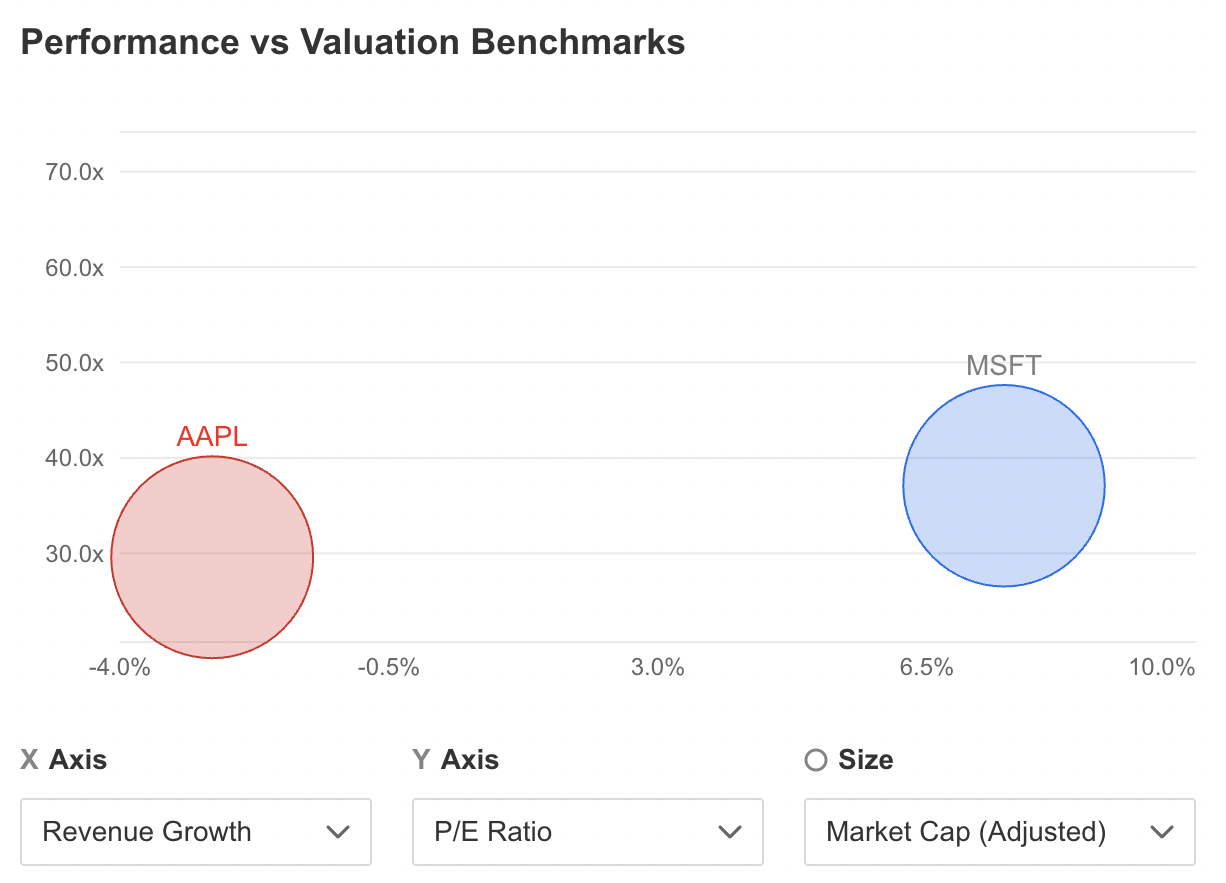

Each firms face challenges associated to excessive inventory costs in comparison with anticipated earnings. Apple’s shares commerce at a future a number of of 28x, nicely above the 10-year common of 19, whereas Microsoft displays a a number of of roughly 31x.

Nonetheless, going a bit deeper into the businesses’ fundamentals with InvestingPro, we will see that Microsoft clearly presents extra constructive factors than the competitors.

Supply: InvestingPro

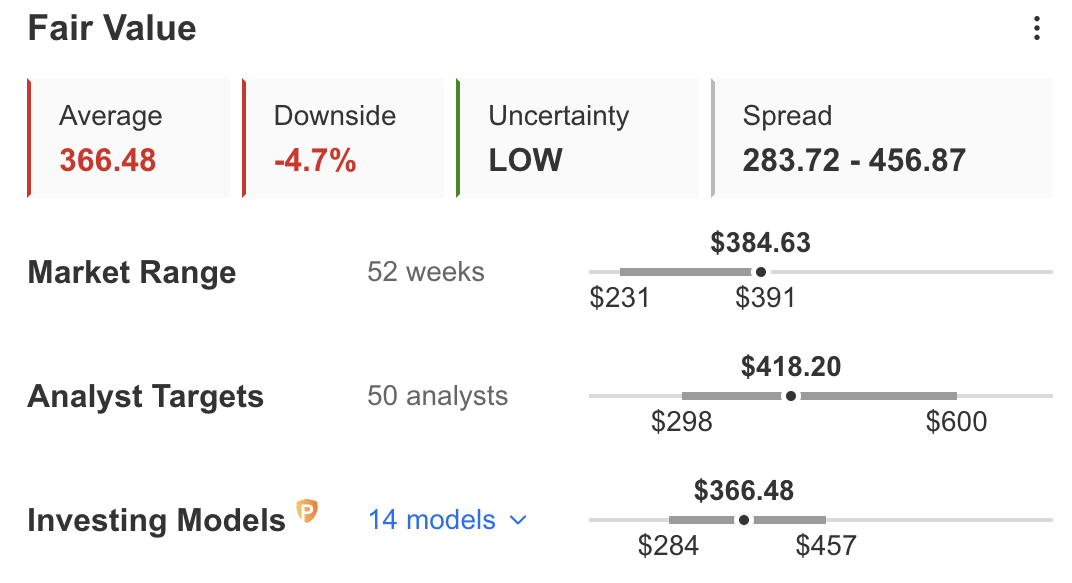

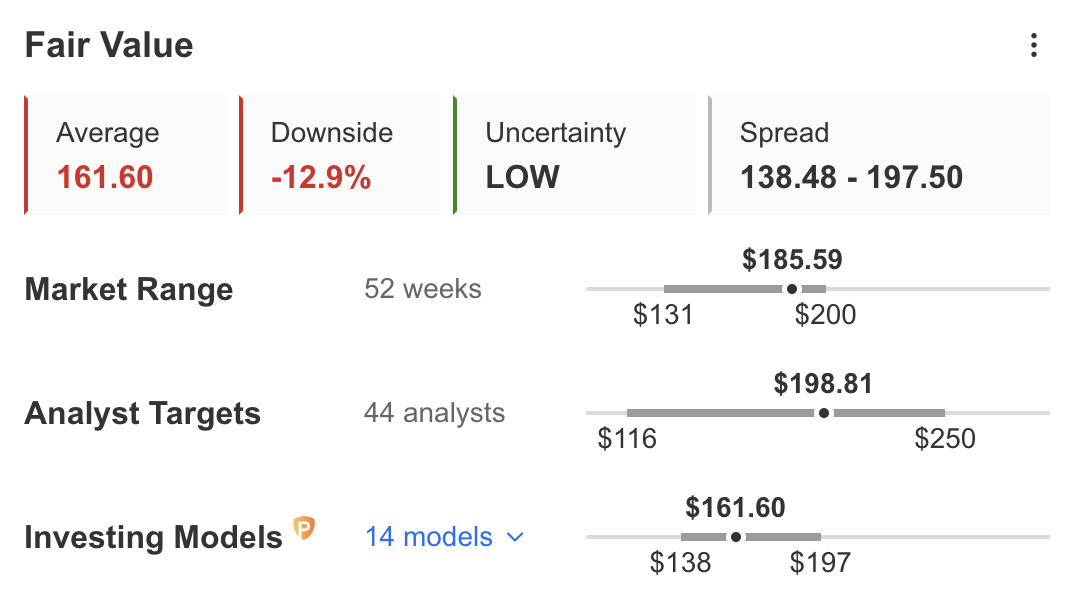

Supply: InvestingPro

Whereas each firms current a draw back Honest Worth Estimate, Microsoft’s is simply -4.72%, whereas Apple’s is a hefty -12.9%.

Supply: InvestingPro

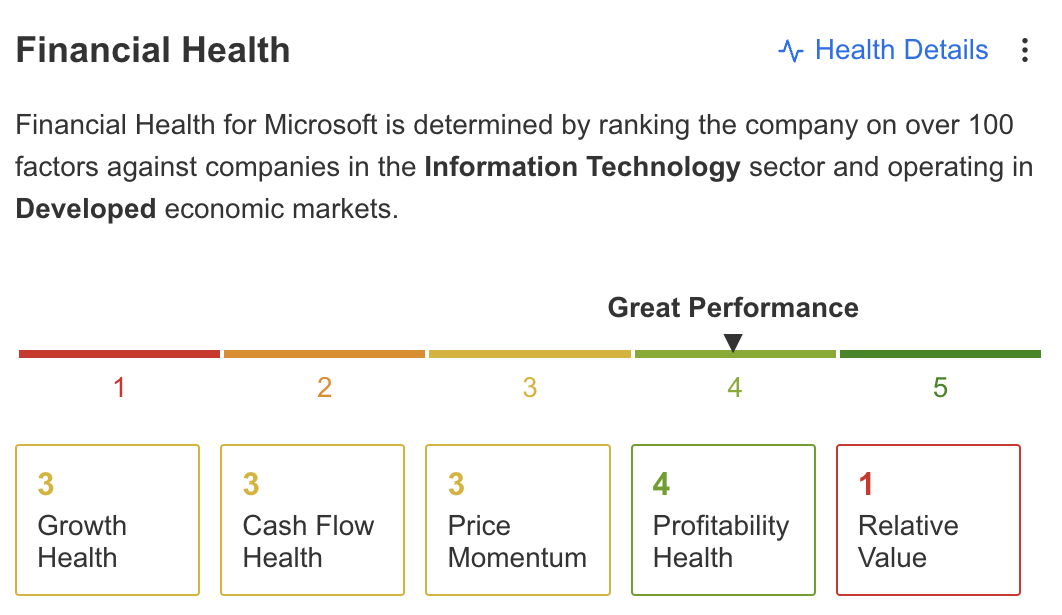

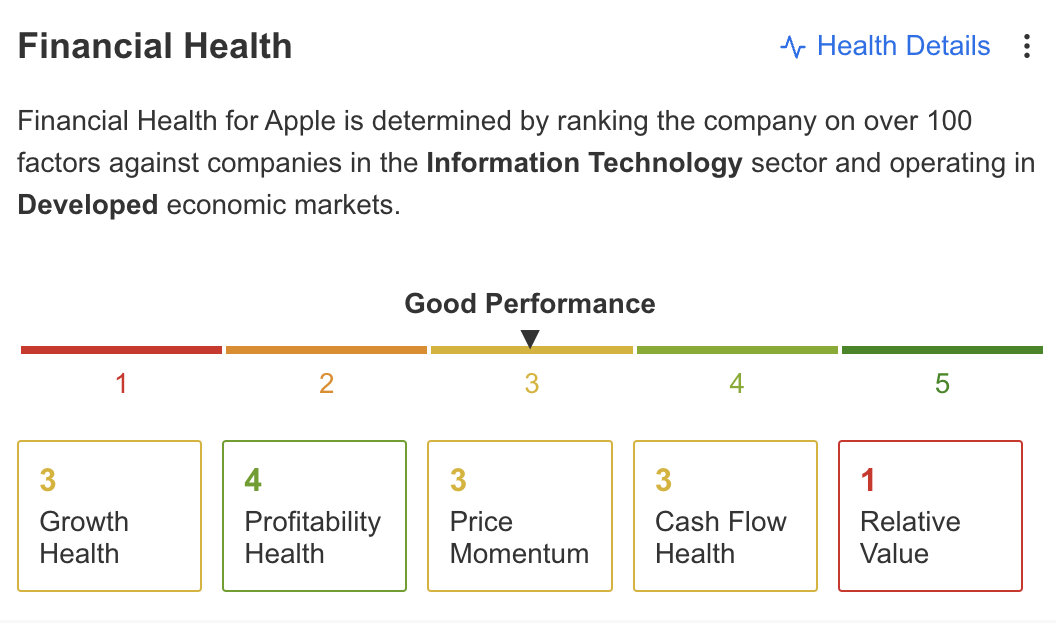

Accordingly, InvestingPro’s Monetary Well being rating additionally favors Microsoft, giving it an ‘Nice Efficiency’ rating – in opposition to Apple’s ‘Good Efficiency.’

Supply: InvestingPro

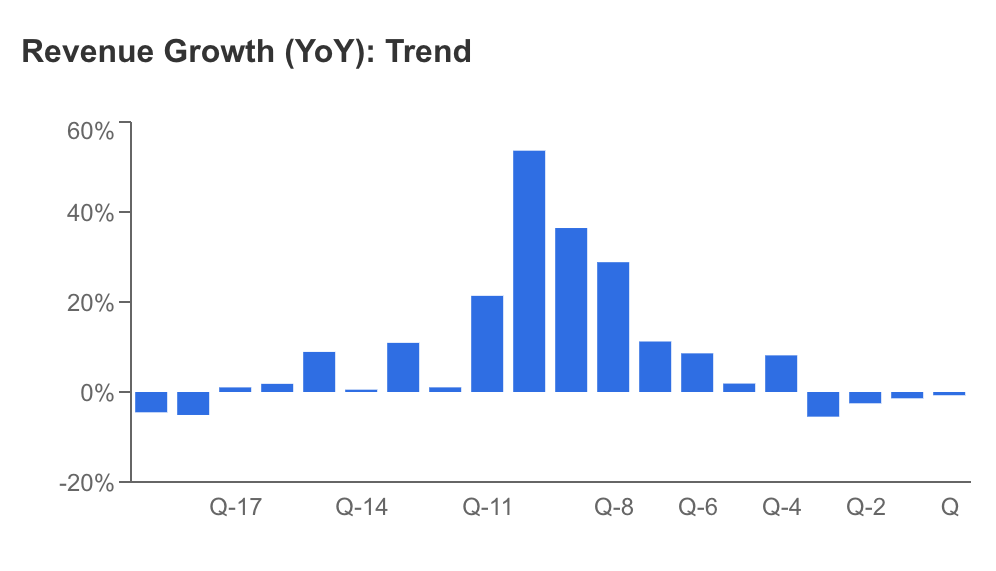

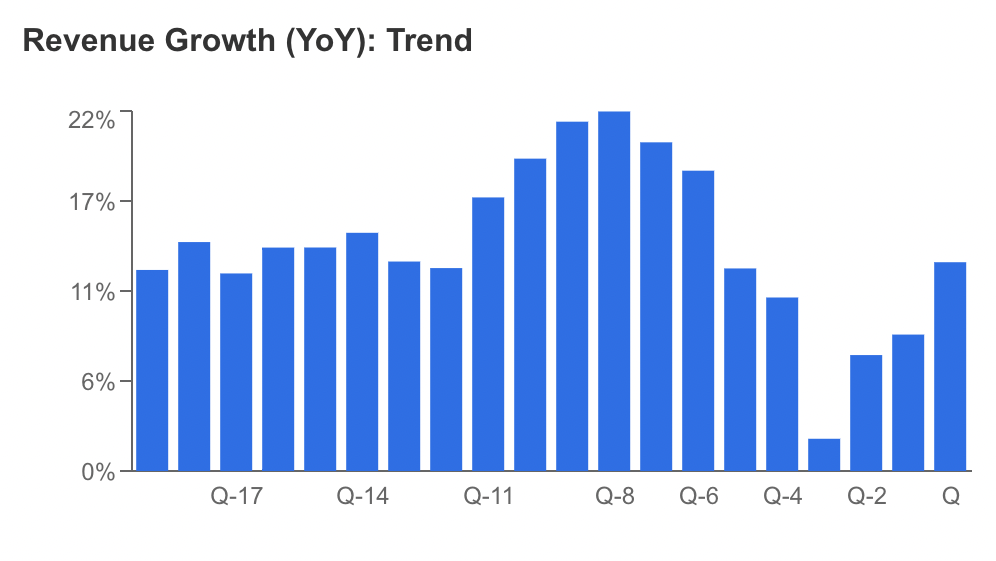

The primary purpose behind the development is the businesses’ profitability development – as seen within the comparability between the 2 firms beneath. Whereas Apple’s income development (on the left) stays subdued, Microsoft (proper) seems to be again to sustained development.

Supply: InvestingPro

As such, the comparability between income development, PE, and market cap extremely favors Microsoft going ahead.

Supply: InvestingPro

Backside Line

The years forward will reveal whether or not Microsoft’s strategic use of AI integration can safe its management because the world’s most useful firm or if Apple will efficiently deal with its challenges and regain the highest place.

Nonetheless, as of now, all of the main indicators trace at a decade of Microsoft management.

Furthermore, it stays clear that Apple should rethink its enterprise mannequin shortly to adapt to the brand new macro and technological surroundings to catch as much as the identical development degree of its friends.

***

In 2024, let laborious selections develop into simple with our AI-powered stock-picking software.

Have you ever ever discovered your self confronted with the query: which inventory ought to I purchase subsequent?

Fortunately, this sense is lengthy gone for ProPicks customers. Utilizing state-of-the-art AI know-how, ProPicks supplies six market-beating stock-picking methods, together with the flagship “Tech Titans,” which outperformed the market by 670% during the last decade.

Be part of now for as much as 50% off on our Professional and Professional+ subscription plans and by no means miss one other bull market by not figuring out which shares to purchase!

Declare Your Low cost At present!

Disclosure: The creator owns each Apple and Microsoft shares, with a heavier publicity to the latter.