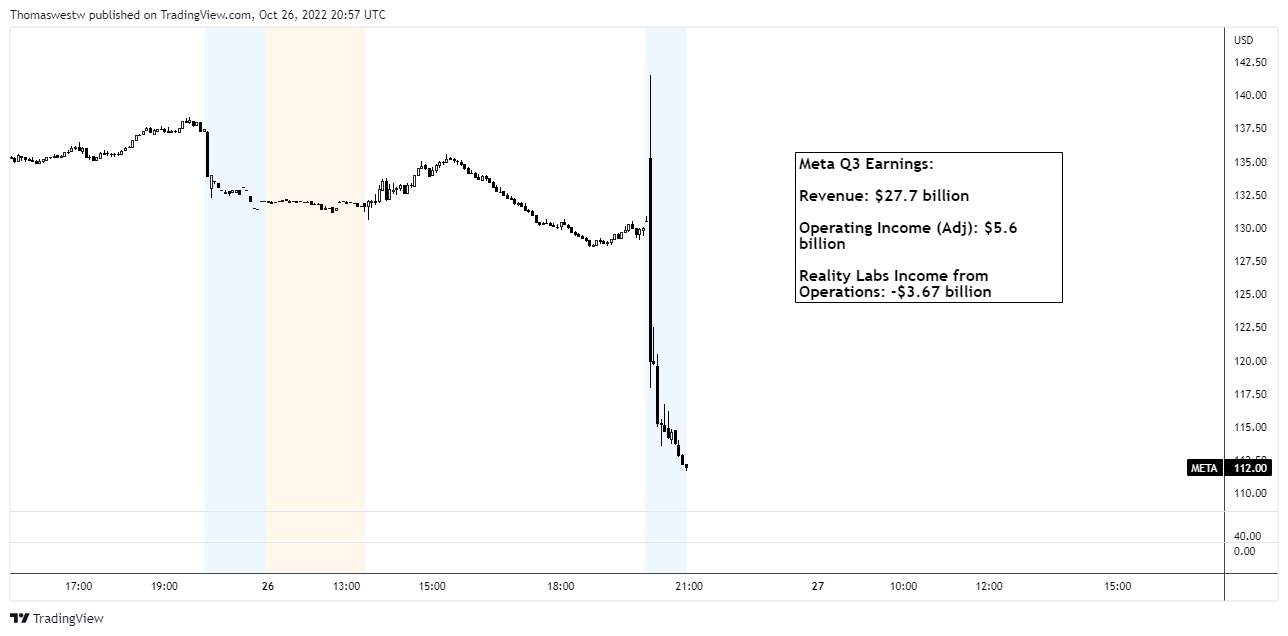

- Meta stocks fell over 13% in after-hours trading after Q3 earnings

- Revenue fell for the second straight quarter, and guidance disappoints

- Nasdaq to come under more pressure amid broader tech sector misses

Recommended by Thomas Westwater

Get Your Free Equities Forecast

Meta Platforms Inc., the Facebook parent company, reported third-quarter earnings after the bell on Wednesday. The social networking and virtual space company saw its revenue decline for a second consecutive quarter, falling to $27.71 billion. That beat the $27.41 Bloomberg consensus forecast, but earnings on a GAAP basis missed the $1.88 EPS estimate, coming in at $1.64, a 13% miss.

Investors shunned the stock in cash trading, with Meta falling 5.59% after Alphabet, Inc.—Google’s parent company—and Microsoft posted disappointing earnings before the opening bell. Google fell nearly 10%, and Microsoft shed 7.72%. A rising rate environment is sending capital away from high-beta technology stocks.

Discover what kind of forex trader you are

Meta provided grim guidance for the fourth quarter, saying they expect revenue at $30 billion to $32.5 billion. An increase in competition from China’s TikTok and changes to Apple’s new iPhone privacy measures, along with a broader slowdown in ad spending are seen dampening the company’s sales. Expenses rose more than expected, totaling $22.05 billion versus the $21.23 billion expected. A stronger US Dollar weighed on revenue, according to the financial statements: “Had foreign exchange rates remained constant with the third quarter of 2021, revenue would have been $1.79 billion higher.”

Moreover, Reality Labs—a big bet on virtual reality, aka, “the Metaverse” is likely the most potent headwind to the stock price. The CFO Outlook Commentary stated that Reality Labs operating losses will “grow significantly year-over-year.” Elsewhere, daily active users (DAUs) were at 1.98 billion, slightly above the 1.97 billion estimate. Overall, Meta looks poised to remain under pressure as the company rebrands itself in a difficult operating environment.

Meta – 5-Minute Chart

Chart created with TradingView

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter