Ozgu Arslan/iStock by way of Getty Photos

Funding Thesis Abstract

The spate of latest trial and pricing momentum exhibited by quite a few scientific stage immuno-oncology firms on the again finish of FY22 has piqued our curiosity. This portion of the market caught a robust bid within the latter half of This autumn, pushed by a mix of sector beta and a few firm standouts. On the similar time, some names weren’t so lucky, and skilled heavy draw back to shut out the remaining weeks in FY22.

One working example was Merus (NASDAQ:MRUS), after the FDA made suggestions on trials involving its investigational compound, Zenocutuzumab. The inventory had gathered substantial consideration within the first half of the yr, nonetheless has since reversed course sharply. Alas, I am again immediately as a way to ship our examination findings on MRUS, offering context on its investigational compounds on the similar time. The FDA’s advice has put a dent within the inventory’s upside potential in our estimation, and there is now draw back danger that should be factored into the funding debate. Internet-net, with out a directional view in the marketplace, we price MRUS a maintain.

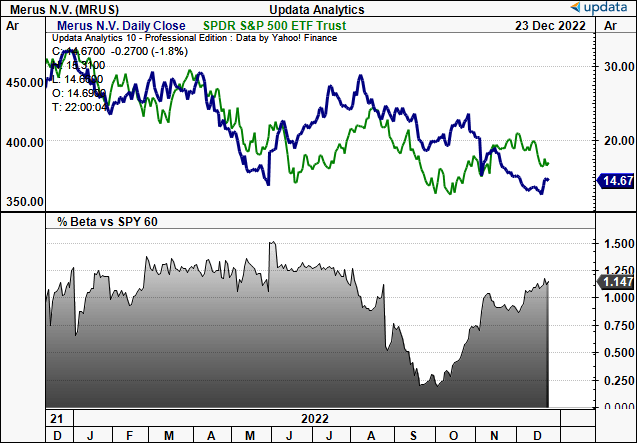

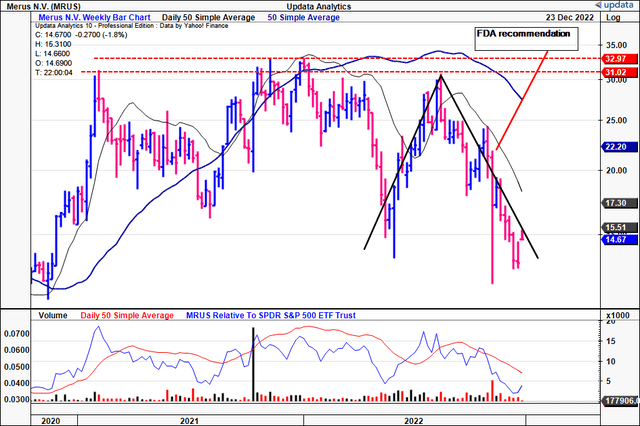

Exhibit 1. MRUS value motion throughout 2022. It is a high-beta inventory that is been punished within the again finish of the yr.

Knowledge: Updata

MRUS latest developments with Zenocutuzumab

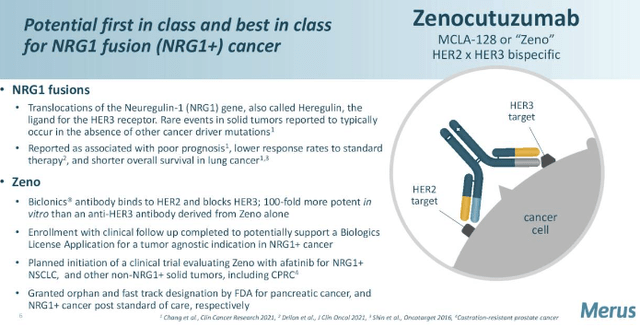

MRUS lately met with the FDA to debate the potential submitting of a biologics license utility (“BLA”) for Zenocutuzumab, (“Zeno”; also called MCLA-128) a bi-specific humanized full-length immunoglobulin G1 antibody, in NRG1 fusion (“NRG1+”) most cancers.

Zeno is designed to inhibit the protein HER2, block ligand binding to the HER3 receptor web site, and stop HER2-HER3 heterodimerization and downstream signalling of tumorigenesis [for reference, HER2 and HER3 are proteins that help breast cancer cells grow at an accelerated pace]. It additionally has the flexibility to recruit pure killer effector cells by its enhanced antibody-dependent mobile cytotoxicity properties.

Following the assembly with the FDA, MRUS believes {that a} potential path to regulatory approval stays viable for Zeno, in a tumour agnostic indication for NRG1+ most cancers, or separate functions for NRG1+ lung and NRG1+ pancreatic most cancers. It believes this might then be adopted by a possible tumor agnostic submitting.

Exhibit 2. Description of Zeno

Knowledge: MRUS Investor Presentation, Searching for Alpha

Exhibit 3. Zeno pharmacology

Knowledge: MRUS Investor Presentation, Searching for Alpha

MRUS’ scientific part I/II eNRGy examine is at present evaluating the potential of NRG1 fusions as targets for focused remedy with Zeno. The vast majority of the eNRGy trial and early entry program enrollment up to now has been for NRG1+ non-small cell lung most cancers (“NSCLC”) and NRG1+ pancreatic most cancers. We might advise that NRG1 fusions, which happen at low frequencies in stable tumours [but are enriched in certain cancer types – such as KRAS wild-type pancreatic cancer, driver-negative non-small cell lung cancer, and the invasive mucinous adenocarcinoma subtype of lung cancer], are extremely enticing therapeutic targets as a consequence of their oncogenic exercise.

It is important to spotlight that, after its assembly with the corporate, the FDA has really helpful that MRUS enroll extra sufferers beneath both a tissue agnostic or tumor-type particular strategy, as a way to acquire additional supportive knowledge for a possible registrational knowledge set, as outlined within the FDA’s draft steering on Tissue Agnostic Drug Improvement in Oncology. For buyers, it is essential to know that the quantity of knowledge wanted for a possible BLA submitting will depend upon:

a). the magnitude, and sturdiness of responses, and

b). the general danger profit evaluation.

Within the meantime, MRUS says it’s at present evaluating the influence of this steering on the timeline for the potential BLA submitting.

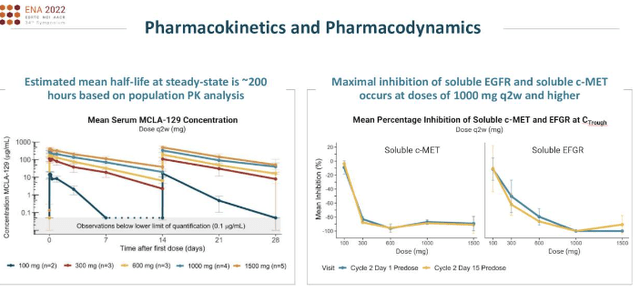

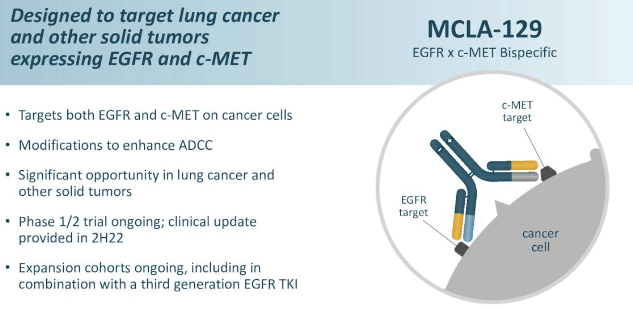

MRUS’ MCLA-129 additionally garnering consideration

In the meantime, it is price highlighting that MRUS continues with enrollment in enlargement cohorts for its its investigational drug, MCLA-129. In accordance with MRUS, MCLA-129 is “designed to inhibit the EGFR and c-MET signaling pathways in stable tumors”. It too is a bi-specific humanized full-length immunoglobulin G1 antibody with enhanced antibody-dependent mobile cytotoxicity exercise, albeit as a monotherapy therapy for NSCLC

It has lately introduced the enrollment of sufferers in a part 1/2 scientific trial of MCLA-129. As of October 2022, a complete of 33 sufferers have been enrolled within the trial, which incorporates people with NSCLC and head and neck squamous cell most cancers (“HNSCC”), in addition to these with epidermal development issue receptor (‘EGFR”) mutant NSCLC who’ve progressed on Tagrisso [osimertinib], a prescription medication used to deal with adults with NSCLC.

Exhibit 4. MCLA-129 traits

Knowledge: MRUS presentation at thirty fourth EORTC-NCI-AACR Symposium

Preliminary knowledge from 18 evaluable sufferers handled with MCLA-129 at numerous dose ranges confirmed promising outcomes, with two confirmed partial responses, and a further 4 sufferers exhibiting greater than 20% tumor shrinkage. MCLA-129 has demonstrated an appropriate security profile in our opinion, with the most typical antagonistic occasions being infusion-related reactions. Primarily based on the pharmacokinetic and pharmacodynamic knowledge, in addition to the favorable security profile, the dosage regime suggests a really helpful part 2 dose of 1500mg administered each 2 weeks.

MRUS technical research to information value visibility

Within the absence of tangible earnings and gross sales development we usually flip to varied technical research as a way to gauge the place the inventory could head subsequent. As you may see within the chart beneath, volatility is a continuing on this identify. MRUS has traded inside a variety throughout the previous 2-year interval, rallying as excessive as $33 and as little as $12.

For essentially pushed buyers, this image is not ultimate, and there is nigh an argument so as to add on value weak spot right here in our opinion. In 2022, the inventory rallied exhausting off a ~$13.50 base in Might to the $31 apex proven. This was a key resistance degree, as seen.

After this take a look at it was rejected at this degree and has continued its reversal at tempo till the current day. Regardless of a snapback rally inside the longer-term transfer, information of the FDA’s suggestions talked about above sealed the inventory’s destiny in the intervening time.

Exhibit 5. Huge volatility with a number of makes an attempt to interrupt out above key resistance ranges, failing at every try.

Knowledge: Updata

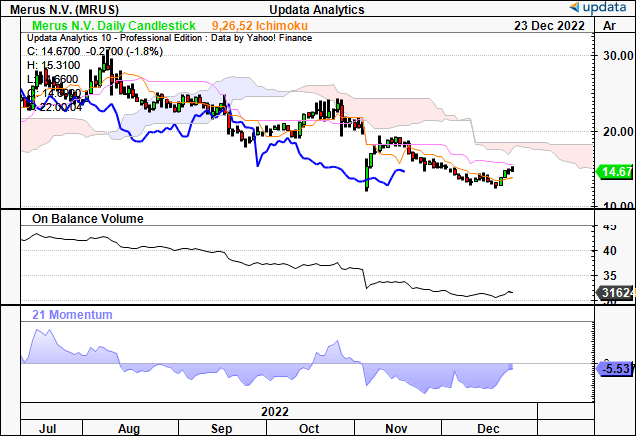

As well as, we would be aware the pattern appears to be like to be bearish in the intervening time, with shares buying and selling beneath cloud assist, and each on stability quantity and momentum research indicating a scarcity of shopping for assist.

Exhibit 6. Buying and selling properly beneath cloud assist, lag line in shut following, while pattern indicators say there is a lack of consumers at this level.

Knowledge: Updata

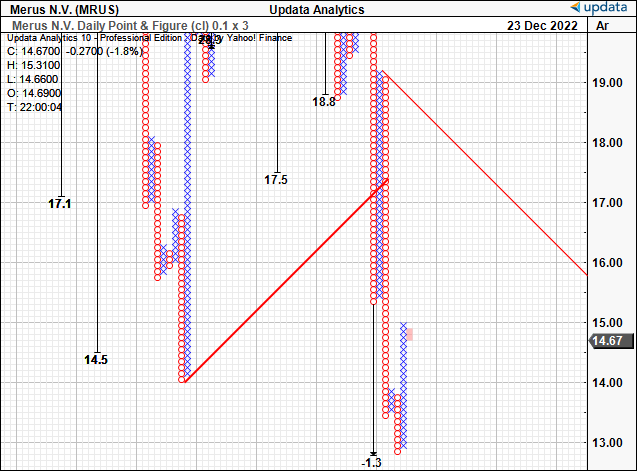

Of equal concern, is that, after the most recent thrust down from the earlier highs, we now have draw back targets as little as $1.30 on our level and determine research. We aren’t so assured this may materialize, nevertheless it does inform us to tread cautiously right here, and that capital can maybe be allotted extra effectively and successfully elsewhere.

Exhibit 7. Draw back targets counsel to tread fastidiously and observe additional developments for MRUS from the sidelines.

Knowledge: Updata

In brief

MRUS stays at ‘show it’ stage in our opinion, and it should ship on advancing its pipeline as a way to command investor consideration. In the mean time, the market is reacting violently to every setback in its pipeline conversion, and this presents as a key danger to holding the inventory. With out the information current in its speculation testing, the FDA has indicated it requires extra knowledge as a way to grant the BLA for Zeno. On that entrance, buyers have been clearly anticipating higher outcomes from the Q3 earnings replace in November, therefore the fast selloff from then up to now. Internet-net, we’re joyful observing MRUS from the sidelines for now.