- ProPicks, Investing.com’s flagship AI-powered funding instrument, constantly outperforms benchmarks just like the S&P 500 with meticulously analyzed high-performing shares.

- With six strong methods, ProPicks caters to various investor preferences, making certain superior efficiency by way of steady updates and evaluations.

- On this piece, we are going to take a deep dive into every technique individually.

Embrace the way forward for inventory choice with ProPicks, your gateway to streamlined AI-powered funding decision-making!

Out there for below $9 month completely with this hyperlink, ProPicks introduces a handpicked listing of high-performing shares meticulously analyzed and validated by superior AI fashions, constantly outshining main benchmarks just like the .

Not only for institutional buyers and hedge funds, this cutting-edge product provides a large spectrum of long-term funding methods, constantly refined to showcase solely probably the most promising alternatives.

Every technique undergoes rigorous evaluations towards present market adjustments to make sure unwavering reliability and efficiency.

On the coronary heart of ProPicks lie AI fashions rigorously skilled on over 100 monetary metrics, incorporating a wealth of 25 years’ price of funding information.

Powered by Google Vertex AI, these fashions function with unparalleled velocity and precision, sifting by way of huge firm datasets to month-to-month pinpoint 70+ shares poised to outperform the foremost indexes.

Need to see all of the shares? Subscribe now for below $9 a month and by no means miss one other bull market by not understanding which shares to purchase!

Our Best Strengths

Maybe ProPicks’ largest power lies in its skill to remove emotional biases from inventory choice whereas dynamically adapting to market shifts.

Using machine studying, mixed with AI synergy, it evaluates tens of 1000’s of corporations and identifies shares with the potential to flourish throughout various market circumstances.

Providing methods tailor-made to totally different investor preferences and danger appetites, ProPicks caters to a variety of funding types.

Sometimes, every technique is up to date each month to make sure that what to doubtlessly purchase, and when to doubtlessly purchase it.

Subscribe At present!

*Readers of this text get pleasure from an additional 10% low cost on the yearly and by-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Let’s discover the six strong methods ProPicks provides:

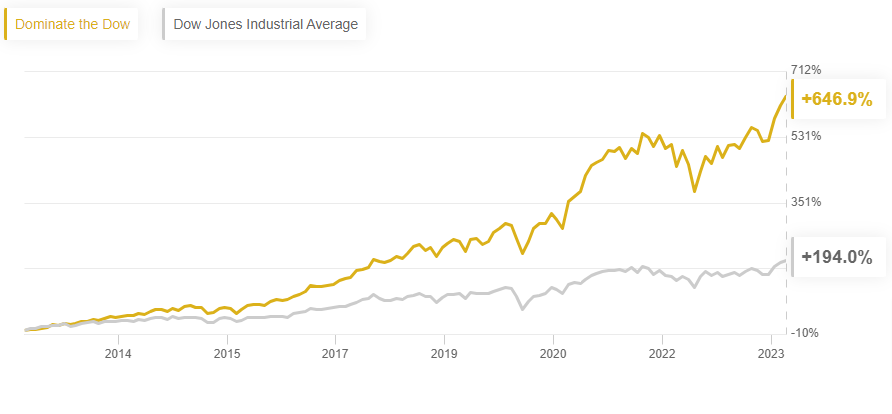

1. Dominate the Dow

Targeted on top-tier corporations throughout the , ProPicks’ AI-driven ‘Dominate the Dow’ technique is methodically tailor-made for industry-leading corporations boasting strong fundamentals and a constant historical past of annual progress.

Supply: InvestingPro

Identified for his or her stability, market management, and excessive progress potential, this technique identifies the highest 10 blue-chip shares throughout the Dow 30 that current probably the most compelling funding alternatives.

The historic back-test of ‘Dominate the Dow’ serves as a testomony to the technique’s efficiency over time, beating its benchmark index by 452% during the last decade, with an annualized return of 19.9%.

Supply: InvestingPro

Be a part of now for below $9 a month for a restricted time solely and by no means miss one other bull market by not understanding which shares to purchase!

Recurrently up to date and charted towards adjustments in market traits, these blue-chip winners greater than earn their status as {industry} leaders.

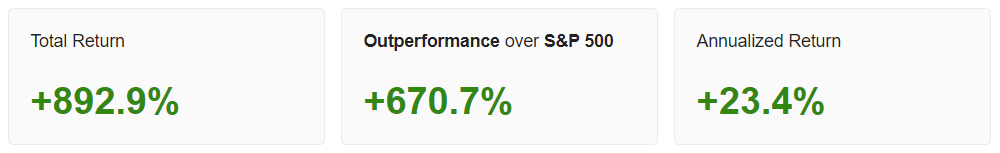

2. Beat the S&P 500

True to its identify, the ProPicks ‘Beat the S&P 500’ technique makes use of subtle AI fashions to fastidiously analyze monetary information from the whole pool of 500 shares throughout the S&P 500. Its major goal is to pinpoint the highest 20 standout names exhibiting the best potential for outperformance every month.

Supply: InvestingPro

Utilizing AI, our fashions consider each inventory primarily based on essential efficiency benchmarks – akin to valuation ratios, momentum metrics, and total firm well being – after which chart them towards evolving market dynamics in real-time.

Historic information exhibits that the ‘Beat the S&P 500’ technique would have outperformed the benchmark index by a whopping 670.7% up to now decade, offering an annualized return of 23.4% throughout that point interval.

Supply: InvestingPro

Constantly monitored and tracked in accordance with market shifts, these high-quality names undeniably validate their standing as {industry} frontrunners.

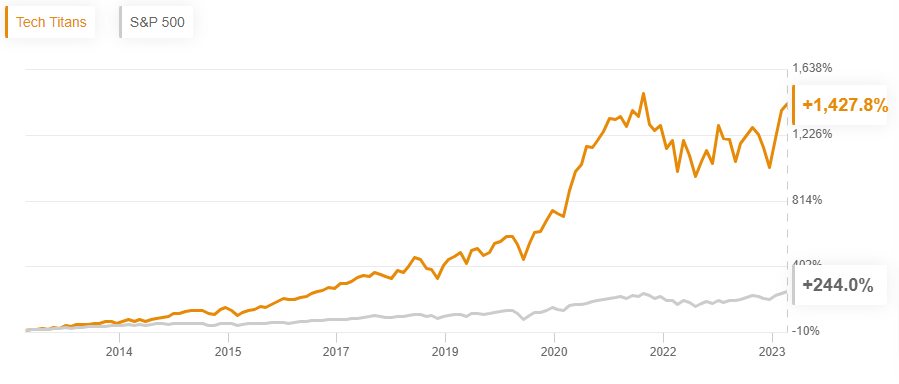

3. Tech Titans

Highlighting 15 tech corporations on the forefront of innovation, the ‘Tech Titans’ technique presents a singular alternative to journey the tech wave with a fastidiously chosen group of confirmed tech winners.

Supply: InvestingPro

Already established with a sizeable market cap, this technique contains present {industry} leaders and quickly rising companies – every with spectacular metrics and improvements.

Historic evaluation reveals the ‘Tech Titans’ technique’s exceptional monitor report, blowing previous the benchmark index by an astounding 1183% over the previous decade, leading to an annualized return of 27.9% inside that interval.

Supply: InvestingPro

As we’ve witnessed this 12 months, the tech {industry} strikes fast. That is why ProPicks’ AI algorithms always monitor and replace each choose accordingly each month.

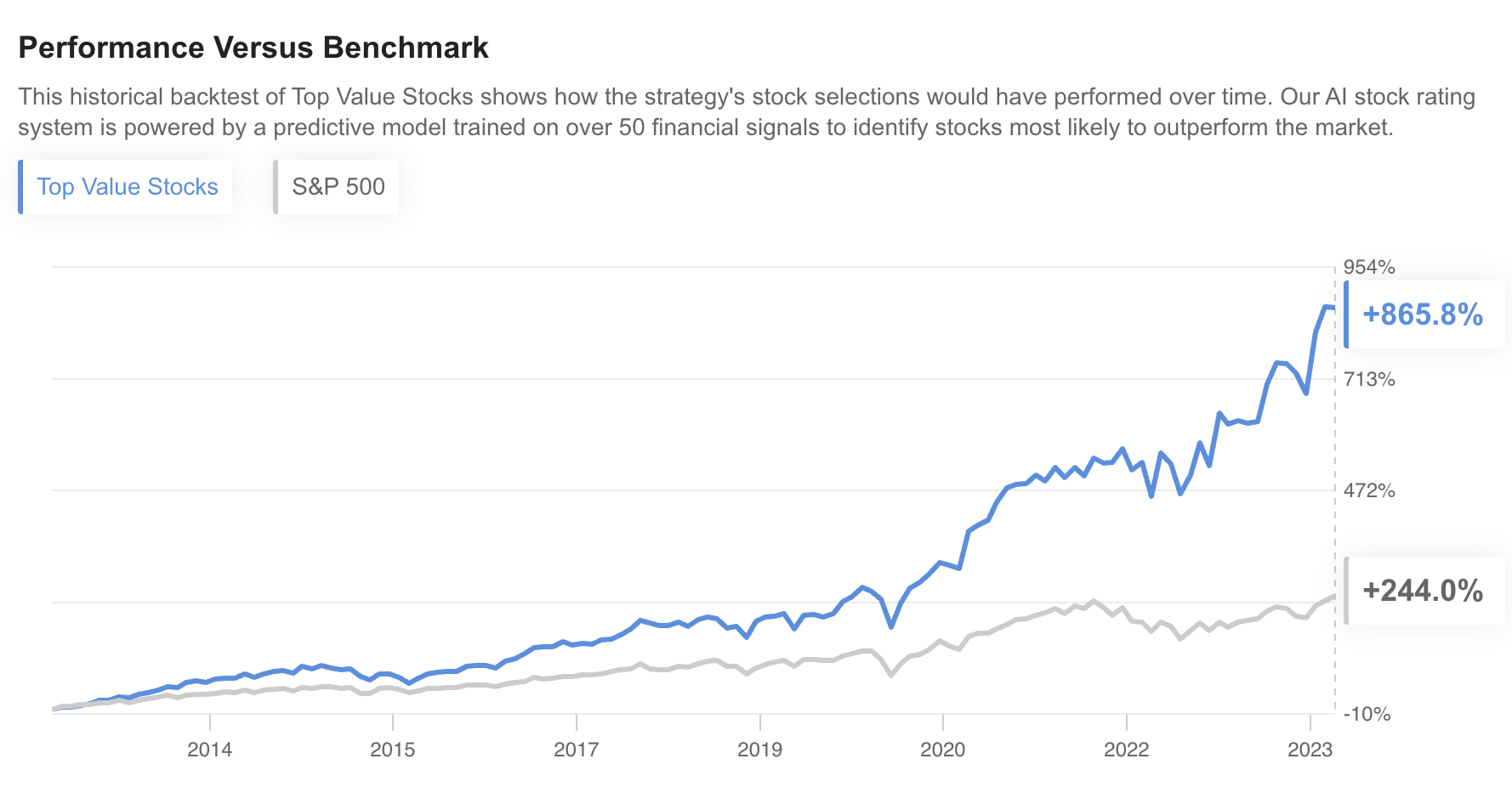

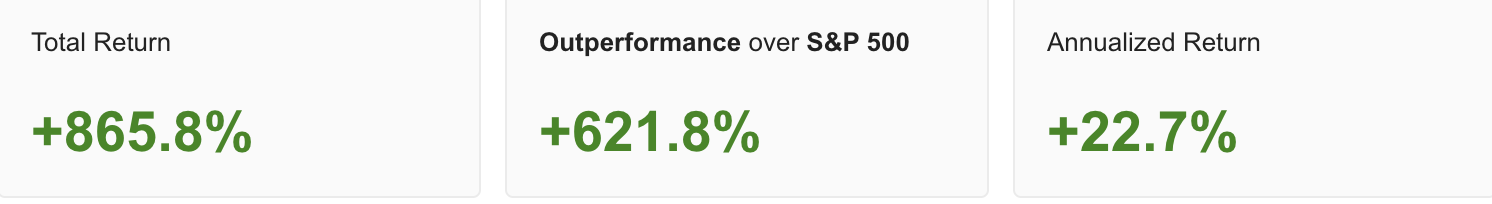

4. High Worth Shares

Because the identify implies, the ‘High Worth Shares’ technique focuses on corporations with enticing price-to-earnings (P/E) ratios which are potential bargains.

Our groundbreaking fashions make the most of AI to determine as much as 20 undervalued shares with sturdy upside potential, every with strong earnings which are primed for progress.

Supply: InvestingPro

The ‘High Worth Shares’ technique constantly evaluates particular person shares, making an allowance for important efficiency indicators akin to valuation ratios, momentum metrics, and total firm well-being, and aligning them with real-time shifts out there.

Trying again, the value-focused ProPicks technique has proven an distinctive historical past, exceeding the benchmark index by a staggering 621% over the earlier decade. That interprets to a notable annualized return of twenty-two.2% in that timeframe.

Supply: InvestingPro

It needs to be famous that these corporations are at present buying and selling decrease than their perceived intrinsic worth – which implies they’re additionally a doubtlessly large cut price.

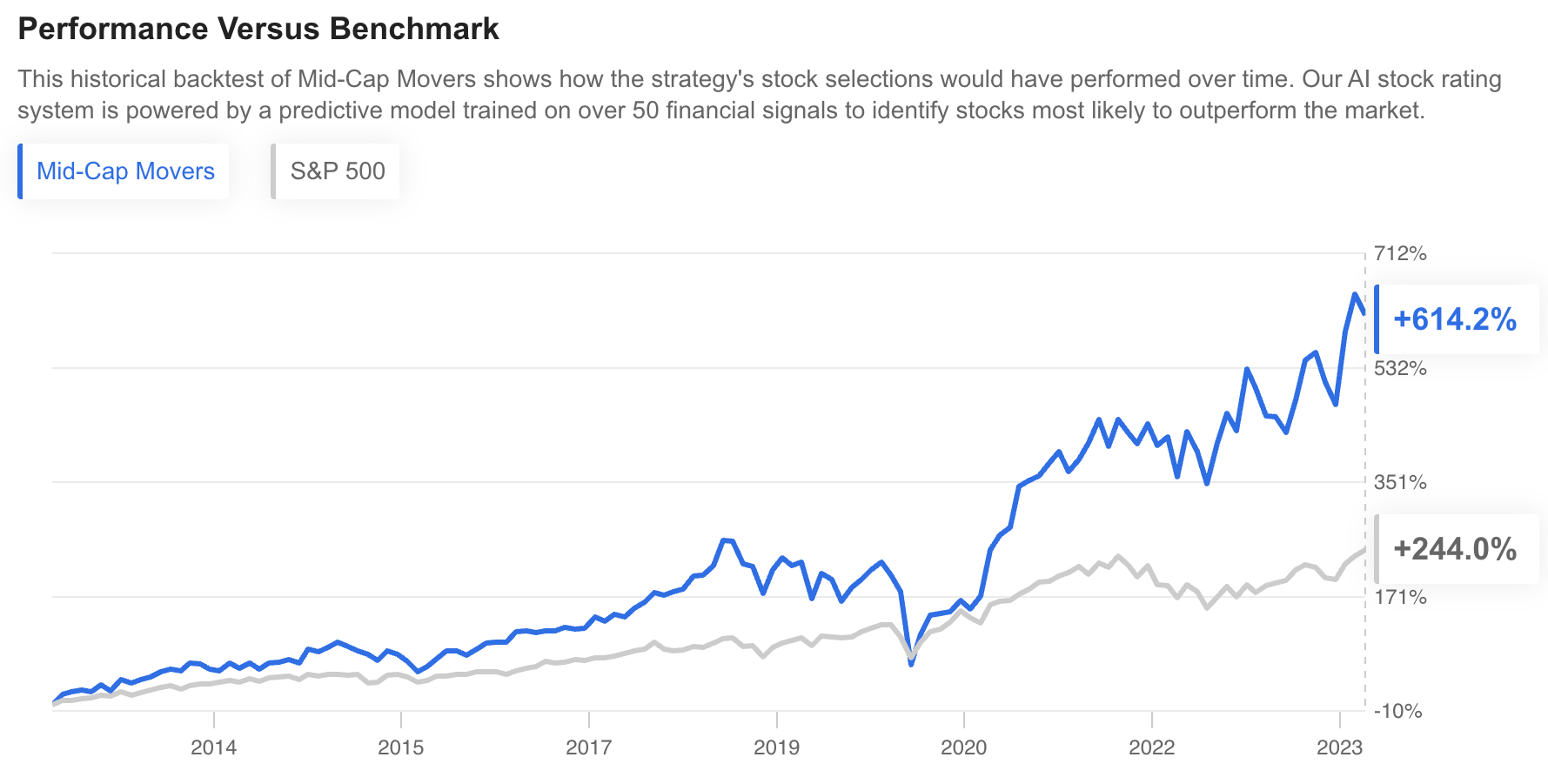

5. Mid-Cap Movers

Famend for producing superior total returns, the ‘Mid-Cap Movers’ technique focuses on standout mid-cap shares which have been totally recognized by our state-of-the-art AI know-how.

Supply: InvestingPro

Not too huge, however not too small, every of the 20 mid-sized corporations to efficiently move the technique’s choice standards are seen because the foremost entities of their respective domains and are poised for vital progress. As such, the ‘Mid-Cap Movers’ technique provides buyers a mix of stability and potential for exponential progress.

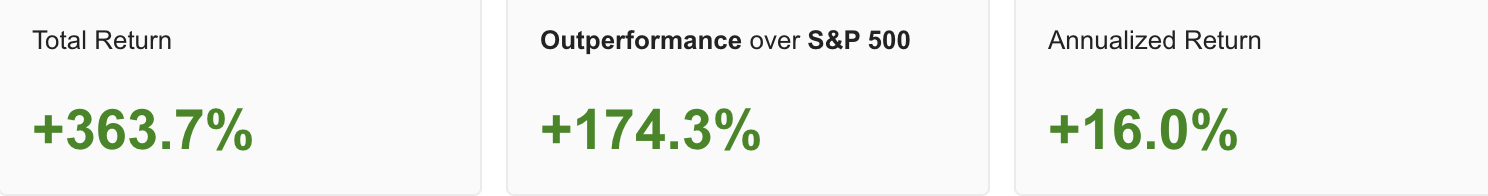

By way of historic evaluation, the ‘Mid-Cap Movers’ technique has showcased an excellent previous efficiency, beating the benchmark index by a exceptional 345% during the last decade, and reaching an annualized return of 19% inside that timeframe.

Supply: InvestingPro

Usually, combing by way of the whole inventory marketplace for mid-cap standouts like this might be a full-time job. However with ProPicks’ superior AI instruments, evaluated month-to-month towards market adjustments, it is now so simple as ever.

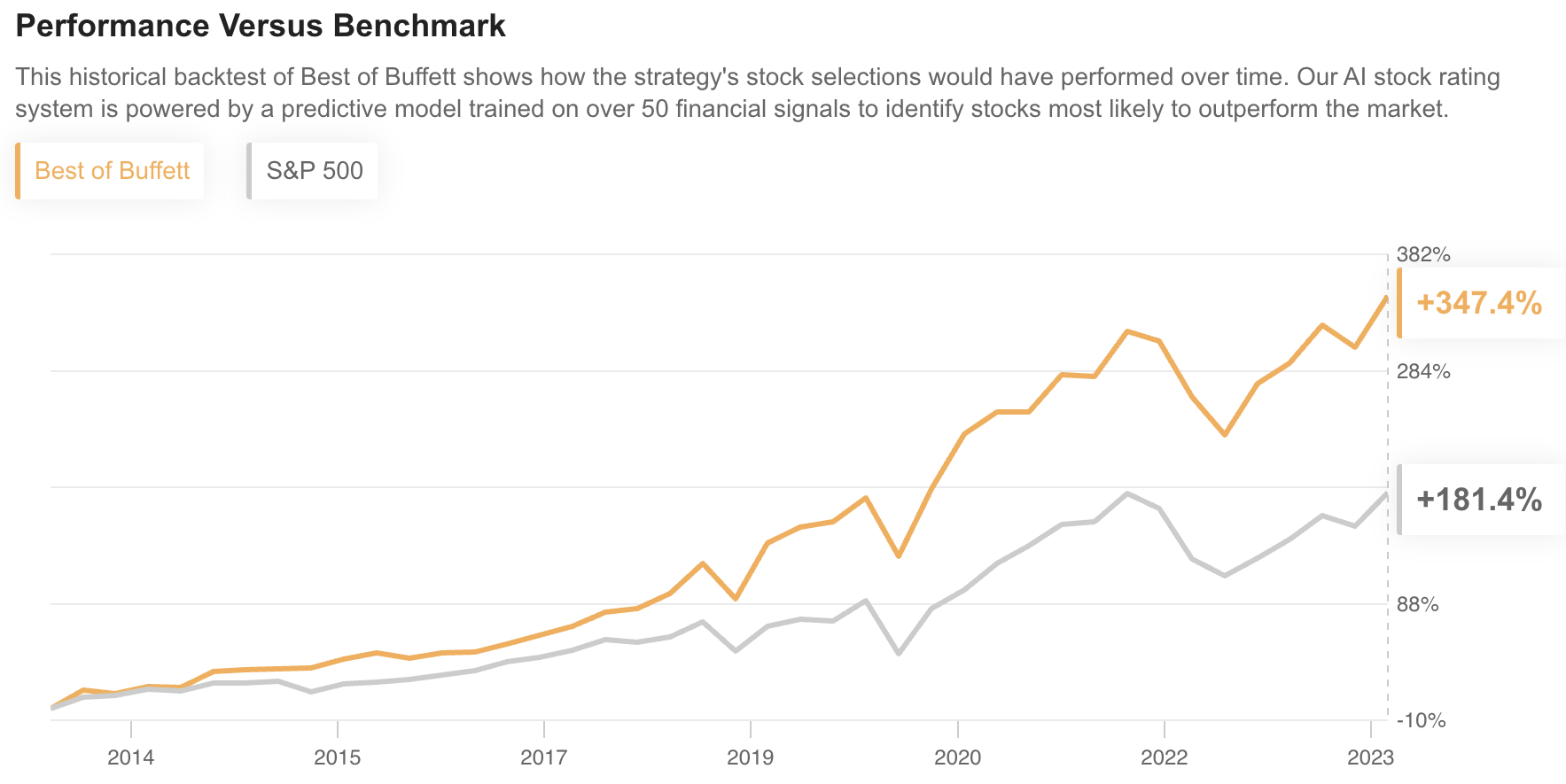

6. Better of Buffett

Not only for beating the indexes, the ‘Better of Buffett’ technique lets you monitor the strikes made by the Oracle of Omaha himself, Mr. Warren Buffett. Our state-of-the-art AI fashions have analyzed each inventory in Buffett’s famend portfolio and decided the highest 15 stars from an already stellar group.

Supply: InvestingPro

Leveraging our cutting-edge AI instruments, ProPicks isolates the cream of the crop inside Buffett’s portfolio to determine the successful shares that resonate with buyers aiming to emulate his success.

Inspecting historic information unveils the exceptional efficiency of the ‘Better of Buffett’ technique, surpassing the benchmark index by an astounding 150% over the previous decade. Followers of this technique would have loved an annualized return of 15% yearly since 2013.

Supply: InvestingPro

It’s price mentioning that these alternatives are evaluated and up to date on a quarterly foundation, aligning with Buffett’s disclosed 13F holdings, to make sure up-to-date accuracy and relevance.

InvestingPro subscribers will obtain periodic updates on the standing of their ProPicks.

Not but a Professional person?

Under is what you are lacking out by not subscribing for lower than $9 a month:

- ProPicks: inventory portfolios managed by a fusion of AI and human experience, with confirmed efficiency

- ProTips: digestible data to simplify plenty of complicated monetary information into just a few phrases

- Honest Worth and Well being Rating: 2 abstract indicators primarily based on monetary information, offering on the spot perception into the potential and danger of every inventory.

- Superior inventory screener: Seek for one of the best shares in accordance with your expectations, making an allowance for tons of of monetary metrics and indicators.

- Historic monetary information for 1000’s of shares: To allow elementary evaluation professionals to dig into all the small print themselves.

- And plenty of extra companies, to not point out these we plan so as to add shortly!

Do not face the market alone any longer, be part of the 1000’s of InvestingPro customers and make the proper choices on the inventory market to assist your portfolio take off, no matter your profile or expectations.

Subscribe Now!

*Readers of this text get pleasure from an additional 10% low cost on the yearly and by-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

***

Disclosure: The views mentioned on this article are solely the opinion of the creator and shouldn’t be taken as funding recommendation.