ansonsaw

Overview

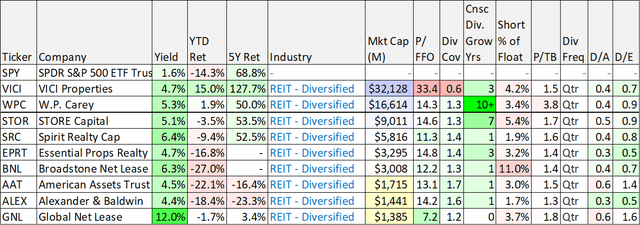

Like many of the market, the true property sector (XLRE) has been horrible this 12 months (-24.4% ytd). And issues can nonetheless worsen as inflation stays excessive and the potential of an unpleasant recession looms. On this report, we share knowledge on over 45 big-dividend Actual Property Funding Trusts (“REITs”) which are down massive, after which dive into three names from the checklist which are notably fascinating and price contemplating. We’ve a particular concentrate on Medical Properties Belief (NYSE:MPW) (together with the 4 massive danger components it at present faces, its dividend security and its present valuation), so let’s begin with that one.

Medical Properties Belief (MPW), Yield: 8.9%

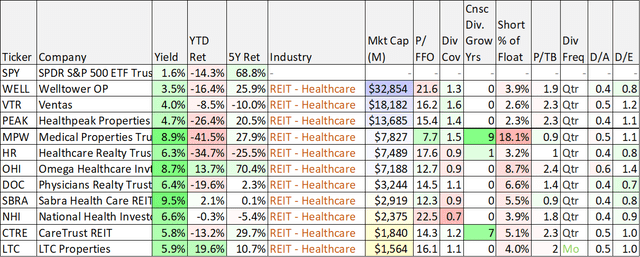

As you possibly can see within the desk under (which is sorted by REIT industries), healthcare REIT Medical Properties Belief stands out as notably ugly contemplating its terrible year-to-date efficiency, very excessive brief curiosity (i.e. individuals betting towards it) and unusually excessive dividend yield (mathematically the yield has risen as the value has fallen).

knowledge as of Fri shut 25-Nov-22 (Inventory Rover)

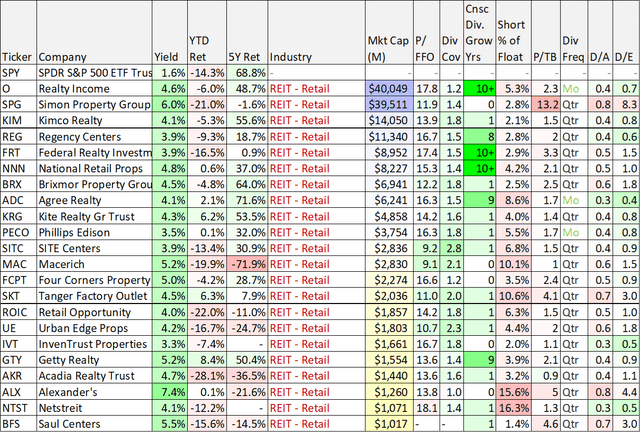

knowledge as of Fri shut 25-Nov-22 (Inventory Rover)

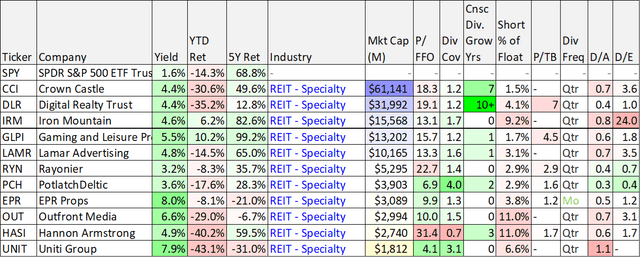

knowledge as of Fri shut 25-Nov-22 (Inventory Rover)

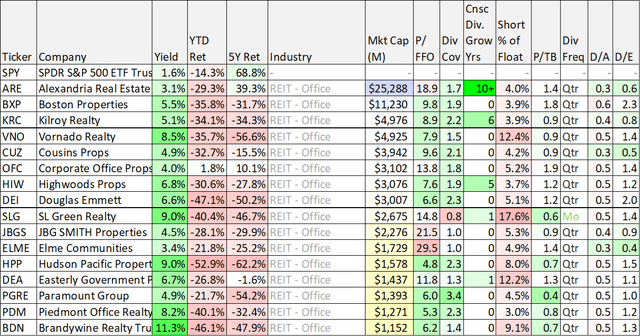

knowledge as of Fri shut 25-Nov-22 (Inventory Rover)

knowledge as of Fri shut 25-Nov-22 (Inventory Rover)

You possible acknowledge at the very least a number of of your favourite REITs within the tables above, however let’s begin with some particulars on Medical Properties Belief.

Enterprise Overview: Medical Properties Belief

Medical Properties Belief is “the worldwide supply for hospital capital.” Principally, it supplies money to hospitals (typically these which are struggling financially) by shopping for their bodily properties (hopefully at a low value, for MPW shareholders’ sake) so the hospitals obtain the money they should proceed (and hopefully enhance) their operations.

For extra particulars on the enterprise mannequin, right here is how we described it in our earlier MPW report:

“In principle, the enterprise mannequin goes one thing like this. Particular person hospitals face dire value reducing pressures and plenty of of them have gotten into monetary hassle whereby it prices them an arm and a leg to borrow capital to enhance their operations as a result of lenders don’t belief that they’ll even be capable of pay again the loans. MPW might help alleviate this drawback by giving the hospitals the money they should enhance their operations in change for possession of the bodily hospital actual property. And MPW can get the true property for a low value as a result of the hospitals don’t have quite a lot of different financing choices.

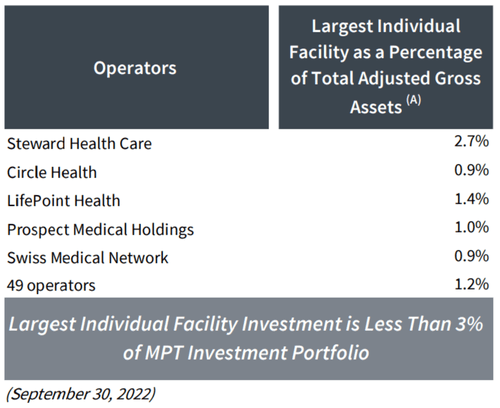

Moreover, MPW just isn’t in nice monetary form itself (it has a secure BB+ credit standing, which is under funding grade), however it’s nonetheless in a lot better monetary form than the hospitals themselves. And MPW can cut back its dangers by diversifying throughout many hospitals (it owns hospitals in 32 U.S. states, seven European nations, Australia and South America) which they’ve finished more and more nicely over time (its single largest property is lower than 3% of its complete portfolio). Moreover, as a result of MPW is organized as a REIT, it will possibly keep away from paying most company taxes by paying out most of its revenue as dividends to shareholders.

Principally, … [MPW] has the monetary wherewithal to offer a lot wanted capital to hospitals whereas concurrently decreasing dangers via portfolio diversification and its personal decrease value of capital as in comparison with the at-risk hospitals themselves.”

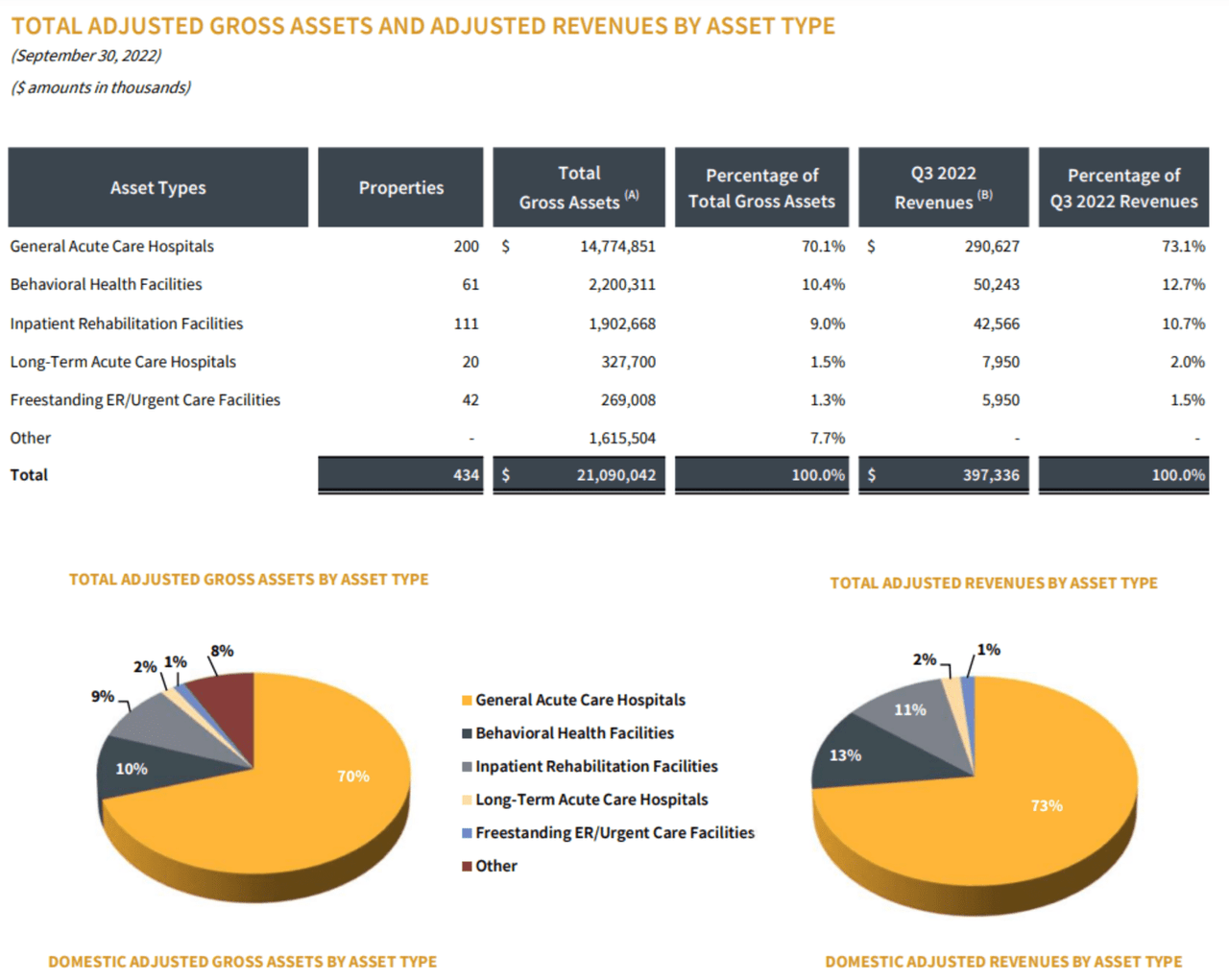

And right here is an up to date take a look at MPW’s portfolio belongings, as of the tip of Q3 (as per its newest quarterly Complement).

Medical Properties Belief Q3 Complement

As you possibly can see above, MPW stays largely centered on common acute care hospitals, which have been struggling, as we’ll describe under.

4 Large Dangers: Overblown and Abating

In our view, there are 4 massive danger components driving all of the MPW negativity. We describe them under, and clarify why we imagine they’re all now overblown and abating.

1. Troubled Operators: fundamentals are bettering

Maybe the primary cause why MPW shares have offered off so laborious this 12 months is as a result of a lot of its hospital operators had been struggling to start with after which pushed nearer to the brink by pandemic challenges (equivalent to rising prices and dangers). Nevertheless, in line with CEO Ed Aldag on the third quarter name, circumstances are beginning to enhance and can proceed to take action. Particularly, he defined:

“As our operators successfully work to convey down value and as reimbursement charges enhance, we anticipate to proceed to see coverages bettering inside our portfolio.

It’s additionally essential to acknowledge the whole portfolio is nicely diversified and the difficulty operators are comparatively small (as you possibly can see within the following desk). Nevertheless, to maintain this in perspective, as per MPW’s most up-to-date annual report.

Our revenues are dependent upon {our relationships} with and success of our tenants, notably our largest tenants, like Steward, Circle, Prospect, Swiss Medical Community, and HCA… As of December 31, 2021, our largest tenants – Steward, Circle, Prospect, Swiss Medical Community, and HCA – represented 18.5%, 11.1%, 7.3%, 5.8%, and 5.6%, respectively, of our complete professional forma gross belongings (which consists primarily of actual property leases and loans).

MPW Investor Presentation

Moreover, Financial institution of America analyst, Joshua Dennerlein, lately upgraded the shares to “Purchase,” explaining that “we anticipate the Steward ABL to be completely prolonged in December, and administration has alluded to a multi-party transaction involving Prospect.” These are good indicators for 2 of MPW’s largest operators (see desk above). Dennerlein additionally famous that “tenants ought to begin to see bettering fundamentals from payor price hikes, bettering labor markets and slowing inflation.”

Additional, MPW introduced encouraging monetary outcomes throughout its most lately quarterly name whereby the corporate introduced FFO in-line with expectations and it additionally raised the decrease finish of its steering vary. It’s additionally essential to notice that the hospitals are strategically essential to the communities wherein they exists, a sign of additional portfolio worth.

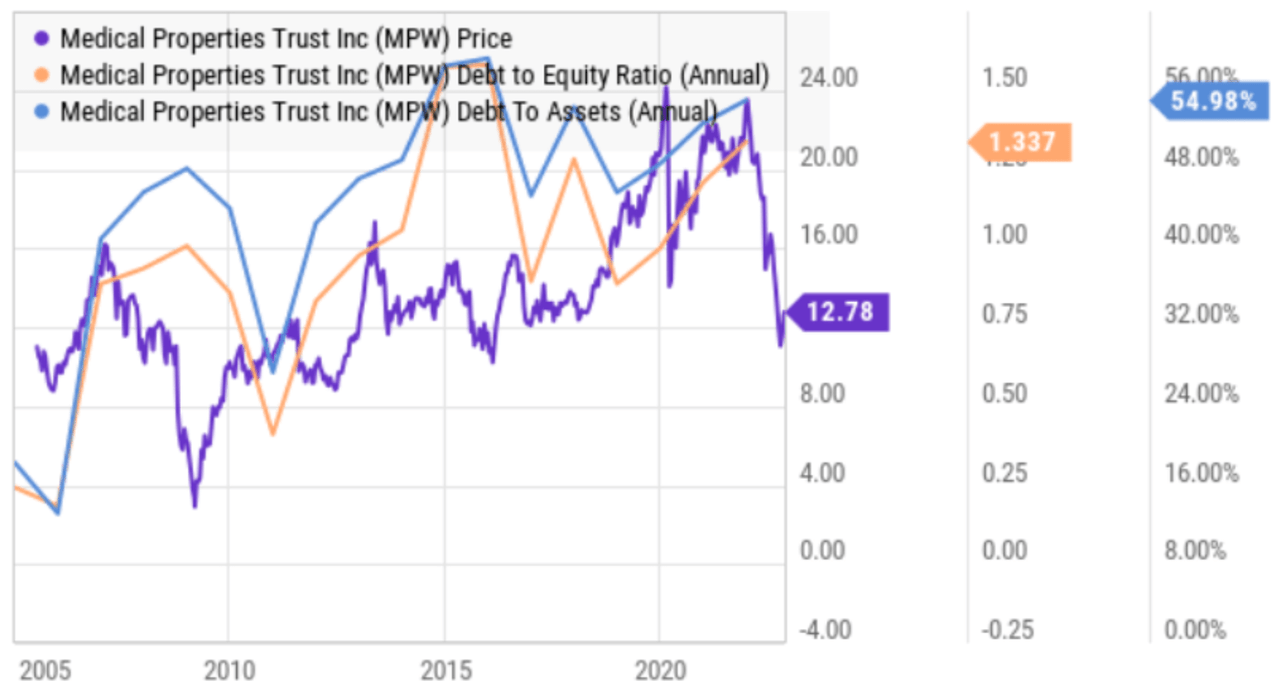

2. Vital Debt: Dangers are Decreasing

It’s additionally critically essential to notice that bettering fundamentals will assist cut back the dangers associated to the corporate’s vital debt load. Particularly, MPW at present has a debt-to-assets ratio of 55% and debt-to-equity of round 1.3x. These are vital, and the corporate has a credit standing of BB+/secure (from Customary & Poor’s), simply barely under funding grade.

YCharts

Nevertheless, the corporate’s bettering fundamentals (as famous within the earlier part) are an excellent signal for the debt. A giant a part of the explanations for this 12 months’s share value decline has been the dangerous operators and fundamentals. Nevertheless, with circumstances now bettering, the excessive debt load dangers are decreasing.

3. Rising Curiosity Charges: Huge Fed Pivot

One other issue on this 12 months’s steep MPW share value decline has been sharply rising rates of interest from the US fed. In a whole 180 from its easy-money insurance policies in the course of the pandemic, the fed is now elevating charges quickly to fight excessive inflation (a excessive inflation price they helped create within the first place), and this has been slowing the economic system and crushing corporations with greater danger debt (as charges rise, it prices extra to refinance debt when it matures). The Fed’s insurance policies have been hurting MPWs considerably.

Nevertheless, there are causes to imagine the Fed might quickly embark on one other huge pivot. Particularly, the latest CPI and PPI inflation readings have been decrease than anticipated, a sign that the fed might NOT should be so aggressive with rate of interest hikes and an excellent signal for MPW. Actually, the identical Financial institution of America score improve (to “Purchase”) that we mentioned earlier, additionally cites “a pivot to a extra dovish Fed is a optimistic for this excessive yielding REIT.”

We might provide up a litany of subjective arguments as to why the Fed’s persevering with rate of interest hike trajectory just isn’t plausible anyway (equivalent to (1) they can not elevate charges a lot additional as a result of it should crush the US economic system below the burden of the rate of interest funds by itself treasuries, and (2) they’ve already gone means too far (and too quick) with price hikes contemplating the impacts are at all times lagged by 6-18 months anyway). Additionally noteworthy, fed fund futures are already predicting the primary fed rate of interest lower earlier than the tip of 2023. Slowing price will increase (and ultimately an rate of interest lower) bodes nicely for MPW.

4. Trade-Particular Dangers: Hospitals are essential

Trade-specific dangers are one other essential issue. For instance, hospitals are closely regulated and depend on authorities funding via a wide range of sources, equivalent to Medicare and Medicaid. And because the authorities is continually pressured to cut back the expansion price in these prices, regulatory modifications pose a major danger for MPW. Moreover, if any hospital operator ceases operations for monetary causes, it might be tough for MPW to discover a substitute. For instance, MPW has been profitable in attracting private-equity capital prior to now, however there is no such thing as a assure they are going to have related success sooner or later.

Nevertheless, an essential issue is solely that the hospitals MPW owns are strategically essential to the communities wherein they exists. Particularly, there may be incentive from the communities, governments and MPW to allow the hospitals to stay a going concern. For instance, here’s what CFO Steve Hamner needed to say on the Q2 earnings name:

…absolutely the certainty that governments and individuals are going to help their infrastructure like hospitals. And so all of that has led to a really excessive degree of curiosity within the non-public space, and that is with sovereigns and pension funds and asset managers and folks such as you simply talked about KKR.

That is additional proof of the worth of MPWs belongings.

Dividend Security

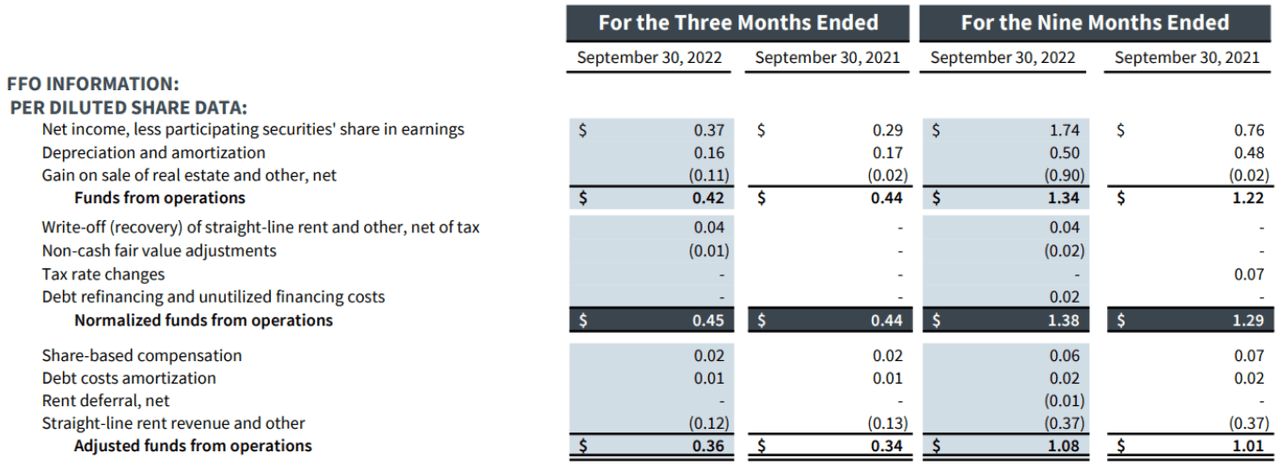

An essential consideration for MPW buyers is solely that the annual dividend has elevated for 9 years straight and it continues to be nicely lined by funds from operations. For instance, you possibly can see within the following chart that firm’s adjusted funds from operations (“AFFO”) of $0.36 and $1.08, respectively, exceeds the dividend quantity for these intervals of $0.29 and $0.87, respectively.

MPW Investor Presentation

Additionally encouraging, the corporate’s fundamentals are bettering, as described earlier.

Valuation:

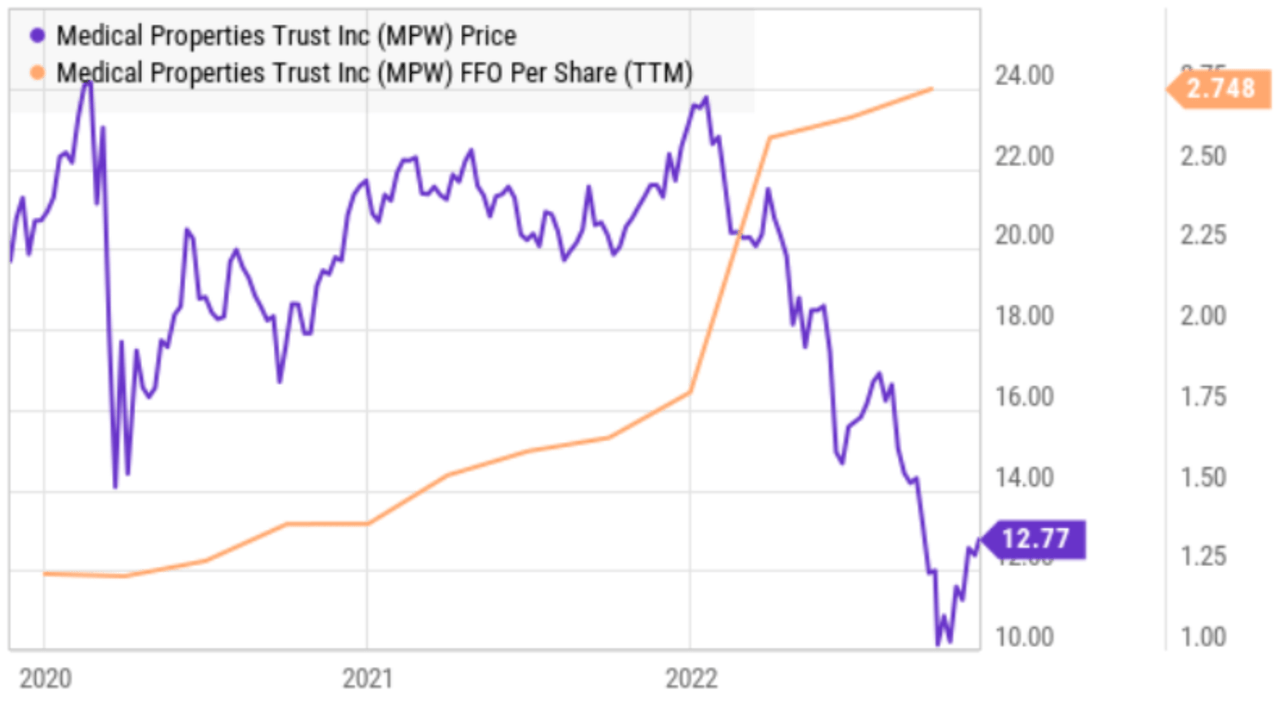

MPW’s valuation has fallen as a result of there are vital dangers, as described above. Nevertheless, it has arguably fallen considerably too far. For starters, here’s a take a look at MPW’s share value versus its Funds from Operations (“FFO”).

YCharts

As you possibly can see above, FFO has held up nicely over the previous 12 months, whereas the share value has fallen in anticipation of potential dangers as described above. Nevertheless, it now trades at a ahead P/AFFO ratio (~9.0x) that may be very low as in comparison with friends, and the fallout from potential dangers will not be almost as excessive as feared.

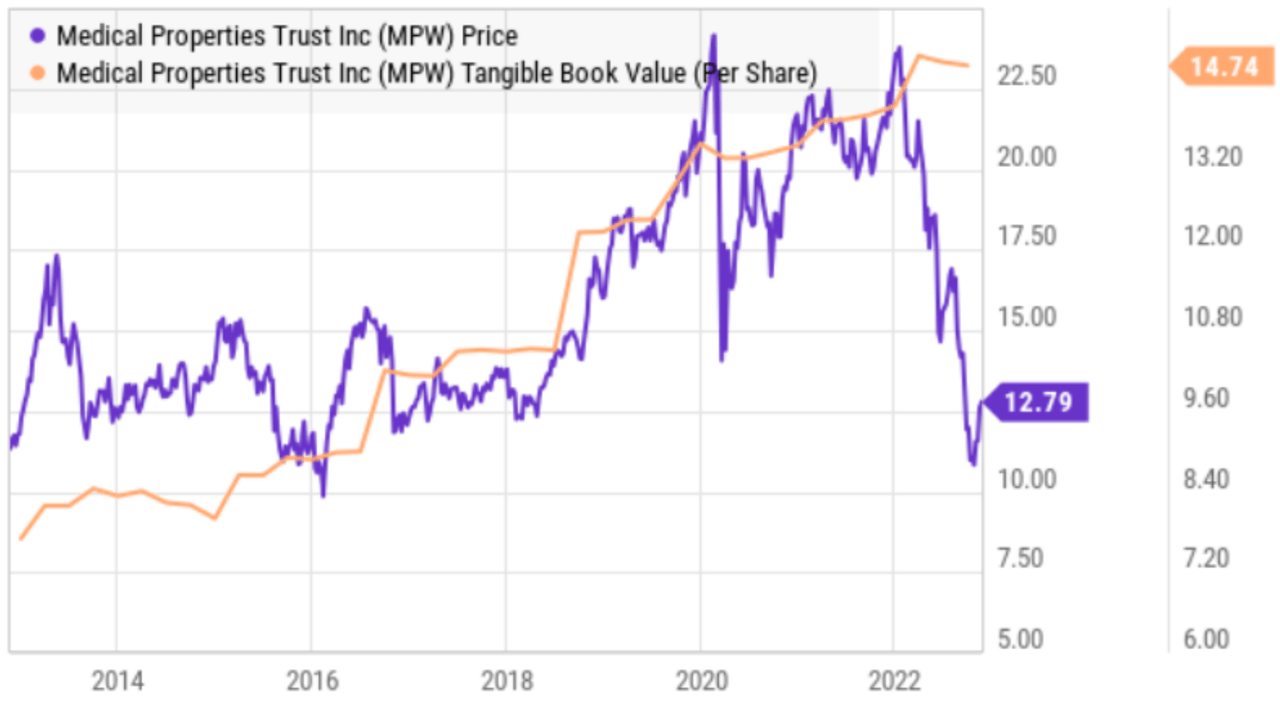

Subsequent, here’s a take a look at MPW’s share value versus its e-book worth per share.

YCharts

And once more, the e-book worth has held up very nicely versus the share value—a sign the shares are undervalued. Granted, if any operators stop to be a going concern (which is unlikely contemplating their strategic significance to the communities wherein they exists) that can create challenges, however these challenges seem much less extreme than the market fears, in our view.

Additionally value noting, Medical Properties Belief lately introduced its board approved the repurchase of as much as $500M of inventory earlier than October 2023, maybe a powerful indication of worth.

Medical Properties Belief Backside Line:

MPW just isn’t applicable for essentially the most danger averse buyers. Nevertheless, MPW could also be value contemplating when you can tolerate the volatility and when you maintain it inside the constructs of a prudently-diversified long-term portfolio. In our opinion, the shares are notably compelling when you take into account the bettering fundamentals mixed with the potential for a large short-squeeze (i.e. short-sellers could also be pressured to cowl as circumstances enhance—which might drive shares greater) and fairly probably an epic fed pivot (as inflation slows, so too might the rate of interest hikes which were hampering MPW). We at present have a small place in MPW shares inside our Earnings Fairness Portfolio and stay up for receiving massive dividends mixed with the potential for vital share value appreciation.

Simon Property Group (SPG), Yield: 6.0%

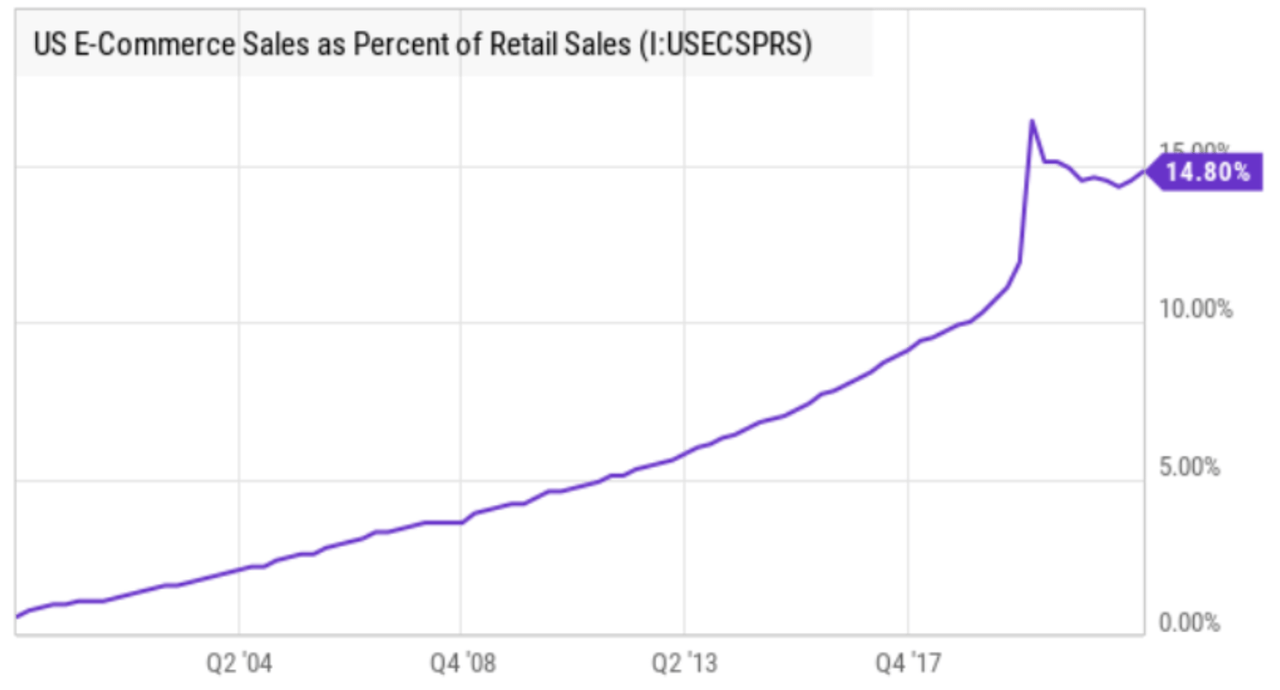

Switching gears, and as you possibly can see in our earlier desk on retail REITs, most of them (equivalent to Simon Property Group) have additionally been ugly this 12 months, and over the previous few years as nicely. The very high-level oversimplified clarification for the weak efficiency for retail REITs typically is that on-line purchasing is destroying demand for retail properties, as you would possibly infer from the chart under.

YCharts

And whereas there may be some reality to the “death-of-brick-and-mortar-real-estate” narrative, not all retail actual property is definitely dying. Actually, A-class retail properties will proceed to develop over time because the outdated adage “location, location, location” issues simply as a lot now because it ever has. As we’ll clarify under, our expectation is that poorly-located retail actual property is getting into a “dying spiral,” however choose prime location properties will proceed to develop over time (and hold paying massive rising dividends).

Simon Property Group is the biggest retail mall REIT (purchasing malls and premium retailers) within the US. It’s centered primarily on A-class properties (greater than 80% of working revenue), whereas B-class constitutes ~15% of NOI and C-class (and under) lower than 1.0%. Doubtless, the continuing development of on-line purchasing is disrupting the retail trade, however it’s our view that A-class properties won’t solely survive, but additionally thrive, whereas C-class and decrease will grow to be largely extinct over the following decade.

Simon Property Group

We lately wrote up Simon intimately for our members, however the fundamental thesis is that regardless of the market’s hatred for retail REITs, Simon has a really robust “funding grade” steadiness sheet, a particularly well-covered dividend (that can possible continue to grow because the payout ratio continues to be overly conservative following the pandemic, see desk above), a compelling low valuation a number of (ahead P/AFFO is under 11x), and its properties are situated in extremely wanted places (primarily based on foot site visitors and the necessity for prime retail places for corporations to market to their omni-channel prospects). In case you are on the lookout for a sexy long-term contrarian alternative, Simon Property Group is value contemplating.

Digital Realty Belief (DLR), Yield: 4.4%

Subsequent, and as you possibly can see in our earlier desk on specialty REITs, the specialty REIT trade is numerous. Nevertheless, one fascinating subset of the group is knowledge facilities. Knowledge facilities mainly home servers to help knowledge that’s “within the cloud.” And contemplating the huge secular development by enterprises across the globe to digitize all the pieces after which migrate it to the cloud for higher entry, knowledge heart REITs (equivalent to Digital Realty (DLR), Equinix (EQIX) and now even Iron Mountain (IRM) to some extent) stand to learn.

Like the whole actual property sector, most knowledge heart REITs have offered off laborious this 12 months. And one frequent unfavourable viewpoint is that they’re turning into more and more out of date sooner than they’ll construct out (or purchase) properties to satisfy demand. For instance, in line with Morningstar analyst, Matthew Dolgin, who has a “purchase score” on knowledge heart REIT, Digital Realty:

“Virtualization and different technological advances might permit Digital’s tenants to do extra with much less house and fewer connections, decreasing their knowledge heart wants.”

Digital Realty shares specifically have offered off means too laborious this 12 months because it’s gotten caught up within the tech unload (i.e. tech shares are down greater than the market averages this 12 months). Nevertheless, DLR has low debt, a really cheap valuation and a dividend (that has been rising yearly for 10+ years) that’s nicely lined by FFO. In our view, the selloff is overdone, and DLR at present represents a sexy worth. Merely put, if you’re on the lookout for a gentle big-dividend with some cheap share value appreciation potential, Digital Realty is a blue chip REIT value contemplating.

Takeaways:

In our view, Medical Properties Belief, Simon Property Group and Digital Realty have fallen too far out-of-favor with the market, thereby making them engaging long-term contrarian alternatives (primarily based on their ongoing worth creation and dividend distributions). And when you recognize these concepts and the information tables on this report, we share a number of extra in our latest article: High 10 REITs (Large Dividends, Discounted Costs). Simply know that long-term income-focused worth investing could be risky, and it’s not proper for everybody (for instance, you might want the upper security high-income alternatives we wrote about on this new report: High 10 Large-Yield Bonds). On the finish of the day, it is critically essential to know your personal private targets as an investor, after which to stay to a disciplined technique that works for you.