demaerre

The state of affairs at hospital actual property funding belief Medical Properties Belief, Inc. (NYSE:MPW) deteriorated this week after the corporate made an necessary replace about its lease state of affairs because it pertains to one among its largest tenants, Steward Well being Care System. The replace brought about Medical Properties Belief’s inventory worth to crash 30% final Friday.

As a consequence to hire assortment points with this explicit tenant, I imagine Medical Properties Belief’s dividend is prone to getting slashed once more within the short-term and the belief might announce a second adjustment to its dividend when it reviews earnings, possible later in February.

Although MPW now actually sells at an impaired valuation a number of, the dangers have drastically elevated after the Steward Well being Care System replace, necessitating a change in my inventory classification to Maintain.

My Score Historical past

But once more, Medical Properties Belief made an unlucky information announcement, this time about one among its failing high tenants, Steward Well being Care System which pressured the hospital actual property funding belief to supply bridge financing to the operator and warn a couple of potential rental shortfall.

I used to be beforehand centered on Medical Properties Belief’s liquidity and debt state of affairs and thought that the state of affairs was slowly bettering on the belief.

Newly disclosed fee points with Steward Well being Care System change the narrative right here fairly drastically and I’m involved that Medical Properties Belief would possibly regulate its dividend pay-out a second time within the close to time period. Up to now, I’ve been constantly constructive on the belief and the likelihood of a turnaround.

Steward Well being Care System Replace

Medical Properties Belief brought about a ruckus with an replace final week when it disclosed new fee issues associated to the belief’s operator Stewart Well being Care System.

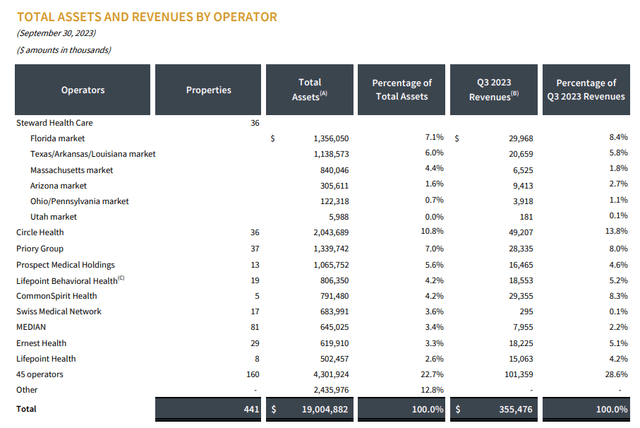

The replace brought about traders to hurry for the exits which in flip triggered a 30% inventory worth fall. Stewart Well being Care System is Medical Properties Belief’s high tenant and accounted for roughly 20% of property and gross sales.

Medical Properties Belief has suffered from operator points for some time, however the newest replace is especially regarding because it implies that the belief is a doubtlessly substantial money shortfall if the state of affairs doesn’t get resolved.

Complete Property And Revenues By Operator (Medical Properties Belief)

As was already identified as a consequence of earlier reporting, Steward Well being Care System paid solely partial hire for September and October to Medical Properties Belief. As of December 31, 2023, Steward has stacked up an unpaid hire invoice amounting to $50 million which clearly poses substantial gross sales and dividend dangers for the belief.

As a treatment to its largest tenant’s fee points, Medical Properties Belief is offering extra liquidity to its high operator and is funding a $60 million bridge mortgage. The operator might search to promote a few of its non-core property and is arguably a possible re-letting of hospital operations as a way to rectify the state of affairs.

Medical Properties Belief did present some assurance in its replace, nevertheless, and stated that the belief expects to obtain partial hire funds in February within the quantity of $9 million and one other $44 million on high within the second quarter.

It’s protected to say, nevertheless, that the tenant state of affairs has deteriorated with Medical Properties Belief’s replace from Thursday and the corporate may even see, as a consequence, a considerable deterioration in its dividend pay-out ratio in 2024.

How Might This State of affairs Play Out?

In one of the best case, the lifeline Medical Properties Belief supplied its high operator might assist restore Steward Well being Care Techniques’ liquidity. Ideally, Steward Well being Care Techniques makes up for its unpaid hire because the yr progresses, and Medical Workplace Properties would possibly keep away from a second dividend reduce.

On the flip facet, Medical Workplace Properties might face an entire rental shortfall because it pertains to Steward Well being Care Techniques which might impair its pay-out metrics drastically and would possibly necessitate a second dividend reduce.

AFFO A number of

Medical Properties Belief’s inventory now sells, with no shadow of a doubt, at a really a lot impaired valuation a number of. Based mostly on the belief’s third quarter outcomes, the hospital REIT is about for a twelve months run-rate AFFO of $1.20 per share. This means, primarily based on a inventory worth of $3.55, a number one AFFO a number of of three.0x.

Given the shortage of a transparent baseline stage of AFFO in the meanwhile, I feel Medical Properties Belief is finest reclassified as a Maintain.

Dividend Reset Danger Is Now The Greatest Danger

A hire shortfall might put Medical Properties Belief’s dividend in danger. In my final protection on the hospital actual property funding belief I pointed to the belief’s improved dividend protection ratio which fell to 50% on an AFFO-basis following Medical Properties Belief‘s dividend reduce within the fourth quarter.

Medical Properties Belief slashed its dividend pay-out, as a consequence of tenant points and hire assortment considerations to $0.15 per share, down from $0.29 per share, reflecting a lower of 48%.

As a consequence, the belief’s pay-out ratio, primarily based on adjusted funds from operations, fell from 97% in 1Q-23 to 50% in 3Q-23. Medical Properties Belief additionally said that each one Steward-related funds in 3Q-23 amounted to $0.11 per share in adjusted funds from operations.

Stripping these funds out of the belief’s AFFO would depart us with a modified AFFO-based pay-out ratio of 79%. The newly disclosed fee points with Steward Well being Care System, nevertheless, put this reset dividend in danger nonetheless.

My Conclusion

To me, the largest threat proper now’s a second consecutive dividend reset that might additional trigger the belief’s market worth and inventory worth to crash.

Clearly, Medical Properties Belief’s inventory is promoting at a distressed adjusted funds from operations a number of and Friday’s 30% crash clearly demonstrated traders’ considerations in regards to the growth with one among its high tenants.

Although the dividend should be coated by adjusted funds from operations shifting ahead, the change within the tenant state of affairs is prone to weigh closely on the corporate’s short-term liquidity, notably as a result of the belief has determined to bail out its tenant and supply essential bridge financing to Steward as properly.

As a consequence, it simply can’t be dominated out that the hospital actual property funding belief will announce a brand new dividend reset when it reviews earnings on the finish of February.

To account for the brand new growth at Medical Properties Belief, I’m modifying my inventory classification to Maintain till the belief gives extra particulars about its money, liquidity and adjusted FFO state of affairs subsequent month.