Justin Sullivan/Getty Pictures Information

Funding thesis

From 2005 to 2022, M.D.C. Holdings Inc, (NYSE:MDC) income grew at a CAGR of 0.8 %. There was hardly any income progress. Throughout this era there was a robust correlation between its income and Housing Begins.

Housing Begins are cyclical. However over the previous 70 years, there was no progress within the long-term annual common Housing Begins. As such, you must view MDC as a no-growth cyclical firm.

A valuation of MDC on an Earnings Energy Worth (EPV) foundation confirmed that there’s a 16 % to 41 % margin of security relying on the way you compute the gross revenue margins. There’s a greater margin of security if you happen to assumed that there could be a 1/3 improve within the long-term annual common Housing Begins. MDC is thus a possible funding alternative.

Thrust of my evaluation

In my article “Dwelling Builders’ Base Charges: A Reference For Higher Basic Evaluation”, I recognized 9 listed house builders. These are corporations with available monetary information from 2005 to 2022 – the most recent peak-to-peak Housing Begins cycle. MDC is among the corporations on that listing.

I had beforehand decided the intrinsic values of 4 homebuilders based mostly on their efficiency over the 2005 to 2022 cycle. Confer with the respective articles on Lennar, Toll Brothers, PulteGroup and NVR if you need the small print.

I’ll analyze and worth MDC utilizing the identical strategy as these for the others. You may then examine them on an “apple-to-apple” foundation. That is the fifth article in my collection to find out the cyclical values of the highest 9 homebuilders.

My strategy for all the businesses may be summarized as follows:

- Confirm that the corporate’s efficiency is correlated to the Housing Begins. Housing Begins is cyclical thus making the corporate a cyclical one if there’s a robust correlation.

- Decide the normalized or through-the-cycle efficiency of the corporate based mostly on the Housing Begins.

- I thought of 2 views of the long-term annual common Housing Begins – 1.5 million models and a couple of.0 million models. For each circumstances, I assumed that there isn’t any progress within the long-term annual common Housing Begins.

You may learn the rationale/foundation for the above strategy from the earlier articles. The crux is figuring out the normalized earnings. On this context, I used the next equation for the homebuilding operations.

The Gross Income for the homebuilding operations have been computed based mostly on Gross Income = Deliveries X Promoting Value X Cyclical Gross Revenue Margins. The Cyclical Gross Revenue Margins have been assumed to be the typical 2005 to 2022 Gross Revenue Margins (normalized margins).

The above formulation was alongside the traces of Damodaran’s suggestion to replicate the present dimension of the enterprise. In line with him, we should always take the present income and decide the cyclical earnings by multiplying it with the normalized margins.

MDC has 2 main operations – homebuilding and monetary providers. The homebuilding is the bigger earnings contributor, and I modelled the income based mostly on Deliveries X Promoting Value.

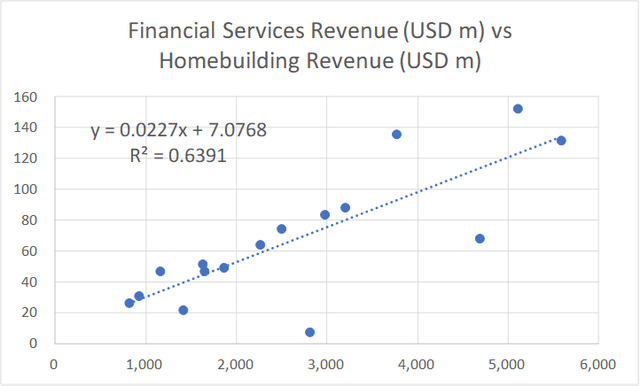

The monetary providers operations solely contributed lower than 3% of the whole income in 2022. I modelled the income for this operation based mostly on a linear regression equation linking its income with that of the homebuilding operations. This was derived utilizing the EXCEL plotting perform as illustrated in Chart 1.

Chart 1: Hyperlink between Finance Companies Income and Homebuilding Income (Creator)

Cyclical sector

MDC operates in a cyclical sector as acknowledged by the corporate.

In my earlier articles of this collection, I drew the next conclusions based mostly on my evaluation of the Housing Begins and Home Value Index. Confer with them for the small print.

- Over the previous 70 years, there isn’t any progress within the long-term annual common Housing Begins. I took this long-term common as 1.5 million models per yr.

- Previously 2 years, Housing Begins appeared to be on the long-term annual common stage.

- Over the previous 70 years, there have been 4 events when the annual Housing Begins had exceeded 2 million models.

- Whereas there isn’t any progress within the annual common Housing Begins, there was long-term worth progress. The income progress for the homebuilding sector resulted from each quantity progress and worth progress.

I used these conclusions to find out the assorted parameters and assumptions for my valuation of MDC.

Whereas no person disputed the cyclical nature of the sector, we have now completely different views on the long-term annual Housing Begins:

- I’ve assumed that there isn’t any change to the long-term annual common Housing Begins. My fundamental argument is that 70 years of information can’t be fallacious.

- There are numerous Looking for Alpha readers who consider that there’s some basic change to this long-term annual common Housing Begins.

I should not have a crystal ball on how the longer term will unfold. As such I’ll worth MDC beneath each views and allow you to determine what to do. I’ve already lined the professionals and cons of those 2 views within the earlier articles. Confer with them.

As well as there isn’t any clear indication of the present path of the Housing Begins. Is the present drop in Housing Begins is a short lived pullback from an uptrend? Or is it the beginning of its downtrend leg?

MDC has this to say concerning the future:

“Whereas we stay assured within the long-term progress prospects for the trade given the underproduction of recent houses over greater than the previous decade, the present demand for brand new houses is topic to continued uncertainty on account of… inflation issues, the Federal Reserve’s continued quantitative tightening…mortgage rates of interest, shopper confidence, the present geopolitical setting…” MDC 2022 Kind 10k.

We are able to count on a declining efficiency for 2023 in comparison with 2022. However to be truthful, MDC didn’t opine concerning the path of the long-term common annual Housing Begins.

Efficiency

I have a look at 3 metrics to get an summary of the efficiency over the cycle – income, revenue after tax (PAT), and gross profitability (gross income/complete belongings).

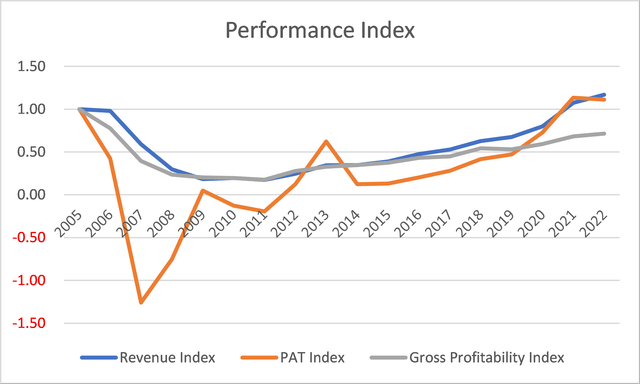

Chart 2: MDC Efficiency Index (Creator)

Chart 2 exhibits the efficiency of MDC over the 2005 to 2022 cycle. Throughout this era there have been:

- 0.86 correlation between MDC income and the Housing Begins.

- 0.85 correlation between the US Housing Begins and MDC’s Deliveries.

The conclusion is that MDC is a cyclical firm whose efficiency is tied to the US Housing Begins.

Notice the next performances:

- There was hardly any income progress from 2005 to 2022. Income grew at 0.8 % CAGR over the previous 18 years.

- MDC suffered losses in 2007 to 2008, and 2010 to 2011. There was even a loss earlier than tax in 2009. However it managed to be worthwhile after tax due to a big tax credit score.

- Gross profitability in 2022 was decrease than that in 2005. In truth, the gross profitability in all of the years since 2006 was decrease than that in 2005.

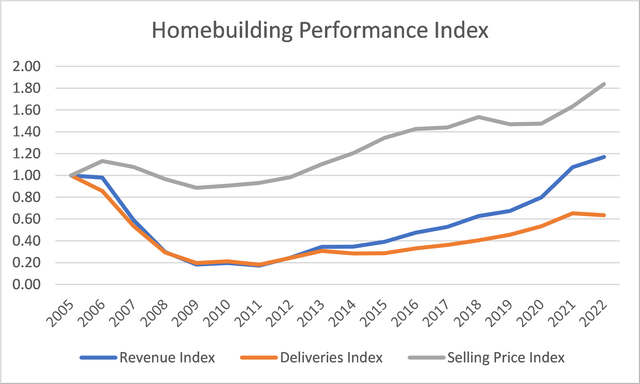

A breakdown of the income into Deliveries and Promoting costs is proven in Chart 3.

Chart 3: Homebuilding Efficiency Index (Creator)

I estimated that in this era bodily quantity (as measured by Deliveries) shrank at 2.4 % compounded per yr whereas unit promoting worth grew at 3.3 % CAGR.

The general income progress of 0.8 % CAGR was pushed by worth progress. Moreover, it was all natural progress as there was no acquisition.

What does all this imply? MDC is a no-growth firm in a no-growth (quantity phrases) cyclical sector. It’s extra applicable to worth it based mostly on its EPV.

Monetary place

As of the tip of Dec 2022, MDC had USD 1.1 billion in money. That is about 21 % of its complete belongings. It is a excessive ratio because the ratios for the Lennar, TOL Brothers and PulteGroup solely ranged from 7 % to 12 %. Nonetheless, NVR had 44 % of money to complete belongings.

Chances are you’ll assume that this meant that MDC is robust financially. However I’ve a number of issues:

- It has a Debt Fairness ratio of 0.55 on the finish of 2022. My base charge for the sector was a imply Debt Fairness ratio of 0.41 for 2022.

- Over the previous 18 years, it generated a mean of USD 72 million per yr in Money Circulation from Operations in comparison with the typical PAT of USD 126 million per yr. The imply Money Circulation from Operations over the identical interval for my base charge was USD 328 million.

- It managed to generate constructive Money Circulation from Operations yearly just for half of years from 2005 to 2022. Among the many 9 panel corporations (together with MDC), there was solely 2 corporations that did worse than MDC.

I would love cyclical corporations to be financially sound going into the downtrend leg of a cycle as I have no idea how extreme the downtrend shall be. I do have some issues right here.

Valuation

I valued MDC based mostly on the EPV utilizing the single-stage Free Money Circulation to the Agency (FCFF) mannequin.

I targeted on 3 Situations:

- Situation 1. I assumed that 2021/22 represented the long-term annual common Housing Begins of 1.5 million models.

- Situation 2. This assumed that the long-term annual common Housing Begins was elevated to 2.0 million models.

- Situation 3 – This assumed a non-cyclical situation. I assumed that the 2021 and 2022 performances represented the long-term efficiency. As such I used the precise common 2021 and 2022 Gross Revenue Margins.

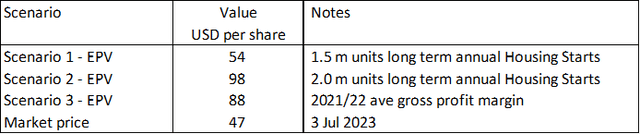

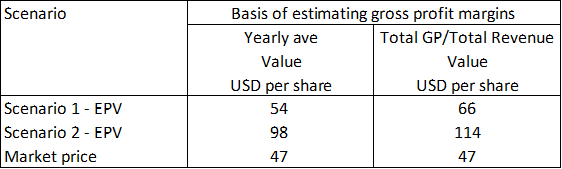

Desk 1 summarized the outcomes. You may see that there’s 16 % margin of security beneath Situation 1. However that is beneath my goal of 30% margin of security.

However the margins of security beneath Situations 2 and three are higher than my 30 % goal.

Whereas there’s a margin of security beneath Situation 3, I don’t assume that that is real looking because the proof factors to MDC being a cyclical firm.

Notice that the worth beneath Situation 2 is over-estimated because it assumed that we at the moment are on the 2.0 million models of Housing Begins. It will take a couple of extra years to achieve this stage and the valuation could be lowered accordingly. However I didn’t estimate the affect of this as the present margin of security could be very giant.

Desk 1: Abstract of MDC Valuation (Creator)

Sensitivity evaluation

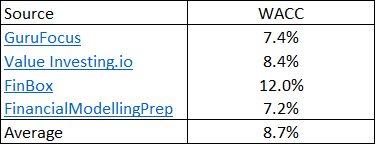

For the valuation proven in Desk 1, I took the typical Gross Revenue Margins for every year from 2005 to 2022.

However in my earlier Lennar article, I had computed the normalized Gross Revenue Margins = (sum of 2005 to 2022 Gross Income) divided by the (sum of the 2005 to 2022 income).

This was completely different from what I did for MDC above.

If I had adopted the Lennar strategy, the worth of MDC could be about 16% to 21 % greater as proven in Desk 2.

- Below Situation 1, there’s now a 41 % margin of security.

- Below Situation 2 we already had a big margin of security based mostly on the sooner assumptions. Altering how the typical gross revenue margins are computed doesn’t change the conclusion right here.

Desk 2: Worth with a special foundation for estimating the gross revenue margins (Creator)

Valuation mannequin

I valued MDC on the identical foundation as I did for the opposite homebuilders utilizing the single-stage Free Money Circulation to the Agency (FCFF) mannequin.

Worth of the working belongings of the agency = FCFF X (1 + g) / (WACC – g)

The place:

FCFF = EBIT X (1 – t) X (1 – Reinvestment charge)

g = progress charge = zero beneath the EPV.

t = tax charge based mostly on the previous 3 years common charge.

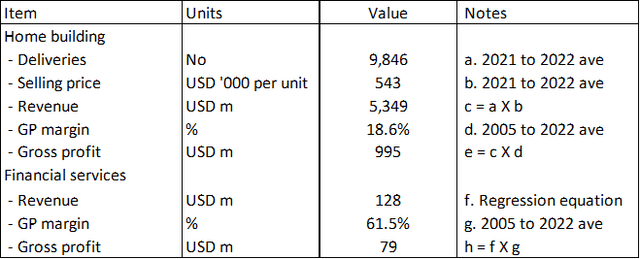

WACC = weighted common price of capital derived from the primary web page of a Google seek for the time period “MDC WACC” as summarized in Desk 3.

Desk 3: Estimating the WACC (Varied)

Reinvestment charge = zero beneath the EPV mannequin.

EBIT = Gross income – Promoting, Admin, and Promoting or SGA bills – Different bills and asset write-downs.

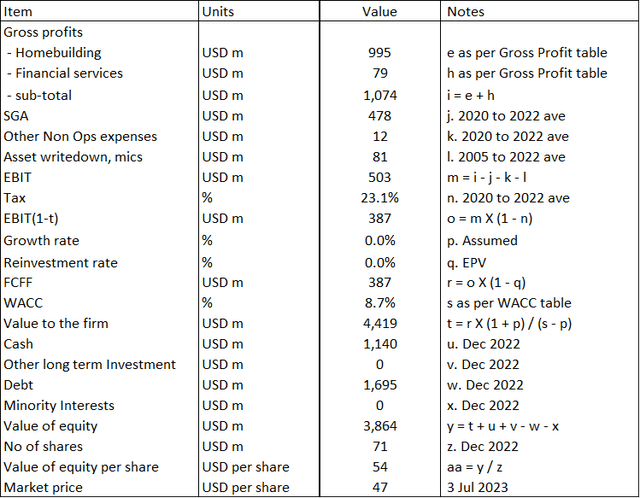

Gross Income

The Gross Income for MDC have been derived as proven in Desk 4. The important thing assumption right here is that the sector was working on the long-term annual common Housing Begins in 2021/22. As such the typical 2021/22 Deliveries and Promoting Value represented the cyclical efficiency.

Desk 4: Deriving the Gross Income (Creator)

The Gross Income for the homebuilding operations = Deliveries X Promoting Value X Gross Revenue Margins.

The Gross Income for the monetary providers operations = Income X Gross Revenue Margins.

The cyclical Gross Revenue Margins for each operations have been assumed to be the 2005 to 2022 common values.

The income for the monetary providers we derived based mostly on the linear regression equation utilizing EXCEL as proven earlier in Chart 1 the place:

- Income for the homebuilding operations was the impartial variable.

- Income for the monetary providers operations was the dependent variable.

Pattern calculation

Desk 5 exhibits a pattern calculation for the intrinsic worth.

Desk 5: Calculating the intrinsic worth (Creator)

Notes to Desk 5: Over the previous 18 years, MDC incurred some asset write-downs and different one-off prices. I included the typical in my valuation.

Dangers and limitations

I’d summarize the dangers and limitations of my valuation into 3:

- Low WACC.

- Regression equation.

- 2021/22 averages

A part of the rationale for the 8.7 % WACC was due to the present excessive risk-free charge and fairness threat premium. That is because of the uncertainty related to the excessive inflation charges, potential recession, and the Ukraine invasion. If you’re going to have a look at the worth over the cycle, I’d argue that you just must also think about the values over the cycle. This meant that my valuation is conservative.

In my evaluation and valuation, I derived the monetary providers income utilizing the linear regression equation. There’s a 0.64 R-squared worth for this equation. In different phrases, the equation solely defined about 2/3 of the adjustments within the income. I’d have most well-liked a better R-squared. In mitigation, the monetary providers are very small as they contributed lower than 3 % of the whole income in 2022.

2021/22 averages

The typical annual Housing Begins in 2021/22 is about 1.5 million models, which is about the identical because the long-term common annual Housing Begins.

As such I’ve assumed that the typical 2021/22 values for the important thing parameters – Deliveries and Promoting Value – have been good representations of the cyclical values.

I’ve used this to find out the Deliveries and Promoting Costs for Situation 1.

However if you happen to settle for this argument, shouldn’t the 2021/22 common Gross Income additionally represented the cyclical Gross Income?

Utilizing this 2021/22 common as the worth for merchandise “i” in my valuation mannequin as per Desk 5, I obtained an intrinsic worth of USD 89 per share. This is the same as a 90% margin of security.

We now have 2 completely different values based mostly on completely different approaches for estimating the intrinsic worth over the cycle – Situation 1 and this gross revenue methodology.

Which is extra consultant? I’m not positive easy methods to reply this but and wish to get suggestions from the readers.

Conclusion

MDC is no-growth firm in a no-growth cyclical sector. Any evaluation, and valuation of MDC must be based mostly on its EPV over the cycle.

I assumed that the cycle is represented by the 2005 to 2022 efficiency. That is pegging it to the most recent peak-to-peak Housing Begins cycle.

My valuation of MDC on an EPV foundation and over the cycle confirmed that there’s a 16% to 41 % margin of security relying on the way you calculate the gross revenue margins. That is based mostly on the view that there isn’t any progress within the long-term annual common Housing Begins beneath Situation 1

In case you assumed that there’s a 1/3 improve within the long-term annual common Housing Begins as per Situation 2, the margin of security could be higher than my 30% cut-off.

Of the 5 corporations that I’ve lined thus far, MDC is the one one which have substantial margins of security. MDC is therefore a possible funding alternative. Nonetheless, I wish to maintain off till I’ve lined the steadiness 4 homebuilders. It is because I’d solely spend money on one homebuilder from a threat mitigation perspective.

Whereas there are margins of security for MDC, I do have some issues about its monetary strengths. It’s apparent that that is one metric I’d use when evaluating with the steadiness 4 homebuilders.

I differentiate between a superb firm and a superb funding. A great firm is one that’s essentially sound. A great funding is one with a excessive margin of security. I wish to have a superb funding and a superb firm. However I’d select a superb funding over a superb firm if compelled to.

MDC appears to fall into the class of a superb funding and a not-so-good firm. I’m nonetheless trying to find a superb funding cum good firm.

I’m a long-term worth investor and my evaluation and valuation is predicated on the long-term prospect of an organization. This isn’t an evaluation for these searching for to earn money over the following few weeks or months.