AzmanJaka

Abstract

In my earlier protection on Matterport (NASDAQ:MTTR), I advisable a maintain ranking as I needed to attend for the actual property headwinds to be cleared earlier than investing. My perception was that this headwind would flip right into a progress tailwind because the financial system recovered, which might drive valuations upward. Till then, I believed it was higher to simply monitor the enterprise efficiency. This put up is to supply an replace on my ideas on the enterprise and inventory. I’m upgrading my ranking from maintain to purchase as I flip bullish on the MTTR progress outlook and the truth that the actual property finish market confirmed >20% progress, easing my earlier considerations.

Funding thesis

MTTR’s whole income for 4Q23 was $39.5 million, a 4% y/y decline that was barely decrease than the midpoint of steerage. The important thing driver was subscription income of $23.7 million, which was up 23% y/y. Web new ARR progress accelerated to 18% y/y progress vs. 15% y/y progress seen in 3Q23, and ARR got here in at $94.7 million, up 23% y/y. Additionally positively, the NRR (internet rental charge) elevated to 109%, which is the best degree in two years and close to the 110% historic common for the corporate.

The fairness narrative for MTTR is steadily shaping in direction of my expectations. In line with administration, the top-line power is various, together with a rise in new subscribers, an growth of present subscribers, and the optimistic affect of the value will increase carried out in mid-2023. Natural progress drivers—each paid and free subscribers—additionally skilled wholesome y/y progress of 13% and 36%, respectively. ARPU additionally elevated to $1.32k (annual pricing), up 9%, because of each an upmarket shift and the growth of present subscribers. The robust demand was felt throughout all enterprise sizes, the place SMB and enterprise cohorts improved, each rising >20%, which signifies a wholesome demand backdrop (and never one-sided to giant enterprises, as an example, which might’ve instructed weak point persists within the SMB market). Importantly, one of many key considerations I highlighted beforehand was that residential actual property and non-residential actual property verticals have been additionally each up >20%. On a extra particular word, administration highlighted the development, amenities administration, and journey and hospitality markets’ ongoing strengths.

I’m additionally turning into extra optimistic on MTTR’s medium-term progress outlook. NRR elevated for a second consecutive quarter, going up from 106% within the earlier quarter and 103% in 4Q22, and half of the NRR growth is because of pure growth which units a baseline expectation for NRR shifting ahead. In different phrases, NRR might maintain at mid-single-digits proportion (low-single-digits proportion from pure growth + inflation-like pricing progress). In my view, pure growth shouldn’t be a difficulty, MTTR has spent the final 12 months honing in on its most beneficial clients and creating deeper relationships with them. The corporate is now concentrating on making the identical work for its smaller, long-tail clients. This could result in extra progress in NRR, bringing it nearer to the historic common of 110% and possibly even past. Moreover, MTTR has been establishing essential partnerships with firms like Autodesk (ADSK), Amazon Internet Companies (AWS), and Procore (PCOR) during the last a number of quarters, and it seems that the corporate will quickly have the ability to profit from these relationships. Following a interval of co-marketing that contributed to new enterprise acquisition in FY23, the partnership relationships are actually shifting to include extra co-selling this 12 months. Administration claims that they’re witnessing sturdy pipeline growth with these essential companions, and that this channel will doubtless grow to be an much more vital progress driver in FY24. As such, I see this as a key upside catalyst to progress acceleration. The discharge of AI options in FY24 is one other encouraging facet. Though the practicality of those options is debatable, I imagine they may enable MTTR to extend costs and, maybe, pave the way in which for added add-on modules that might enhance ARPU even additional.

Profitability-wise, 4Q23 subscription gross margins elevated sequentially as soon as extra because the enterprise completed the present part of value optimizations for cloud internet hosting and customer support and took benefit of current worth will increase. Though the precise 4Q23 EBIT margin was -43%, which was decrease than the consensus estimate of -39%, the principle cause for the discrepancy was the poor product gross margin, which was brought on by the continued promotional pricing that started on Black Friday and Cyber Monday and continued all the way in which till the top of the 12 months. Profitability ought to enhance within the medium time period, in my view, as MTTR continues to witness robust income progress and enhance gross sales effectivity following the corporate’s restructuring final 12 months.

Valuation

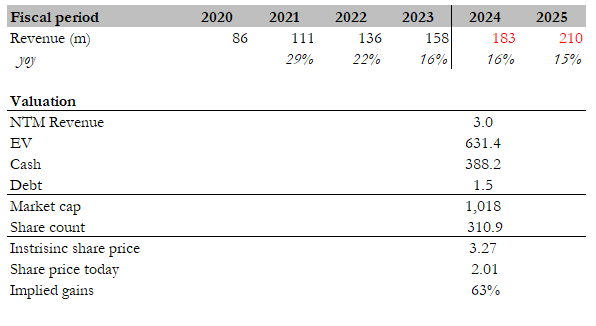

Personal calculation

My goal worth for MTTR primarily based on my mannequin is $3.27. Relative to my earlier mannequin, my progress assumptions have gone up by 100bps in FY24 to replicate the excessive finish of administration steerage ($183 million). That mentioned, as I mentioned above, if the partnership with numerous key gamers leads to extra offers than anticipated and the rollout of options drives extra adoption than anticipated, MTTR might beat this steerage. For FY25, I’m sticking to my 15% progress assumption. I’m additionally holding on to my 3x ahead income assumption because the market is unlikely to rerate the valuation larger except progress accelerates. With these assumptions, the upside stays engaging because the inventory worth has come down since final August (my final protection).

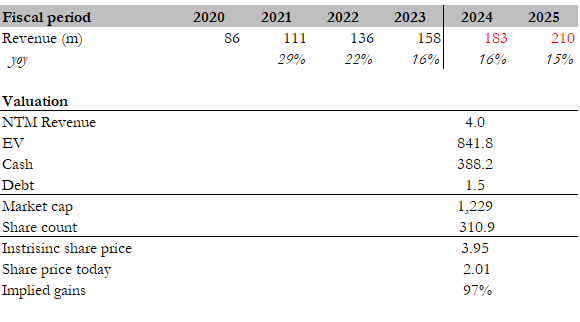

The attention-grabbing level that readers want to notice right here is that I’m not assuming progress to speed up in FY25, which might very properly occur primarily based on the catalysts I discussed above and the truth that MTTR goes to show their consideration to penetrate the smaller clients to drive growth. Any type of acceleration to the mid-teens or above 20% will very doubtless drive valuations upward. If we assume it goes as much as 4x, the upside turns into much more engaging.

Personal calculation

Danger

My fear is that the trail to turning worthwhile is perhaps delayed if administration decides to reinvest within the enterprise, and that is prone to occur if the financial system recovers and administration sees underlying demand speed up. This might disappoint buyers which can be anticipating the enterprise to show worthwhile (on an EBITDA foundation); consensus is anticipating this by FY25, inflicting them to promote their holdings and placing stress on the inventory. One other mini-red flag is that MTTR solely noticed 1K internet additions to paid subscribers, down from 2K/2K/3K in 3/2/1Q23, which might recommend some type of headwinds that I’m not conscious of. If this deceleration turns for the worst, it might set off a really unfavorable narrative for the inventory.

Conclusion

I’m upgrading my ranking on Matterport from maintain to purchase, pushed by a extra promising progress outlook and optimistic developments in the actual property finish market. On the topline, natural progress drivers are wholesome, indicating a powerful demand atmosphere. NRR ought to proceed to maintain or probably enhance as MTTR shifts focus to seize alternatives from smaller clients, and in addition progress might see additional upside because it reaps profit from strategic partnerships and rolling out of latest AI options. Nonetheless, potential delays in profitability and unexpected headwinds impacting subscriber progress stay dangers to contemplate.