- Private motivations typically affect inventory decisions, however they do not assure funding success.

- Within the inventory market, earnings development and dividends play a vital position in long-term efficiency.

- Use InvestingPro to achieve insights right into a inventory’s monetary well being, with a give attention to earnings and historic information for knowledgeable funding choices.

Buyers typically have distinctive motivations behind their inventory decisions, and a few examples embody:

- “I purchase Telecom Italia (BIT:) as a result of I’ve been a buyer of theirs for years and am snug with it.”

- “I purchase Juventus Soccer Membership SpA (BIT:) as a result of it’s my favourite staff.”

- “I purchase Saipem SpA (BIT:) as a result of my third cousin’s husband works there, and he’s doing effectively.”

Whereas these causes could appear legitimate on a private stage, they do not present insights into whether or not these are sound funding decisions.

It is necessary to appreciate that, within the medium to long run, as traders, the inventory market is primarily pushed by two important elements:

- Earnings development

- Dividends

Particularly, earnings contribute about 65-70% of the full, with dividends making up the remaining portion.

Whereas varied different analyses might be performed, even seasoned traders like Peter Lynch have repeatedly emphasised that, within the grand scheme of issues, constant earnings development is probably the most important issue.

With this understanding in thoughts, let’s discover the place and the way we will entry this important data, and that is the place InvestingPro turns into worthwhile.

InvestingPro provides totally different sections that present complete insights for any firm.

For instance, you possibly can choose the financials tab and browse up-to-date steadiness sheets and revenue statements for any firm.

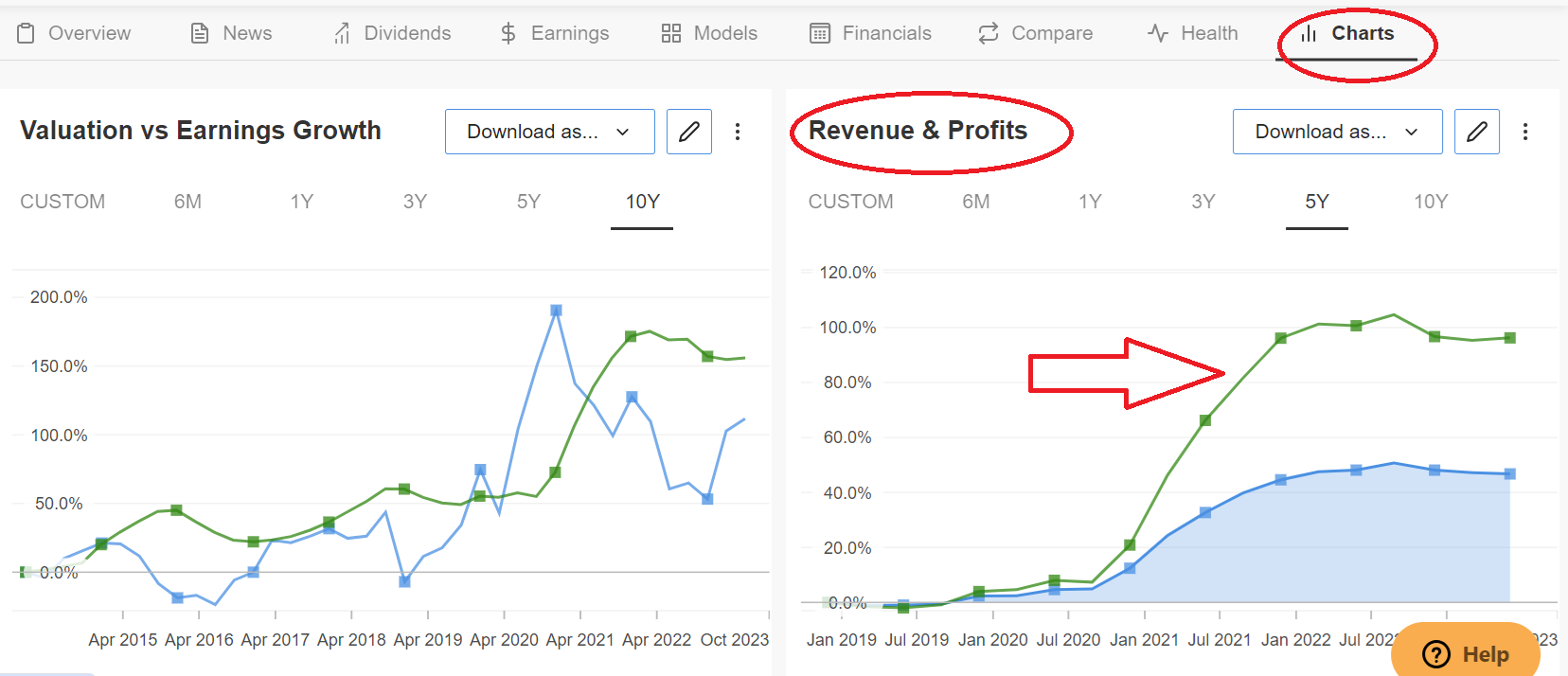

You may also go to the charts tab and see how the important thing monetary metrics have trended over a sure time span.

Within the pictures under, we will see the steadiness sheet and revenue assertion for Apple (NASDAQ:):

Supply: InvestingPro

An evaluation of the primary picture reveals a really perfect earnings per share pattern, characterised by constant development (as proven in Pic 1).

Conversely, within the context of the second picture, it’s evident that earnings ceaselessly transfer in tandem with inventory costs. Nonetheless, when occasional conditions come up, usually within the brief time period, the place earnings present an upward trajectory whereas costs expertise a decline — generally known as divergence.

This state of affairs turns into significantly intriguing and warrants additional investigation to uncover potential alternatives (as depicted in Pic 2).

What’s significantly advantageous within the full model of InvestingPro is that it provides a historic information vary spanning as much as 10 years, offering a wealth of knowledge to look at statistically important traits.

In our upcoming evaluation, we’ll shift our focus to the second key driver of efficiency, particularly dividends.

***

With InvestingPro, you possibly can conveniently entry a single-page view of full and complete details about totally different firms multi function place, eliminating the necessity to collect information from a number of sources and saving you effort and time.

Discover All of the Data You Want on InvestingPro!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counseling or suggestion to take a position as such it’s not meant to incentivize the acquisition of belongings in any means. I want to remind you that any sort of belongings, is evaluated from a number of factors of view and is extremely dangerous and due to this fact, any funding resolution and the related threat stays with the investor.