Asia-Pacific markets had been decrease on Friday as Japan launched revised second quarter gross home product figures (+1.2% vs +1.3% anticipated, down from 1.5%) and Hong Kong cancelled the morning buying and selling session as a result of a storm warning. In a single day the US100 fell for a 4th session, weighed by Apple after a report that China is allegedly banning authorities employees from utilizing iPhones; NVDA, AMD, Qualcomm slipped as effectively. US30 managed to edge up 0.17% as defensive sectors outperformed (Utilities the perfect one). Preliminary Jobless claims fell to 216k final week, under estimates and hinting to a nonetheless tight job market after final week’s streak of information. Unit labor prices rose 2.2% (1.9%). A ”optimistic” word got here from Walmart that introduced it’s decreasing its employees entry pay. EU GDP and employment change in Q2 disenchanted yesterday and EU shares are down for the seventh day in a row. German CPI/HICP is simply out, in line (CPI +6.1% y/y).

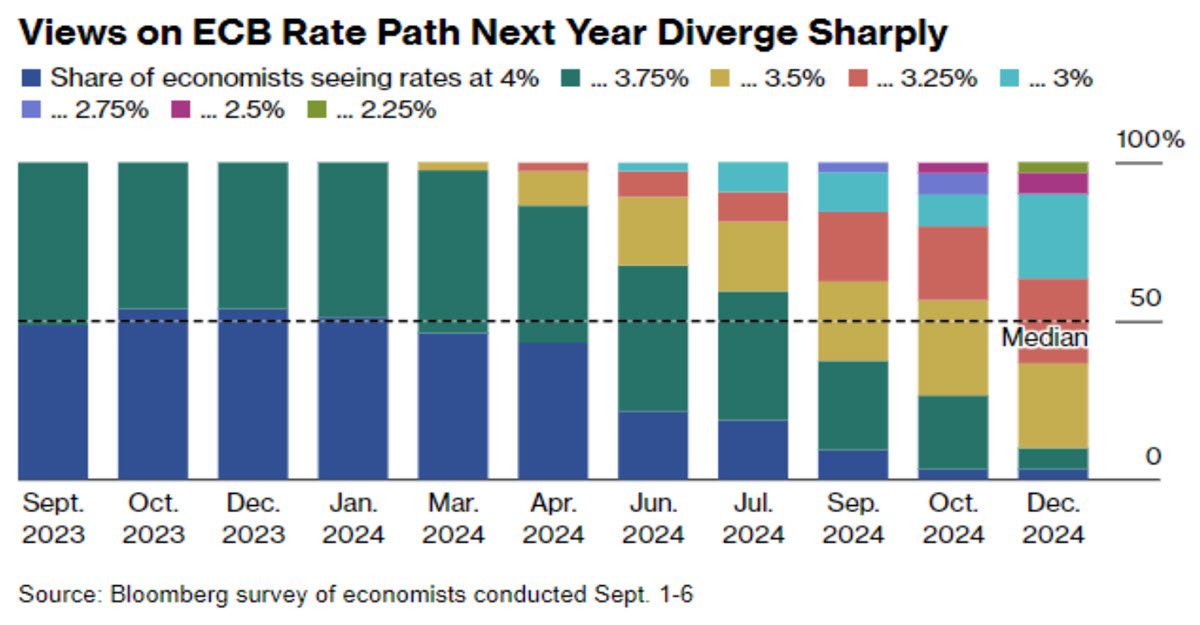

This morning a ballot of 69 economists interviewed by Bloomberg confirmed that almost all of them (39) are seeing an ECB pause in September, with some odds (33) of a brand new hike by the top of the yr. Lastly, USDCNH is buying and selling at 7.3528 and has damaged 2023 highs the day after CNY did so, exhibiting the Chinese language authorities are giving up defending the 7.30 barrier.

- FX – USDIndex -0.20% at 104.82 retreated again under 105, EURUSD sits within the low 1.07s, Cable lingers under 1.25 and USDJPY trades on a 147 deal with (147.15).

- Shares – EU Futures +0.3% (each GER40 and FRA40), US30 +0.14%, US100 +0.31%, AAPL – 2.92%, AMD -2.46%, Qualcomm – 7.22%.

- Commodities – USOil -0.36% at $86.43, UKOil loses $90, $89.59 now. Strikes started at Australian Chevron LNG vegetation.

- Gold – +0.38% at $1926.80, XAG +0.82% at $23.15, Palladium +1.15% at $1228 is making an attempt to rebound from 2023 lows.

LATER TODAY: Canadian Unemployment Fee, Fed’s Bostic & Barr.

INTERESTING MOVER: Apple -2.92% at $177.56 is down -6.54% in 2 classes on heavy volumes after US-China tech-related tensions arose once more. It managed to get better the $176 degree after opening at 175.18 and hitting a low at $173.54. The MACD is impartial and RSI barely under 50. Value is between the MM50 ($186.50) and MM200 ($164).

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a basic advertising and marketing communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or ought to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.