US shares fell on Tuesday – aside from the US100 – weighed down by increased oil costs and rising Treasury yields. Saudi Arabia will prolong its 1 million barrel per day voluntary oil manufacturing minimize till the tip of the yr, in keeping with the state-owned Saudi Press Company, and the minimize provides to the 1.66 million barrels per day that different OPEC members have put in place till the tip of 2024. Russia, by means of its Deputy Prime Minister Novak, additionally pledged to increase its 300k bpd cuts till the tip of December, and can evaluation the measure on a month-to-month foundation. UKOil traded above $90 until a couple of minutes in the past (now $89.84) and USOil went as excessive as $88 sooner or later yesterday. This was instantly mirrored firstly in US yields, which rose 6bps on the 10-year, and the USD additionally benefited. The phantom of inflation could not but be vanquished with the primary uncooked materials of our energy-intensive societies rising by 30% in simply over two months. Shares have fallen: airline and cruise shares clearly suffered however all sectors besides Power, Expertise and Client discretionary went down. European indices additionally dropped as financial information for the area got here in blended. Eurozone producer costs fell 7.6% in July from a yr in the past. However enterprise exercise in August dropped on the steepest charge in practically three years. In a single day the Australian GDP determine confirmed a slowdown in comparison with the earlier quarter, however was much less marked than anticipated.

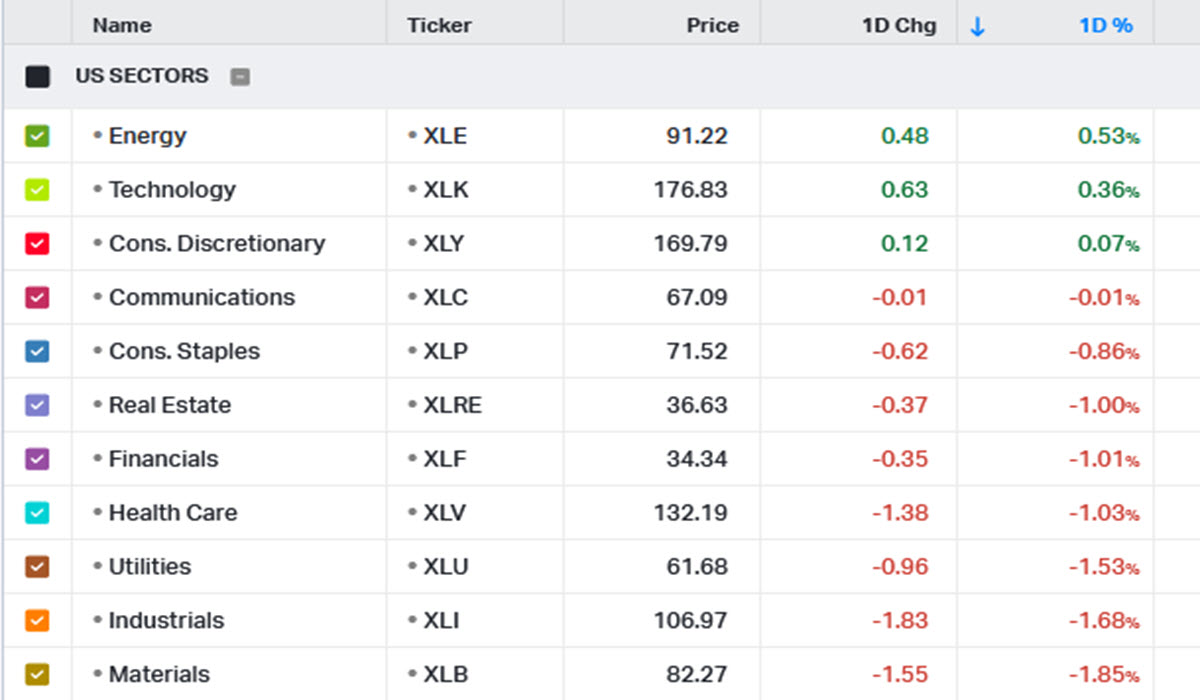

Sectorial Etf Performances

- FX – USDIndex hit its highest stage since 10 March, now at 104.64. USDJPY at 2023 highs, 147.08 now however traded as excessive as 147.815. USDCNH slides to 7.31 however beforehand touched 7.325. EURUSD -0.61% at 1.0737 now near important ranges, GBPUSD at 1.2581 with its value clearly beneath a trendline.

- Shares – Flattish Chinese language indices, JPN225 +0.77% at 33227, AUS200 -0.75%. US Futures all aligned at -0.07% proper now, EU Futures -0.2%/-0.3%. Yesterday Supplies -1.85%, Industrials -1.68%, Utilities -1.22%.

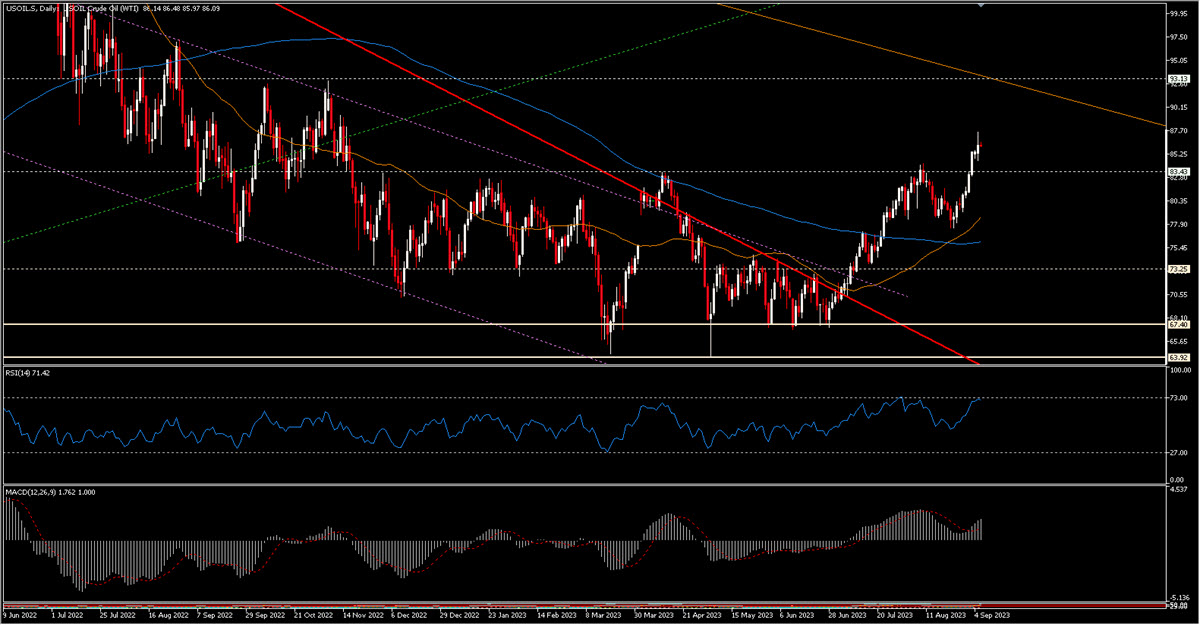

- Commodities – USOil touched $88.05, buying and selling at $86.50 proper now; UKOil rose as excessive as $91.12 now at $89.83.

- Gold – pressured once more, -0.56% yesterday now flat at $1926. XAG dropped -1.67%, additional down -0.33% at $23.45 now.

LATER TODAY: Germany Manufacturing facility Orders, EU Retail Gross sales, US Commerce Stability, PMIs, Financial institution of Canada Curiosity Charge determination, Fed Beige Guide.

INTERESTING MOVER: USOil added one other +0.84% ($86.7) to its greater than 2 month lengthy 30% rally. Resistances at $88.5/$89 and $92.5/$93 areas, assist within the $83.5/$84 space. MACD, RSI constructive, Worth above 50d-200d MAs that just lately crossed to the upside.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a common advertising communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or ought to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.