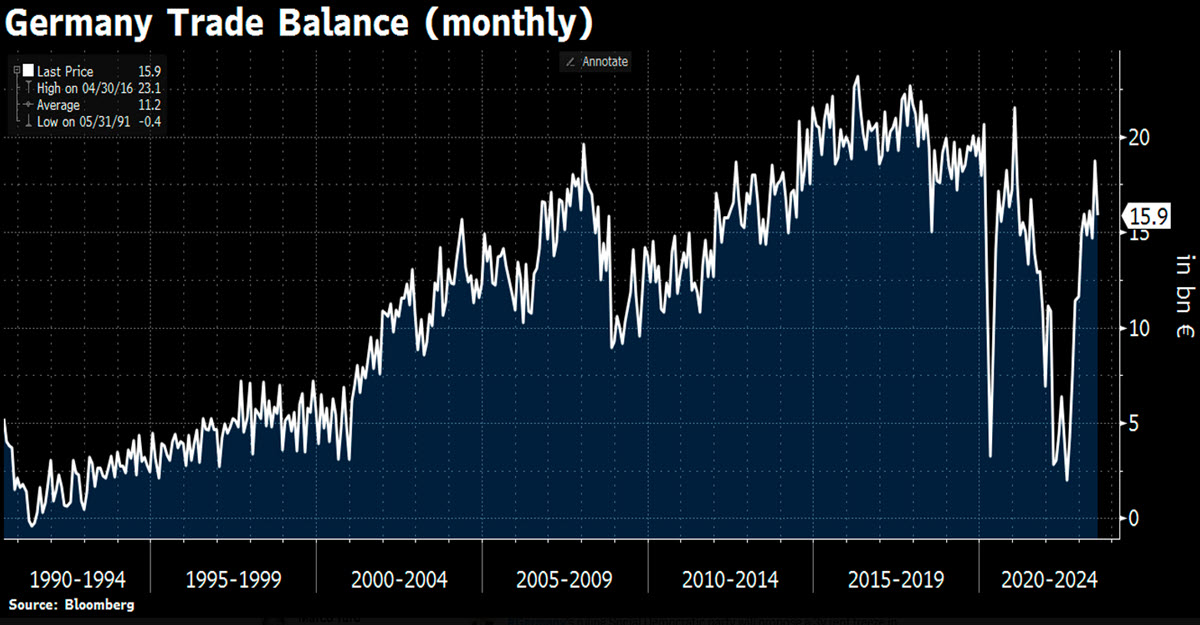

Yesterday was a slightly calm day, missing the US drive, and because the hours handed it partially soured. The European indices all completed barely within the purple, nevertheless not more than -0.24% on the FRA40, whereas the one vital determine from the Eurozone – aside from the Sentix Investor Confidence nonetheless nosediving – was the German commerce stability’s -15% m/m decline led by the autumn in exports, which was nevertheless smaller than anticipated; exports to China are down -16.5% YTD (Eur 57.7 billion). On her half, Lagarde cleverly averted answering questions on future financial coverage in her speech in London.

A short time in the past, the RBA left its money price unchanged at 4.1% as anticipated, the third consecutive month of pause, weighing on AUD’s efficiency, however it’s all the Asian currencies which might be weak. The Chinese language Caixin Providers PMI – whereas nonetheless in expansionary territory – posted its worst studying in 9 months (51.8 down from 54.1) and this comes after another if not actually good, not less than hopeful manufacturing statistics final week. Nevertheless, the entire of APAC is within the purple regardless of Nation Backyard managing to keep away from its first default. US futures are additionally -0.1% on common in the mean time. UBS expects clear indicators of a US financial slowdown in November, bringing an finish to the Fed’s tightening cycle.

- FX – USDIndex nonetheless robust at 104.19, AUDUSD underperforms (-0.66% at 0.6418), USDJPY faces 147 (146.82 now), USDCNH 7.29, EURUSD -0.11% at 1.0784, Cable -0.07% at 1.2619.

- Shares – China 50 -0.56, AUS200 -0.25%, GER40 set to open -0.22% at 15789; US Futures: US500 -0.07%, US100 -0.03%, US30-0.10%.

- Commodities – USOil at a ten month excessive @ $85.87, UKOil @ $88.88. Copper continues correcting, -0.67% at $382.40.

- Gold – beneath $1940, at $1937.25. Silver – 0.65% at $23.82.

LATER TODAY: HCOB PMIs Providers & Composite in DE, FR, IT, SP, EU, European PPI, US Redbook and Manufacturing unit orders, Lagarde speech.

INTERESTING MOVER: BTCUSD -0.79% within the final 24h at 25726 retains hovering across the essential 25250 space that occurs to be additionally the 200d MA; it has just lately misplaced its 2023 ascending channel and retested from the draw back final week, being brutally rejected.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is supplied as a normal advertising and marketing communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or must be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.