Revenue-taking on overbought situations was the overall rational after bond bulls overzealously introduced ahead Fed price cuts to the spring, and aggressively priced in 50 bps in easing by mid-year. The blended alerts from the information on retail gross sales, PPI, and the Empire State didn’t present a lot path. Treasuries gave again about half of Tuesday’s CPI-inspired rally as yields climbed about 7 bps throughout the curve.

In the meantime, President Biden and Chinese language chief Xi Jinping adopted a much less contentious tone at their summit, although deep US-China disagreements stay.

- Japanese exports grew for a second consecutive month in October however at a considerably slower tempo, primarily attributable to decreased shipments of chips and metal to China.

- Chinese language knowledge confirmed extended weak point within the property sector and dented a few of the latest optimism a couple of restoration on the planet’s second-largest financial system. Chinese language dwelling costs fell essentially the most in 8 years in October.

- USDindex maintained its place above 104 on Thursday, displaying stability after latest volatility.

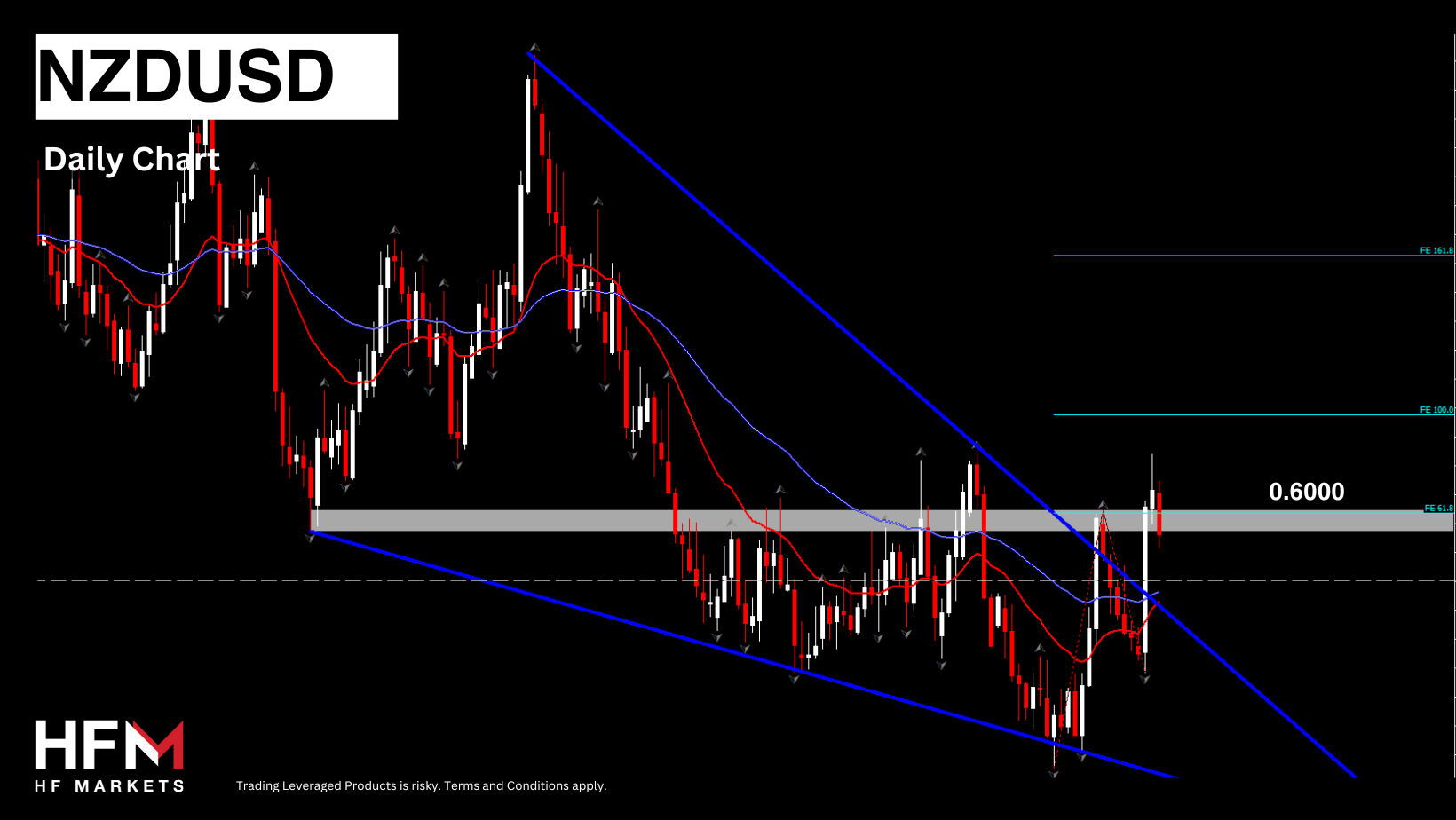

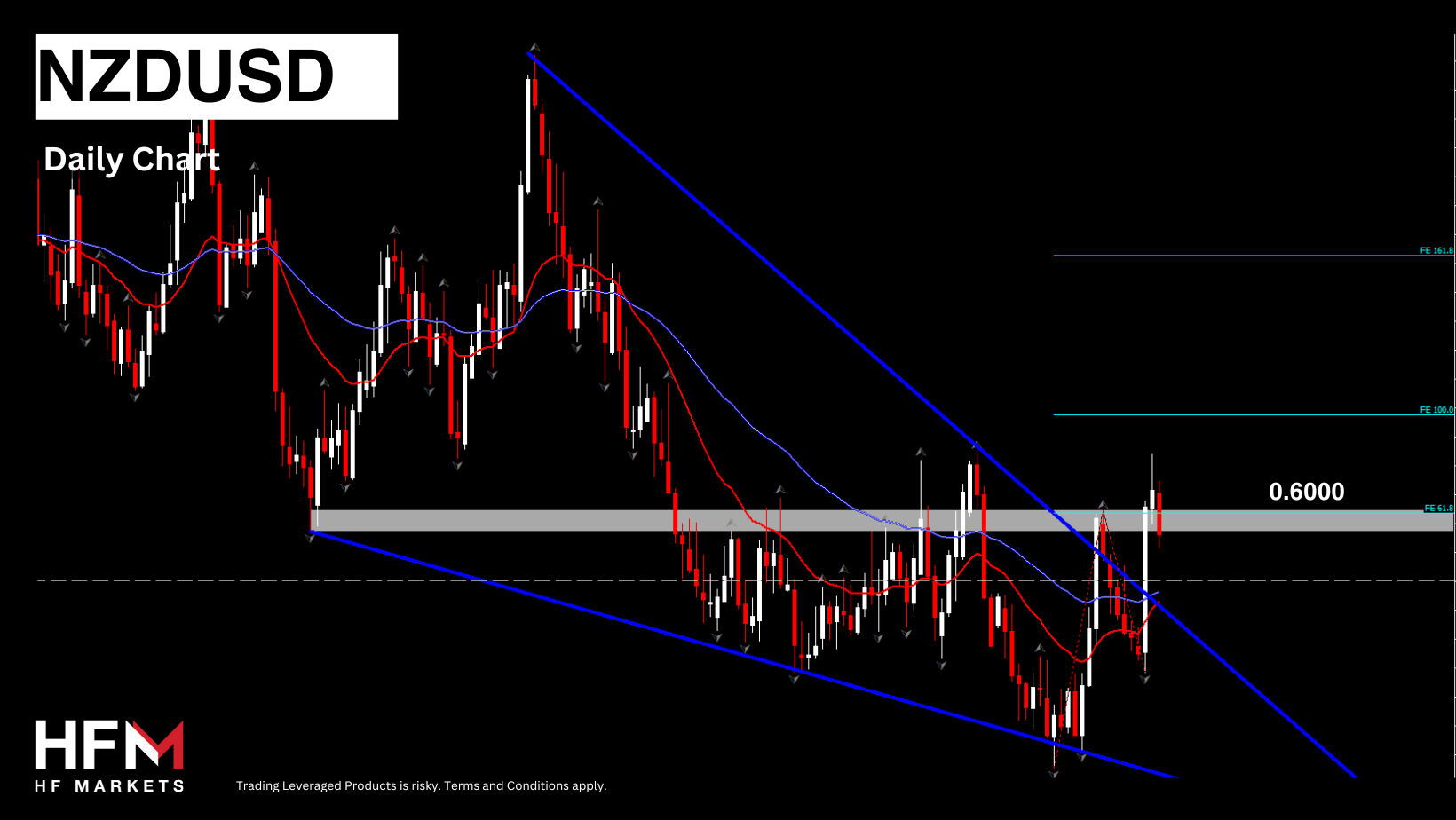

- AUDUSD and NZDUSD: The danger-sensitive Australian and New Zealand {dollars} dropped to 0.6474 and 0.5978 respectively, in response to declining regional equities and Australian rising jobless price at the same time as employment numbers improved in October.

- Shares:

- Asian shares declined, interrupting the week’s important good points, following Chinese language knowledge. JPN225 ended 0.28% decrease at 33,424.41, breaking a 3-day successful streak, influenced by profit-taking and a rebound in US Treasury yields.

- US shares closed barely increased, with the US30 rising by 0.47%, the US500 gaining 0.16%, and the US100 ending flat.

- #Goal skilled a greater than 15% enhance following better-than-expected Q3 outcomes, whereas #Microsoft launched its first AI chip, Maia 100, and a cloud computing chip.

- Vitality: Oil prolonged declines after a authorities report confirmed swelling US crude inventories. USOIL dipped 0.9% to $75.97 a barrel, and UKOIL crude fell to $80.44 per barrel.

- Metals: XAUUSD rose barely, with spot gold traded at $1967 per ounce.

- Cryptos: BTCUSD recovered a 2-day drift and returned above 37.3K, probably attributed to profit-taking by sellers anticipating one other SEC spot ETF delay; decrease inflation and bond yields anticipated to help additional crypto costs.

Attention-grabbing Mover: NZDUSD (-0.74%) holds floor above 4-months descending channel. Key help at 0.5940 and Key Resistance at 0.6000.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a common advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or needs to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.