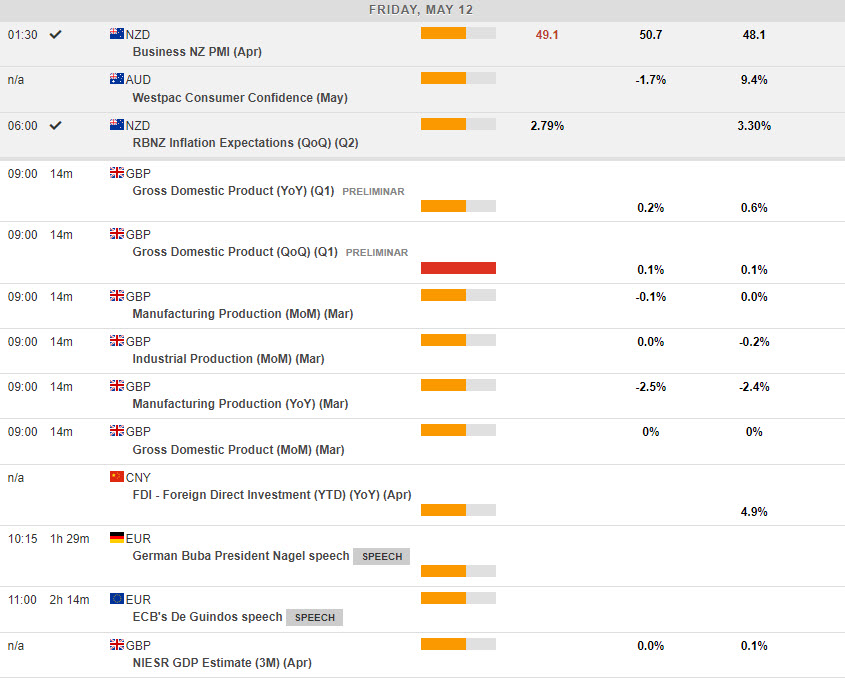

The USDIndex rallied to 101.95 because the cooler PPI (3.2% vs 3.4%) and Weekly Claims (264k vs. 245k) readings yesterday added to speak that the FED is completed however the persistent risk of decelerate/recession additionally gave the USD a secure haven bid. Yields ticked decrease and US Shares closed blended, NIKKEI (+0.98%) has outperformed in Asian markets. Sterling tanked to 1.2500 publish BOE charge hike and unconvincing outlook. NZD underperforms in Asian buying and selling after weaker inflation expectations (2.79% vs 3.3%). The US debt ceiling points progress was stalled as President Biden and congressional leaders postponed their scheduled assembly to subsequent week.

In a single day – UK – March GDP missed (-0.3% vs 0.5%), Quarterly GDP was confirmed at 0.1%, and there have been large beats for Ind. Prod. (0.7% vs 0.1%) and Manu. Prod. (0.7% vs -0.7%). France March CPI confirmed at 0.6%.

- FX – USDIndex rallied from 101.09 lows to 101.95 highs following weak knowledge in China and US, trades at 101.85 now. EUR examined into 1.0900 and trades at 1.0925 now. JPY slipped beneath 134.00 once more, earlier than recovering to 134.75 now. Sterling collapsed to check 1.2500 yesterday, down from 1-year highs, at 1.2670 earlier this week, and is at 1.2515 at present.

- Shares- US markets closed blended (-0.66% to +0.18%). GOOGL +4.34%, TSLA +2.10% (Musk stated he’d discovered CEO for Twitter & minimize costs in US), PACW -22.07%, (extra deposit outflows) PTON -8.9% – US500 closed -7.02pts 4130, FUTS are buying and selling at 4150, beneath key resistance at 4175.

- Commodities – USOil – Futures have misplaced $3 a barrel from yesterday, declining from $73.50 to $70.50 immediately, after US Power Secretary stated strategic reserve oil purchases may start on June 1. Gprevious – declined from $2040 yesterday to underneath $2008 immediately on the stronger USD.

- Cryptocurrencies – BTC continued to say no, breached the $26.75k lows from Wednesday & trades at $26.20k now.

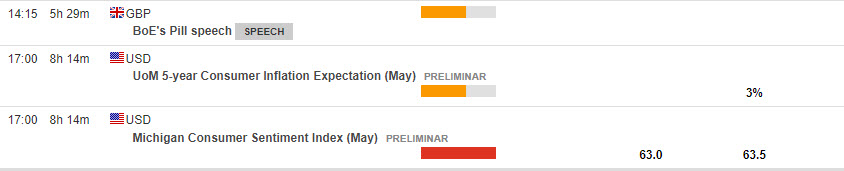

At the moment – US Export/Import Costs, Uni. of Michigan, Inflation & Client Sentiment, Treasury Secretary Yellen, Fed’s Bullard & Daly, BoE’s Tablet, ECB’s de Guindos.

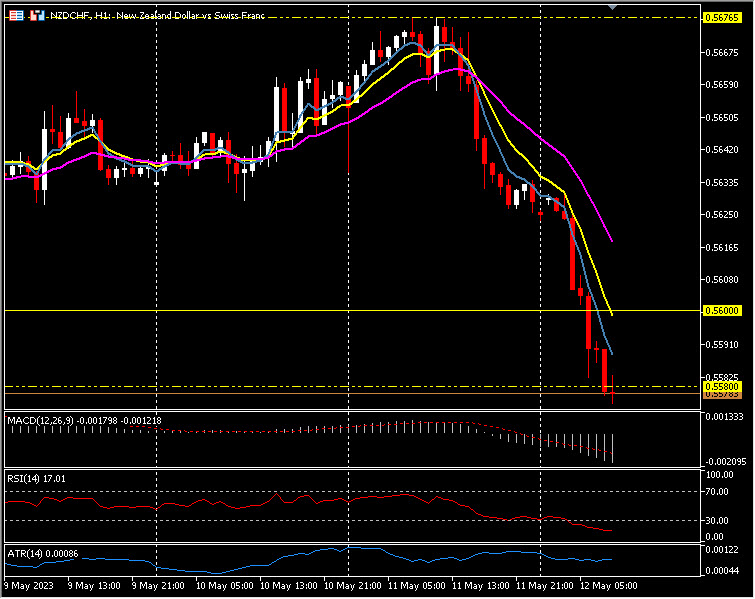

Greatest FX Mover @ (06:30 GMT) NZDCHF (-0.88%). From yesterday’s largest gainer to immediately’s largest loser. Declined from 0.5675 highs yesterday, again underneath 0.5600 to 0.5580 now. MAs aligned decrease, MACD histogram & sign line unfavourable & falling, RSI 17.01 OS however nonetheless falling, H1 ATR 0.00086, Every day ATR 0.00520.

Click on right here to entry our Financial Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This materials is supplied as a normal advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or must be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.