China shares rallied and hit a 6-week excessive, as investor confidence in official stimulus measures strengthened. Property, monetary and client associated shares specifically benefited, after alerts of additional assist. The BoJ signalled a widening of the band for the 10-year yield, which was taken as an indication that the BoJ is heading for coverage normalisation. The Yen rallied because of this. Bunds are promoting off in early commerce, after a lot stronger than anticipated French GDP numbers and as markets proceed to digest yesterday’s ECB announcement. French inflation dropped to five%, the bottom stage for 16 months. In US, a lot stronger than anticipated GDP, tighter than projected jobless claims, a pop in sturdy items orders, a bounce in pending dwelling gross sales, and a narrowing within the items commerce deficit boosted threat for a twelfth charge hike for the FED. Bonds and Shares selloff.

In a single day: BoJ tweaks yield curve management. The BoJ stored the goal for 10-year yields at round 0% however signalled that the 0.5% ceiling was now a reference level, not a inflexible higher restrict. It would supply to purchase bonds on the 1% mark, which implies an efficient widening of the band. Ueda vowed to maintain easing, whereas on the identical time, he pledged to proceed to ease tenaciously and so as to add additional easing if vital. Ueda added that he expects inflation to sluggish earlier than regularly choosing up once more.So some try to play down the significance of at the moment’s shock transfer and stop markets from shopping for into an imminent transfer in the direction of coverage normalisation.

- FX – The USDIndex held most of yesterday’s positive factors and is at 101.72, because the 10-year Treasury yield inched larger. The Yen strengthened with USDJPY at 138 lows. GBP drifted to 1.2760 and EUR at 1.0950.

- Shares – The CSI 300 is up 2.1%, the Hold Seng nonetheless 1.2%, and JPN225 declined. #Evergrande plunged as buying and selling resumed almost 16 months after the inventory was suspended pending the discharge of economic outcomes. #Ford inventory is larger after hours after the automaker reported sturdy second quarter earnings and likewise upped its full-year revenue forecast, although it did challenge steeper annual losses in its EV division. Ford’s outcomes come after its crosstown rival #GM reported sturdy earnings and raised its full-year revenue steerage for a second time. #Intel’s (+8% after hours) earnings stunned positively after two consecutive quarters of report losses. Sturdy gross sales of medication for most cancers and diabetes helped #AstraZeneca beat gross sales and earnings expectations.

- Commodities – USOil spiked to $80.30 on tighter provide (Fed raises rates of interest by 25 bp, US crude inventories fall lower than anticipated, ECB raises charges to 23-year excessive, OPEC+ panel assembly in focus)

- Gold – drifted to $1941 from $1980, amid sturdy US financial knowledge which renewed the Fed’s pledge to remain hawkish.

As we speak: German Inflation, Canadian GDP and US PCE, Earnings: Exxon Mobil, Procter & Gamble, Chevron and many others.

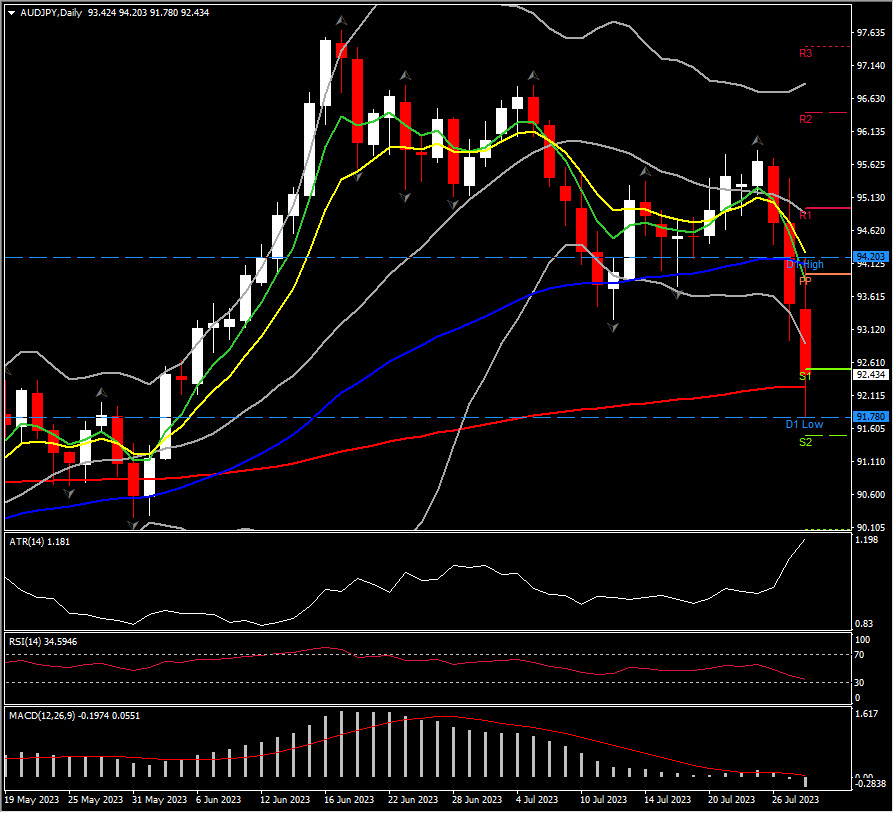

Largest Mover: (@6:30 GMT) AUDJPY (-1.31%) bottomed at $91.78 with RSI and MACD turning beneath impartial according to 3-day sharp decline. ATR(H1) is at 0.591 and ATR(D) is at 1.181.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a normal advertising communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or needs to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.