Optimism in China’s restoration has made a comeback and buyers are shopping for into hopes that decisive stimulus motion from Beijing will enhance home demand. The Chinese language equities jumped on Tuesday, after the nation’s ruling politburo vowed to spice up employment and revive a “tortuous” financial restoration. China’s highly effective 24-member politburo stated it might deal with unemployment, velocity up issuance of native authorities particular bonds and enhance consumption of electronics, electrical autos and different items. The JPN225 struggled via and positive aspects in Australia had been rather more muted. Futures in Europe and the US haven’t moved a lot as markets flip cautious forward of this week’s key central financial institution bulletins in Germany, the US and Japan. Wheat costs climbed to a 5-month excessive on Tuesday, as Russian assaults towards Ukrainian ports that ship the grain intensified.

- FX – The USDIndex is at 101.26. USDJPY is struggling for a 3rd day in a row to beat 142.00. GBP closed under 20-DMA yesterday and holds under it to date at 1.2840, whereas EUR holds above 1.11.

- Shares – Hong Kong jumped as a lot as 5% and the Cling Seng is at the moment up 4.0%, whereas the CSI 300 has rallied 2.9%.

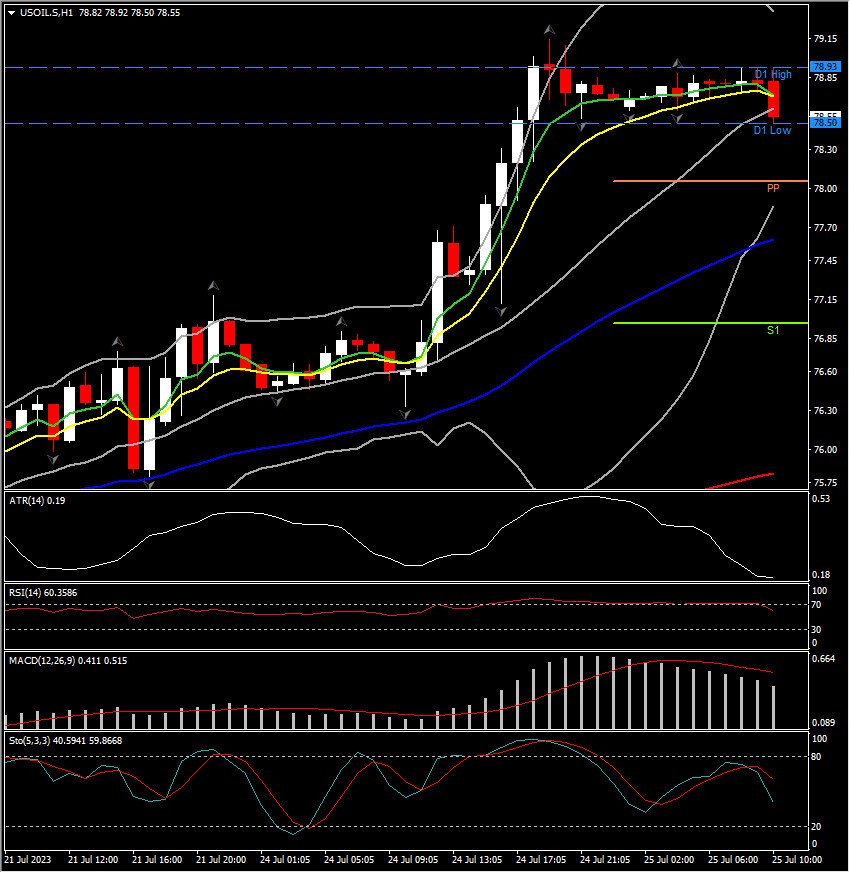

- Commodities – USOil spiked to $79 space. Oil is heading for a strong month-to-month achieve, as output cuts begin to chunk and counterbalance concern that the sluggish restoration in China will cap demand. There are actually extra indicators that Russia is making good on its pledge to rein in provides with information displaying that the nation’s crude shipments fell to a 6-month low within the 4 weeks to July 16. Provide may additional tighten in August, as Russian oil exports are set to be decreased additional. A decline in drilling exercise within the US is including to produce considerations and the US Vitality Data Administration has already revised down its short-term outlook for US manufacturing with additional corrections attainable except the development in drilling exercise reverses. Additionally China flagged extra measures to spice up financial development, aiding the outlook for power demand simply as the worldwide market reveals indicators of tightening.

- Gold – holds a ground above 50-DMA at $1955.

Immediately – Germany’s Ifo enterprise survey and IMF publishes an replace to its World Financial Outlook. Earnings: Microsoft, Alphabet, Visa, Verizon, UBS, Nextera.

Greatest Mover: USOIL spiked to $79.16 whereas immediately it sustains positive aspects above 78 territory.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a basic advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or needs to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.