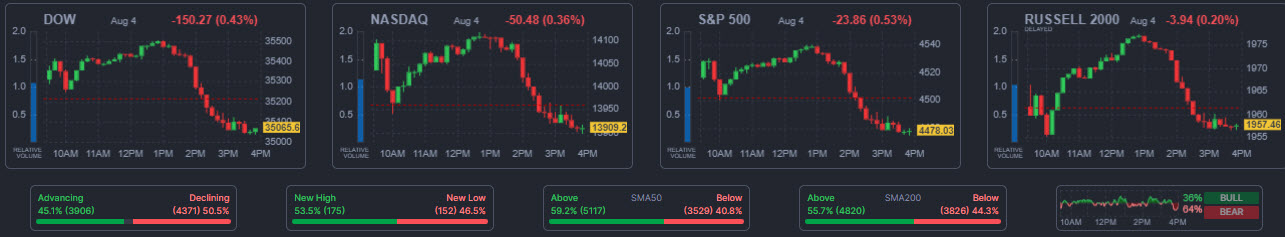

A smaller than anticipated 187k NFP rise and -49k in downward revisions to Might and June offered the spark for the bond market to right from the post-Fitch and provide pushed selloff. The stomach of the curve outperformed as the roles report didn’t alter Fed coverage expectations and the markets proceed to cost in solely a couple of 33% threat for one more price hike. The steepening of the 2-year/30-year yield curve by 30 foundation factors was one of many greatest weekly strikes in over a decade. The ‘delicate touchdown’ and even ‘no touchdown’ narrative is gathering momentum, and JP Morgan on Friday turned the most recent Wall Road financial institution to take away or delay their US recession name. Shares initially rallied on the employment headlines, however spillover from disappointing Apple earnings outcomes, which overshadowed Amazon’s beat, noticed shopping for peter out and income taken by means of the afternoon.

This morning: German industrial manufacturing contracted -1.5% m/m in June – greater than anticipated after two robust months of orders influx for the manufacturing sector. The robust bounce in manufacturing orders provides some hope for the approaching month, however building is more likely to proceed to wrestle. Consumption could have strengthened within the second quarter, however these numbers depart the danger of a downward revision to Q2 GDP.

This morning: German industrial manufacturing contracted -1.5% m/m in June – greater than anticipated after two robust months of orders influx for the manufacturing sector. The robust bounce in manufacturing orders provides some hope for the approaching month, however building is more likely to proceed to wrestle. Consumption could have strengthened within the second quarter, however these numbers depart the danger of a downward revision to Q2 GDP.

- FX – USD Index rose at 102.05, EURUSD fell again to 1.0980, USDJPY recovered some losses however is struggling to interrupt 142.30. Cable holds at 1-month lows, presently at 1.2720.

- Shares – The US100, US500 and MSCI World index final week all registered their greatest weekly losses since March. Amazon closed +8.27% and Apple at -4.8%. Right this moment, Asian share markets had been in a cautious temper, JPN225 is flat, EUROSTOXX 50 -0.3%, UK100 0.5%, US500 +0.3% and US100 +0.5%.

- Commodities – USOil at $82.85, after Saudi Arabia and Russia confirmed that they’ll prolong voluntary output cuts. Ukraine added a brand new entrance in its conflict towards Russia over the weekend, utilizing drones to strike a naval vessel at a Russian oil-exporting port within the Black Sea and an oil tanker within the Kerch Strait.

- Gold – pulled again to $1935.44 under PP.

Right this moment: July CPI and earnings out of Disney will spotlight the calendar this week. Asia’s company earnings season picks up this week, with Alibaba the standout in a trickle from China.

Greatest Mover: (@6:30 GMT) GBPUSD holds at 1-month lows. It’s approaching the resistance line of a down channel Assist: 1.2620.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a common advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or needs to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.