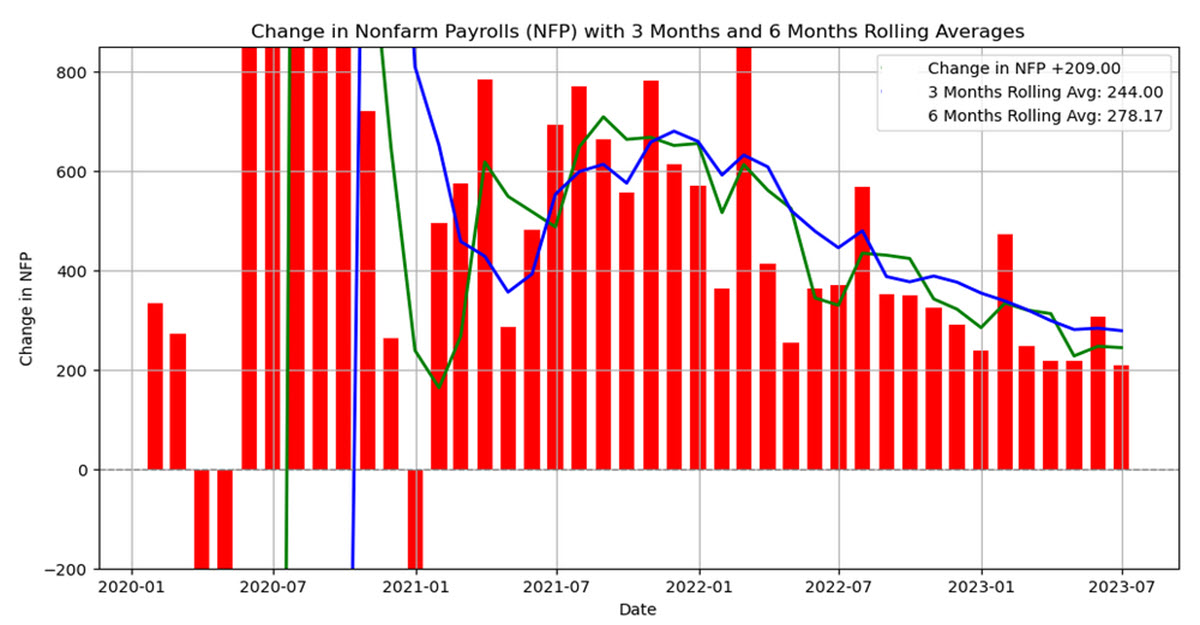

Amazon delighted buyers on Thursday posting earnings of 65 cents/share vs 35 cents/share anticipated. Value slicing coverage has allowed the corporate to increase its total margin even when its cash making AWS enterprise revenue margin declined to 24.2% from 29% a 12 months earlier. The inventory jumped 9% after hours. Apple beat smooth Wall road expectations however total gross sales fell 1% y/y and so did the inventory, -2% in prolonged buying and selling. Yesterday US indices closed off the lows after some in-line Jobless Claims information however Yields on the lengthy finish – each 10Y and 30Y are eyeing final October’s highs– are placing strain on shares: US100 is down 2.5% to date this week whereas US500 is -1.8%. PPI in Europe have proven a unfavorable studying for six months in a row, 3 months for the Core element highlighting not solely the deflationary threat however the economic system slowing down. Crude and Brent jumped after the Saudis and Russia confirmed the extension of their manufacturing cuts in September (even when Russia is right down to 300k bpd from 500k beforehand). Later right now the ”pivotal” NFP information is anticipated to come back in at +200k in July, down from +209k: that may be the bottom month-to-month change since DEC 2020. A beat would most likely push charges even larger and be a drag available on the market.

- FX – USD Index -0.14% at 102.21, AUDUSD beneficial properties after Financial Coverage Assertion (+0.22% at 0.6565), USDJPY at 142.41 after having strengthened in yesterday’s afternoon session.

- Shares – US Futures are up: US500 +0.36%. US100 +0.60%, US30 +0.18%. DAX is firmly buying and selling beneath 16k. Russell 2000 stays wanting eclipsing its 52-week excessive. Berkshire hits a brand new ATH. Airbnb slid after hours after bookings grew at a slower than anticipated price.

- Commodities – USOil at $81.74, unfold towards UKOil at $4.48 near current lows.

- Gold – Firmly beneath $1940 on larger charges, XAG underperforms -0.32%.

At the moment: EU retail gross sales, DE Manufacturing unit Orders (simply out +7% vs -2% anticipated), US NFP, Unemployment, Common Hourly Earnings, Canadian Unemployment.

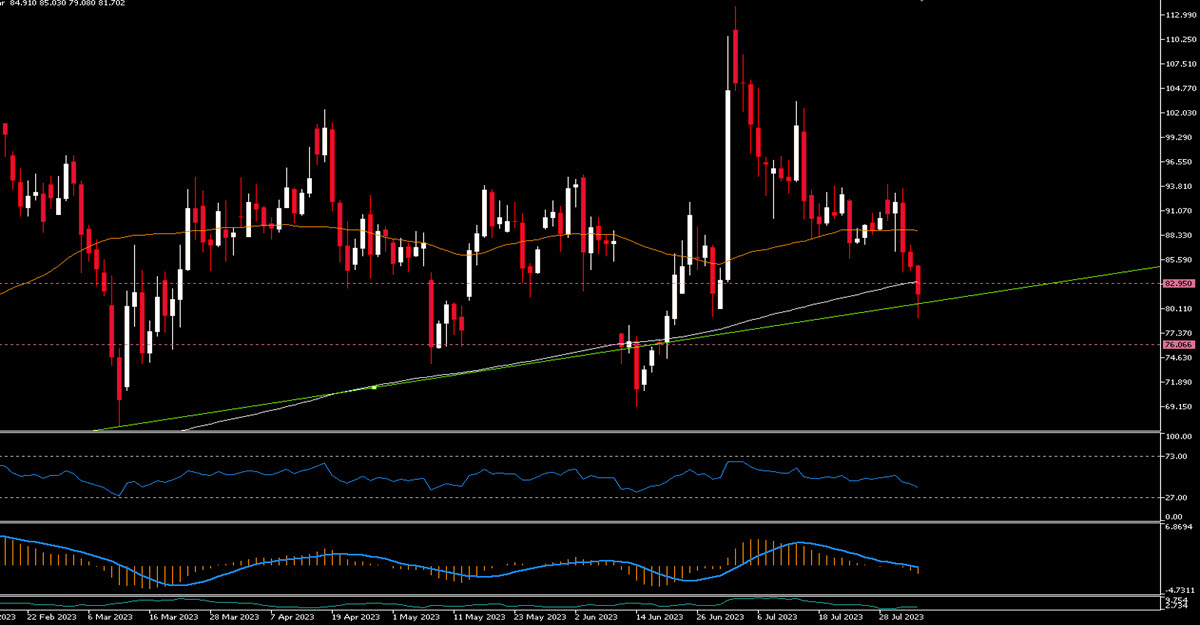

Largest Mover: (@6:30 GMT) LTCUSD (-3.38%) buying and selling at $ 82.05, inside this 12 months’s wide selection and near a help space + 200d MA. RSI negatively sloped, MACD unfavorable.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is supplied as a basic advertising communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or ought to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.