48 periods: that is how lengthy it has been for the reason that final time the US500 was down greater than 1%, on 23 Could. Fitch’s downgrade was a great excuse to promote a most likely costly market and the US100 fell 2.21%. Charges had been bought, particularly on the lengthy finish (the 10y) which led to a steepening of the curve once more (the 2y10y is now at -77 bps): it is a traditional the place the motion comes not from a change within the outlook for development, inflation and so on however from a (minimal) ”improve” in nation danger. At present solely Moody’s retains the AAA qualification. Admittedly, a a lot larger than anticipated ADP determine helped the promoting stress on bonds (+324k vs. +189k anticipated) however let’s not be below any illusions concerning the NFP: it has lengthy proved to be a poor forecaster.

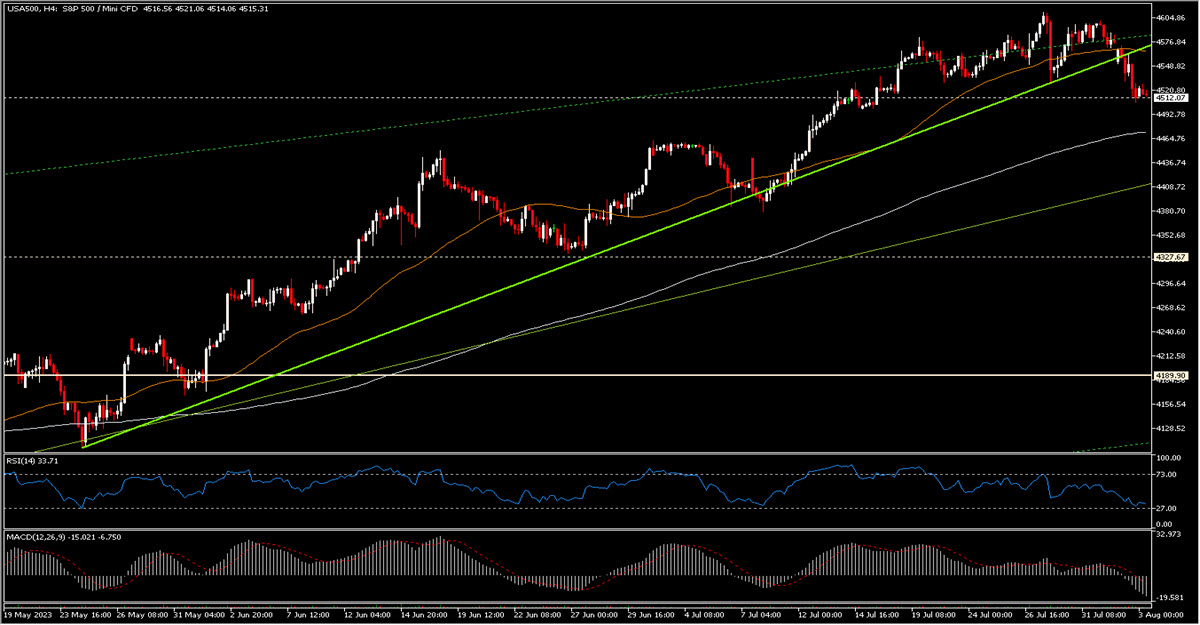

US500, H4

In a single day the BOJ carried out its second unscheduled bond shopping for intervention because the JPY sank once more. Later we can even have the BOE’s determination, which is predicted to make a troublesome selection between a 50 bps improve or maybe 25 bps with a deal with extra quantitative tightening. Curiously, the easing cycle began in South America after which Chile, whereas Brazil additionally minimize 50 bps yesterday, greater than anticipated. Lastly, allow us to not overlook the massive names that may report tonight, Amazon and Apple: for the previous the choices market is pricing an implied motion of 5.9% after the outcomes, for the latter solely 1.59%.

- FX – USDJPY is as much as 143.88 on a sinking Yen, additional dragging down the USD Index that stays at 102.60 now. EUR and GBP are little moved whereas AUDUSD and NZDUSD sank to 0.6535 and 0.6073 respectively.

- Shares – US Futures are barely up (0.1%) this morning after yesterday’s unload. China50 +0.78%, JPN225 -0.94%. Qulacomm slipped almost -7% after hours after lacking on fiscal third quarter income and steerage for the present interval.

- Commodities – USOil suffered some promoting stress as did the general market yesterday (-2.95%) and is now buying and selling at $79.59, Copper at $385.15.

- Gold – flat this morning after having retreated to $1934, XAG at $23.66.

At present: European HCOB Composite and Companies PMI, EU PPI, BOE Curiosity Fee Choice, US Jobless Claims, US Manufacturing unit orders, Companies PMI. EARNINGS: Apple, Amazon, Coinbase, Airbnb after the shut, Moderna BTO.

Largest Mover: (@6:30 GMT) Espresso (+1.64%) buying and selling at 167.45, continues the upward transfer from the $154.5 assist, RSI positively sloped at 55.51, MACD nonetheless unfavorable however transferring north.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is supplied as a normal advertising and marketing communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or ought to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.