On a day when Monday’s optimism had already pale in US markets, weighed down by each a brand new downgrade of the banking sector’s credit standing – this time by S&P – and the pullback of NVDA, one of the vital fascinating actions was the USD. With none actual information stream and with none abrupt actions within the bond market, the US forex appreciated steadily all through the day – slowly however certainly – particularly towards the currencies of the European continent (the YEN was saved from the promoting and that is one other piece of reports). This was a purely technical motion, with none vital ranges being weak – an adjustment of flows – however the EURUSD for instance fell 97 pips from the highs to the lows of the day. All this on the day that the BRICS assembly in Johannesburg began, there was speak of ”inevitable de-dollarisation’‘ and President Putin assured that the commerce in USD between the constituent international locations is now solely 28%. Again on the company aspect, retail is displaying far more blended outcomes than the official stats present: yesterday MACY‘s dropped 14% after reiterating its conservative outlook, whereas LOWE‘s rose 3% after beating expectations; Nike has been down for 8 consecutive classes, its worst streak ever. Immediately will see Peloton, Foot Locker, Abercrombie and particularly NVIDIA after the shut: implied volatility within the choices market is for an 8.8% transfer after the outcomes. Immediately is PMI day, tomorrow the Jackson Gap Symposium kicks off.

- FX – USDIndex -0.05% at 103.42 after rebounding on its 200 MA yesterday; EURUSD sitting on its ST assist (1.0855), CABLE 1.2748, YEN eked out a acquire yesterday and is now buying and selling at 145.667. USDCNH < 7.30.

- Shares – US and EU Futures greater (+0.28% US30/+0.56% US100/+0.42% US500/ +0.34% GER40); China50 -0.59% regardless of good BAIDU earnings outcomes.

- Commodities – USOil is under $80 ($79.54 now), UKOil comparatively stronger at $83.87.

- Gold – Rising at $1904.41, XAG outperforming (-1.17% at $23.67).

Immediately: HCOB PMIs Composite, Manufacturing, Providers in Germany, France, Europe, SP PMIs in UK, US, Residence Gross sales in US, European Client Confidence.

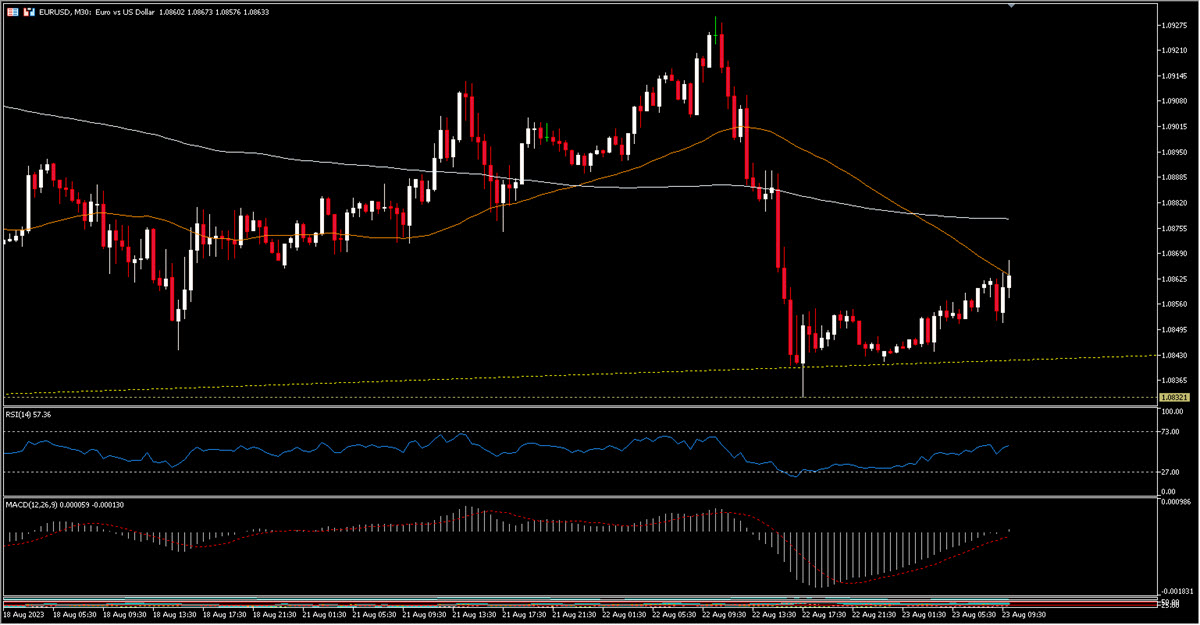

EURUSD, 30 minutes

Attention-grabbing FX Mover: EURUSD (+0.12% @ 1.0859) hovering across the assist space of 1.0840/1.0855 after falling from a excessive of 1.0930 to a low of 1.0832 yesterday. MA 200 at 1.08.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a common advertising and marketing communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or ought to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.