The inventory market has continued to construct on final month’s optimistic technical enhancements. Under is a chart of the and listed here are my takeaways.

- The index has superior above its downtrend line (purple line).

- The index is in a structural uptrend that started with the October 2022 low.

- The up-trending value motion is contained inside the notated value channel (blue traces).

- The index is above its 200-day shifting common.

- The index has lately superior strongly above two extra vital resistance areas (red-shaded traces).

The inventory market is continuous to construct optimistic technical momentum. So long as the S&P 500 continues to commerce above its 200-day shifting common and doesn’t fall decisively beneath the decrease finish of its up-trending channel, the market is bullish from a value perspective.

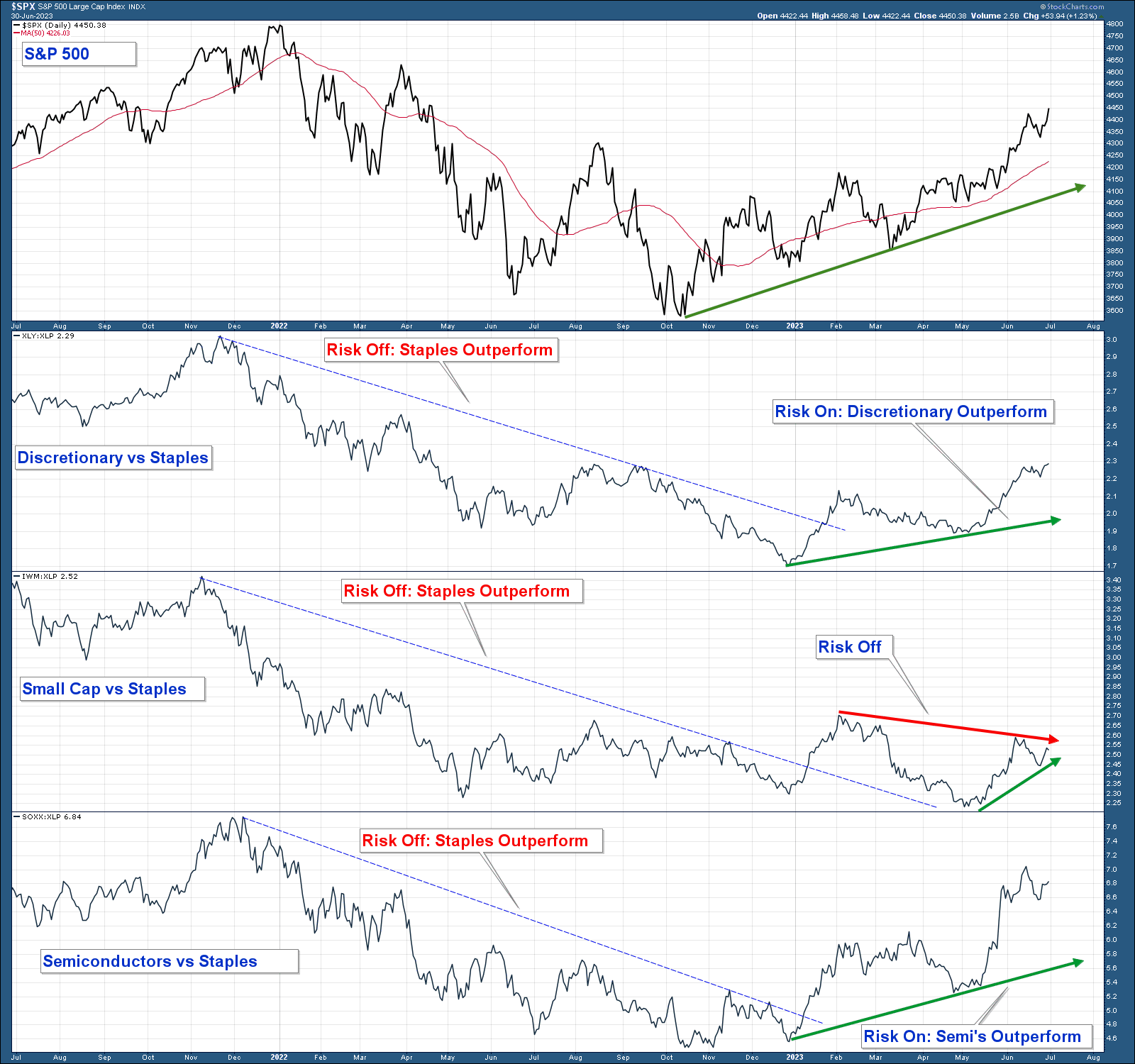

A powerful inventory market is commonly characterised by a risk-on atmosphere, the place buyers are likely to favor inventory classes that provide greater potential returns, regardless of the accompanying draw back dangers.

Within the chart beneath, I’ve plotted the relative energy of three risk-on funds in comparison with the Client Staples Choose Sector SPDR® Fund (NYSE:) which is a risk-off sector. Listed here are the important thing takeaways:

- When the risk-on group is outperforming, the road is rising, and when it’s falling it signifies that the risk-off Client Staples sector is outperforming.

- The market was in a decidedly risk-off atmosphere all through final 12 months’s market correction.

- Threat-on property began to outperform in January of 2023.

- Client Discretionary and Semiconductor inventory indexes proceed to outperform.

- Small Cap shares began to outperform two months in the past however are nonetheless far beneath their February peak.

Conclusion: The truth that risk-on property are outperforming because the inventory market advances above resistance is a bullish signal. It means that market individuals embrace higher-risk investments, indicating a optimistic outlook for the inventory market.

Whereas small-cap inventory’s relative efficiency has improved during the last couple of months, it’s nonetheless underperforming over the long term. If small caps outperform within the coming months it will be bullish for the general market. That is one thing that we are going to be watching carefully.

Small-Cap Shares

Small-cap shares have underperformed since March 2021. That 2021 underperformance was one of many destructive technical elements that warned of the market correction that adopted in 2022. The is now at an inflection level sitting proper at its downtrend line and beneath a few areas of resistance. Sector rotation is the lifeblood of a robust market; subsequently, if we see cash transfer into this asset class it will have bullish broad market implications.

Market Breadth

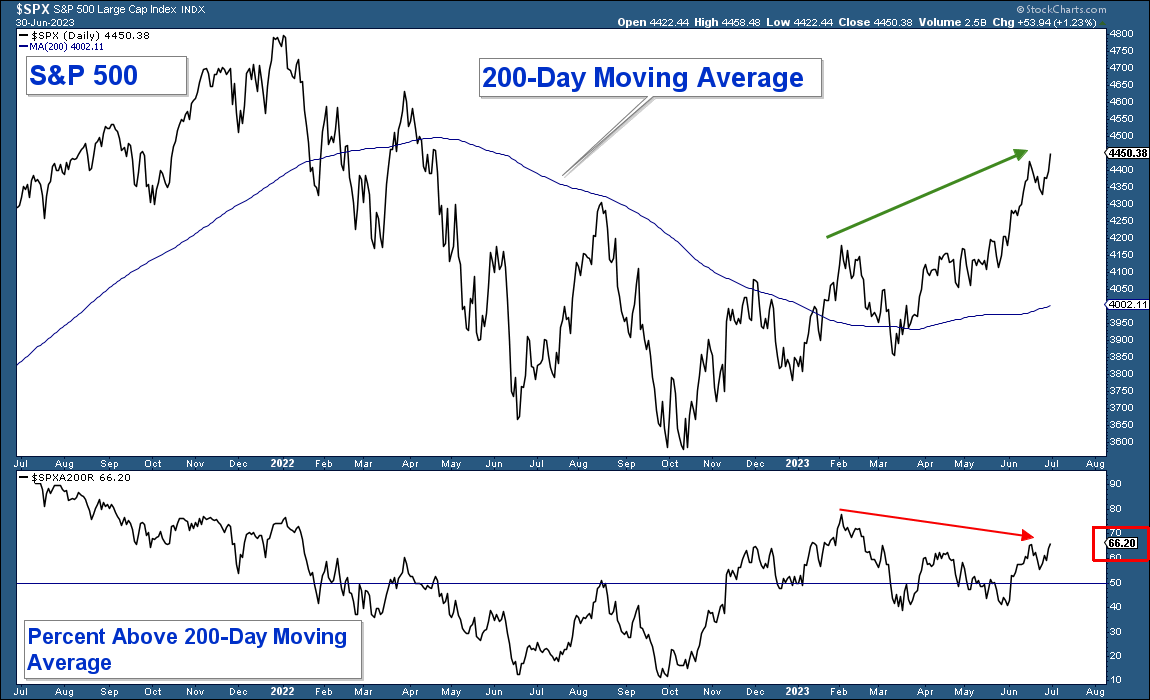

Market breadth has improved barely however the mega-cap shares are nonetheless doing many of the heavy lifting related to this 12 months’s market advance. Under is similar chart that I confirmed final month.

Within the prime panel is a chart of the S&P 500 Index, and within the decrease panel is a chart that tracks the variety of shares inside that index which might be above their respective 200-day shifting averages. Listed here are my takeaways.

- The S&P 500 has superior considerably above its 200-day shifting common.

- Nevertheless, solely 66% of shares inside that index are above their respective shifting averages. That is greater than final month (53%) however nonetheless beneath its February excessive (purple arrow).

Conclusion: Market breadth has improved however continues to be considerably weak.

Conclusion

General the market seems bullish from a technical perspective. Sure, there may be the problem of slim management however that may get resolved with time. The factor to look at within the coming weeks is for indicators of sector rotation which might counsel that this market has extra room to run.

The largest danger to the bullish situation that market technicals are sending is a recession. Most notable macroeconomists that I observe consider a recession is coming despite the fact that it could be a bit of later than initially predicted. If financial knowledge begins to verify these recession calls, the market will expertise a major decline.

To make use of a climate analogy, market technicals are predicting sunny skies with an opportunity of ominous thunderstorms.

***

Disclaimer: Each our conservative and aggressive fashions are invested defensively. Our web fairness publicity is minor and we personal each lengthy and quick positions.

I’ll proceed to regulate our web fairness publicity based mostly on the burden of the technical proof.