The next is a visitor submit from Christina Comben.

I first met Mark Moss on the entrance to the media middle by the principle stage at Bitcoin MENA in Abu Dhabi, the primary official Bitcoin convention on this a part of the world. We haven’t met earlier than however from his acquainted drawl, infectious persona, and volumes of insightful content material (together with a YouTube channel and best-selling e-book The Uncommunist Manifesto), I really feel I do know him already.

Mark has been championing the advantages of Bitcoin to anybody who will pay attention since 2016 and was a serial entrepreneur lengthy earlier than.

“I began a enterprise in 1999 on the peak of the dot-com increase. That crashed. I began one other enterprise in 2001, an e-commerce enterprise, it wasn’t straightforward,” he laments. “It was horrible timing. Everybody laughed at me and mentioned, nobody would ever purchase something on-line. I constructed that up and had an enormous exit on it.”

From Orange County to Abu Dhabi

What brings him to Bitcoin MENA in UAE’s opulent capital all the best way from his house in Orange County?

“I’m an educator and content material creator,” he says. “I’m additionally a accomplice at a Bitcoin Enterprise Capital fund, so we put money into the companies constructing on and across the Bitcoin ecosystem. I even have a brand new firm that simply went public in Canada referred to as Matador, and that’s working a Microstrategy play with Bitcoin as a steadiness sheet asset and investing via the Bitcoin Layer 2 house. So I’m actively educating and investing within the house to attempt to construct the world that I need to see.”

What sort of a world is that? For Mark, it’s firmly Bitcoin, not crypto. He’s been on the altcoin rollercoaster however sees no different cryptocurrencies with “long-term” endurance. “I definitely made some huge cash,” he says, “a lot of cash,” he repeats with added emphasis. I look forward to him to share the same old cautionary story of holding a stash all the way down to zero or getting rugged on the sh**coin on line casino, however he says:

“In 2017 and 2018, we had been competing for Layer 1s. Ethereum, Cardano, Litecoin, NEO… effectively, Bitcoin received that. So then the crypto narrative went to DeFi and that each one fell aside, then crypto went to NFTs, and that each one fell aside, and now it’s meme cash. Nobody’s pretending that’s world-changing expertise.”

He concedes that meme cash (and altcoins basically) might serve some objective as a “gateway drug” in bringing individuals over to Bitcoin. “Individuals come for the cash and so they keep for the liberty,” embarking on their Bitcoin journeys and discovering why they want permissionless, censorship-resistant cash within the first place.

“I believe stablecoins result in that as effectively,” he says, “ultimately individuals get used to having a pockets and transferring digital property, however then they marvel why their U.S. greenback stablecoins purchase them fewer items and providers, and why Bitcoin buys them extra, and I believe ultimately all of it kind of funnels over.”

The Flawed Fiat System and the Magic Cash Printer

Mark says the principle drawback with fiat is that it has no price of capital.

“Whenever you begin to perceive cash, you perceive that if printing cash made individuals rich, why don’t we simply print much more? Cash has to have a real price of capital. So gold, for instance, I’ve to purchase land and get tools and spend vitality and capital to get the gold, with Bitcoin, new cash are solely launched when you spend the cash and do the work to get them. So the capital has to have a real price. You’ll be able to’t simply print cash out of skinny air, in any other case, we’d all be wealthy.”

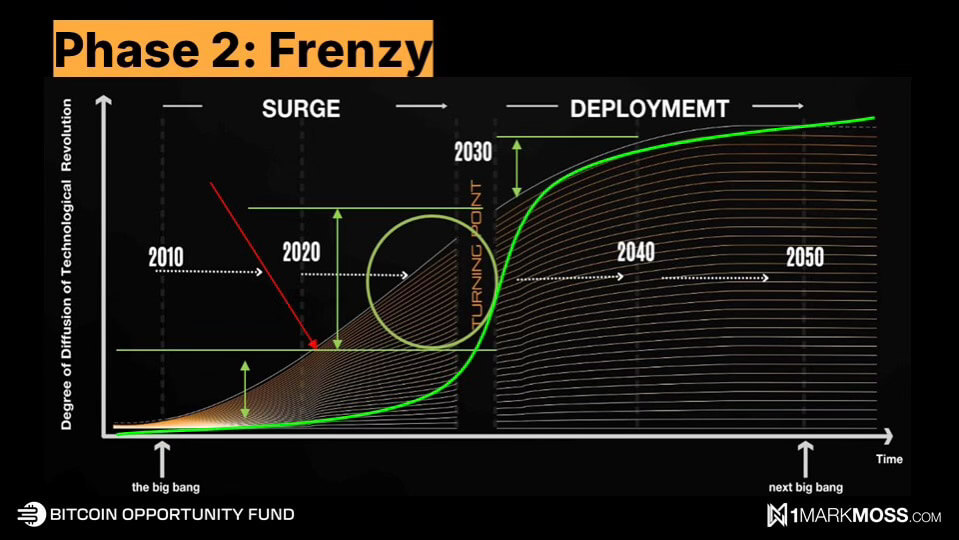

He factors to the S-curve mannequin for measuring Bitcoin adoption.

“The best way an S-curve works is the time it takes to get to 10% adoption is identical time it might take to get to 80-90%. So you may see that this second part [between 2020 and 2030] is the place we get essentially the most development. We had retail adoption which introduced [Bitcoin] to $1.2 trillion between 2010 and 2020, after which with institutional adoption, the 90% will come.”

What does a world with 90% Bitcoin adoption appear to be? Is there an inevitable collapse of the fiat system and Armageddon on the streets? Mark pauses and shakes his head.

“I believe one massive false impression is individuals suppose that for Bitcoin to get to $1 million [something Mark envisions cerca 2030] or $10 million per coin, then that implies that fiat is nugatory and now it’s $1 million for a gallon of gasoline, however that’s completely not true.”

A Readjustment of Retailer-of-Worth Belongings

He likens Bitcoin adoption to market disrupters like Uber and Airbnb saying,

“Airbnb takes a bit of bit from the lodges. It doesn’t imply lodges go away, similar to Uber continues to get increasingly more from taxis. Bitcoin isn’t taking away from the greenback. Bitcoin is taking away from different store-of-value property, like gold, equities, bonds, and actual property.”

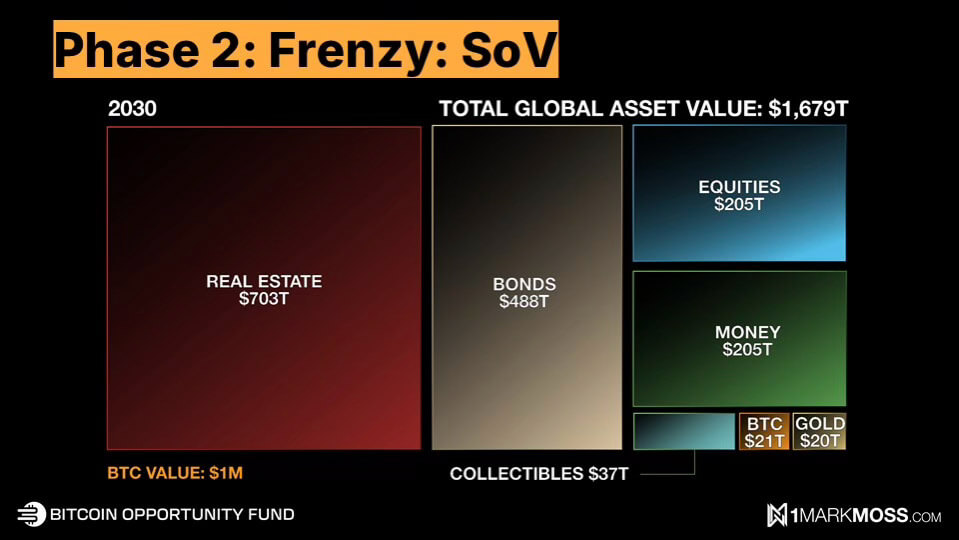

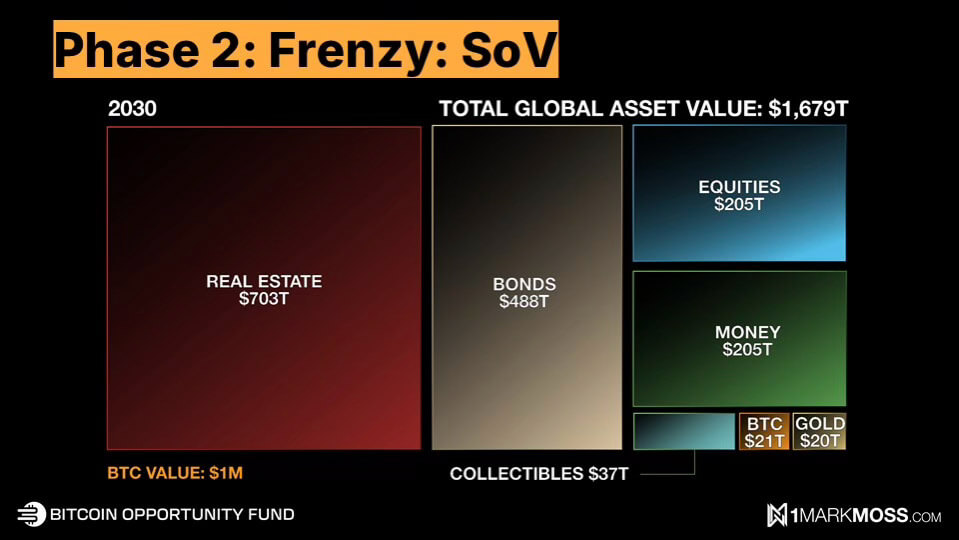

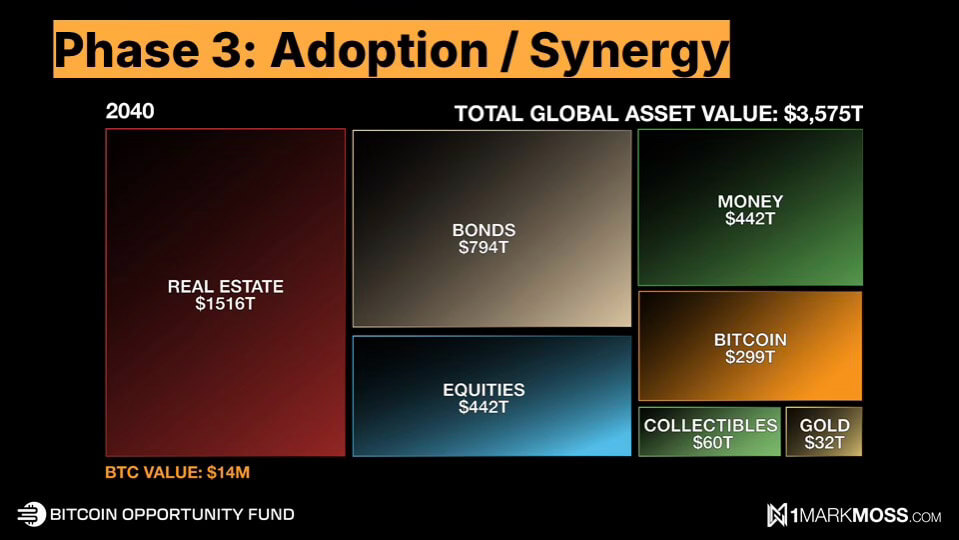

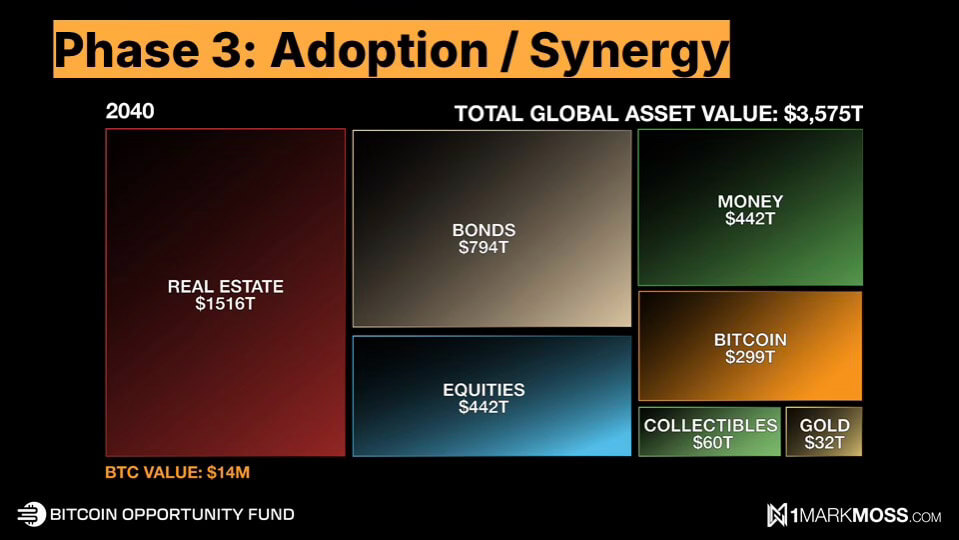

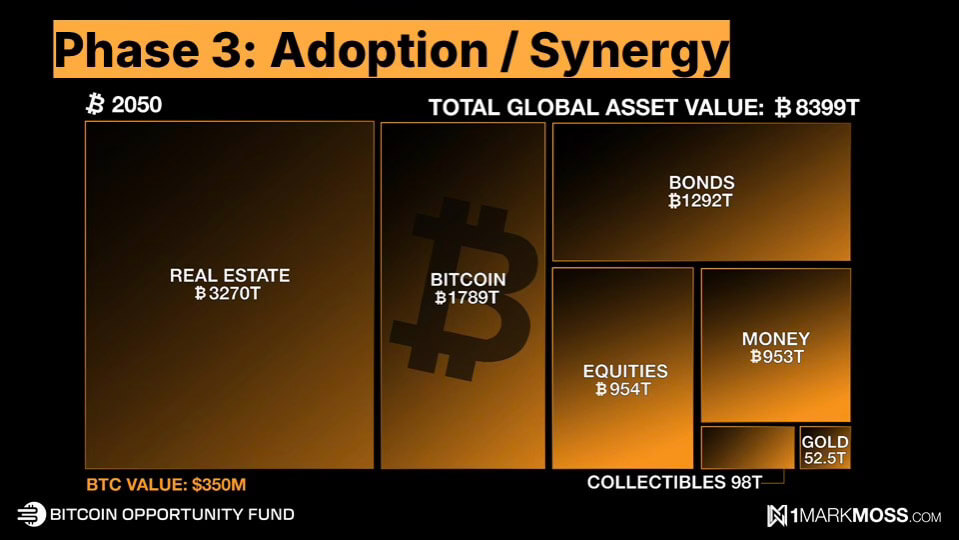

He pulls out three charts evaluating Bitcoin to store-of-value property as its value, dimension, and market cap develop.

“Bitcoin might develop to $21 trillion by 2030, which suggests $1 million per Bitcoin, however it doesn’t imply all these different property go away. It’s on par with gold. It’s taking a bit of bit from bonds, a bit of bit from cash, and a bit of bit from equities.”

“If we quick ahead to 2050, Bitcoin turns into the second greatest asset class, however it doesn’t imply the opposite asset courses go away… By 2050, I imagine all of the store-of-value property shall be priced in Bitcoin as a substitute of U.S. {dollars}, after which one Bitcoin shall be value one Bitcoin, as a substitute of $100,000 or $1 million.”

He brings up Gresham’s legislation in his argument for the continued existence of the greenback.

“Gresham’s Regulation states that unhealthy cash drives out good cash. So an instance is in the US, as much as 1965, quarters and dimes had been manufactured from pure silver. After ‘65, they began making them out of junk metallic. You’ll be able to’t discover a pre-65 quarter and dime in circulation anymore, and when you did, you wouldn’t spend it as a result of it’s value like $4. So that you’d put it aside. The unhealthy cash drove out the great cash, the pre-65s out. So I’ll at all times need to use fiat and retailer my Bitcoin.”

‘Good Occasions’ Forward for Bitcoin

The incoming President’s son, Eric Trump, gave a keynote on the occasion, proclaiming to “completely love Bitcoin,” congratulating Bitcoiners on their imaginative and prescient, stating that “America has to prepared the ground in a digital revolution,” and describing the second he referred to as his father at 6 am on the day Bitcoin hit $100,000, resulting in the now-infamous “You’re welcome” submit on Fact Social. So, does Mark count on a golden age forward for Bitcoin in the US? Will we see a resurgence of innovation and a return of the expertise that bled out to different jurisdictions throughout earlier administrations?

“The brand new administration will certainly be bullish for the trade,” he states. “It’s not likely that Bitcoin that was on the poll. What was actually on the poll was freedom. The liberty to decide on the way you need to retailer your cash, and the way you need to transact your cash.”

He sees Trump making a “a lot friendlier” setting for companies however doesn’t envision a mass return of the businesses that left. “When you’re gone, you’re type of gone. Why would you come again?” he asks. “However possibly we’ll decelerate the businesses which might be leaving and possibly extra will keep.”

What a couple of nationwide strategic reserve in Bitcoin igniting world Bitcoin recreation principle? He believes the possibilities are as excessive as 80%.

“I imply, RFK mentioned he would do it and he’s now within the Trump administration. Trump mentioned he would do it. We have now a purple Republican Home, Senate, and Presidency, and we have already got the invoice that’s been submitted by Senator Lummis. It simply must be authorized. Possibly it fails and so they’ll resubmit, however I might say within the subsequent 24 months that goes via.”

One other prediction Mark has for the subsequent 24 months is that U.S. banking establishments will begin custodying Bitcoin, promoting Bitcoin, and providing Bitcoin merchandise.

“Final 12 months the banks tried to overturn an SEC rule referred to as SAV21, which prevents banks from with the ability to custody Bitcoin. It received to President Biden and he vetoed it. So we all know they need to. They already tried to overturn it and Biden vetoed it. I’m guessing as quickly as Trump takes over they’ll resubmit it and it’ll get authorized… it’s good occasions,” he beams, “I’m optimistic. I’m very optimistic.”

If you wish to hear extra about Mark’s imaginative and prescient for Bitcoin and its phases of worldwide adoption, you may observe him on X, catch his keynote from Bitcoin MENA, or watch his instructional movies on his YouTube channel.