US Greenback (DXY) Information and Evaluation

- Constructive manufacturing knowledge lifts the downtrodden greenback

- DXY technical issues: bounce at help gives help for growing pullback

- The evaluation on this article makes use of chart patterns and key help and resistance ranges. For extra data go to our complete schooling library

Beneficial by Richard Snow

See what our analysts foresee in Q1 for USD

Constructive Manufacturing Knowledge Lifts the Downtrodden Greenback

In a fairly surprising flip, the greenback has acquired a welcomed increase after considerably higher than anticipated knowledge from the NY Empire State Manufacturing Index. The index, after registering 4 successive prints beneath zero (indicating a contraction), rose to 10.8 when solely forecasted to return in at -18.

Customise and filter stay financial knowledge through our DailyFX financial calendar

US Greenback Basket (DXY) Technical Issues

Manufacturing knowledge as a complete has lagged the extra necessary providers business however the newest decide up within the NY Empire State variation has despatched the greenback greater on the day to this point, extending the pullback that gained traction in the direction of the tip of final week.

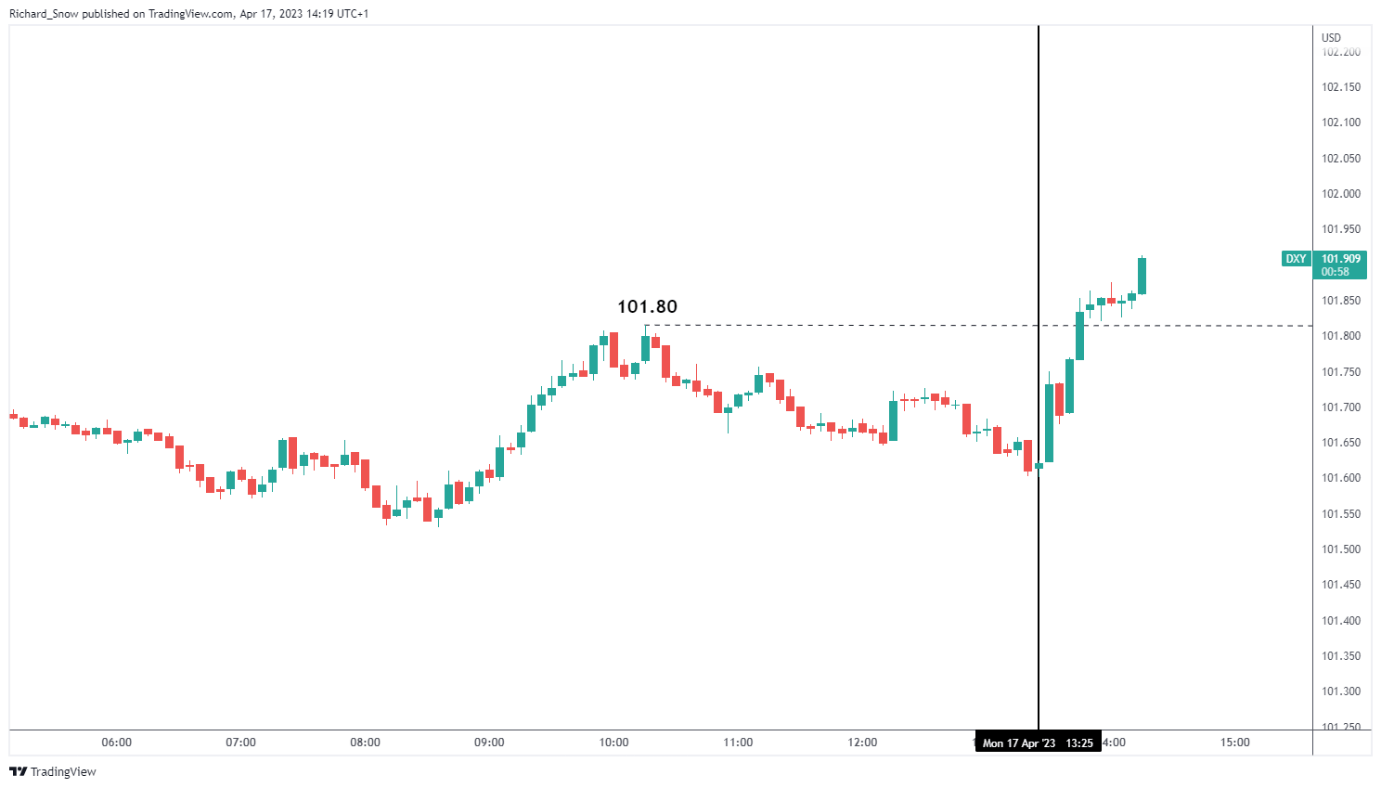

Greenback Basket 5-Minute Chart

Supply: TradingView, ready by Richard Snow

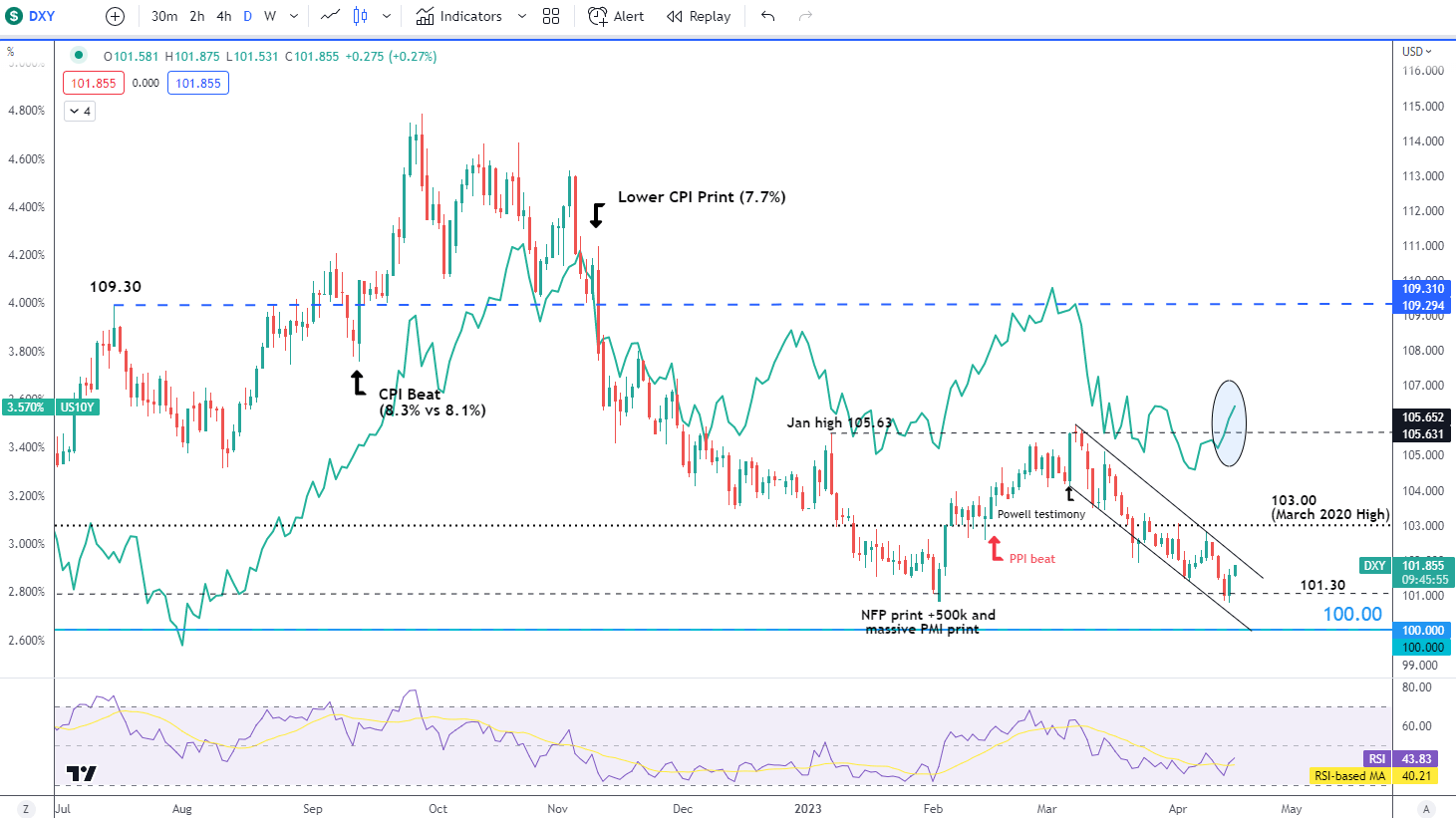

The greenback has roughly been buying and selling in-line with the 10-year treasury yield and the newest transfer to the upside coincides with one other leg greater in US charges. DXY stays throughout the descending channel because the broader bearish development continues. Nevertheless, if a reversal is afoot, greenback bulls shall be looking out for a bullish channel breakout and an try at buying and selling in the direction of 103.00.

A bearish continuation entertains decrease ranges like 101.30 and the psychologically necessary 100 degree.

US Greenback Basket (DXY) Each day Chart with the 10-Yr Treasury Yield

Supply: TradingView, ready by Richard Snow

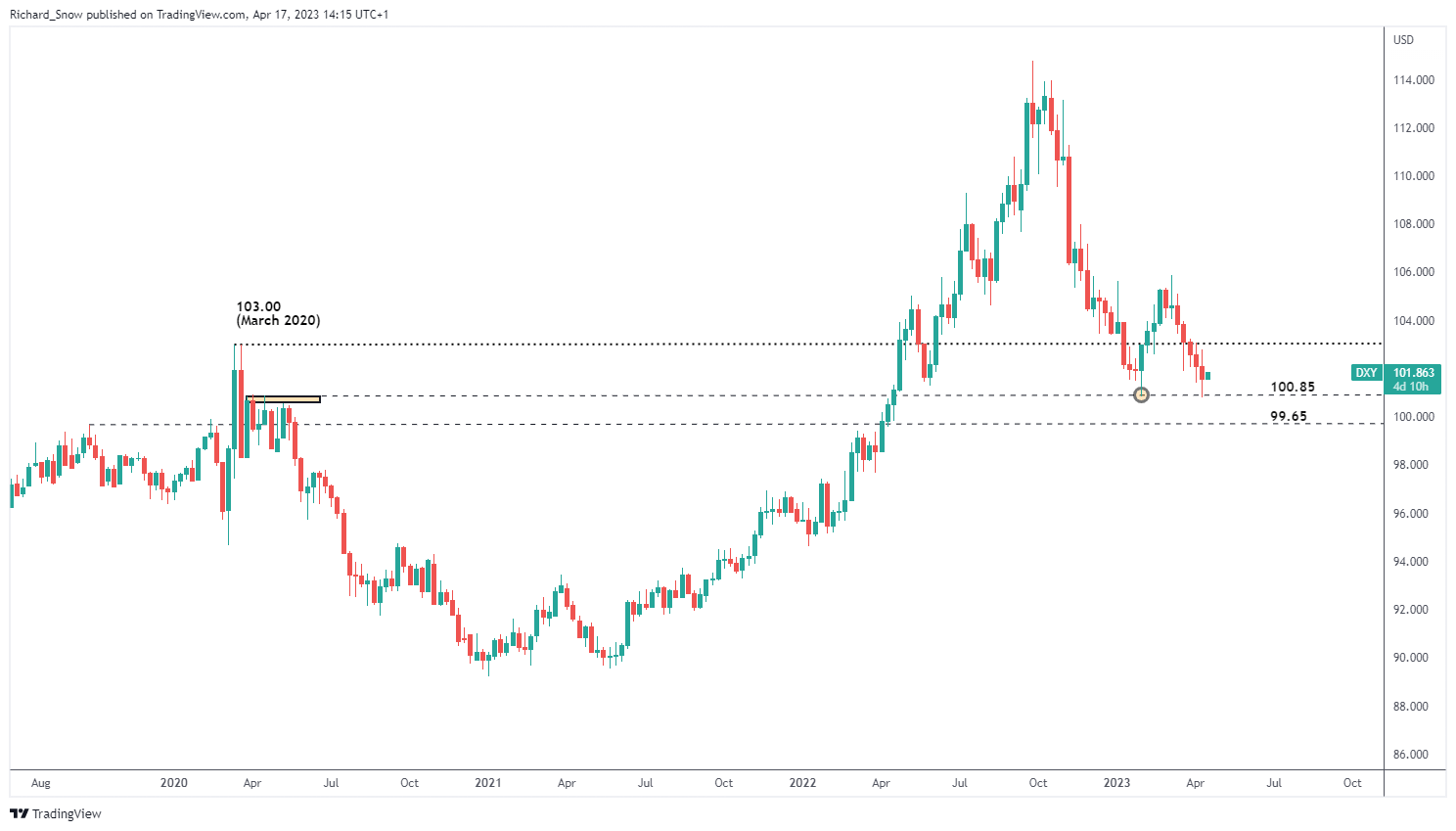

There’s something to be mentioned a couple of potential greenback pullback as final week’s US inflation knowledge proved that regardless of headline inflation dropping like a stone, core inflation (headline inflation excluding extra risky gadgets like gas and meals) edged barely greater. This now has markets revising their rate of interest expectations greater, which is supportive of a short greenback pullback at the very least. The weekly chart beneath suggests {that a} short-medium time period reversal could also be within the works as costs did not selloff past 100.85 and now commerce greater.

DXY Weekly Chart

Supply: TradingView, ready by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and observe Richard on Twitter: @RichardSnowFX