simpson33

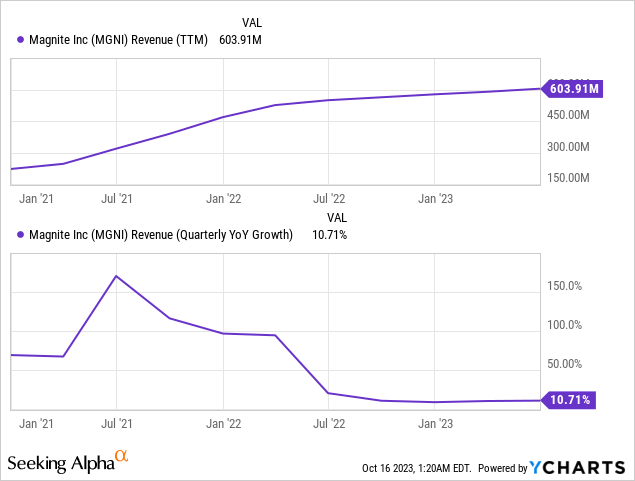

Magnite (NASDAQ:MGNI) was a high-flying firm whose inventory reached $60+ on a wave of CTV enthusiasm and progress (a lot of it by acquisitions) however has now fallen again to earth as CTV and the digital advert market, generally, are going by a tough patch.

FinViz

Our optimism of 2022, which was predicated on CTV progress and integration advantages, while arguing any recession was already priced in, panned out solely partially.

The recession hasn’t materialized even when the digital advert market goes by a tough patch. The mixing advantages have arrived with administration anticipating $100M+ in free money movement this fiscal yr.

The shock has been the slowing of CTV progress. We did not see that coming. But we expect even that’s priced in right here and we see a number of causes to be optimistic:

- The digital advert market will get well sooner or later.

- The corporate is gaining market share.

- The corporate is finished digesting its acquisitions and integrating platforms and now has vital assets to develop new options.

- A shift in direction of programmatic adverts harm within the short-term however might be helpful within the longer run, additionally with the assistance of recent high-value companies

- Administration nonetheless guides for $100M+ in free money movement this yr.

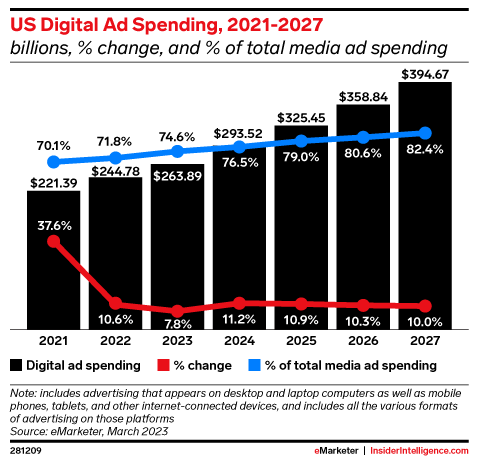

Digital advert market

Administration seen softness in its managed service enterprise, which is unlucky as that is the enterprise with the best take charge. They argue that it is simply an air pocket (Q2CC):

a few of these campaigns seemed to be paused reasonably than fully taken off the desk. We expect that it is type of, as our gross sales crew described earlier, an air pocket for a number of months right here. And so we’re comfy with some restoration on the managed service entrance. After which I believe the remainder of the enterprise, as Michael talked about, from an advert spend share perspective, the enterprise is definitely very wholesome

However we’ll need to see about that. Progress is broadly anticipated to be much less buoyant in comparison with the pandemic heyday, however that is not shocking:

The B2B Home

From Axios:

The slowdown within the advert market contributed to an enormous sell-off throughout the media, leisure and expertise sectors final yr. That resulted in a report variety of layoffs and varied cost-cutting measures at media and tech corporations in 2022 and early 2023. Driving the information: Analysts are optimistic that promoting progress will enhance within the second half of the yr, with knowledge exhibiting the financial system transferring in the fitting course.

- “We expect the underlying tone is optimistic,” Tim Nollen, Macquarie senior media tech analyst, wrote in an analyst be aware

- Nollen pointed to a newly-released second quarter GDP report that confirmed whereas shopper spending has slowed to +1.6%, enterprise funding spending popped to +7.7%.

- “We have now discovered this to be probably the most related main indicator of advert spending traditionally,” he added.

The final sentence additionally reveals the precariousness of the optimism, an additional slowdown within the financial system might shortly sniff it out so we’re not counting our chickens but right here, though it is more likely to be a very powerful driver of the inventory.

Market share and shift to programmatic

CTV ex-TAC (visitors acquisition value) grew 8% y/y and DV+ ex-TAC grew 10% y/y, this is not massively above market progress at first sight. Nevertheless, administration seen a major pattern in Q3 (Q2CC):

the biggest and fastest-growing streaming gamers, the broadcasters, plus companies and TV OEMs are all getting really critical about programmatic and are taking share from smaller CTV publishers. We’re seeing this shift present itself in our personal companions, together with Disney, Roku, Warner Brothers, Discovery, and Vizio who’re transferring extra stock towards programmatic transactions and away from conventional direct bought executions.

This isn’t income impartial (Q2CC our emphasis):

As all of these massive sellers transfer direct-sold offers to writer direct programmatic, they’re changing into a much bigger a part of our advert spend combine however they’re counting on companies with decrease take charges. What’s not exhibiting up in our financials is that we’re rising market share at a far higher charge than our income would counsel.

Nonetheless, administration sees an enormous alternative right here long run as it’s profitable these top-tier purchasers and with new higher-value SSP (sell-side platform) companies when progress returns the charges will enhance and this improvement will categorical itself within the financials.

New Companies

What are these new higher-value SSP companies? Administration described:

- SpringServe

- ClearLine

- Magnite Entry

- After the shut of Q2, we will add the brand new Demand Supervisor options

That administration talked about SpringServe shocked us just a little as this was an acquisition courting again to 2021, however administration argues that it continues to win new ad-serving purchasers, introducing new codecs and direct personal marketplaces between businesses and premium publishers.

ClearLine was launched in April this yr, it is a self-service direct video shopping for resolution for advert businesses. Magnite Entry is (Q2CC):

a set of omnichannel viewers knowledge and id merchandise that make it simpler for media house owners and they’re having promoting companions to maximise the worth of their knowledge property, together with a DMP, an information storefront, a safe resolution enabling sellers and patrons to match datasets and extra.

It is nonetheless partly in beta. Administration argued we should not anticipate a lot in the way in which of fabric financials from these but, however in time they may produce that.

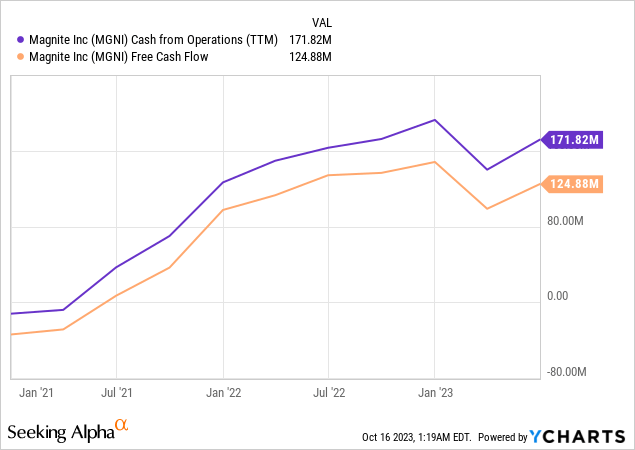

Money movement

We expect traders are to some extent overlooking the next:

Administration initiatives $100M+ in free money movement this yr which on an anticipated income of $546.4M is a really wholesome 18.3% free money movement margin.

That is throughout macro headwinds (the TTM determine is even larger, as readers might need famous within the graph above) and with the seasonally stronger H2 nonetheless to return.

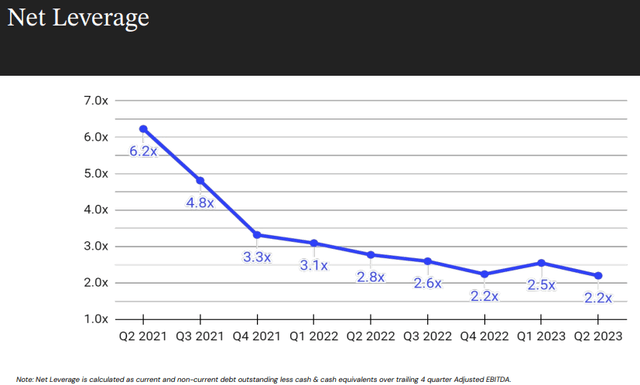

Money movement confers choices and needs to be cherished in instances of excessive financing value. One of many choices the corporate is selecting is to deleverage. The corporate retired $40M of excellent notes for $34M in money leading to a reduction of 15% with $310M of notes left.

Over $90M or 23% of the notes have already been retired, and the overall debt of the corporate is $638.6M with internet debt at $372.3M.

There’s a new $100M buyback fund in place for each the notes and inventory, and administration believes that internet leverage, which was all the way down to 2.2x from 2.5x on the finish of Q1, might be beneath 2x at yearend.

MGNI Earnings Deck

Other than the appreciable money movement, money was $266M on the finish of Q2, a rise from $237M on the finish of Q1.

Funds

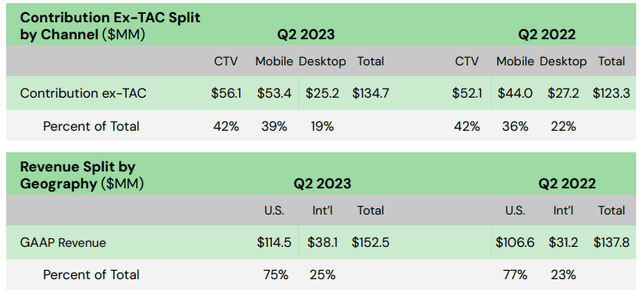

BY class and geography:

MGNI Earnings Deck

Just a few notable developments that impacted financials:

- The ex-TAC contribution combine for Q2 was 42% CTV, 39% cellular, and 19% desktop.

- The MediaMath chapter resulted in a one-off $4.5M dangerous debt cost.

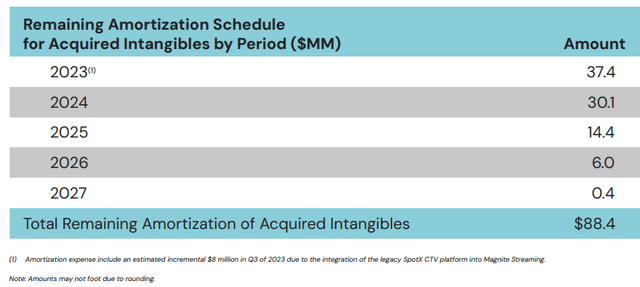

- The corporate’s GAAP figures are massively impacted by the $53M amortization expense (therefore the big GAAP internet loss).

- The corporate is principally performed integrating varied platforms and it will unencumber an enormous quantity of individuals and assets for creating new merchandise.

MGNI Earnings Deck

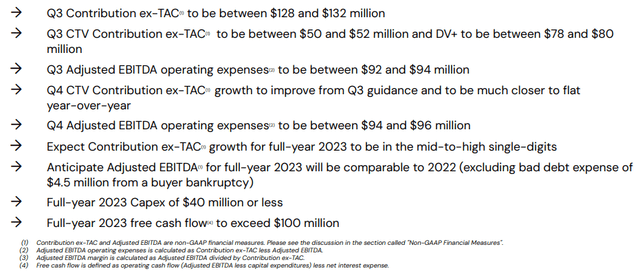

Steering

MGNI Earnings Deck

H2 has tough comps as a consequence of excessive political spending in This fall final yr.

Valuation

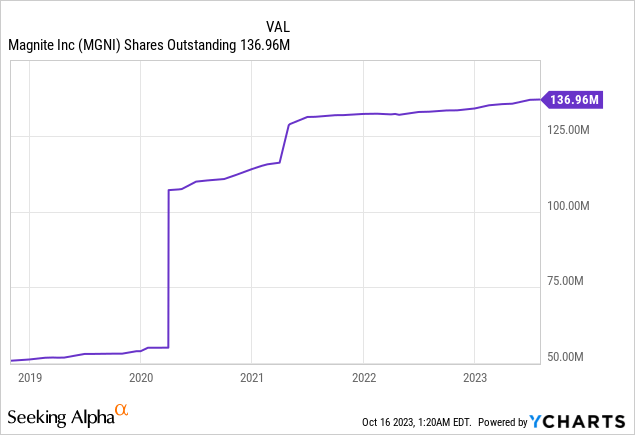

There are 146M shares totally diluted, at $7.5 per share this quantities to a market cap of $1.09B and an EV of $1.47B, which produces an EV/S of two.7x. With FY23 EPS estimated at $0.52 rising to $0.77 subsequent yr, the shares are low cost on an earnings foundation.

Conclusion

There’s fairly a bit to love:

- The corporate is well-positioned to learn from a restoration within the digital advert market, at any time when that arrives.

- The corporate is gaining market share.

- The corporate is finished digesting its acquisitions and integrating platforms and now has vital assets to develop new options, a number of of those are already rising.

- A shift in direction of programmatic adverts harm within the short-term however might be helpful within the longer run, additionally with the assistance of recent high-value companies.

- Administration guides for $100M+ in free money movement this yr and on a TTM foundation, the corporate is definitely already exceeding this by some margin, enabling it to cut back leverage.

- The shares are surprisingly low cost.

There are some issues as nicely:

- The streaming revolution might need topped out, though the identical does not essentially apply to the advert market on streaming, which we expect will proceed to develop for fairly a while.

- We do not know when the macro headwinds will subside and whereas it lasts the lower in managed service and improve in programmatic has a unfavourable impact on take charges and therefore financials.

The upshot: There are good causes to anticipate a major rally within the shares when the clouds raise over the digital advert market, however it’s very tough to time this to perfection. One might accumulate some shares on dips and never anticipate an excessive amount of near-time, even when the shares might take off at any second.