Walter Bibikow

Over the previous couple of years, the Macerich Firm (NYSE:MAC) has skilled important upside and draw back volatility, which has been related to notable share issuances to fund the money movement gaps and subsequent restoration adopted by yet one more disappointment when it comes to extra fairness dilution.

In Q1, 2024 we noticed an identical sample, the place the brand new Administration introduced an aggressive plan to convey down the leverage by divesting non-core property, directing surplus liquidity towards debt discount, and, importantly, tapping the secondary fairness market so as to speed up this course of.

Provided that MAC certainly has a really sturdy asset portfolio consisting of trophy-like malls, there may be undoubtedly a substantial worth potential embedded in MAC. Again when the earlier earnings report was launched, I issued an article on the Firm, arguing that underneath extra balanced leverage ranges, MAC could possibly be a really nice choose for earnings traders. But, my advice was to pause a bit and let the brand new Administration ship the primary outcomes on the capital construction targets (together with issuing these extra shares to entry the required funding) that will reduce the uncertainty a bit.

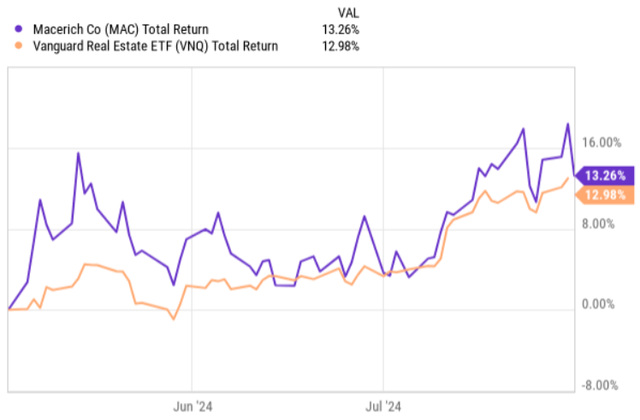

Because the issuance of my earlier article on MAC, the inventory has carried out effectively and is kind of consistent with the general REIT market. Nonetheless, given the extent of threat that MAC carries in addition to the truth that on a TTM foundation, MAC trails the index by ~19%, one would count on a lot increased reward from an extended place on this REIT.

YCharts

With this being mentioned, let’s now check out the just lately printed Q2 2024 earnings outcomes and see how the Administration is progressing with the bold targets to get the Firm again on monitor.

Thesis

As one may have anticipated, the Q2 efficiency didn’t end in rising FFO technology because of the numerous transactions related to portfolio clean-up and debt discount. In truth, the inherent money movement unpredictability that comes with such notable strikes led the administration to droop the FFO steering earlier this yr.

The FFO per share got here in at $0.39 per share, which is $0.01 per share beneath the Q2 2023 end result. The first purpose for this drop is the mixture of flat gross sales and rising curiosity expense part, which additionally consists of the accruals for potential tenant bankruptcies.

One of many key metrics driving the FFO efficiency – occupancy degree – decreased by 10 foundation factors to 93.3% (relative to the earlier quarter). In comparison with the identical interval final yr, the occupancy degree is up by 70 foundation factors, which ought to theoretically additionally contribute to the upper FFO per share determine.

Nonetheless, the seven tenant bankruptcies did certainly impose a headwind on MAC’s FFO technology. The biggest tenant chapter was Specific, which has 26 separate places taking 206,000 sq. ft in MAC’s portfolio. Of those 26 places, 10 are set to be closed, which might convey down the general portfolio occupancy by 40 foundation factors (we must always see a full impression on this in a Q3 report).

A further side that provides strain on MAC’s occupancy (and thus FFO technology) is the 2024 lease expirations, which normally end in some additional location vacancies. Nonetheless, as of Q2 2024, MAC had already dedicated 76% of the expiring sq. footage and signed a letter of intent with tenants representing one other 18% of the expiring house. It is a very stable statistic, the place even the Administration has communicated that it expects the 2024 renewal retention price to be very wholesome (i.e., within the low 90% vary). In different phrases, the reliance on new tenant attraction is about to be fairly low this yr, benefiting MAC not solely from the occupancy perspective but in addition via the inherently decrease CapEx spend that normally comes with full retailer refurbishment (or changes) for the brand new tenant wants.

Now, if we additional dissect the Q2 information factors, we are going to see that the Administration has certainly been very energetic in delivering on the steadiness sheet targets. As an example, throughout Q2 MAC offered an Outparcel deal for $7.1 million, and totally divested its 50% JV curiosity in Biltmore Style Park, which is able to permit to entry $110 million recent liquidity. On the mortgage giveback finish, MAC stepped away from Nation Membership Plaza property and, as of Q2, had been nonetheless within the discussions with lenders about probably defaulting Santa Monica Place. Right here, the mixture of those proceeds from asset gross sales and mortgage givebacks will allow MAC to cut back its excellent debt by circa $564 million.

For my part, this could possibly be deemed as very stable progress, sending the appropriate message for traders that the method of attaining the goal capital construction shall be comparatively fast and productive. In truth, the Administration now expects to lower the excellent debt by $1 billion to $1.4 billion by the top of 2024. If MAC succeeds and retires $1 billion of debt throughout this yr, half of the pre-communicated debt discount goal shall be already met.

We’ve to additionally consider that the portfolio simplification course of will not be solely about divesting non-core property but in addition about enhancing the prevailing core property in addition to rising the JV pursuits in these properties, that are important for MAC’s technique. As an example, throughout Q2, MAC acquired the remaining 40% minority curiosity from its companion in Arrowhead and South Plains by paying roughly $37 million.

With the intention to execute this system successfully at comparatively low, it’s essential to have entry to optimum financings. Right here, Scott Kingsmore’s commentary within the latest earnings name sends clearly a optimistic sign on this entrance:

The financing marketplace for Class A retail actual property stays extensive open and may be very, very sturdy. 12 months-to-date in 2024, we now have closed 5 transactions totaling almost $700 million or $539 million at our share. This follows a really sturdy 2023, throughout which our financing exercise totaled $2.6 billion or $1.8 billion at our share.

With all of this being mentioned, we now have to confess that the present leverage (together with the goal degree for the top of 2024) remains to be comparatively excessive. Throughout the H1 2024 interval, after conducting a number of notable asset gross sales and retaining a part of undistributed FFO technology, MAC has introduced down the leverage from 8.76x to eight.48x. The expectation is to cut back it additional to the low 8x vary by the top of 2024.

The Backside Line

In a nutshell, the Q2 2024 earnings report introduced a number of optimistic messages, particularly, on the steadiness sheet optimization entrance. Even the underlying portfolio efficiency was, in my view, stable on condition that the FFO per share declined solely by $0.01 towards the backdrop of a number of headwinds (e.g., tenant bankruptcies, incremental dangerous debt accruals).

Nonetheless, the present leverage profile nonetheless stays too excessive for me to enter, particularly contemplating the uncertainty round additional bankruptcies and, importantly, MAC’s monitor file of failing to optimize the steadiness sheet correctly. In my humble opinion, it’s value ready for a few quarters to see how the progress is continuous and getting into the Firm at a extra balanced monetary threat.