Bim

LyondellBasell Industries N.V. (NYSE:LYB) operates as a chemical firm in the US, Germany, Mexico, Italy, Poland, France, Japan, China, the Netherlands, and internationally.

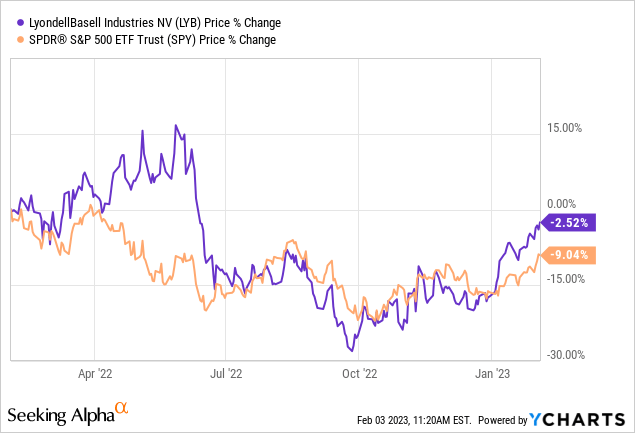

Prior to now 12 months, LYB’s inventory has barely outperformed the broader market, regardless of the sharp inventory value decline mid-2022.

In as we speak’s article, we’re going to check out LYB’s inventory from a number of angles to find out if it might be a horny purchase on the present value ranges. First, we’ll briefly study the enterprise from a profitability and effectivity perspective, whereas reflecting additionally on the newest earnings figures. On the finish, we may even talk about how the agency is returning worth to its shareholders.

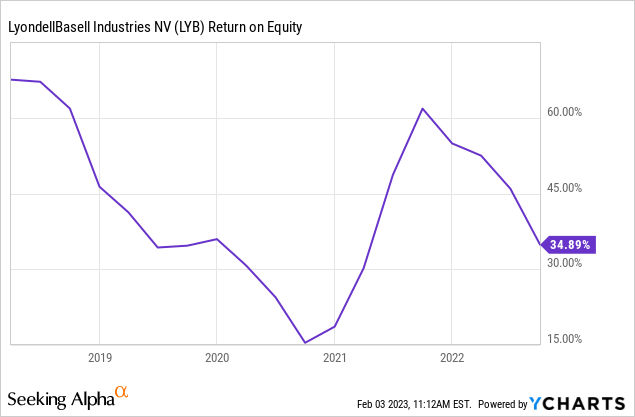

Return on fairness

ROE is a crucial measure of economic efficiency and it’s typically used to gauge the company’s profitability and its effectivity of producing earnings. Generally, we like this measure staying steady over time. LYB’s ROE has declined considerably over the previous 5 years.

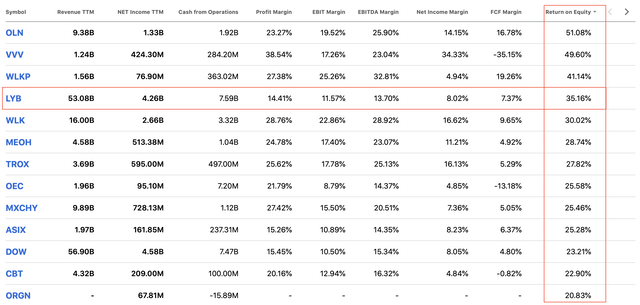

Regardless of the decline, LYB’s ROE nonetheless stays enticing within the commodity chemical compounds business.

Comparability (Looking for Alpha)

Earlier than sounding too alarming in regards to the declining ROE, we even have to grasp what elements have been precisely driving this development. Because of this, we can be decomposition the ROE to 3 components, specifically the online revenue margin, the asset turnover and the fairness multiplier.

ROE decomposition (inestopedia.com)

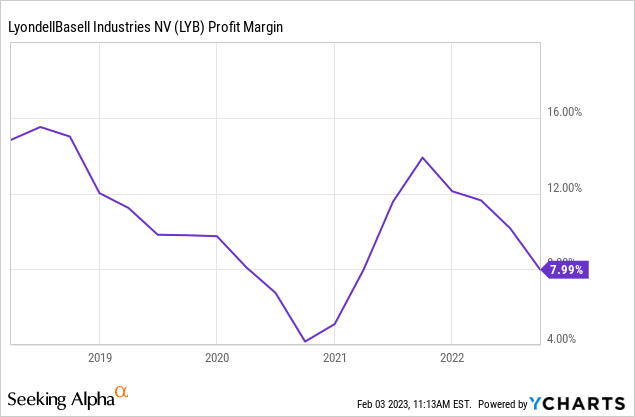

Internet revenue margin

Internet revenue margin measures how a lot internet earnings or revenue is generated as a proportion of income. This measure has seen a pointy improve after the pandemic, but it surely began to say no once more after its peak in 2021.

To grasp this improvement, we’ll take a look at the agency’s newest earnings report.

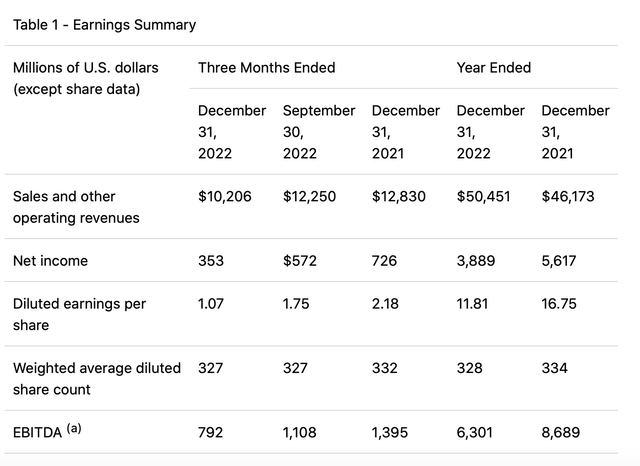

Within the fourth quarter, LYB’s gross sales and earnings have been considerably harm. The decline of the monetary efficiency might be largely defined by the difficult macroeconomic setting, together with inflationary pressures and elevated vitality and uncooked materials costs, and in addition not directly the poor shopper sentiment.

Earnings abstract (LYB)

The agency has acknowledged these headwinds of their newest press launch, stating the next:

Over the total yr, petrochemical markets have been pressured by excessive and risky vitality and feedstock prices in addition to softer world demand. The corporate’s Olefins & Polyolefins companies encountered headwinds from diminished demand in Europe and Asia in addition to world capability additions. Decrease shopper demand for sturdy items compressed margins for a number of merchandise within the Intermediates & Derivatives section. Oxyfuels and refining margins benefited from elevated world mobility and favorable markets.

In consequence, gross sales have declined and margins have contracted.

Going ahead, nevertheless, we aren’t anticipating this decline to proceed. There are a number of causes to help our speculation.

1.) The macroeconomic setting is more likely to preserve bettering in 2023. Vitality and uncooked materials costs have already began normalising within the second half of 2022. We anticipate this improvement to proceed. The bettering shopper sentiment can be more likely to proceed within the coming quarter, although its tempo could gradual considerably. These collectively could result in improved gross sales and increasing margins. In This fall, we have now already seen some promising outcomes pushed by these developments

Decrease product costs have been partially offset by moderating vitality and feedstock prices. Margins for merchandise from LyondellBasell’s oxyfuels and refining companies remained nicely above typical fourth quarter ranges.

2.) The agency’s new strategic course/initiatives additionally seem enticing:

In 2022, the corporate launched a complete overview of our technique. Preliminary strategic actions included the choice to exit the refining enterprise and the sale of the Australian polypropylene enterprise. The Round & Low Carbon Options enterprise unit was created to speed up progress in capturing worth from serving the quickly rising buyer demand for recycled and renewable options. Organizational and cultural initiatives are being applied to extend concentrate on agility, accountability and worth era. In October, the corporate launched a price enhancement program that’s anticipated to generate $750 million in recurring annual EBITDA by the top of 2025. Progress on this program is on monitor.

Have in mind, nevertheless, that dangers associated to each of those factors exist. The quickly altering geopolitical scenario, particularly the developments within the Japanese European area, can have substantial influence on each vitality and uncooked materials costs within the close to time period. Additional, whereas the agency’s progress as regards to its strategic initiatives is on monitor as of now, they should preserve executing successfully and effectively to ship the promised worth era.

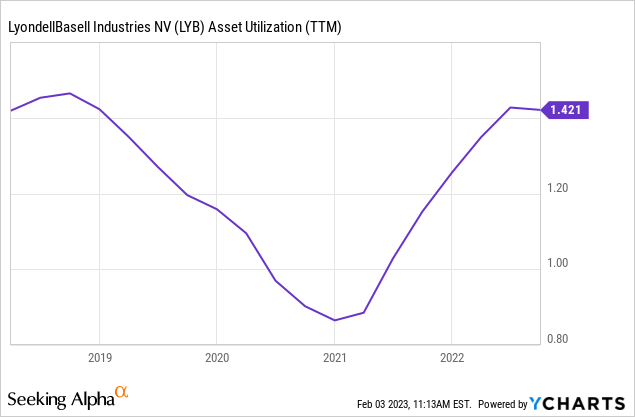

Asset turnover

The asset turnover ratio (or typically known as asset utilization) measures the worth of an organization’s gross sales or revenues relative to the worth of its belongings. It signifies how successfully the corporate is utilizing its belongings to generate gross sales.

Whereas the margins have been harm previously quarters, LYB’s asset turnover has reached pre-pandemic ranges.

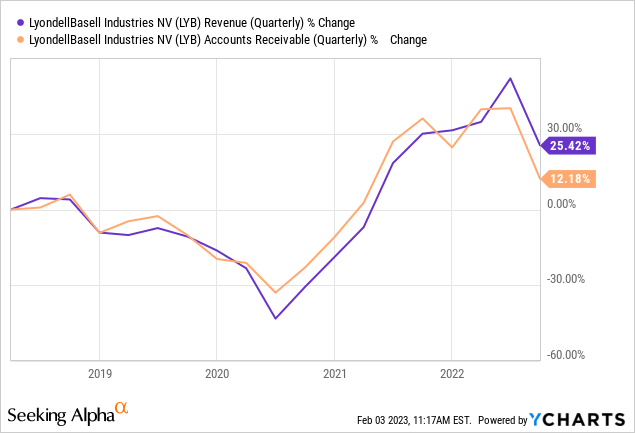

It has primarily been fueled by rising gross sales. Additionally essential to grasp that regardless of the difficult macroeconomic setting, the gross sales improve has not been a results of aggressive accounting practices, which is a promising signal. The rise in accounts receivable in comparison with the rise in gross sales can be utilized to gauge the potential aggressiveness of the accounting practices.

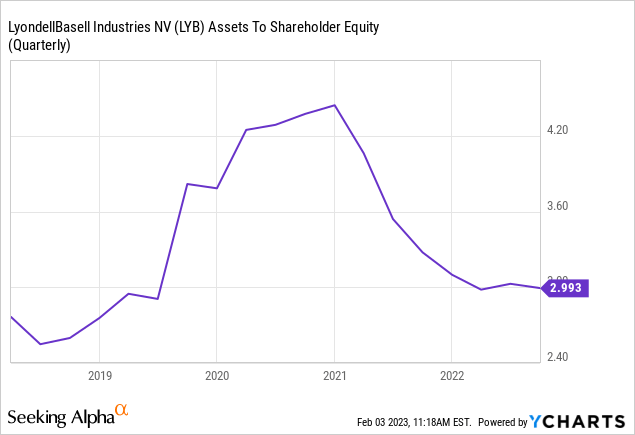

Fairness multiplier

The final a part of the three step decomposition of the ROE is the fairness multiplier, which is just the ratio of belongings to shareholder fairness. The next ratio signifies extra leverage, which means that the agency is utilizing a bigger quantity of debt to finance its belongings. This ratio has been steadily declining since 2021, approaching additionally pre-pandemic ranges.

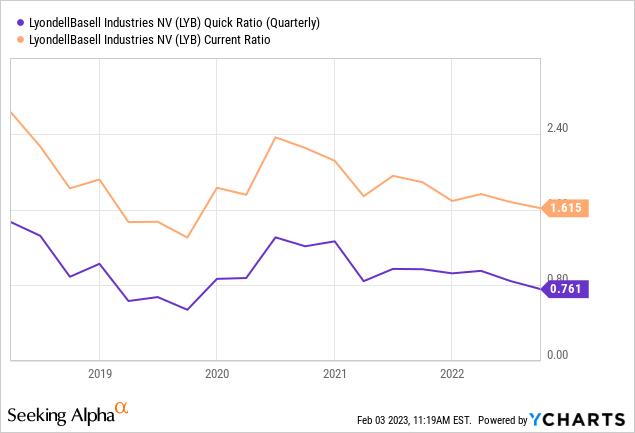

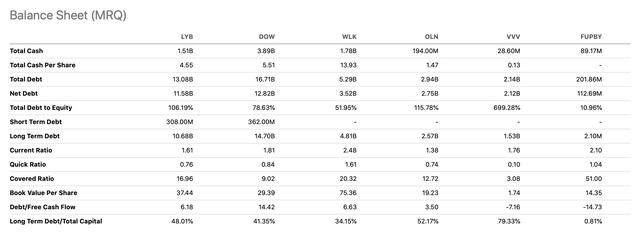

We want to see this improvement proceed, and we additionally want to see an enchancment of the liquidity ratios, which have been steadily lowering over the previous years.

Whereas these liquidity ratios are akin to ratios of LYB’s friends/opponents, we usually prefer to see them above 1, to be sure that the agency has sufficient monetary flexibility, particularly throughout occasions of downturns.

Comparability (Looking for Alpha)

Returns to shareholders

Earlier than we conclude our writing, we want level out two essential sources of shareholder returns. The dividends and the share buybacks.

Dividends

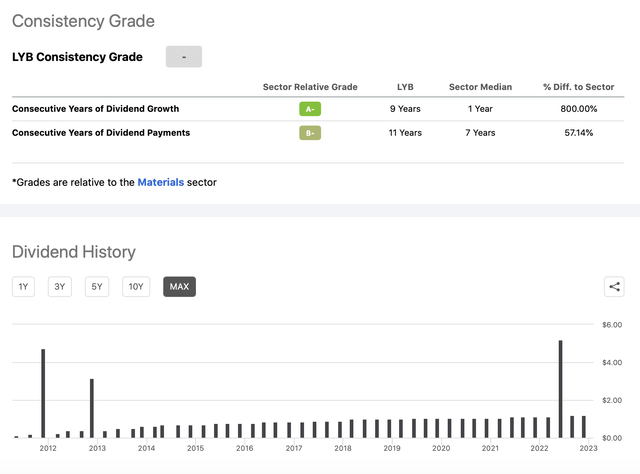

Many have been contemplating investing in LYB’s inventory on account of its excessive dividend yield. The agency presently pays a $1.19 quarterly dividend, which is equal to an annual yield of virtually 5%, which undoubtedly makes the inventory an attention-grabbing candidate for a lot of dividend buyers.

Additional, the agency has additionally been a dependable dividend payer within the final decade. LYB has been paying dividends in every of the previous 11 years, whereas it has managed to extend the funds within the final 9 years.

Dividend historical past (Looking for Alpha)

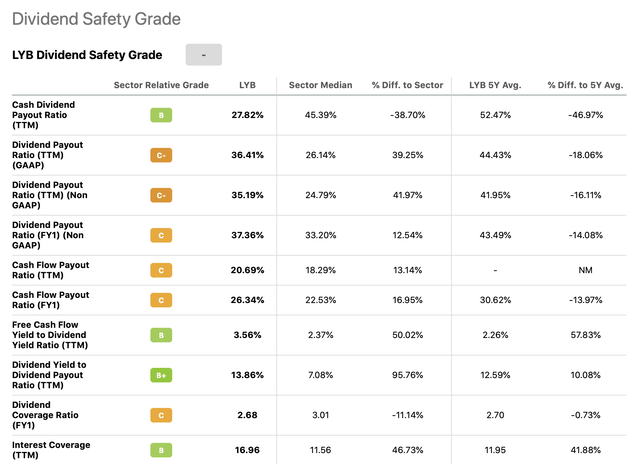

Additionally essential to say the security and sustainability of the dividend. LYB’s monetary measures, that are indicative of the sustainability and the security of the dividend examine favourably to the supplies sector median. The one metrics, which is barely worse is the dividend protection ratio. However as this ratio is way above 1, it nonetheless signifies that the agency can simply cowl its dividend funds.

Dividend security (Looking for Alpha)

Share buybacks

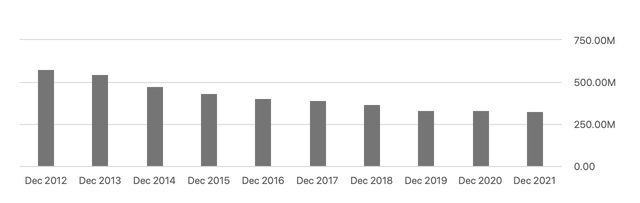

Prior to now decade, LYB has managed to cut back its numbers of shares excellent by greater than 40%, which is a major determine.

Shares excellent (Looking for Alpha)

Generally, we like companies which might be dedicated to returning worth to shareholders by way of share buybacks, as in some jurisdictions it may be a extra tax environment friendly manner of getting “paid”.