Torsten Asmus

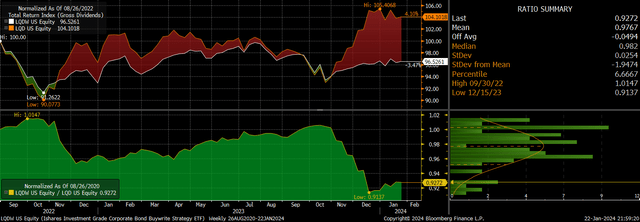

The iShares Funding Grade Company Bond Buywrite Technique ETF (BATS:LQDW) seeks to trace the funding outcomes of an index that displays a technique of holding the iShares iBoxx $ Funding Grade Company Bond ETF (LQD) whereas promoting one-month coated name choices to generate revenue. Because it got here to market in August 2022 it has truly misplaced cash as losses on its LQD holdings have outweighed the influence of excessive revenue funds. We’re prone to see a reversal of this efficiency in 2024 as excessive Treasury yields and charges of implied volatility lead to robust revenue, whereas the scope for main directional strikes that might trigger the LQDW to say no and/or underperform the LQD has diminished.

LQDW Vs LQD Complete Return Efficiency (Bloomberg)

The LQDW ETF

The LQDW holds a portfolio of LQD, which is comprised of US dollar-denominated funding grade company bonds, which has a 5.2% yield to maturity and a median maturity of 13 years. The LQD’s excessive period of 8.4 years, mixed with its low default threat, signifies that it’s pushed primarily by modifications in rate of interest expectations. The LQDW then sells one month on the cash calls on the LQD that permits it to generate excessive revenue, however means the fund doesn’t take part in LQD upside. Its expense payment of 0.34% pales compared to the yield, which is at present 19.3%.

The LQDW employs the identical technique because the iShares 20+ 12 months Treasury Bond BuyWrite Technique ETF (TLTW) and the iShares Excessive Yield Company Bond BuyWrite Technique ETF (HYGW), which additionally use coated calls to generate excessive revenue. The LQDW has a barely decrease yield than the TLTW’s 20.3% as a result of latter’s larger volatility which ends up from its longer period. Nevertheless, the yield is larger than the HYGW’s 15.9%, regardless of being uncovered to decrease credit score threat.

Declining Price Volatility To Assist LQDW Outperformance

If the LQD manages to submit 12 consecutive months of constructive returns it needs to be anticipated to generate 19.3% over the subsequent yr as a result of mixture of the LQD’s yield and name possibility revenue. That is in fact a finest case situation however even important losses on the LQD would nonetheless permit the LQDW to submit constructive returns. The LQDW ought to outperform the LQD except we see a big diploma of volatility, which appears unlikely.

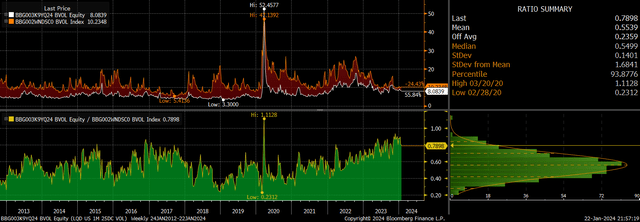

Whereas equities have seen a collapse in implied volatility over latest months and years, ranges of implied volatility on the LQD stay elevated. The next chart exhibits 1 month 25 delta name possibility volatility on the LQD versus the S&P500. The unfold is now close to its narrowest degree over the previous decade. Contemplating that the LQD has been far much less unstable than the S&P500 traditionally, this gives a possible alternative.

LQD vs SPX Implied Name Volatility (Bloomberg)

This view is supported by the outlook for US Treasuries, the place a big directional transfer appears unlikely. Upside dangers to Treasury yields seem capped by the necessity for the Fed to maintain authorities funding prices from spiralling uncontrolled. Whereas the Fed’s official mandate is worth stability and full employment, its function as lender of final resort to the Treasury means it stands prepared to stop a surge borrowing prices that will in any other case end result from persistently excessive fiscal deficits. The Fed’s coverage reversal in October final yr in response to the disorderly rise in yields was a transparent indication of this and it’s unlikely to permit an analogous spike in yields once more.

In the meantime, on the draw back, market expectations for fee cuts this yr appear too aggressive, with 150bps of easing priced in over the subsequent 12 months. It could take a big decline in inflation and/or progress for charges to be minimize sufficiently to drive down Treasury yields. Even when this had been to occur, it might doubtless imply that credit score spreads would rise, tempering good points within the LQD and permitting the LQDW to outperform.

Renewed Inflation Pressures Pose The Greatest Threat

The principle threat to the LQDW comes from a renewed rise in inflation. Not solely would this put upside stress on company yields to the detriment of the LQD, however it might additionally result in an increase in volatility. In distinction to many of the previous decade, LQD volatility has change into positively correlated with market implied long run inflation charges, and a spike in oil, as an illustration, might set off a transfer larger in each inflation and volatility.

Abstract

The LQDW has had a tricky time over the previous 18 months, with the buywrite technique struggling capital losses throughout final yr’s yield spike however failing to partake within the subsequent rally since October. 2024 is prone to be a lot kinder to the ETF as the next yield on its LQD and a extra subdued outlook for fee volatility permits it to outperform.