Yesterday’s market exercise was predictable, with the closing flat. Futures quantity mirrored the vacation temper, with simply 840,000 contracts traded. On condition that it was the day after Christmas, this gentle buying and selling session was anticipated, and in the present day could comply with an analogous pattern.

Treasury Yields Present Shocking Power Amid Sturdy Auctions

Charges climbed throughout the morning however eased after a sturdy public sale. This week has seen persistently sturdy auctions, which is noteworthy contemplating the rising U.S. debt ranges. Traders appear interested in present charges, serving to the , which peaked at 4.64%, shut decrease at 4.59%.

The presents intriguing technical formations, together with a possible double backside (January 2024 and September 2024 lows) and an inverse head-and-shoulders sample (June, September, and December 2024 ranges). A breakout above 4.82% might push the 30-year yield again above 5%, signaling a continued yield curve normalization.

10-2 Yield Curve Holds Regular

The curve remained comparatively flat at 25 foundation factors, holding regular for a number of days.

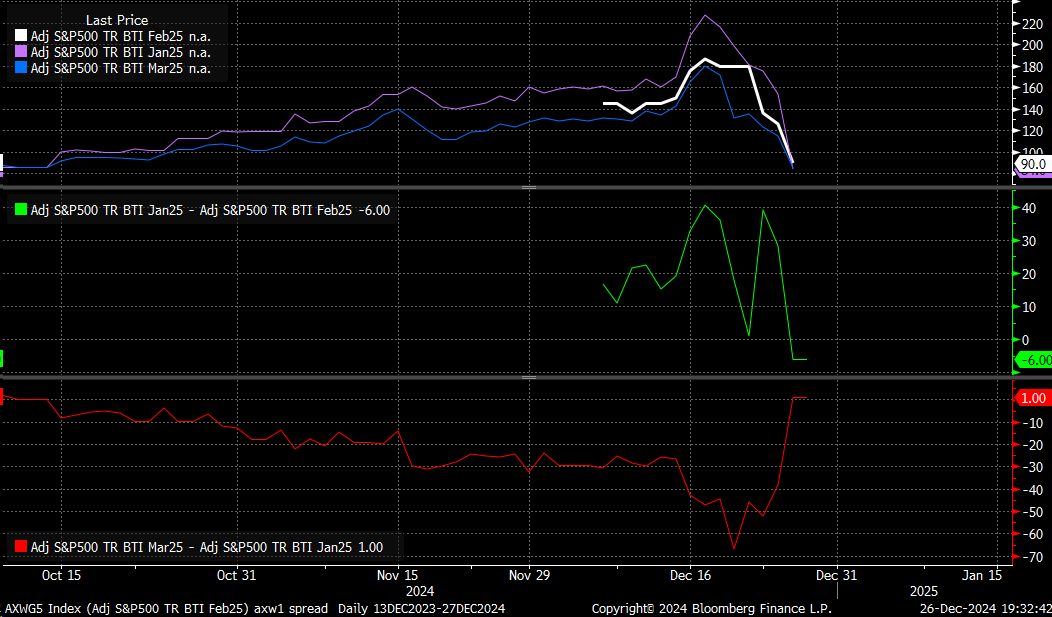

Fairness Financing Prices Expertise a Important Drop

Fairness financing prices, particularly the BTIC rollover contracts, noticed a pointy decline. January contracts, which hit 227 foundation factors on December 17, have dropped to 84 foundation factors. February contracts are buying and selling at 90, and March at 85. This means diminished demand for leverage, probably influenced by year-end elements or a broader market pattern.

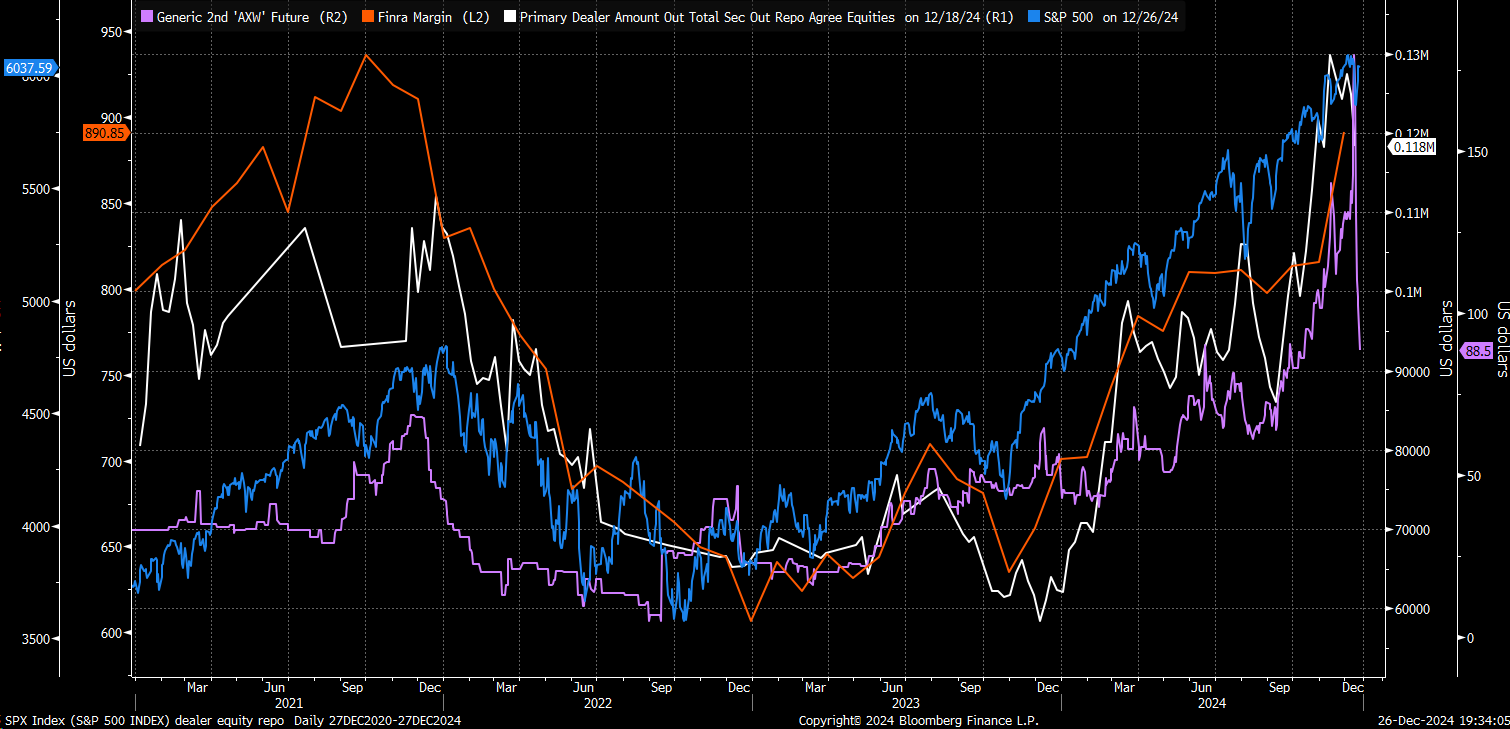

Decline in Repo Exercise for Fairness Securities

Repo exercise within the in a single day funding marketplace for equities has additionally fallen sharply. This decline aligns with diminished fairness financing prices, indicating decrease demand for margin and leverage. Whether or not this shift is because of year-end dynamics or an indication of broader threat repricing stays unsure.

Market Outlook

With fewer anticipated Fed fee cuts subsequent yr, markets could also be reassessing threat and lowering leverage ranges. These developments might form buying and selling dynamics as we head into the brand new yr. We simply should proceed to watch.

Unique Put up