We have been requested to touch upon the grim forecast by economists at Goldman Sachs that the will produce annualized returns of solely 3% (earlier than accounting for inflation) over the following 10 years. They reckon that the vary of attainable outcomes contains -1% on the low finish and +7% nominal returns on the excessive finish.

In our opinion, even Goldman’s optimistic state of affairs won’t be optimistic sufficient. That is as a result of we consider that the US financial system is in a “Roaring 2020s” productiveness development growth with actual at present rising 3.0% y/y and moderating to 2.0%.

If the productiveness development growth continues by way of the tip of the last decade and into the 2030s, as we count on, the S&P 500’s common annual return ought to at the least match the 6%-7% achieved for the reason that early Nineties (chart). It ought to be extra like 11% together with reinvested dividends.

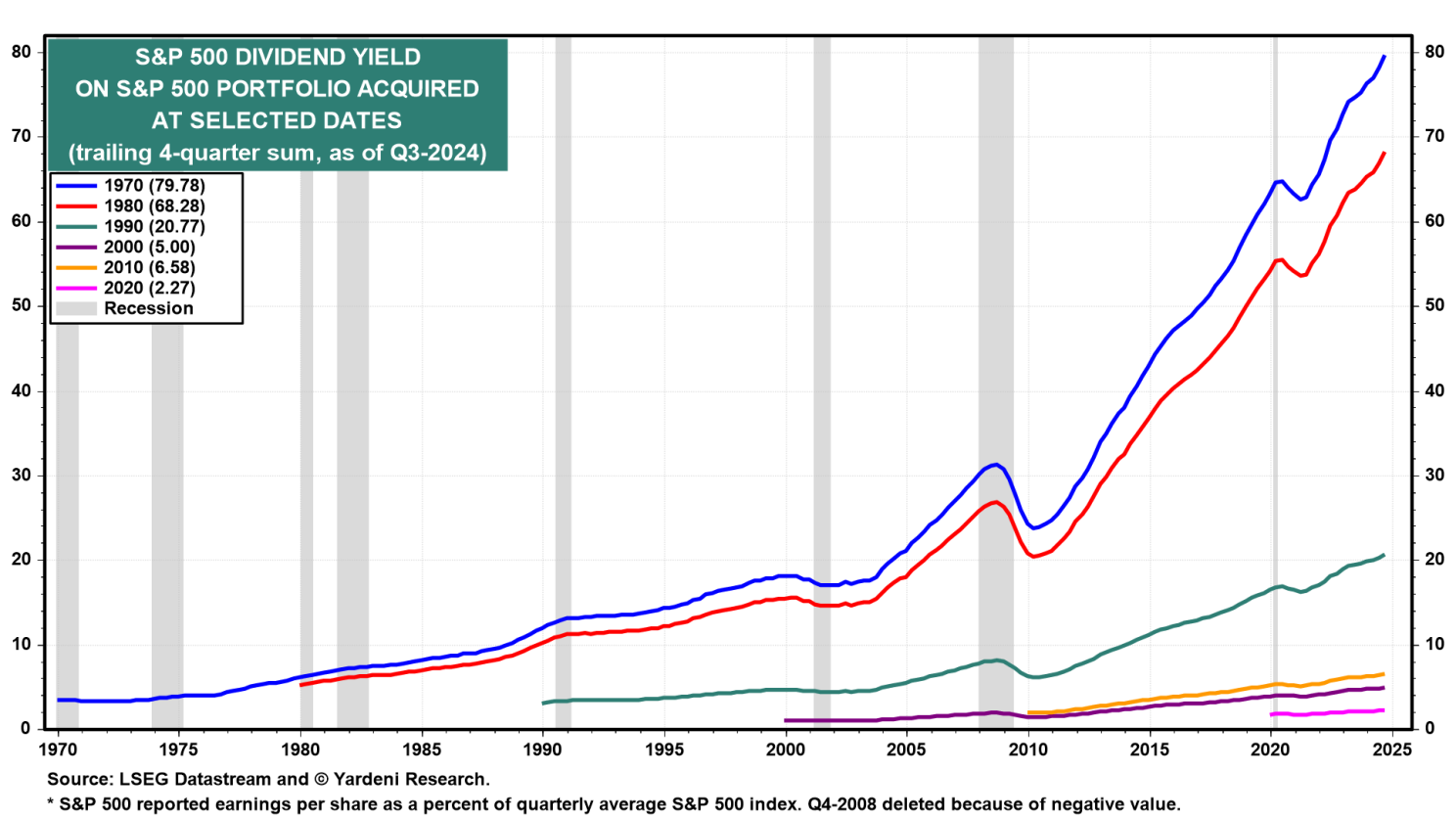

It is arduous to think about that the full return of the S&P 500 could be solely 3% sooner or later given the returns simply from the compounding of reinvested dividends (chart).

Let’s dig into a number of the factors made by Goldman:

Earnings development

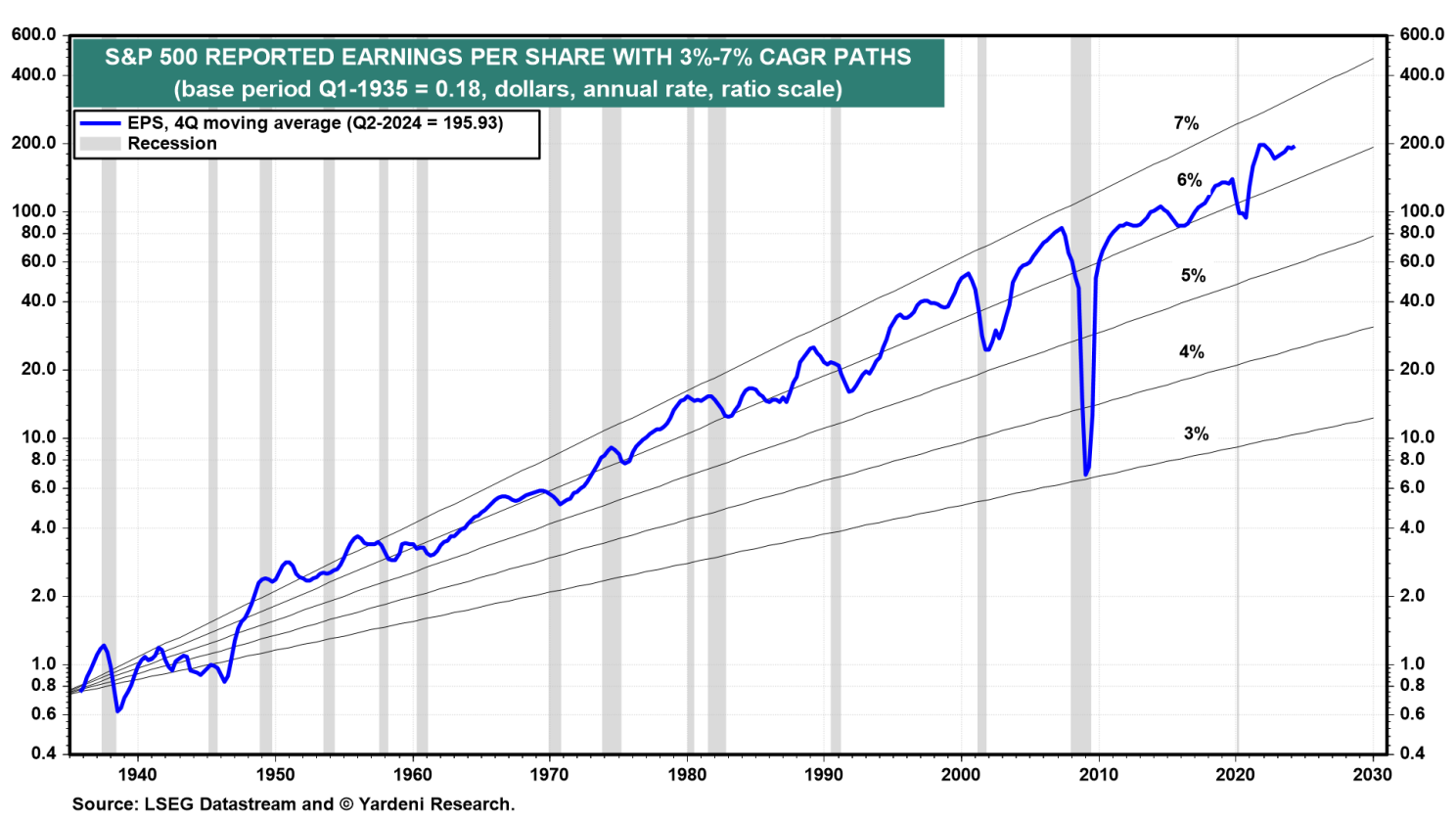

S&P 500 earnings per share has grown roughly 6.5% per yr for practically a century (chart). Assuming 6% development over the approaching decade (and eradicating dividends from the equation), valuations would should be reduce in half to provide simply 3% annual returns.

Valuation

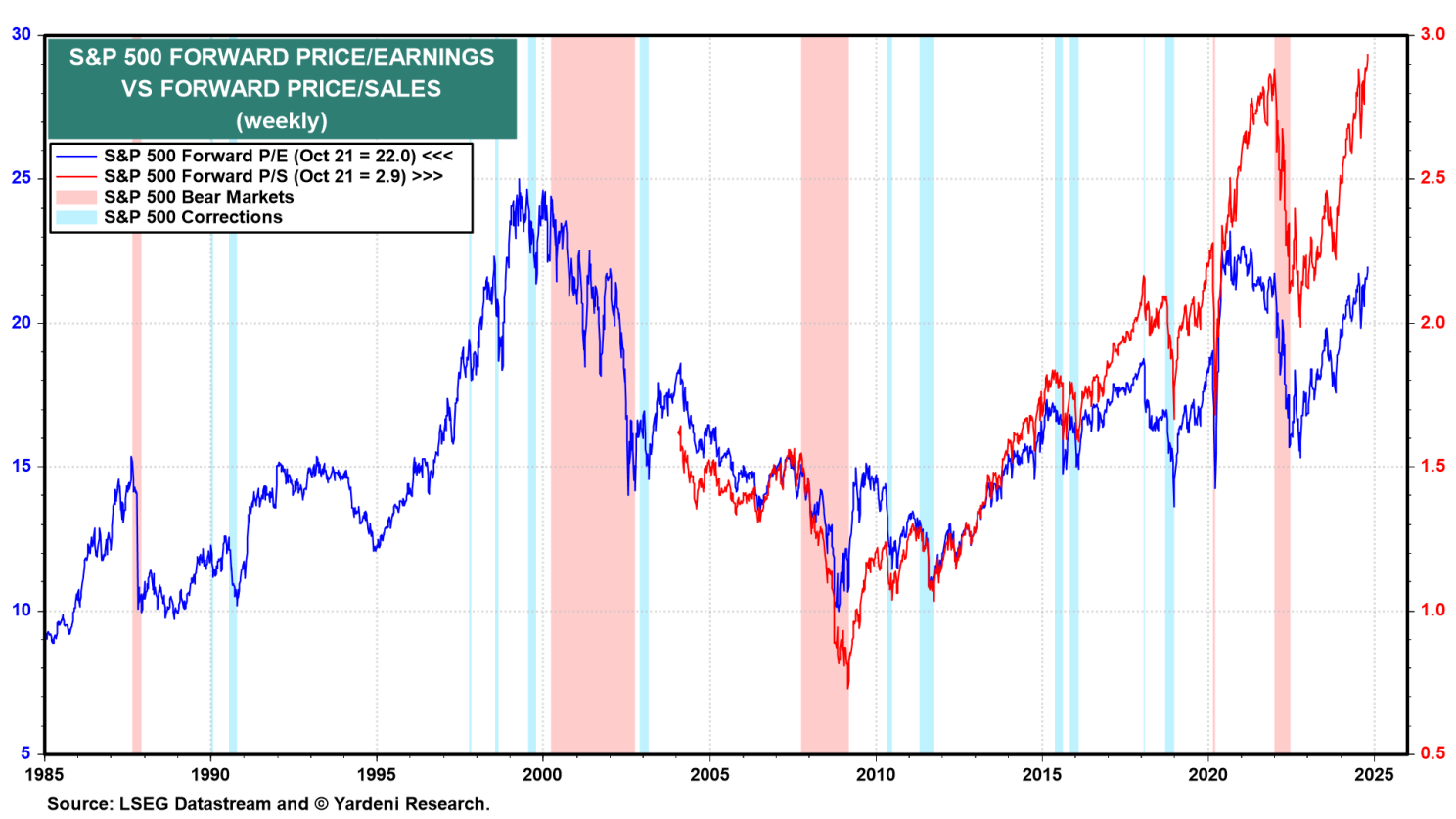

A lot of Goldman’s evaluation is a narrative of excessive valuations. Standard knowledge holds that greater beginning valuations result in decrease future returns. With the Buffett Ratio (i.e., ahead P/S) at a document excessive 2.9, and the S&P 500 ahead P/E elevated at 22.0 occasions, we agree that valuations are stretched by historic requirements (chart).

Revenue margins

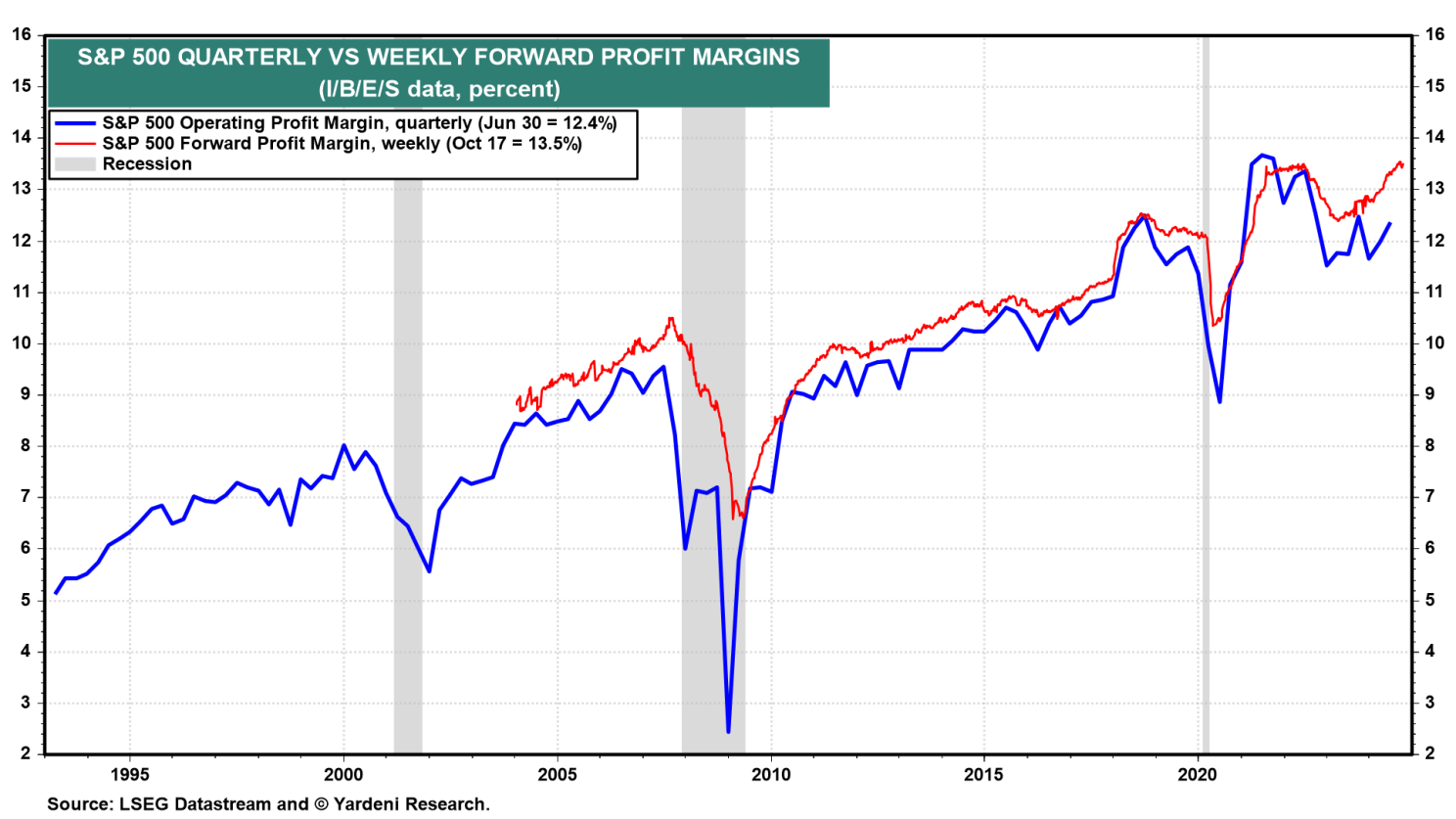

The ahead P/E is comparatively low in comparison with the ahead P/S as a result of the S&P 500 ahead revenue margin has been rising into document excessive territory and may proceed to take action in our Roaring 2020s state of affairs (chart).

Inflation hedge

Goldman’s forecast doesn’t take into account that shares are traditionally the most effective inflation hedge, as corporations have embedded pricing energy. In the meantime, bonds undergo as rates of interest rise to fight greater inflation.

Market focus

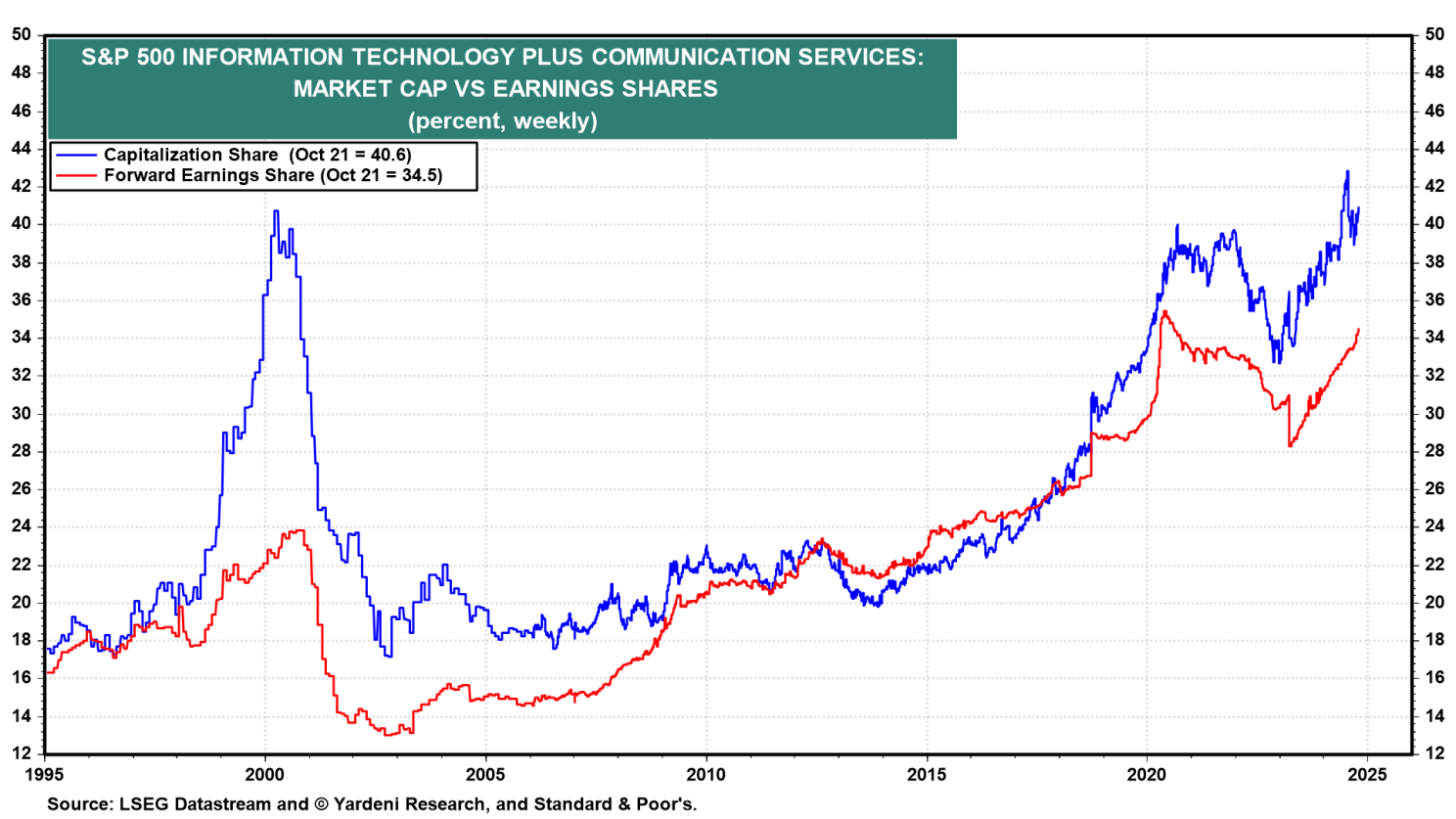

One of many largest “worries” in Goldman’s evaluation is that the market is extremely concentrated. However whereas the and sectors at the moment are about 40% of the general S&P 500, across the identical as the height of the dot-com bubble, these are way more essentially sound corporations.

These two sectors account for greater than a 3rd of the S&P 500’s ahead earnings at this time versus lower than 1 / 4 in 2000 (chart). We additionally consider that each one corporations may be considered know-how corporations. Expertise is not only a sector within the inventory market, however an more and more necessary supply of upper productiveness development, decrease unit labor prices inflation, and better revenue margins for all corporations.

Backside line

In our view, a looming misplaced decade for US shares is unlikely if earnings and dividends proceed to develop at stable paces boosted by greater revenue margins thanks to higher technology-led productiveness development. The Roaring 2020s would possibly result in the Roaring 2030s.

Authentic Put up