USD/CAD ANLAYSIS & TALKING POINTS

- Crude oil, Israel-Palestine struggle and US information dynamic present sophisticated backdrop for USD/CAD.

- US elements beneath the highlight in the present day.

- Key assist break might see USD/CAD breakdown additional.

Elevate your buying and selling expertise and acquire a aggressive edge. Get your fingers on the U.S. greenback This autumn outlook in the present day for unique insights into key market catalysts that must be on each dealer’s radar.

Really useful by Warren Venketas

Get Your Free USD Forecast

CANADIAN DOLLAR FUNDAMENTAL BACKDROP

The Canadian greenback braces forward of US PPI and the FOMC minutes respectively. Yesterday’s dovish remarks by the Fed’s Logan that there could also be ‘much less want for the Fed to lift charges” weighed negatively on the USD regardless of an elevated demand for the protected haven forex as a result of Israel-Palestine (Hamas) battle.

Later in the present day (see financial calendar beneath) will see additional Fed audio system give their addresses whereas US PPI might give a sign to the inflationary backdrop within the US. PPI is mostly seen as a number one indicator and if we see an upside shock, this might counsel that CPI figures shifting ahead might stay elevated.

The FOMC minutes is prone to favor the hawkish narrative because the prior assembly resulted in a reinforcement of the ‘larger for longer’ narrative that might maintain the dollar supported.

Crude oil costs keep buoyed on the struggle within the Center East as contagion fears grip buyers minds with regard to potential provide disruptions. The loonie will proceed to profit from this viewpoint ought to the struggle escalate and contemplating OPEC raised the demand forecast, crude oil might prolong its latest rally.

From a Canadian perspective, constructing allow information is scheduled and with expectations hinting at 0.5% development, USD/CAD bears might push the pair decrease.

Wish to keep up to date with probably the most related buying and selling info? Join our bi-weekly publication and maintain abreast of the most recent market shifting occasions!

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX crew

Subscribe to Publication

USD/CAD ECONOMIC CALENDAR (GMT +02:00)

Supply: DailyFX Financial Calendar

TECHNICAL ANALYSIS

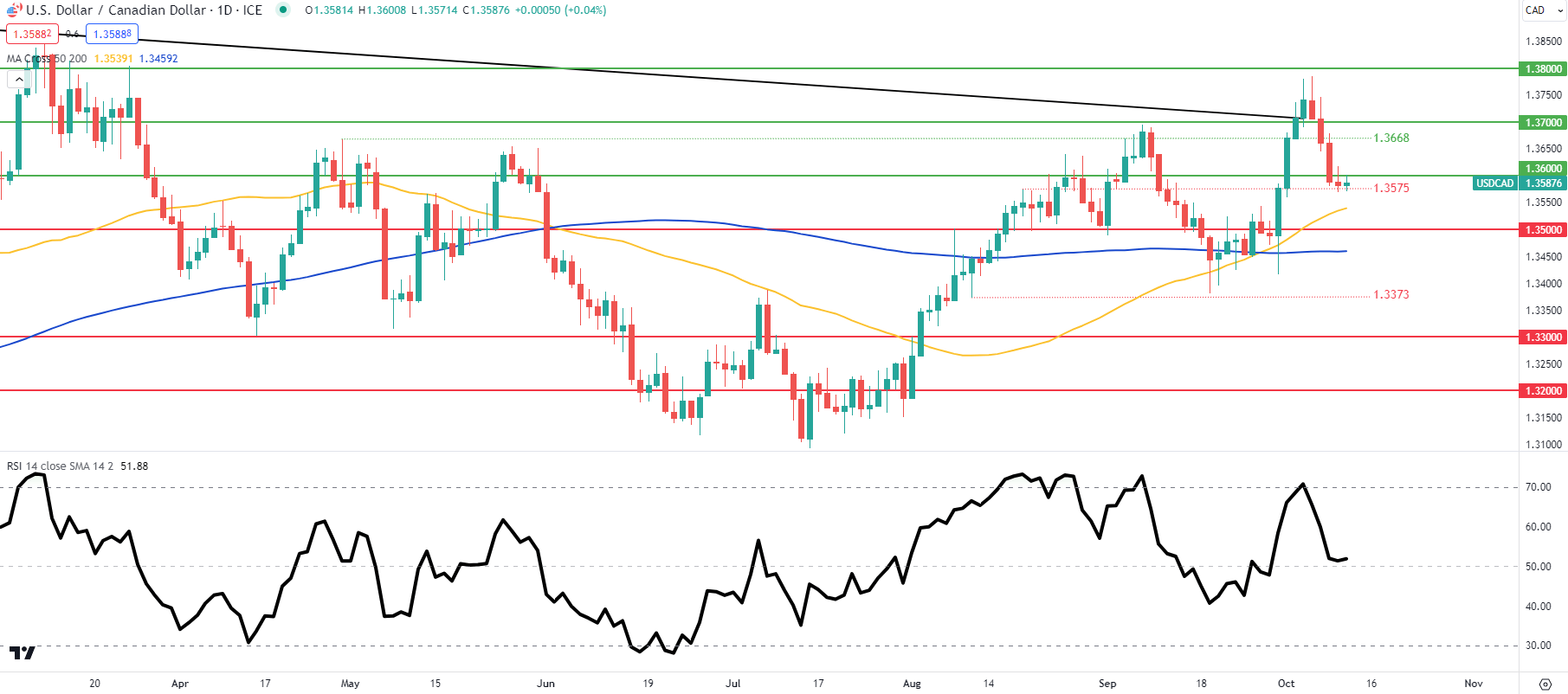

USD/CAD DAILY CHART

Chart ready by Warren Venketas, IG

USD/CAD worth motion on the each day chart above highlights market hesitancy at this level with two doji candlesticks presenting themselves. The Relative Power Index (RSI) reaffirms this with the oscillator favoring neither bullish nor bearish momentum across the midpoint 50 degree. A affirmation shut beneath 1.3575 might catalyze a transfer decrease forward of tomorrow’s US CPI print.

Key resistance ranges:

Key assist ranges:

- 1.3575

- 50-day MA

- 1.3500

- 200-day MA

IG CLIENT SENTIMENT DATA: BEARISH

IGCS exhibits retail merchants are presently web SHORT on USD/CAD, with 57% of merchants presently holding quick positions (as of this writing).

Curious to learn the way market positioning can have an effect on asset costs? Our sentiment information holds the insights—obtain it now!

Introduction to Technical Evaluation

Market Sentiment

Really useful by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas