RicAguiar

Loma Negra Compañía Industrial Argentina Sociedad Anónima’s (NYSE:LOMA) 2Q24 outcomes have been fairly unhealthy, in step with a difficult Argentinian macroeconomy. Offered volumes have been down 30%, and the corporate stopped its clinker manufacturing and grinding operations. The impact was not felt as a lot in working earnings due to larger costs and cost-cutting measures (just like the plant halts talked about).

On the management aspect, and never talked about in the course of the name, Loma Negra’s controller, the Brazilian Intercement, needed to file for a protecting injunction final month, leaving the door open for a possible sale of Loma’s controlling stake to a different participant. In the interim, the Brazilian Companhia Siderurgica Nacional, CSN, maintains an unique negotiation proper.

On the valuation aspect, the corporate has remained in a good worth vary for the previous three years with out arousing the curiosity that different Argentinian shares (for instance, in vitality) have generated since 2021, particularly for the reason that new administration took workplace. On condition that the corporate’s earnings yield will not be excessive sufficient to justify its buy and that progress expectations are nonetheless adverse for the remainder of the 12 months (with subsequent 12 months all the time being an unknown in Argentina), I nonetheless consider the inventory is a Maintain at these costs.

Horrible 1H24

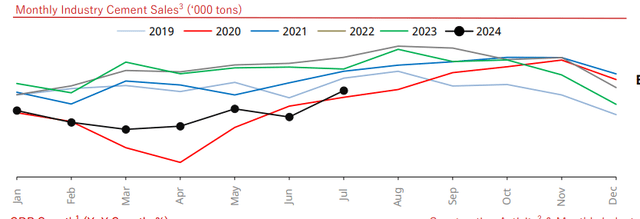

Cement downturn solely corresponding to the pandemic: Argentina is present process a major recession, with the financial system anticipated to fall to mid-to-high-single digits this 12 months. The state of affairs is even worse for cement for 3 causes. First, retail patrons see their disposable revenue shrink and have much less cash to spend money on constructing their properties. Second, actual property builders see the availability of properties enhance with out patrons, have a look at the greenback price of constructing, at file highs measured on the parallel FX, and resolve to not construct. Lastly, the nationwide authorities determined to cease all public works in December, due to this fact completely drying up authorities demand. Cement has not had a worse 12 months for the reason that early pandemic, as seen beneath.

Argentinian cement dispatches (LOMA’s 2Q24 earnings presentation)

This has proven up in Loma’s volumes, collapsing 30% in 2Q24 versus final 12 months. Within the case of concrete, which is utilized in giant building initiatives, volumes are down 45%.

Brief-term margin enhancements: The corporate’s margins have really elevated regardless of the horrible topline state of affairs, 500 foundation factors in each gross and EBITDA. This led to the corporate having the ability to submit an 11% contraction in adjusted EBITDA and a 12% contraction in working revenue.

There are two causes for this. First, the corporate has not raised salaries a lot and has most likely put some work shifts on maintain, so OpEx has decreased in step with manufacturing by round 30%. The second purpose is that the corporate actually halted manufacturing in key areas. Citing financial savings from not utilizing electrical energy and pure fuel in the course of the costlier winter months, Loma halted clinker cooking and limestone grinding. This might help cut back the vitality invoice and the payroll for some months, however stopping the plant will not be viable long-term. As well as, when cement crops are usually not producing at scale, the inventories generated throughout these intervals are costlier (as a result of they’ve to soak up extra overhead per unit), which reveals up in a lot decrease margins in future months.

Some hope: Loma’s administration cited the month of July as certainly one of restoration, with dispatches down 14% versus final 12 months. It additionally factors to the constructive development between April and July, seen within the nationwide chart above. This might very properly be the case, significantly as a result of throughout July, the FX hole expanded, resulting in a discount in dollar-denominated building prices and, due to this fact, making actual property improvement extra enticing. Nevertheless, the hole has shrunk in August, and there are evident seasonal elements in 2Q and 3Q. I consider it’s nonetheless too early to name an finish to the present building recession.

Controller bother

Loma Negra’s controller, the Brazilian cement conglomerate Intercement, has been sagged by debt for years. This has led to IC providing Loma Negra’s stake on the market for some years (the primary negotiations began in 2018). Though IC has been in a position to promote operations in Africa, it has not but been in a position to promote its Loma stake.

The newest chapter on this story consists of IC submitting for asset safety in Brazil, as Loma knowledgeable the SEC final month. The injunction doesn’t indicate any operational drawback for Loma however does make the sale of Loma’s fairness sake extra urgent.

On this respect, the primary potential purchaser is one other Brazilian firm, Companhia Siderurgica Nacional, which has an unique negotiation proper (just lately renewed till early August after which mechanically renewed once more). CSN is negotiating to buy all of IC’s property, amongst which Loma is barely a portion.

In any case, it’s unlikely that both IC or CSN will promote Loma’s inventory within the open market, dampening the inventory worth. Nevertheless, the potential change of controller may spur extra curiosity from different strategic gamers. One such participant is an Argentinian businessman with stakes in Pampa Energía S.A. (PAM), concerned in building, and all in favour of buying Loma’s stake alone.

Valuation not enticing regardless of yield

Evaluating Loma’s state of affairs this 12 months will not be very appropriate, on condition that the nation is in an incredible recession. It might be equal to valuing Loma primarily based on 2020 profitability.

In my final article, I used a extra long-term method to forecasting Loma’s profitability; it consists of EBITDA margins and cement dispatches throughout completely different intervals, together with booms like 2021/22 and busts like 2018/2020.

Essentially the most adverse situation, with present volumes and 2018 margins per ton, implies about $55 to $60 million in money earnings for the corporate. In contrast with a market cap of about $820 million, this represents an elevated a number of of 15x. Due to this fact, in essentially the most adverse situation, Loma gives a yield of roughly 6.6%.

If we assume that margins don’t fall to 2018 ranges or that finally, volumes enhance (say to fifteen% decrease than the booming 2023 ranges), then we could possibly be speaking of $70 million in earnings. I consider this yield is extra honest, albeit not significantly enticing, on condition that Argentina constantly fails to develop above the 2021/22 ranges. If Loma is destined to cycle between booms and busts, then we can’t mission cycle-average profitability approach above $70 million, and due to this fact, the inventory will not be a possibility. For that purpose, I preserve my Maintain ranking.